Belgium Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), Sales Channel (Retail Offline, Retail Online), Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), End User (Bodybuilders, Athletes, Lifestyle Users)

- Food & Beverage

- Dec 2025

- VI0634

- 115

-

Belgium Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

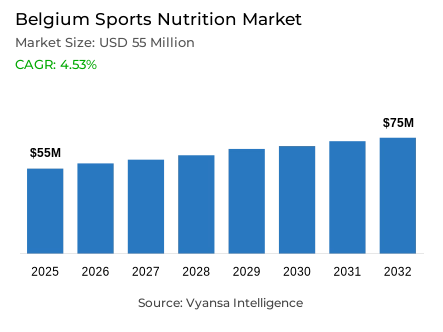

- Sports nutrition in Belgium is estimated at USD 55 million.

- The market size is expected to grow to USD 75 million by 2032.

- Market to register a cagr of around 4.53% during 2026-32.

- Product Type Shares

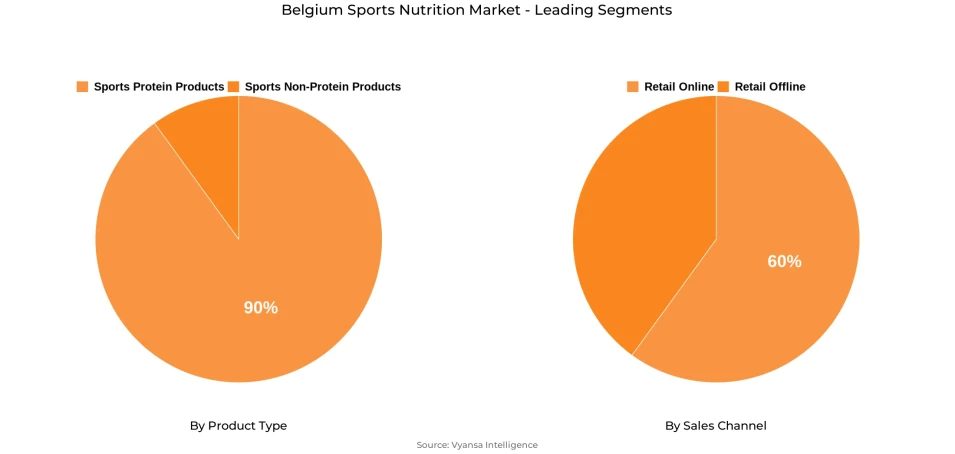

- Sports protein products grabbed market share of 90%.

- Competition

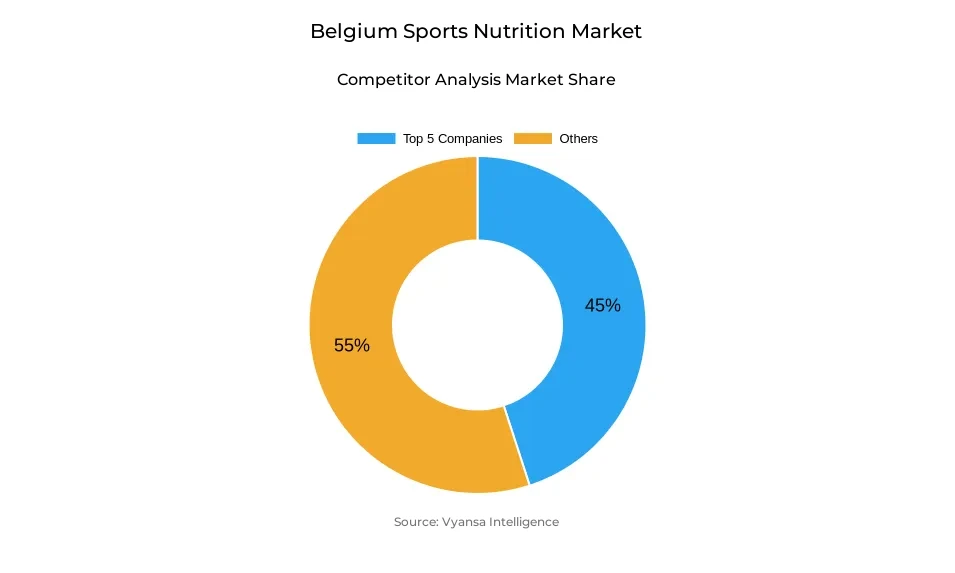

- More than 20 companies are actively engaged in producing sports nutrition in Belgium.

- Top 5 companies acquired around 45% of the market share.

- Decathlon Belgium NV, Ceres Pharma NV, Nutrition & Santé Benelux SA, QNT NV SA, Camps Food BV etc., are few of the top companies.

- Sales Channel

- Retail online grabbed 60% of the market.

Belgium Sports Nutrition Market Outlook

The sports nutrition market in Belgium stood at around USD 55 million in the year 2025 and is projected to reach around USD 75 million by the year 2032, exhibiting constant growth during the forecast period. This growth is driven by the rising interest of end users towards a healthy lifestyle and fitness. In the aftermath of the COVID-19 pandemic, gyms have witnessed increased membership from all segments of society. Sports nutrition products are becoming more of a daily part of health routine, as end users search for products that not only enhance performance but contribute to overall well being and energy levels.

Irrespective of this, the market is hindered by rigorous EU food health and safety laws. These include extensive testing and approval before new products can be introduced, and this is expensive and time consuming for companies. It is harder for smaller brands to achieve, which reduces innovation and restricts product range. Regular amendment of ingredient approvals, labeling, and advertising rules also makes things more complex, restricting flexibility and slowing market expansion.

At the same time, the trend of personalized and sustainable nutrition gaining momentum. End users are drawn to products tailored to their unique health needs, such as those based on DNA testing or lifestyle. Users are more assured of using the product, and brands can build deeper relationships with their target end users. The larger brands are also getting in on this action, marketing customized solutions based on personal fitness goals and everyday health needs.

The leading five players captures around 45% of the market share, indicating a balance of intense competition and consolidation. Retail online segment are leading the market with nearly 60% of total sales, as end users prefer the ease of online purchases, comparison of products, and home delivery. This growing online reach is likely to be a decisive aspect for sales and availability in sports nutrition industry over the coming years.

Belgium Sports Nutrition Market Growth DriverGrowing Health Awareness and Active Lifestyles Encourage Product Adoption

As end users are focusing on adopting active lifestyles and healthy habits, is leading to the increase in the use of sports nutrition products. Since the COVID-19 pandemic, there is a continuous rise in gym memberships and participation of end users in fitness activities. This shift is seen across different age groups, including older end users, who are now accepting the use of such products for health support. As a result, the market sees a continuous but steady increase in retail volume sales, showing a genuine rise in everyday usage.

Moreover, this change in behavior of end user is expanding the purpose of sports nutrition. It is no longer seem limited only for athletes and professional players but is becoming part of regular wellness routines. End users are selecting sports nutrition products that not only support physical performance, also their general health.

Belgium Sports Nutrition Market ChallengeStrict Rules Slowing Market Innovation

The market is facing issues because of strict food safety and health rules set by the EU. These rules require detailed testing and approvals before any new product can enter the market, making the process costly and time consuming. Small brands find it hard to meet such regulations, driving up their costs and hindering their growth. Various regulations in EU nations also lead to confusion and delay for businesses attempting to expand.

Additionally,the strict regulatory environment is slowing product innovation. Frequent changes in ingredient approval, labelling, and advertising rules make it difficult to adjust quickly. This situation reduces creativity and decelerates market growth, preventing businesses from fulfilling the increasing demand for new and healthy sports nutrition items.

Belgium Sports Nutrition Market TrendRise of Personalised Nutrition Enhances End User Engagement

End users are choosing sports nutrition products that are sustainable and are made to match their personal needs. Some companies now focused on creating products based on DNA Analysis and blood tests, to help end users get the right mix of nutrients for their bodies. This makes end user feel more confident in using these supplements because they are altered according to their bodily needs and their health goals.

Additionally, as more end users hear about personalised nutrition, they’re becoming more open to trying it. It’s not just about boosting workout results anymore many are using these products to feel better in their day to day lives. While smaller brands started this trend, bigger brands are also starting to offer customised options. This helps more end user to see sports nutrition as a useful part of their everyday health, not just for professional end users.

Belgium Sports Nutrition Market OpportunityOn the Go Nutrition Unlocking Market Expansion

The market will grow steadily with brands concentrating on creating convenient, easy to consume product forms. As sports nutrition enters daily routines, end user demand more choices that goes along with their busy lifestyles while contributing to overall well being. Ready to drink protein drinks, sachets, and single serve packs are becoming increasingly popular, providing convenient solutions for rapid and healthy consumption.

This increasing demand for convenience offers a solid growth trajectory for brands targeting a wider scope of end user. By developing products that are both portable and nutritionally balanced, companies can attract both fitness enthusiasts and everyday wellness enthusiasts. Investing in accessibility and innovation within product design will enable brands to solidify their market standing and achieve steady growth in changing sports nutrition market.

Belgium Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Sports Non-Protein Products

Sports protein products segment dominates the market, with around 90% of share under the product type segment. The segment is further fragmented into protein and energy bars, protein powders, and ready to drink (RTD) protein shakes. With protein and energy bars holding the largest share among sports protein products, as they are popular for their convenience and taste. Protein powders follow closely, favored by end users who prefer customizable options for shakes and smoothies. Meanwhile, RTD protein drinks are growing because of their on the go appeal and ease of use.

Moreover, the strong focus of end users on sports protein products highlights their importance in helping them with muscle building, recovery, and energy support. This clear dominance shows that protein based nutrition remains the key segment for growth and end user interest in sports nutrition market.

By Sales Channel

- Retail Offline

- Retail Online

With retail online being the leading sales platform in sports nutrition market, covering around 60% of the overall market. End users are increasingly turning to retail online segment for their sports nutrition requirements because of ease of access, product variety, and competitive prices. Products such as protein bars, powders, and ready to drink shakes are widely available online, where it becomes convenient for end users to locate products of their choice and interest.

The convenience of comparison of brands, online reviews, and home delivery has ensured retail online becomes the destination of choice for most of the end users. As health and fitness awareness continues to rise, the segment is likely to continue to dominate the market share in the next few years, particularly as brands spend more on online and end user driven direct strategies.

Top Companies in Belgium Sports Nutrition Market

The top companies operating in the market include Decathlon Belgium NV, Ceres Pharma NV, Nutrition & Santé Benelux SA, QNT NV SA, Camps Food BV, Fulfil Ltd, House of Nutrition BV, Herbalife International Belgium SA NV, Barebells Functional Foods AB, Kellogg Benelux, etc., are the top players operating in the Belgium sports nutrition market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Belgium Sports Nutrition Market Policies, Regulations, and Standards

4. Belgium Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Belgium Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Belgium Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Belgium Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.QNT NV SA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Camps Food BV

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Fulfil Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.House of Nutrition BV

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Herbalife International Belgium SA NV

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Decathlon Belgium NV

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ceres Pharma NV

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Nutrition & Santé Benelux SA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Barebells Functional Foods AB

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Kellogg Benelux

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.