Brazil Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0567

- 120

-

Brazil Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

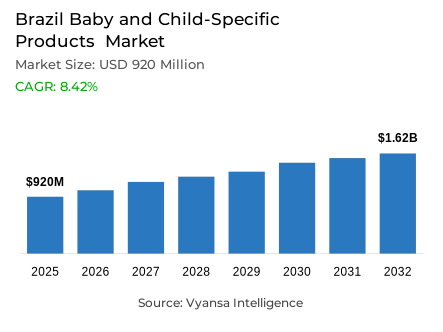

- Baby and Child-Specific Products in Brazil is estimated at $ 920 Million.

- The market size is expected to grow to $ 1.62 Billion by 2032.

- Market to register a CAGR of around 8.42% during 2026-32.

- Product Shares

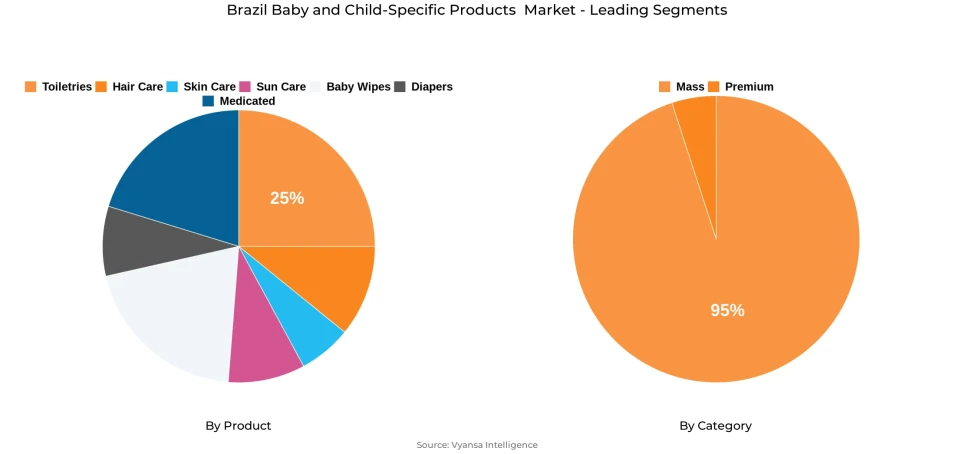

- Toiletries grabbed market share of 25%.

- Competition

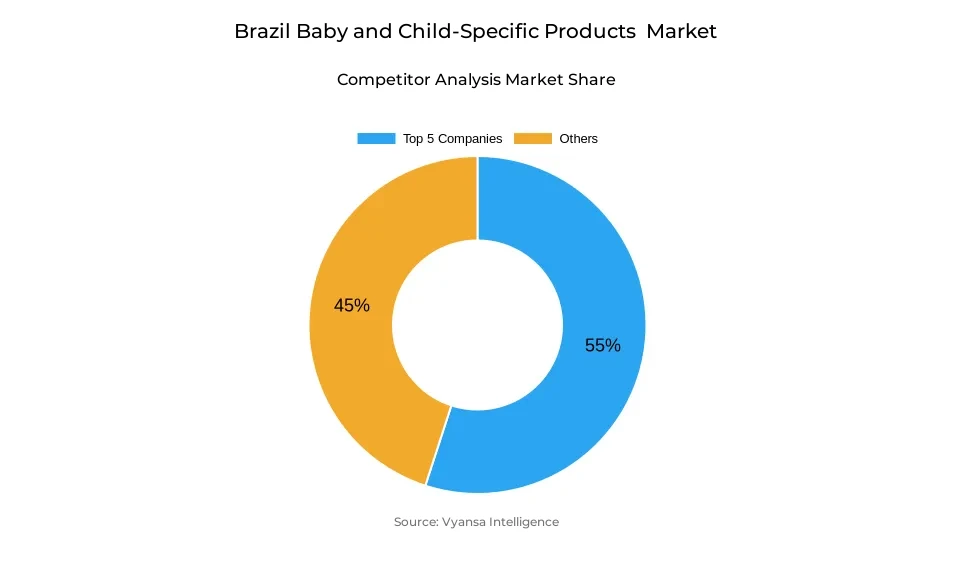

- More than 15 companies are actively engaged in producing Baby and Child-Specific Products in Brazil.

- Top 5 companies acquired around 55% of the market share.

- Laboratórios Expanscience Comércio Importação e Exportação de Produtos para a Saúde Ltda, Bayer Brazil SA, Phisália Produtos de Beleza Ltda, Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda, Natura Cosméticos SA etc., are few of the top companies.

- Category

- Mass grabbed 95% of the market.

Brazil Baby and Child-Specific Products Market Outlook

The Brazil baby and child-specific products market is anticipated to grow steadily during the forecast period, from an estimated $920 million in 2025 to $1.62 billion by 2032. Sun care for children, baby wipes, and treatments for nappy (diaper) rash are forecast to be the most significant drivers of growth, driven by increasing hygiene awareness, convenience, and multi-purpose use. Baby wipes, in turn, continue to gain from regular usage and widened usage areas, such as personal care for adults and cleaning surfaces, while sun care products pick up momentum with affordability and premiumisation.

The top five commanding around 55% of overall market share. Most established brands like Mustela and Granado gain end user trust on the back of ingredient-led communication, sustainability themes, and authentic paediatric endorsements. Innovative marketing strategies, engagements with popular franchises, and gifting-oriented products are assisting brands in reaching modern end users and pre-teens, encouraging engagement, and repeat buying.

Mass-market brands sweep the distribution board, representing 95% of all sales, with pharmacies and supermarkets still being major channels. Retail online expands exceedingly fast, especially for high-end brands, with convenience, bulk buying, and price competitiveness being offered. Online channels also open opportunities for small firms to reach end userss directly, increasing brand exposure and market penetration.

Demographic shifts and delayed motherhood are impacting the direction of the market. With declining families and births, demand for baby and child-centric goods will increasingly center on premium, specialist, and sustainable products. Businesses that favor quality, safety, and innovation will benefit from appealing to contemporary end users, such as those with good product safety records, that will ensure consistent value growth even in the face of a shrinking target population.

Brazil Baby and Child-Specific Products Market Growth Driver

Increased Demand for Children's Skin and Sun Care

The Brazil child-specific and baby products market is spurred by rising health and skincare awareness for children. Baby wipes, treatments for nappy rash, and sun protection are still on the must-have lists of end users, who value safety, efficacy, and cleanliness. end userss increasingly look for specialized formulations featuring calming and hypoallergenic ingredients, mirroring growing concern for child wellness.

Increased parental focus on product safety and performance, coupled with growing household incomes, stimulates expenditure on premium and functional infant and child-focused products. Ongoing popularity of sun care and skincare products indicates the resilience of the market, even in the face of price sensitivity, thus representing health-conscious purchasing as one of the drivers for growth.

Brazil Baby and Child-Specific Products Market Challenge

Slowing Birth Rate Limits Volume Growth

One of the main challenges facing the Brazil baby and child-specific products market is the shrinking number of children in the 0–9 age group. Decreasing births lower the base end users segment, constraining volume growth for products like toiletries, baby wipes, and nappy care products. As much as demand for specialty items increases, decreasing target population constrains the overall market growth.

In addition to that, price sensitivity is an issue for end users who have to keep household budgets, especially for non-essential products. With fewer kids and conservative spending, firms will have to invest in premiumization, value-added products, or product differentiation in order to keep growing and retain end users loyalty.

Brazil Baby and Child-Specific Products Market Trend

Product Development Innovation

The most significant market trends is innovation in baby and child-specific products. Companies are launching multi-functional preparations, mild and hypoallergenic ingredients, and sensitive skin products. Product forms are becoming more playful and interactive, frequently tied to licensed characters or themed packaging to appeal to children and end users alike.

Innovation also encompasses functional advantages like moisturizing, sun protection, or antibacterial. Intersecting safety, functionality, and innovative design, manufacturers distinguish products in a congested marketplace, driving engagement and brand loyalty. The relentless rollout of innovative products solidifies end users interest and propels the market's overall growth pattern.

Brazil Baby and Child-Specific Products Market Opportunity

Multi-Use Applications to Increase Market Potential

One potential for the Brazil market of baby and child-specific products is to extend the use of products beyond the target child segment. Products like baby wipes, creams, and lotions can be positioned for additional uses, such as personal care, cleaning surfaces, or skin care for older children with sensitive skin.

Through the use of multi-use products, manufacturers can appeal to a large audience, sustain sales in the face of a dwindling children population, and justify higher prices. Multi-use products also satisfy contemporary end users who want convenience, efficiency, and value. This strategy offers room for innovation, differentiation, and deeper end users adoption across generations.

Brazil Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with highest market share under Product Type is toiletries, with a share of approximately 25% in the Brazil baby and child-specific products. The category consists of basic products like baby wipes, nappy rash treatments, and other hygiene products that are commonly bought by end users to keep their child healthy and in good shape. Baby wipes, in turn, appreciate multipurpose application, being utilized not only for babies but also for surface and personal hygiene when on the go. The union of convenience, efficiency, and hypoallergenic or natural ingredients solidifies the position of toiletries in the market.

Other line types, including sun care and baby and child-only hair care, are also growing. Sun care is increasing at a higher rate than adult lines, thanks to education campaigns and newer, more convenient products, and hair care is picking up thanks to plant-based formulas and no-tears offerings for sensitive hair, contributing to overall product mix growth.

By Category

- Premium

- Mass

The segment with highest market share under Category is mass products and it captures about 95% of the Brazil baby and child-specific products market. Mass products lead the way because they are widely available in supermarkets, pharmacies, and other retail stores and end users opt for them when they want basic baby essentials like wipes and nappy care products. Price sensitivity and promotion activities like offers and bundling further enhance the mass segment's appeal.

Niche and premium products, such as gift sets and sun care, are also becoming a growing source of value increase. end users are prepared to spend more on quality, sustainable, and specialist products for children, particularly with reduced family sizes and increasing motherhood ages. The trend aids premiumisation in the market while mass products continue as the foundation of retail value sales.

Top Companies in Brazil Baby and Child-Specific Products Market

The top companies operating in the market include Laboratórios Expanscience Comércio Importação e Exportação de Produtos para a Saúde Ltda, Bayer Brazil SA, Phisália Produtos de Beleza Ltda, Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda, Natura Cosméticos SA, Kimberly-Clark Brasil Indústria e Comércio de Produtos de Higiene Ltda, Botica Comercial Farmacêutica Ltda, Colgate-Palmolive Indústria e Comércio Ltda, Ontex Brasil Holding Ltda, Unilever Brasil Ltda, etc., are the top players operating in the Brazil Baby and Child-Specific Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Brazil Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Brazil Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Brazil Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Brazil Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Brazil Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Brazil Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Natura Cosméticos SA

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Kimberly-Clark Brasil Indústria e Comércio de Produtos de Higiene Ltda

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Botica Comercial Farmacêutica Ltda

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Colgate-Palmolive Indústria e Comércio Ltda

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Laboratórios Expanscience Comércio Importação e Exportação de Produtos para a Saúde Ltda

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Bayer Brazil SA

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Phisália Produtos de Beleza Ltda

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Ontex Brasil Holding Ltda

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Unilever Brasil Ltda

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.