Brazil Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0100

- 124

-

Brazil Skin Care Market Statistics, 2025

- Market Size Statistics

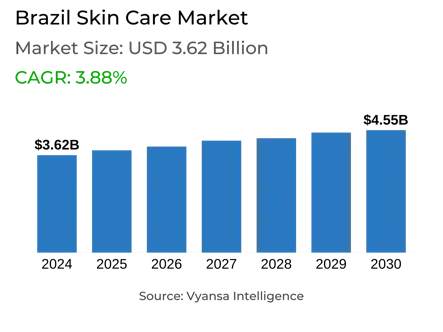

- Skin Care in Brazil is estimated at $ 3.62 Billion.

- The market size is expected to grow to $ 4.55 Billion by 2030.

- Market to register a CAGR of around 3.88% during 2025-30.

- Product Shares

- Facial Care grabbed market share of 55%.

- Competition

- More than 20 companies are actively engaged in producing Skin Care in Brazil.

- Top 5 companies acquired 65% of the market share.

- Johnson & Johnson do Brasil Indústria e Comércio, Coty Brasil Indústria e Comércio de Cosméticos Ltda, Mary Kay do Brasil Ltda, Natura Cosméticos SA, Botica Comercial Farmacêutica Ltda etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 85% of the market.

Brazil Skin Care Market Outlook

Brazil skin care market will register consistent growth from 2025 to 2030, led by surging demand for lip care and staple moisturisers. Lip care is gaining traction, particularly among young consumers, with the support of popular trends like luscious lips and innovative collaborations such as Carmed's collaboration with Fini. Staple moisturisers are gaining traction as well, with consumers trending towards simple, daily hydration habits that appeal to both genders and age groups. Yet, the popularity for simple and speedy routines still hampers the development of multi-step facial care, particularly when compared to multifunctional sun protection products.

Body care is also another segment with good growth potential. Brazil is responsible for a significant portion of the world's body care market, and consumers are becoming more attracted to ingredient-driven products that benefit skin health. The emergence of dermocosmetics and ingredient-driven beauty brands is transforming the category. Domestic and global brands are investing in more sophisticated formulations, providing not just fragrance but treatment benefits such as moisturisation, collagen stimulation, and skin firming. Premiumisation also is increasing, with consumers seeking natural and performance-driven ingredients.

Giftable products are driving body care usage, particularly for more non-traditional occasions. Body creams and moisturisers as affordable gifts are among the most popular gift items and fuel repeated use. Such a gift culture has established solid demand for body care products both for everyday and special occasion use, spreading consumer participation across income segments.

Distribution channels are critical in influencing consumer behavior. Direct selling holds ground through players such as Natura&Co and Grupo Boticário, with pharmacies and retail e-commerce advancing in premium skin care, but with ingredient-centric products. Retail e-commerce keeps expanding with emphasis on higher-value facial care, though grocery retailers become less relevant in the category.

Brazil Skin Care Market Trend

Brazil skin care market is expected to continue growing steadily in 2025-30 with a strong single-digit retail current value CAGR, surpassing the global and regional averages. Growth is fueled by higher demand for both facial and body care. The market is challenged with consumer values and actual behavior frequently diverging. As there is increasingly more interest in natural, vegan, and ethical skin care, most still value performance and price. For example, Baby Boomers always favor natural and eco-friendly products, backed by their stable values and greater disposable income. In contrast, Generation Z, even though they are outspoken online, value known brands rather than natural ones.

This paradox is echoed in larger trends, such as growing trends in aromatherapy and better diets existing alongside greater use of sleep medication. Parallel to this, AI-based customized skin care is on the rise, particularly in treating ailments such as melasma and dermatitis, pointing toward more precise, value-based solutions.

Brazil Skin Care Market Opportunity

Severe weather conditions attributed to climate change are contributing to an increase in mosquito-borne illnesses such as dengue, zika, and chikungunya, precipitating increased consumption of insect repellents. In 2023, Brazil reported 1.6 million cases of dengue—its second worst record since 2000—because heat and rain made mosquito breeding fields so perfect. The World Health Organization also reported that dengue was a rising global risk, fueled by increased temperatures, humidity, and precipitation.

While not strictly within the skin care segment, this trend does open up new possibilities. Excessive use of repellents is likely to cause dryness and irritation to the skin, just like hand sanitisers do. This will tend to boost the demand for moisturising and calming body care products, particularly those with the ability to restore skin on larger body surfaces. Consequently, increasing repellent consumption can propel high growth in Brazil's body care market during the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 3.62 Billion |

| USD Value 2030 | $ 4.55 Billion |

| CAGR 2025-2030 | 3.88% |

| Largest Category | Facial Care segment leads with 55% market share |

| Top Trends | Contradictory Consumption Shaping Future Product Choices |

| Top Opportunities | Climate-Driven Surge in Repellent Use to Support Market Demand |

| Key Players | Johnson & Johnson do Brasil Indústria e Comércio, Coty Brasil Indústria e Comércio de Cosméticos Ltda, Mary Kay do Brasil Ltda, Natura Cosméticos SA, Botica Comercial Farmacêutica Ltda, BDF Nivea Ltda, Procosa Produtos de Beleza Ltda, Avon Cosméticos Ltda, Laboratórios Pierre Fabre do Brasil Ltda, Galderma Brasil Ltda and Others. |

Brazil Skin Care Market Segmentation Analysis

The most popular segment under the sales channel in the Brazil Skin Care Market is Retail Offline, followed by pharmacies and beauty specialist stores. Pharmacies are especially dominant with a strong emphasis on performance-driven facial and body care, carrying a premium set of products from the likes of La Roche-Posay, Vichy, Darrow, and Avène. While "dermocosmetics" is not an official term, stores have developed in-store sections by that name, keeping pace with the trend towards ingredient-driven beauty. Beauty experts also help in this segment, particularly in gift situations, where brands like Avatim leverage local identity through local ingredients.

Direct selling also contributes a noteworthy share, with such large players as Natura&Co and Grupo Boticário. But it is struggling to bring in young customers more willing to try newer formats. Retail e-commerce, the growth of which remains mostly limited to high-end facial care, still trails offline channels. Grocery retail, with no premium or giftable appeal, posted the weakest performance.

Top Companies in Brazil Skin Care Market

The top companies operating in the market include Johnson & Johnson do Brasil Indústria e Comércio, Coty Brasil Indústria e Comércio de Cosméticos Ltda, Mary Kay do Brasil Ltda, Natura Cosméticos SA, Botica Comercial Farmacêutica Ltda, BDF Nivea Ltda, Procosa Produtos de Beleza Ltda, Avon Cosméticos Ltda, Laboratórios Pierre Fabre do Brasil Ltda, Galderma Brasil Ltda, etc., are the top players operating in the Brazil Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Skin Care Market Policies, Regulations, and Standards

4. Brazil Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Brazil Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Brazil Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Brazil Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Brazil Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Natura Cosméticos SA

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Botica Comercial Farmacêutica Ltda

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. BDF Nivea Ltda

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Procosa Produtos de Beleza Ltda

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Avon Cosméticos Ltda

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Johnson & Johnson do Brasil Indústria e Comércio

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Coty Brasil Indústria e Comércio de Cosméticos Ltda

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Mary Kay do Brasil Ltda

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Laboratórios Pierre Fabre do Brasil Ltda

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Galderma Brasil Ltda

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.