Brazil Beer Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Dark Beer (Ale, Sorghum Beer, Weissbier/Weizen/Wheat Beer), Lager (Flavoured/Mixed Lager, Standard Lager (Premium Lager (Domestic Premium Lager, Imported Premium Lager), Mid-Priced Lager (Domestic Mid-Priced Lager, Imported Mid-Priced Lager), Economy Lager (Domestic Economy Lager, Imported Economy Lager))), Non/Low Alcohol Beer (Low Alcohol Beer, Non Alcoholic Beer), Stout, Others (Porter, Malt etc.)), By Production (Macro Brewery, Micro Brewery, Craft Brewery), By Packaging Type (Bottles, Cans, Others), By Sales Channel (On-Trade, Off-Trade)

- Food & Beverage

- Dec 2025

- VI0564

- 125

-

Brazil Beer Market Statistics and Insights, 2026

- Market Size Statistics

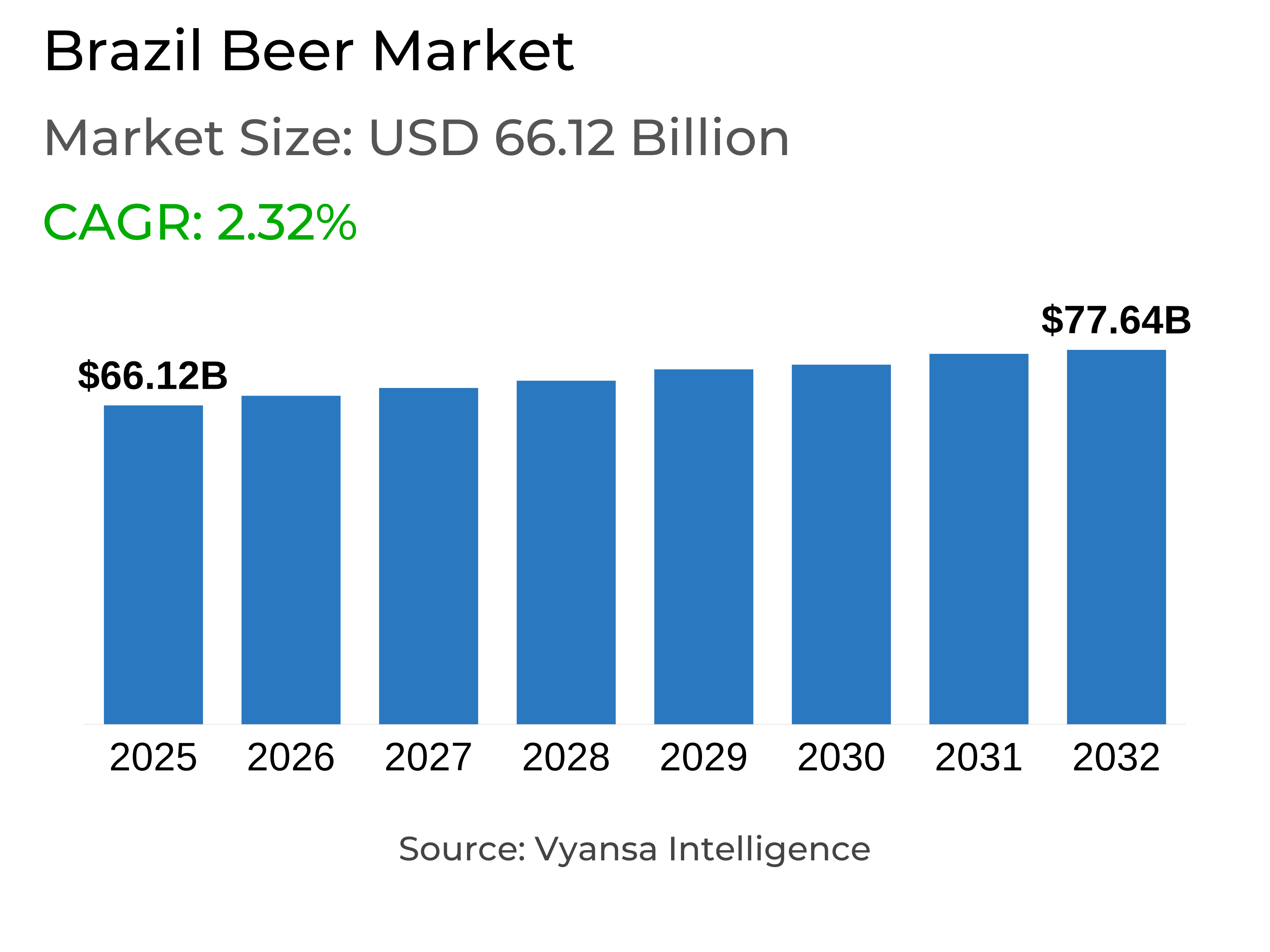

- Beer in Brazil is estimated at $ 66.12 Billion.

- The market size is expected to grow to $ 77.64 Billion by 2032.

- Market to register a CAGR of around 2.32% during 2026-32.

- Product Type Shares

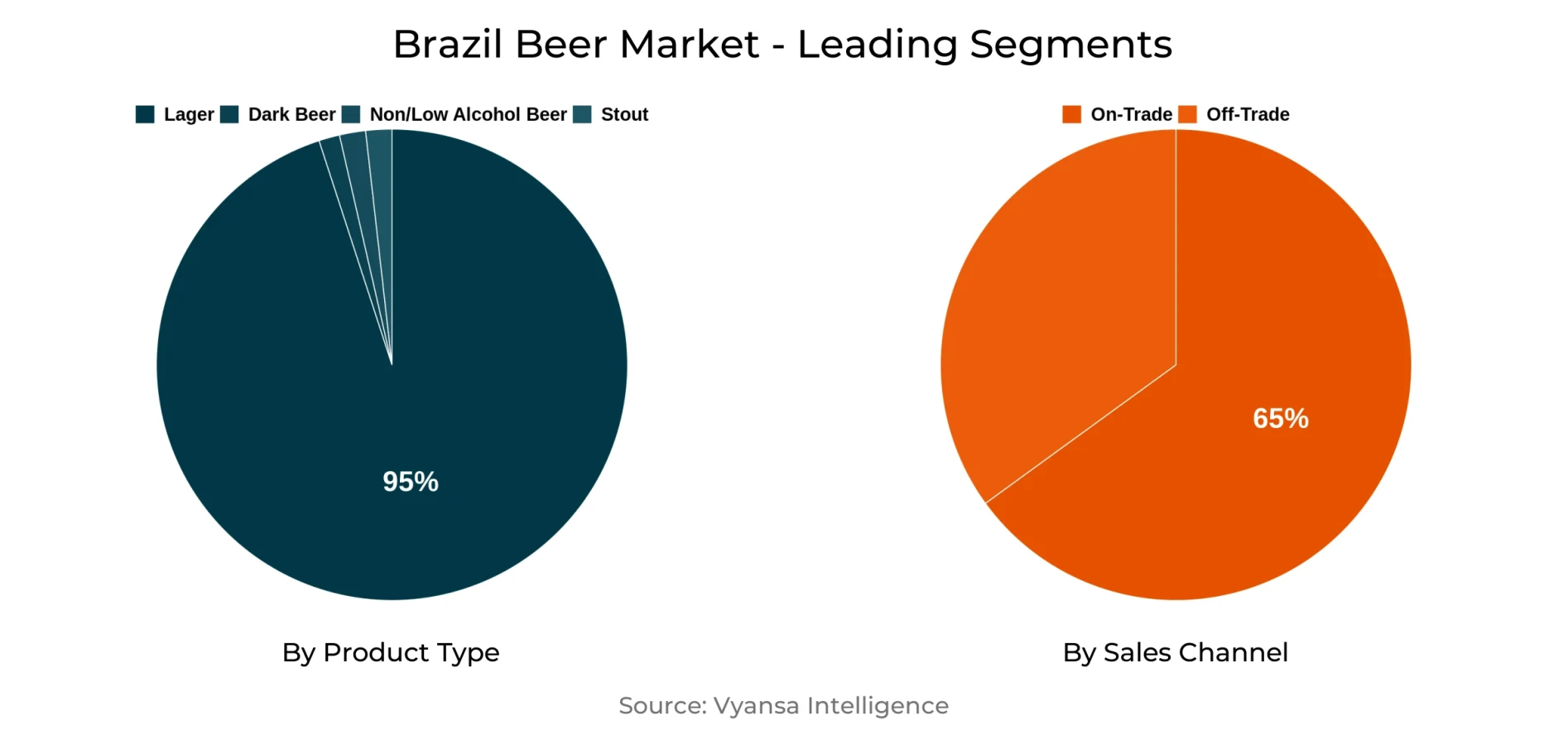

- Lager grabbed market share of 95%.

- Competition

- More than 5 companies are actively engaged in producing Beer in Brazil.

- Top 4 companies acquired around 95% of the market share.

- Cia Brasileira de Bebidas, Heineken do Brasil Comercial Ltda etc., are few of the top companies.

- Sales Channel

- On-trade grabbed 65% of the market.

Brazil Beer Market Outlook

The Brazil beer market size is estimated at $66.12 billion in 2025 and is expected to grow to $77.64 billion by 2032, at a CAGR of approximately 2.32% for the period 2026–2032. Beer maintains its strong cultural significance in Brazil, with extensive consumption during social events and perfect adaptability to the hot weather of the country. In spite of economic pressures like package material cost increases and currency devaluation, beer is still relatively inexpensive when contrasted with other alcoholic beverages, allowing the category to be resilient and show continued growth.

Lager is still the largest product category, accounting for about 95% of the market. Premium lager remains the growth driver in this segment, increasing its shelf footprint and rising in popularity among end users who opt for higher-quality brands. Large players like Heineken, Corona, and Stella Artois saw good sales on the back of production and distribution investments. Mid-priced and economy lagers, however, experienced stagnation or soft declines as end users increasingly upgrade to premium products.

Dominant players like Anheuser-Busch InBev and Heineken do Brasil are also pushing for premiumisation, digitalisation, and innovation. The two are developing their online ecosystems—like Zé Delivery and Heishop—to source directly from end users and enhance operational efficiency. Non- and low-alcohol beers are also growing strongly, in line with increasing health and wellness trends. Examples include Heineken 0.0 and Corona Cero, which accentuate this trend through functional or fortified propositions.

By distribution channel, on-trade accounts for approximately 65% of the volume sales of beer, underlining the country's lively bar scene, but off-trade also continues to expand through supermarkets and online sales. In the future, premiumisation, health-conscious products, and digital integration are likely to be at the core of market strategies underpinning continued growth in Brazil's lively beer sector.

Brazil Beer Market Growth DriverIncreasing Trend Towards Premium Lager Consolidates Market Performance

The Brazil Beer Market is propelled by the increasing demand for premium lager, which has become the main agenda for major brewers. Corona, Heineken, and Stella Artois brands are gaining strong traction as end-users identify them with higher quality, taste, and lifestyle appeal. Large firms are investing in the development and distribution networks to cater to this demand and enhance brand exposure in on-trade and off-trade distribution channels.

This premiumisation focus plays to a great extent in reducing slowed mid-range and economy segment sales. Even when economic times are uncertain, end users pay extra for better quality products that make drinking even more enjoyable. Moving towards premium products is, hence, a main driver of volume and value development in Brazil's beer market.

Brazil Beer Market ChallengeHigh Production Costs and Currency Fluctuations Strain Profitability

Brazilian brewers are being confronted with ongoing cost challenges as a result of the increased prices of primary packaging materials like glass and aluminium, coupled with the weakening of the local currency. This has squeezed profit margins and compelled firms to evaluate their operating models in order to stay competitive. Minimizing costs without affecting product quality and price is still a principal concern for producers.

Even with consistent demand, economic uncertainty and inflation further complicate operations. Brands are forced to come up with cost-effective measures while retaining their distribution coverage and promotional campaigns. Therefore, reconciling profitability and continued market growth remains a significant challenge for both local and foreign beer manufacturers.

Brazil Beer Market TrendIncreasing Trend Towards Health-Focused and Non-Alcoholic Beer Options

Health and wellness trends are transforming Brazil beer drinking, with growing popularity for non-alcoholic and light-alcohol versions. Brands such as Heineken 0.0 and Corona Cero are becoming popular for providing lighter options that are in line with end users emphasis on moderation and health. On top of this, products with features such as low-calorie, gluten-free, or vitamin-enhanced ingredients are being launched to meet changing health trends.

This change mirrors the way end users are re-evaluating their drinking patterns, looking for products that deliver pleasure without alcohol downside. Brewers are pushing back by innovating in product, packaging, and marketing, turning health-aware options into a large and rapidly growing share of the market.

Brazil Beer Market OpportunityDigitalisation and Technological Integration to Improve Market Coverage

Brazil beer market is set to see strong growth driven by digital advancements. Major brewers will continue to build their direct-to-end users and B2B online portals like Zé Delivery, BEES, and Heishop. These online channels will contribute to enhanced operational effectiveness, enhanced access to market information, and improved communication with retailers and end users.

Investing in tech will also allow businesses to maximize supply chain management and tailor end users interaction. As brewries develop their digital environments, they will be able to better understand end users preferences and enhance brand allegiance. This shift towards technology-based operations will create new opportunities for sustainable growth in the industry.

Brazil Beer Market Segmentation Analysis

By Product Type

- Dark Beer

- Lager

- Non/Low Alcohol Beer

- Stout

The segment with highest market share under Product Type is Lager, which holds about 95% of the Brazil Beer Market. Beer is firmly ingrained within Brazilian culture, and lager is the most favored within end users as a refreshing drink suitable for the warm climate of the nation. The prevalence of lager also results from its extensive availability on both off-trade and on-trade channels and the existence of established brands addressing all price segments such as economy, mid-priced, and premium lagers.

Among lager, premium lager maintains firm momentum with backing from growing end users demand for high-quality products and the premiumisation trends pursued by major producers. Heineken, Corona, and Stella Artois are broadening their distribution and marketing initiatives, while local players like Brahma and Antarctica share consistent demand. Such firm cultural affinity and price appeal further entrench lager's dominance in the Brazilian beer market.

By Sales Channel

- On-Trade

- Off-Trade

The segment with highest market share under Sales Channel is On-trade, accounting for approximately 65% of the Brazil Beer Market. Beer is an integral part of Brazil social life, with restaurants and bars being the strongest points of consumption. The on-trade channel is aided by Brazil lively bar scene—the country boasts one of the highest counts of bars in the world—providing a focal point for beer consumption, especially when with friends or while watching sports.

In spite of some pressure from inflation and lower purchasing power, the on-trade channel continues to dominate because end users still identify beer as synonymous with social experience. Premium and mainstream brands make a conscious investment in bar promotions and alliances to further enhance visibility and brand loyalty. The off-trade channel, spearheaded by supermarkets and hypermarkets, has recorded swiftest volume growth in recent times, but on-trade will probably continue to hold its leading position due to its deep-seated cultural saliency and experiential consumption pull.

Top Companies in Brazil Beer Market

The top companies operating in the market include Cia Brasileira de Bebidas, Heineken do Brasil Comercial Ltda, Cervejaria Petrópolis SA, Brasil Kirin Participações e Representações SA, etc., are the top players operating in the Brazil Beer Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Beer Market Policies, Regulations, and Standards

4. Brazil Beer Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Beer Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.1.2. By Quantity Sold in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Dark Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Ale- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sorghum Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Weissbier/Weizen/Wheat Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Flavoured/Mixed Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Standard Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1. Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.1. Domestic Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.2. Imported Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2. Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.1. Domestic Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.2. Imported Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3. Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.1. Domestic Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.2. Imported Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Non/Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Non Alcoholic Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Stout- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others (Porter, Malt etc.) - Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Production

5.2.2.1. Macro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Micro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Craft Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Packaging Type

5.2.3.1. Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. On-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Brazil Dark Beer Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.1.2. By Quantity Sold in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Production- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Lager Beer Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.1.2. By Quantity Sold in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Production- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Non/Low Alcohol Beer Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.1.2. By Quantity Sold in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1. By Production- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Brazil Stout Beer Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.1.2. By Quantity Sold in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1. By Production- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. Cia Brasileira de Bebidas

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Heineken do Brasil Comercial Ltda

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Cervejaria Petrópolis SA

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Brasil Kirin Participações e Representações SA

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Production |

|

| By Packaging Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.