Brazil Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

|

Major Players

|

Brazil Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

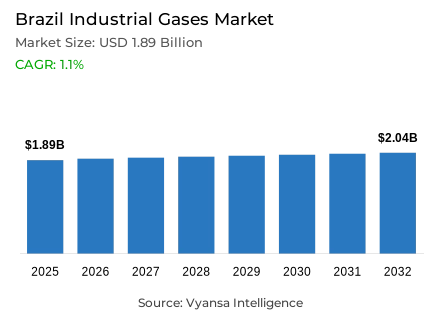

- Industrial gases in Brazil is estimated at USD 1.89 billion in 2025.

- The market size is expected to grow to USD 2.04 billion by 2032.

- Market to register a cagr of around 1.1% during 2026-32.

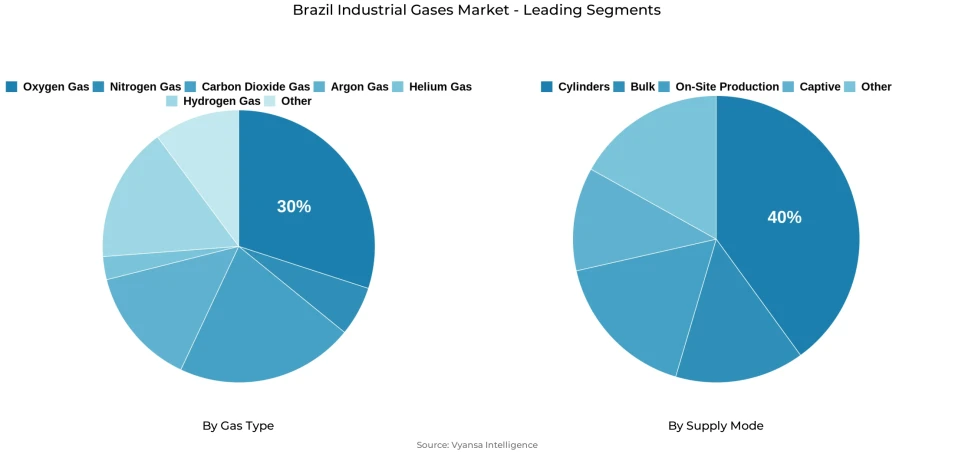

- Gas Type Shares

- Oxygen gas grabbed market share of 30%.

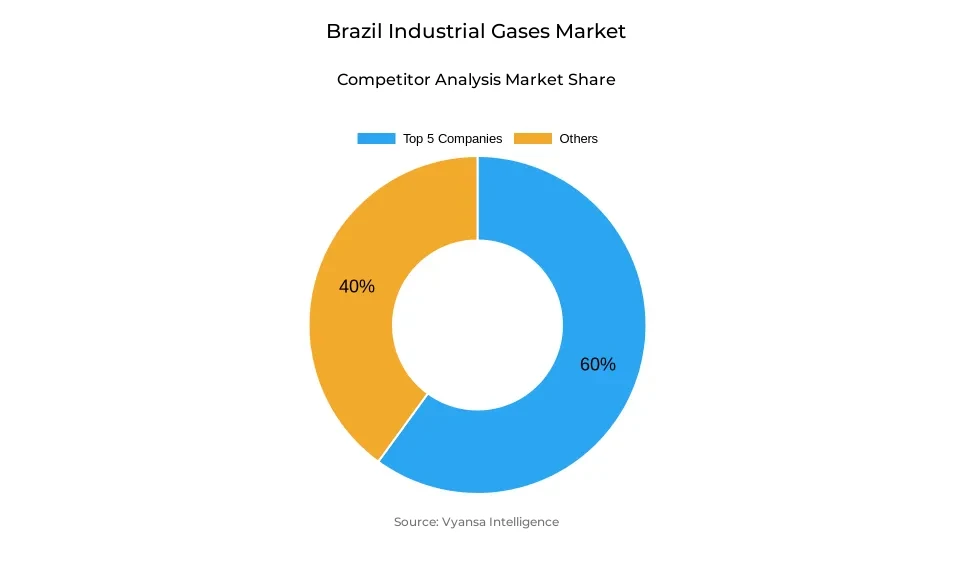

- Competition

- Industrial gases in Brazil is currently being catered to by more than 5 companies.

- Top 5 companies acquired around 60% of the market share.

- Air Products & Chemicals; Messer Group (Messer Gases Brasil); SOL Group; Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 40% of the market.

Brazil Industrial Gases Market Outlook

The growing industrial base in Brazil is still increasing the demand of industrial gases as the manufacturing, food processing, and offshore industries continue to grow. In 2024, industrial energy consumption increased 1.4%, with a 64.4% share of renewable energy that promotes cleaner and more efficient production. The high performance in such segments as pulp and paper, which produced 12.7 million tonnes of pulp in the first half of 2024, and the USD 233 billion food processing sector have reinforced the necessity of oxygen and nitrogen in bleaching, freezing, packaging, and preservation processes. As a result, the market of industrial gases is estimated at USD 1.89 bn in 2025 and is expected to rise to USD 2.04 bn in 2032, with the CAGR of about 1.1% in 2026-2032.

Long-term demand is also increased by offshore energy activities. The 4.143 million barrels of oil equivalent per day record of Petrobras in September 2025 and the anticipated opening of 44 offshore production systems by 2030 remain to increase the consumption of oxygen, nitrogen, and specialty gases in extraction, safety systems, and maintenance. The technological improvements in steel, glass, and petrochemicals are being driven by green hydrogen projects and national sustainability policies, which are increasing the demand of high-purity gases as industries transition to low-carbon production models.

Nevertheless, the problem of supply constraints is also a major issue. Brazil has significant logistical bottlenecks because of the lack of cylinders, and the country needs 5-10 million new cylinders by March 2026. The structural pressure on domestic supply is high because of the high reliance on imports of nitrogen-based fertilizers, 44.34 million tonnes in 2024. Nevertheless, oxygen is the most popular type of gas with 30% share, and the cylinder mode is the most popular with 40% market share.

The industrial development, offshore, sustainability, and increasing food processing demands all contribute to the stable and long-term demand of industrial gases in Brazil, although the supply-chain constraints still demand strategic consideration.

Brazil Industrial Gases Market Growth DriverExpanding Industrial Base Strengthens Demand Upswing

The fast-growing industrial environment in Brazil is still strengthening the demand of industrial gases as industries increase their production capacity and energy use. In 2024, the industrial energy consumption grew by 1.4% with a 64.4% renewable energy ratio, which facilitated cost-effective and cleaner production. The pulp and paper industry, a major industrial gas end user, produced 12.7 million tonnes of pulp in the first half of 2024, representing a 5.9% increase year-on-year, which directly strengthened demand for oxygen and nitrogen across bleaching and processing operations. Moreover, the food-processing industry earned USD 233 billion in revenues in 2024, which is an increase of 9.9% per year, which directly reinforced the use of gases in freezing, modified-atmosphere packaging, and preservation purposes.

The demand is further increased by end users in offshore operations. Pre-salt operations continue to be a major driver of gas consumption, and Petrobras recorded a record of 4.143 million barrels of oil equivalent per day in September 2025, an increase of 12.5% per year. The estimated 44 offshore production systems that will be activated by 2030 highlight the long-term needs of oxygen, nitrogen, and specialty gases used in extraction, processing, and safety systems. All these developments support the long-term demand in the heavy industries, food processing, petrochemicals, and offshore energy operations.

Brazil Industrial Gases Market ChallengeInfrastructure Limitations and Import Dependence Restrain Market Potential

The industrial gases supply chain in Brazil is still under pressure due to persistent logistical challenges even as the demand in the country increases. The supply of cylinders has turned into a bottleneck, with domestic manufacturers obliged to provide 5 to 10 million new cylinders by March 2026 to support the Gas do Povo subsidised LPG programme. Distribution networks are limited by limited production capacity and long delivery times, especially in remote and northern areas where infrastructure gaps add to transport delays and decrease inventory reliability. These limitations have a direct impact on the capacity of gas suppliers to ensure stable supply to end users of distributed industries and agriculture. The dependency on imports creates structural pressure throughout the nitrogen-intensive applications.

In 2024, Brazil imported 44.34 million tonnes of fertilisers, which covers about 80% of its domestic demand, and indicates a lack of domestic nitrogen production capacity. Unstable international markets and domestic energy prices make local production less competitive. The deindustrialisation in the Brazilian chemical industry in the past also restricts the growth of ammonia and nitrogen-based production. These capacity gaps increase supply vulnerability as industrial demand increases due to steel, petrochemicals, and food processing, and market scalability is slowed by robust downstream growth.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Industrial Gases Market TrendTechnology Modernization and Sustainability Shifts Redefine Operations

The industrial gas use is changing with technological transformation as Brazil focuses on efficiency and decarbonisation in key manufacturing hubs. The steel industry continues to use BF-BOF processes as it considers moving to hydrogen-based direct-reduced iron technologies, with firms like Vale considering low-carbon steel centres based on green hydrogen production. Operators such as Cebrace are also implementing hydrogen solutions based on electrolyser starting in 2025 to cut down on furnace emissions and enhance energy efficiency, which is creating growing demand on high-purity oxygen and hydrogen. These changes are initial steps towards a wider change in industrial energy forms. These changes in technology are hastened by national sustainability measures.

In October 2024, the Future Fuels Law was passed, requiring biomethane to be blended beginning in 2026, with CNPE targeting 1-10% per year. These policies, together with the Brazilian Greenhouse Gas Emissions Trading System, force industrial facilities to implement gas-based solutions that improve combustion efficiency, decrease emissions, and facilitate compliance. The petrochemicals, automotive manufacturing, steel production, and food-processing industries are progressively incorporating the state-of-the-art gas management and low-carbon technologies to address the narrowing standards and minimize operational footprints.

Brazil Industrial Gases Market OpportunityRenewables Integration and Offshore Expansion Unlock Growth Prospects

New investments in offshore and renewable energy systems open up major prospects of the suppliers of industrial gases in the future. Rota 3 pipeline, which will be in operation since May 2025, will increase the processing capacity to 21 million cubic metres per day at the Boaventura complex, which will support increased volumes of pre-salt production. This growth raises demands of oxygen, nitrogen and specialty gases in extraction, maintenance and safety uses. Expansion of offshore platforms till 2030 further enhances the need of stable gas supply chains to sustain energy production clusters that are clustered along the coast of Brazil. These trends make industrial gases a key input to the growing offshore industry in the country.

Advancement in agricultural production and energy transition programs provide further growth opportunities. In 2024, the demand of fertilisers was 44.34 million tonnes, which supports the strategic role of nitrogen in agricultural and industrial activities. The growth of food-processing operations and the increased use of sophisticated freezing and packaging systems create more opportunities in the use of nitrogen and CO₂. The demand of welding equipment, which is estimated to increase by 6% CAGR until 2030, is underpinned by significant infrastructure development projects like the Plano Decenal de Expansao de Energia 2026. The collaboration of the Ministry of Mines and Energy with foreign investors increases the chances of expanding domestic gas infrastructure, which will decrease the reliance and increase resilience.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen holds the leading position in the Brazil Industrial Gases Market, accounting for approximately 30% of total market revenue in 2023 and establishing itself as the largest gas-type segment. Its dominance results from extensive utilization in steelmaking via basic oxygen furnace operations, in glass manufacturing for high-temperature combustion, and in petrochemical processes where oxygen enhances reaction efficiency. Large-scale heavy industries maintain continuous demand, highlighting oxygen’s strategic importance in Brazil’s production ecosystem. This entrenched industrial base reinforces the segment’s long-term strength across multiple high-volume applications.

Nitrogen and hydrogen represent secondary but expanding segments as their use increases across food processing, cooling systems, laboratory operations, and emerging hydrogen-based industrial processes. Specialty gases such as argon, carbon dioxide, and acetylene support specific needs in welding, electronics, refrigeration, and enhanced oil recovery. The evolving segmentation reflects Brazil’s diverse industrial profile, where oxygen anchors demand but complementary gases expand as end users adopt automated processing, advanced manufacturing technologies, and environmentally conscious production methods.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

The cylinder supply mode remains the dominant distribution channel in the Brazil Industrial Gases Market, capturing approximately 40% of total market share. Its leadership reflects the flexibility and portability required by decentralized end users including metal fabrication workshops, laboratories, small manufacturing units, healthcare facilities, and remote industrial sites lacking fixed gas infrastructure. Cylinders play a crucial role in enabling on-demand usage for welding, maintenance, and specialized industrial operations across dispersed geographic regions. This model is particularly important outside southeastern industrial hubs where pipeline networks are limited.

Moreover, On-site generation and pipeline supply modes collectively serve large-volume industrial facilities requiring uninterrupted supply. Steel mills, petrochemical complexes, and pulp and paper plants rely on on-site systems for continuous high-volume gas flow, while pipeline networks primarily support industrial clusters in southeastern Brazil. The sustained prominence of cylinders highlights the country’s distributed industrial structure and the operational needs of agricultural, food processing, and small-to-medium-scale manufacturing sectors, which depend on adaptable delivery formats rather than centralized infrastructure.

List of Companies Covered in Brazil Industrial Gases Market

The companies listed below are highly influential in the Brazil industrial gases market, with a significant market share and a strong impact on industry developments.

- Air Products & Chemicals

- Messer Group (Messer Gases Brasil)

- SOL Group

- Linde

- Air Liquide

Market News & Updates

- Linde, 2025:

Linde Subsidiary (White Martins) Scaled up green hydrogen production through new 5 MW pressurized alkaline electrolyzer facility in Jacareí, São Paulo commissioned in 2025 powered by renewable energy from solar and wind projects; supplies glass manufacturer Cebrace to reduce CO₂ emissions from furnace operations; expansion serves growing industrial demand across metals, food, and chemical sectors positioning White Martins as South American first-mover in industrial-scale green hydrogen.

- Air Liquide, 2025:

Inaugurated biomethane purification and upgrading facility at Environmental Mark waste processing site in Espírito Santo (operational H2 2025) with capacity to process 2,500 cubic meters per hour of biogas into 155 GWh/year biomethane production for injection into natural gas pipelines; project demonstrates Air Liquide's consolidated expertise across biomethane value chain from biogas production through purification and pipeline injection/compression serving energy transition objectives; CEO François Jackow appointed Co-Chair of Hydrogen Council (December 2025) reflecting Air Liquide's leadership in low-carbon and renewable hydrogen across 60+ years operational expertise in hydrogen value chain.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Industrial Gases Market Policies, Regulations, and Standards

4. Brazil Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Brazil Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Brazil Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Brazil Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Brazil Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Brazil Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Brazil Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Products & Chemicals

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Messer Group (Messer Gases Brasil)

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. SOL Group

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.