Brazil Plant-Based Dairy Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), Sales Channel (Retail Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Retail Online)

- Food & Beverage

- Dec 2025

- VI0583

- 130

-

Brazil Plant-Based Dairy Market Statistics and Insights, 2026

- Market Size Statistics

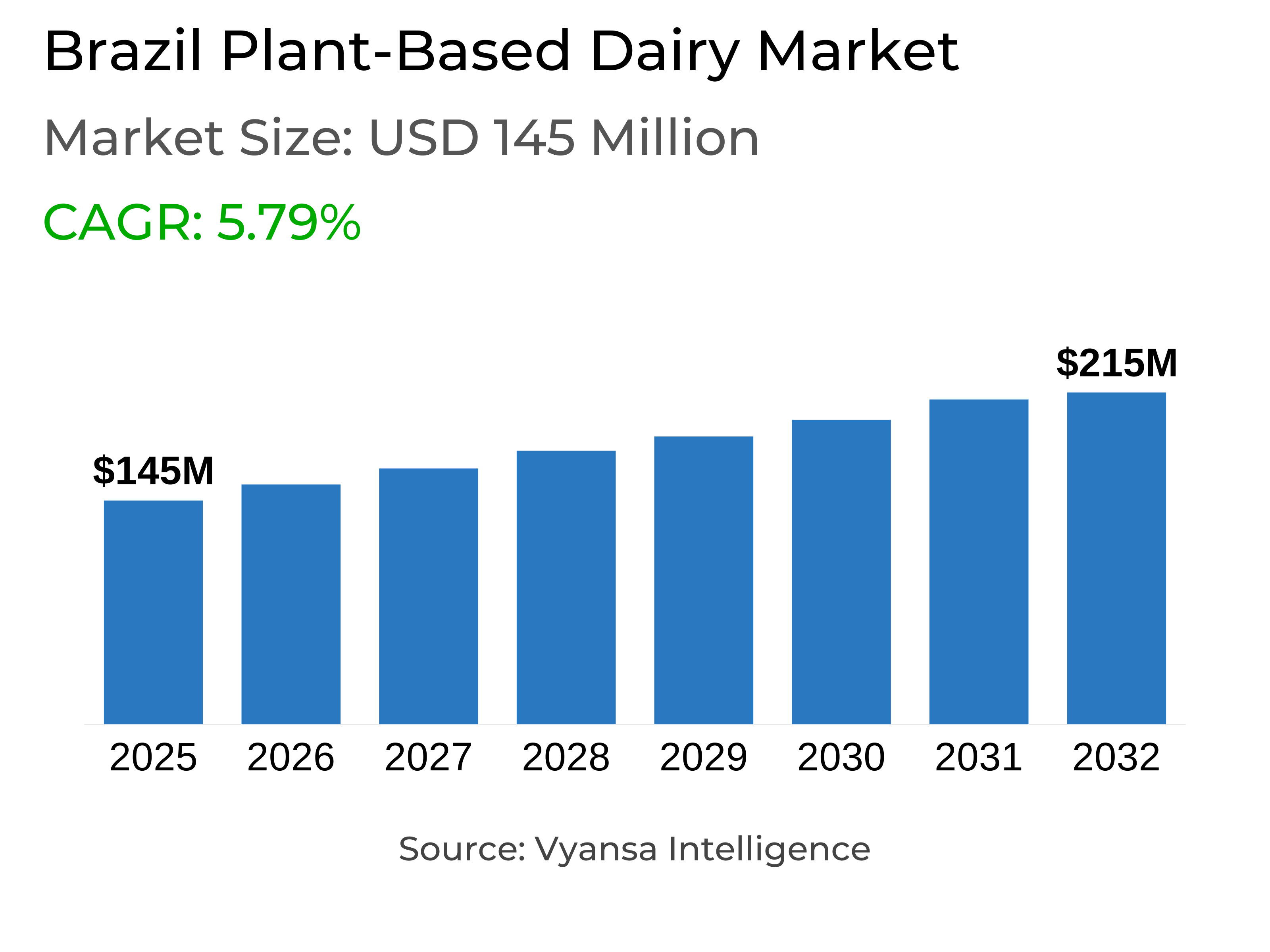

- Plant-based dairy in brazil is estimated at $ 145 million.

- The market size is expected to grow to $ 215 million by 2032.

- Market to register a cagr of around 5.79% during 2026-32.

- Product Type Shares

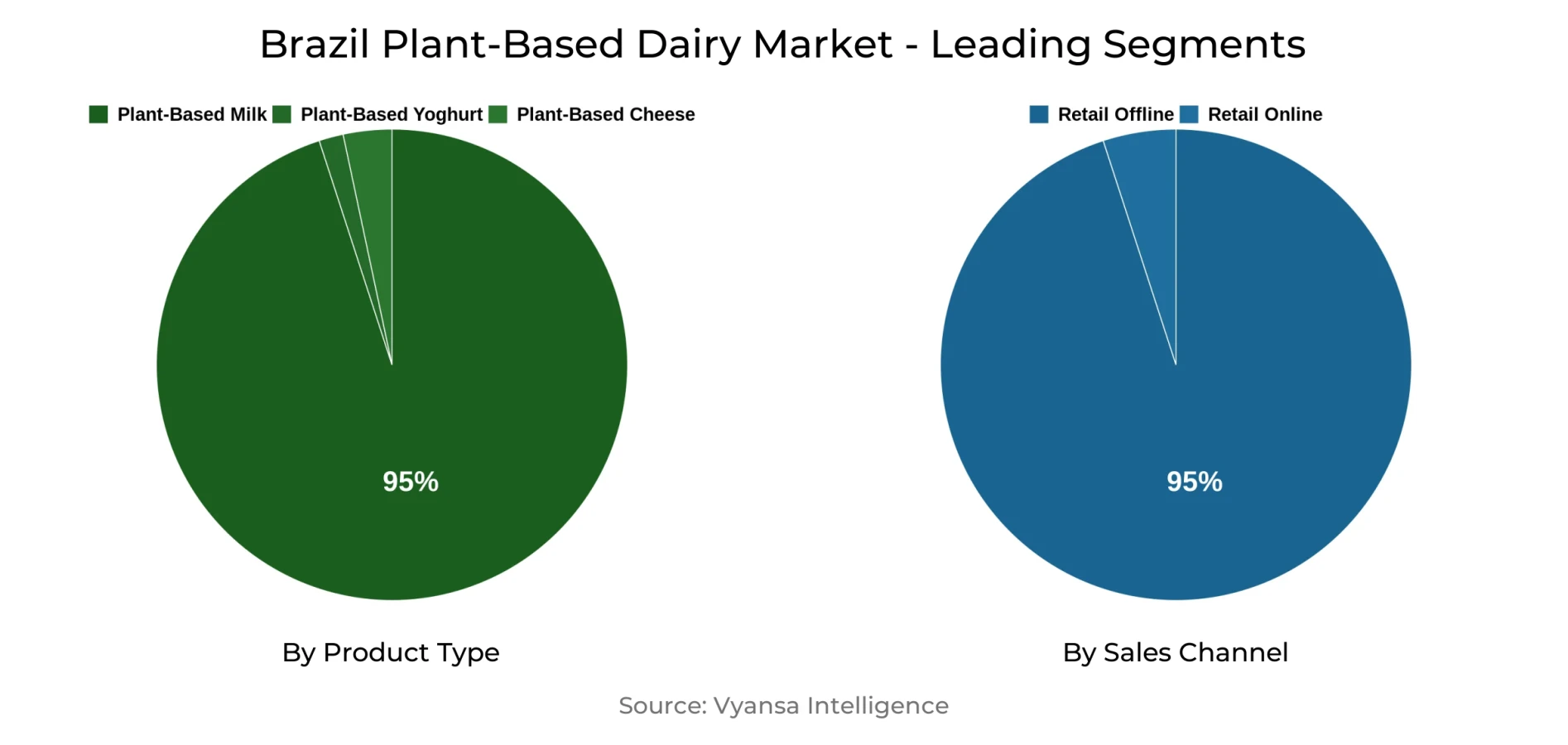

- Plant-based milk grabbed market share of 95%.

- Competition

- More than 10 companies are actively engaged in producing plant-based dairy in brazil.

- Top 5 companies acquired around 70% of the market share.

- Nestlé Brasil Ltda, Cocamar Cooperativa Agroindustrial, Lactalis do Brasil Comercio, Importação & Exportação de Laticinios Ltda, Coca-Cola Indústrias Ltda, Positive Brands Indústria e Comércio de Alimentos Saudáveis SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Brazil Plant-Based Dairy Market Outlook

The Brazil Plant-Based Dairy Market is $145 Million in 2025 and growing to $215 Million by 2032, indicating robust demand by health-conscious and environmentally conscious end users. Plant-based dairy categories, including alternative milk, cheese, and yoghurts, are fast gaining momentum beyond niche vegan foundations, also appealing to flexitarians seeking healthier way-of-life alternatives. The market is supported by technological developments that closely replicate the taste, texture, and purpose of traditional dairy foods, encouraging more uptake.

Less mature segments, such as plant-based cheese and other non-soy milk alternatives, are experiencing lively growth, driven by investment and innovation by local players as well as leading brands. Players are introducing fortified and protein-fortified formats, rendering plant-based dairy not only sustainable but also functional and healthy for end userss leading healthy active lifestyles.

The market is dominated by top 5 players collectively contribute around 70% of the market. Retail offline channels remain the primary channel of sale, with 95% of the market, with the assistance of wide distribution networks, shelf-space expansion, and mainstreaming of plant diets in Brazil. Collaborations between plant-based companies and health-conscious brands continue to raise awareness and end users participation.

Overall, the Brazil Plant-Based Dairy Market is expected to register robust growth throughout the forecast period, driven by functional innovation, product diversification, and growing mainstream acceptance. End-users demand for high-quality, fortified, and convenient alternatives will be a prime market driver, maintaining the market's robust growth trajectory.

Brazil Plant-Based Dairy Market Growth DriverRising Health-Conscious Lifestyles

Growing demand for health-conscious lifestyles is one of the main drivers of growth for the plant-based dairy market in Brazil. end users are getting increasingly willing to support wellness-friendly products that also just so happen to be lower in saturated fat, rich in protein, and loaded with essential nutrients. This has led to increased demand for plant-based alternatives in sync with functional health goals and ethical consumption habits.

Firms producing products showcasing nutritional benefits, clean-label, and plant-based formulations are experiencing greater acceptance by health-focused end users. Greater awareness about environmental as well as individual health benefits of plant-based dairy drives this trend to continue to propel market growth, which is encouraging manufacturers to develop and launch more products to meet shifting end users preferences.

Brazil Plant-Based Dairy Market TrendShift Towards end users-Centric, Functional Plant-Based Products

End users taste in Brazil is progressively turning towards plant-based dairy that most closely replicates the taste, texture, and functionality of traditional dairy. End users can be observed to move away from niche vegan use and mass adoption, which is being driven by health-conscious and flexitarian end userss who desire convenient, healthy, and tasty alternatives.

This trend is encouraging brands to focus on functional innovation such as high-protein products, value-added yoghurts, and plant-based creams for meal prep and snacking. By linking products to the requirement of lifestyles and convenience of cooking, companies are bridging the gap between traditional dairy and plant-based products. The trend also reflects higher end users awareness of health, wellness, and sustainable nutrition, integrating plant-based dairy in to standard daily diets and not a niche option.

Brazil Plant-Based Dairy Market OpportunityNew Dairy Categories Diversification

There is a high opportunity for Brezil plant-based dairy brands to diversify into less developed categories like cheese, spreads, butter, and chilled desserts. As end user acceptability is growing, these categories can be innovated with attributes that closely resemble conventional dairy but with greater functional benefits like high protein, vitamins, or minerals.

By diversifying product portfolios, brands can attract a greater number of end users, including flexitarians and health-focused end users, and create new sources of revenue. Innovations in taste, texture, and nutritional profile will have plant-based products capture a growing share of the dairy market. Growth also enables brands to establish their market positions, create leadership among categories, and stand out in a crowded marketplace.

Brazil Plant-Based Dairy Market Segmentation Analysis

By Product Type

- Plant-Based Milk

- Plant-Based Yoghurt

- Plant-Based Cheese

The segment with highest market share under Product Type is Plant-Based Milk, dominating the Brazil market with around 95% market share. Plant-based milk remains the top driver of the category, fueled by positive end users preference for dairy alternatives as a means of promoting healthier and more sustainable lifestyles. Soy, oat, and almond milk remain in favor, as further helped by product innovation closely mimicking the taste and functionality of traditional milk.

Other plant-based dairy sub-segments such as cheese, yoghurts, and butter are progressing rapidly but still have smaller shares. Plant-based cheese especially is closing the gap with improvements in taste and texture and suiting flexitarian and vegan end use end users. Expansion of these sub-segments propels greater application of plant-based dairy and enables brands to differentiate based on nutritional enhancement, functional benefit, and innovative format.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is Retail Offline, with share of nearly 95% of the Brazil Plant-Based Dairy Market, is the most powerful segment. The key channels are supermarkets and hypermarkets that have extensive distribution networks, good shelf positions, and mainstream popularity for plant-based products. Retail offline is the most sought-after option among end userss that need convenience, instant access, and plenty of varieties of plant-based dairy products.

While online distribution is growing in popularity, with subscription plans and bulk purchasing of premium or functional products, it plays a relatively modest percentage compared to offline retail. Retail offline continues to drive market penetration, especially in urban areas, where end users can access variety plant-based milk, cheese, yoghurt, and other dairy substitutes. This dominance has broader implications for the importance of physical retail in shaping end users choice and category growth.

Top Companies in Brazil Plant-Based Dairy Market

The top companies operating in the market include Nestlé Brasil Ltda, Cocamar Cooperativa Agroindustrial, Lactalis do Brasil Comercio, Importação & Exportação de Laticinios Ltda, Coca-Cola Indústrias Ltda, Positive Brands Indústria e Comércio de Alimentos Saudáveis SA, Danone Ltda, Cia Brasileira de Distribuição SA, Yoki Alimentos SA, Wow Nutrition Ind e Com Ltda, Yakult SA Industria e Comércio, etc., are the top players operating in the brazil plant-based dairy market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Plant Based Dairy Market Policies, Regulations, and Standards

4. Brazil Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Plant Based Dairy Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Convenience Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Supermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.4. Hypermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Brazil Plant-Based Milk Market Outlook, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Plant-Based Yoghurt Market Outlook, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Plant-Based Cheese Market Outlook, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Coca-Cola Indústrias Ltda

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Positive Brands Indústria e Comércio de Alimentos Saudáveis SA

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Danone Ltda

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Cia Brasileira de Distribuição SA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Yoki Alimentos SA

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Nestlé Brasil Ltda

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Cocamar Cooperativa Agroindustrial

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Lactalis do Brasil - Comércio, Importação & Exportação de Laticínios Ltda

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Wow Nutrition Indústria e Comércio Ltda

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Yakult SA Indústria e Comércio

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.