Benelux Water Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine, Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Positive Displacement Pump (Diaphragm Pumps, Piston Pumps, Gear Pumps, Lobe Pumps, Progressive Cavity Pumps, Screw Pumps, Vane Pumps, Peristaltic Pumps, Others)), By End User (Oil & Gas, Power, Residential, Agriculture & Irrigation, Commercial Building, HVAC, Chemical, Water & Wastewater, Food & Beverage, Others)

- Energy & Power

- Dec 2025

- VI0313

- 125

-

Benelux Water Pump Market Statistics and Insights, 2026

- Market Size Statistics

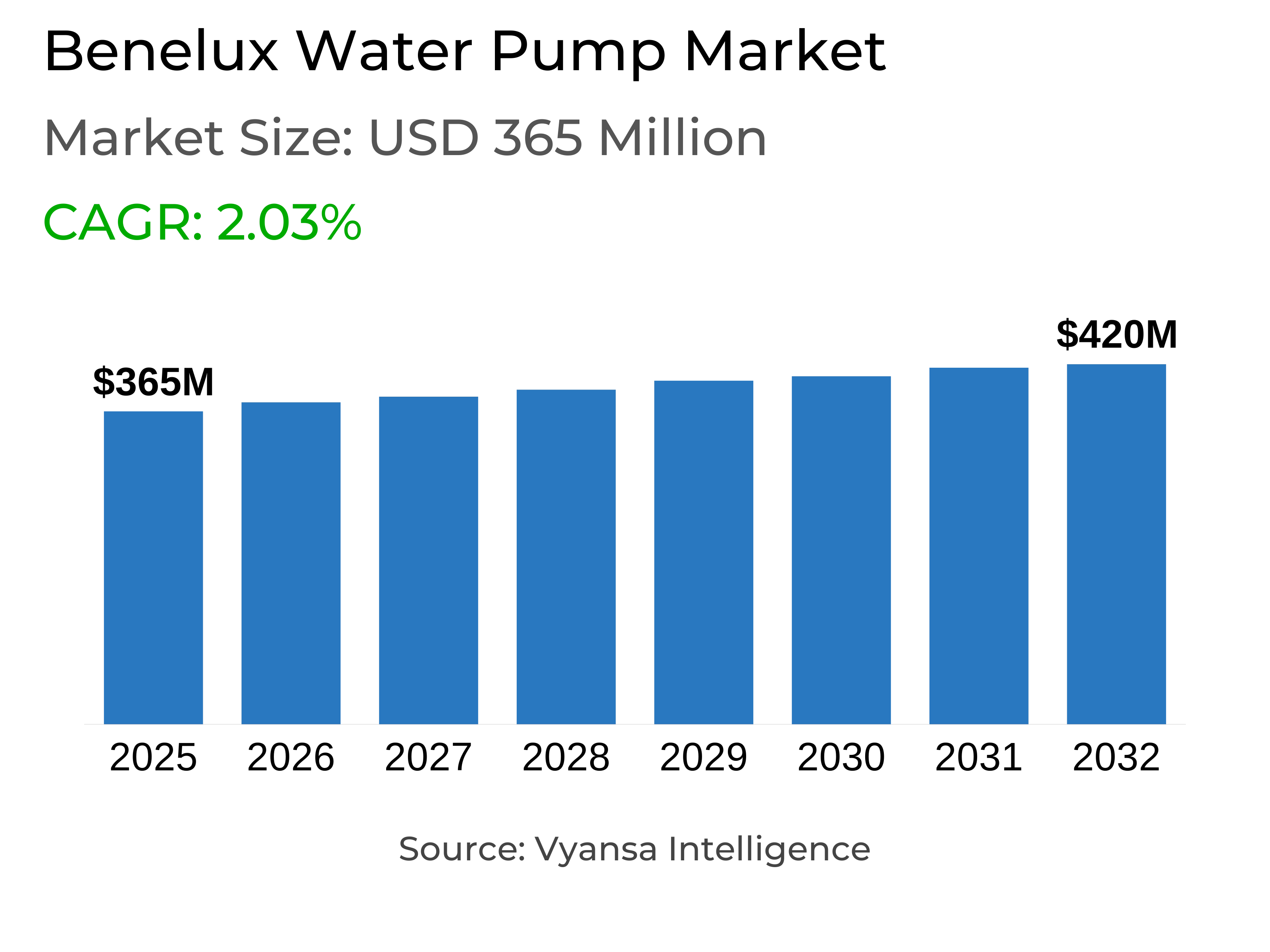

- Water Pump in Benelux is estimated at $ 365 Million.

- The market size is expected to grow to $ 420 Million by 2032.

- Market to register a CAGR of around 2.03% during 2026-32.

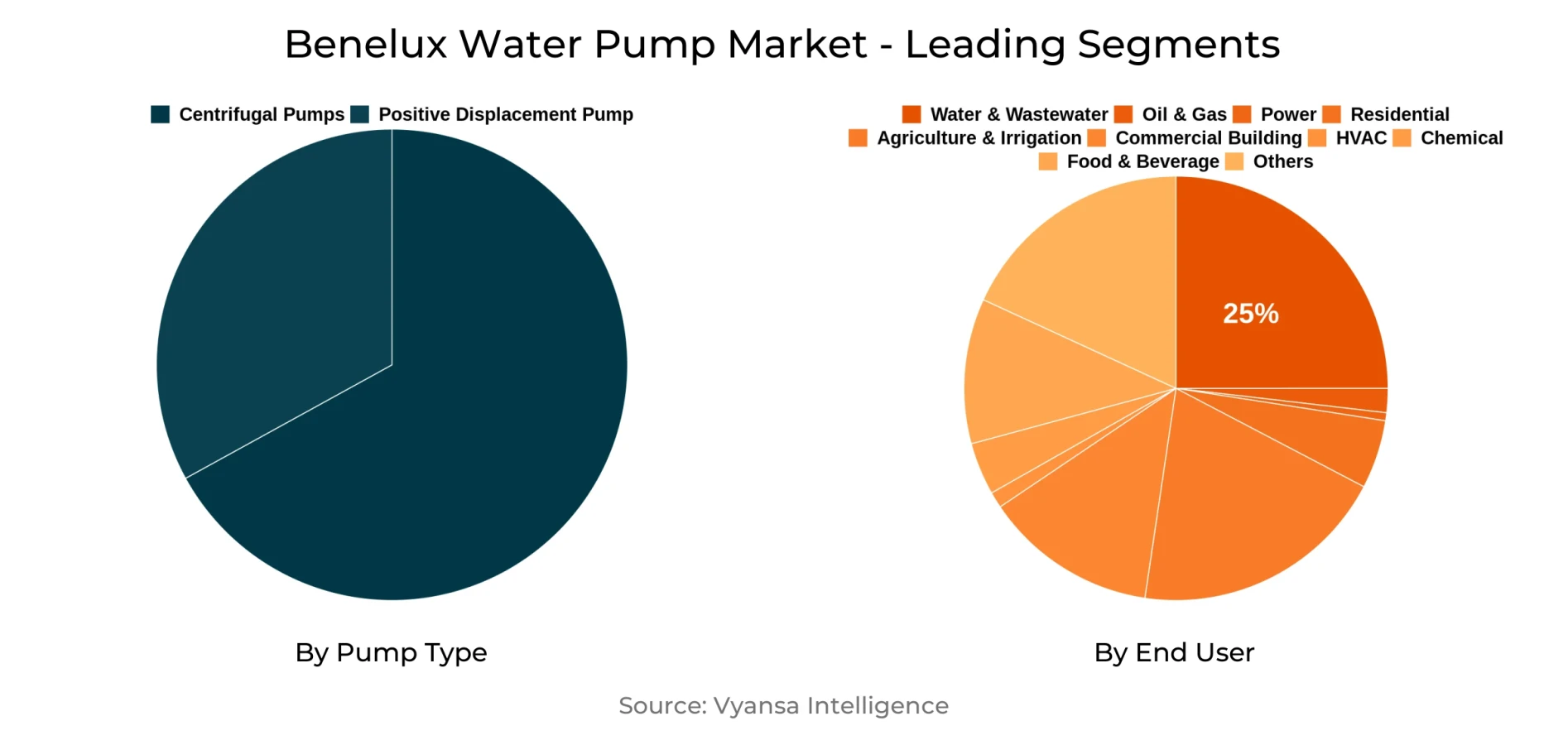

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

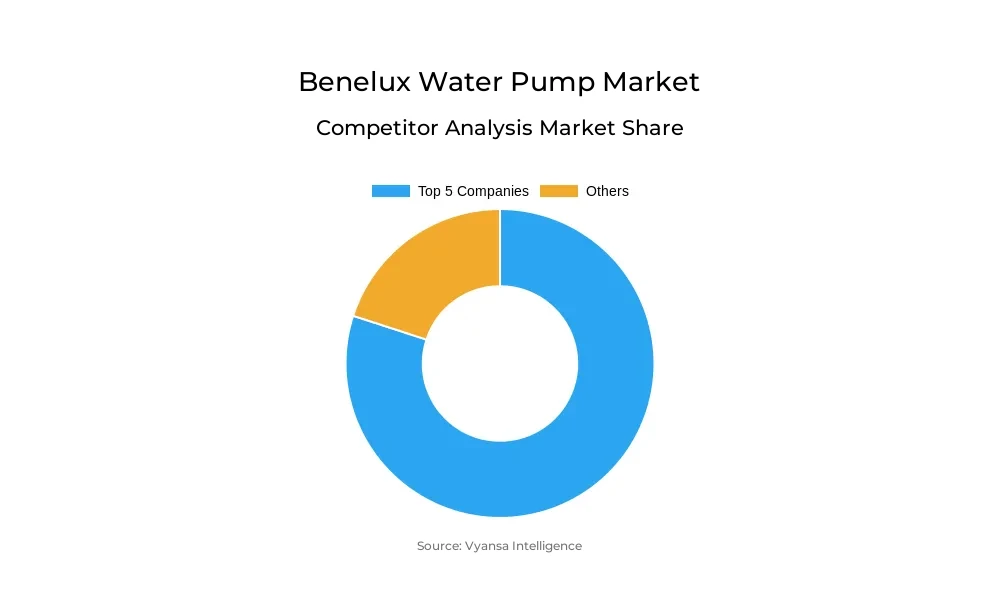

- Competition

- More than 10 companies are actively engaged in producing Water Pump in Benelux.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Water & Wastewater grabbed 25% of the market.

Benelux Water Pump Market Outlook

The Benelux water pump industry, worth USD 365 million in 2025, is expected to reach USD 420 million by 2032, driven by fast-paced urban growth and increasing sustainability demands. Municipal governments are subject to stringent EU discharge requirements, necessitating high-end pumps for sewage transfer, sludge management, and effluent treatment. As more than 70% of Europe's urban wastewater gets treated efficiently, demand for corrosion-resistant and energy-efficient pumps continues to gain momentum. Smart-city projects extend the adoption of IoT-powered systems that provide real-time leak detection and predictive maintenance to reduce unplanned downtime by as much as 30% in pilot programs.

In spite of such progress, manpower shortages are a challenge. The European Centre for the Development of Vocational Training also points to a 30% gap in IoT and automation skills, with 25% of pump-industry engineers approaching retirement age. Such shortage results in extended commissioning times and additional maintenance costs, and training programs therefore become paramount to maximize the use of advanced pump technologies and meet water-quality regulations.

Technology uptake is remodeling operations in Benelux. Interconnected pumping networks in the Netherlands have achieved up to 20% energy savings with adaptive speed control and pressure optimization. SCADA-connected platforms enhance fault detection and enable proactive maintenance, minimizing water losses and facilitating circular-economy objectives in reuse schemes. Meanwhile, the aging infrastructure generates profit-rich retrofit opportunities, with municipalities spending more than €500 million every year on network renewals. EU cohesion fund subsidies pay for as much as 40% of the capital expenditures for energy-efficient pumps, making replacements affordable as electricity rates increase.

By Pump Type category, centrifugal pumps are the most dominant with over half of Europe's installations, due to their ease of design, minimal maintenance, and high flow rate capabilities. On the end-user front, Water & Wastewater is the largest with a 25% market share in Benelux in 2025, testifying to ongoing investments in treatment plant upgrades and distribution growth. The segment will continue to be the fulcrum of growth until 2032, with municipalities focusing on dependable pumping solutions for wastewater management.

Benelux Water Pump Market Growth Driver

Urban development in the Benelux area forces local-authority infrastructure to upgrade pumping facilities. More than 70% of European urban wastewater is efficiently treated today, serving to underline the pivotal role that dependable pumps play in sewage pumping and effluent treatment. Local-authority authorities are coming under increasing regulatory strain to conform to tight EU discharge standards, compelling the use of sophisticated pumps with enhanced corrosion resistance and energy-efficient designs.

Growing smart-city projects further drive demand. IoT-enabled monitoring platforms integration enables real-time leak detection and predictive maintenance, cutting unplanned downtime by as much as 30% in pilot municipal programs across Europe. This transformation not only increases operational efficiency but also works towards sustainability targets, making new water pumps an absolute necessity for urban water management.

Benelux Water Pump Market Challenge

Advanced pump technologies need specialized knowledge for installation and maintenance. According to the European Centre for the Development of Vocational Training, demand outnumbers supply by 30% for technicians with expertise in IoT and automation. In Benelux, this shortage means commissioning takes longer and maintenance is more expensive as operators cannot easily find skilled labor.

An aging workforce adds to the challenge: 25% of veteran pump-industry engineers in Europe are approaching retirement. Without targeted training programs, municipalities risk not fully taking advantage of smart-pump capabilities, potentially jeopardizing water-quality compliance and adding lifecycle costs.

Benelux Water Pump Market Trend

Benelux utilities increasingly embrace connected pumping systems that provide remote monitoring and analytics. Initial rollouts in the Netherlands realize up to 20% energy savings using adaptive speed control and pressure optimization. These systems provide real-time data to centralized dashboards that allow operators to manage network pressure and curb leak-related water losses.

In addition, integration with SCADA platforms minimizes fault diagnostics. Instant alerts of vibration deviations and seal integrity enable maintenance teams to act prior to failure, enhancing network robustness and contributing to circular-economy aspirations in urban water reuse applications.

Benelux Water Pump Market Opportunity

Benelux aged water distribution networks offer attractive retrofit opportunities. Local authorities spend in excess of €500 million per year on pipeline replacement and pump station upgrades. Upgrading existing stations with modular, drop-in pump units streamlines works and prevents costly civil works.

Government subsidies under EU cohesion funds cover a maximum of 40% of the capital expense for energy-efficient pump replacements. With this added support, combined with escalating electricity costs, pump replacement becomes an economical way to lower running costs and carbon emissions.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2026-32 |

| USD Value 2025 | $ 365 Million |

| USD Value 2032 | $ 420 Million |

| CAGR 2026-2032 | 2.03% |

| Largest Category | Centrifugal Pumps segment leads the market |

| Top Drivers | Growing Demand Driven by Urban Water Management |

| Top Challenges | Skilled-Labor Shortage Hinders System Performance |

| Top Trends | Rise of Connected Pump Solutions |

| Top Opportunities | Growing Opportunities to Upgrade Old Water Networks |

| Key Players | ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow and Others. |

Benelux Water Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pump

The most dominant market share segment in the Pump Type category is the centrifugal pump. Centrifugal pumps represent 55.1% of water-and-industrial pump installations in 2024 across Europe due to their capability to handle large flow rates in municipal and industrial applications. Their inherent simplicity, reduced maintenance needs, and capacity to provide constant discharge under fluctuating pressure conditions position them as the preferred choice for the majority of Benelux water management endeavors.

Producer s are improving centrifugal pump efficiency by introducing multi-stage and submersible versions, solidifying their stranglehold further. Such developments allow for efficient operation in deep-well and booster-station services, servicing uneven terrain and long-distance water transport within the area.

By End User

- Oil & Gas

- Power

- Residential

- Agriculture & Irrigation

- Commercial Building

- HVAC

- Chemical

- Water & Wastewater

- Food & Beverage

- Others

The most market share segment within the End User category is Water & Wastewater. The Water & Wastewater end users captured 25% of the Benelux water pump market in 2024, fueled by continued expenditure on treatment plant modernization and distribution network development. Municipal utilities focus on dependable pumps for sewage handling, sludge transfer, and effluent discharge, which forms the basis of this segment's top position.

Industrial customers follow, utilizing pumps for cooling-water supply, process flows, and fire systems. But in the Benelux area, tough environmental regulations and public opinion guarantee that wastewater applications continue as the strongest motivator of pump sales.

Top Companies in Benelux Water Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Benelux Water Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Benelux Water Pump Market Policies, Regulations, and Standards

4. Benelux Water Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Benelux Water Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Lobe Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Progressive Cavity Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.6. Screw Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.7. Vane Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.8. Peristaltic Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.9. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By End User

5.2.2.1. Oil & Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Power- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Commercial Building- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. HVAC- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Chemical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Food & Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Benelux Centrifugal Pump Water Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Benelux Positive Displacement Pump Water Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Grundfos

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.KSB SE & Co. KGaA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Pentair

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Xylem Inc.

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Sulzer Ltd.

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Calpeda

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Flowserve Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Wilo SE

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Ebara Corporation

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. DAB Pumps

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.