Australia Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Dec 2025

- VI0383

- 120

-

Australia Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

- Leisure & Business Travel Booking in Australia is estimated at $ 63.8 Billion.

- The market size is expected to grow to $ 77.94 Billion by 2032.

- Market to register a CAGR of around 2.9% during 2026-32.

- Travel Sales Type Shares

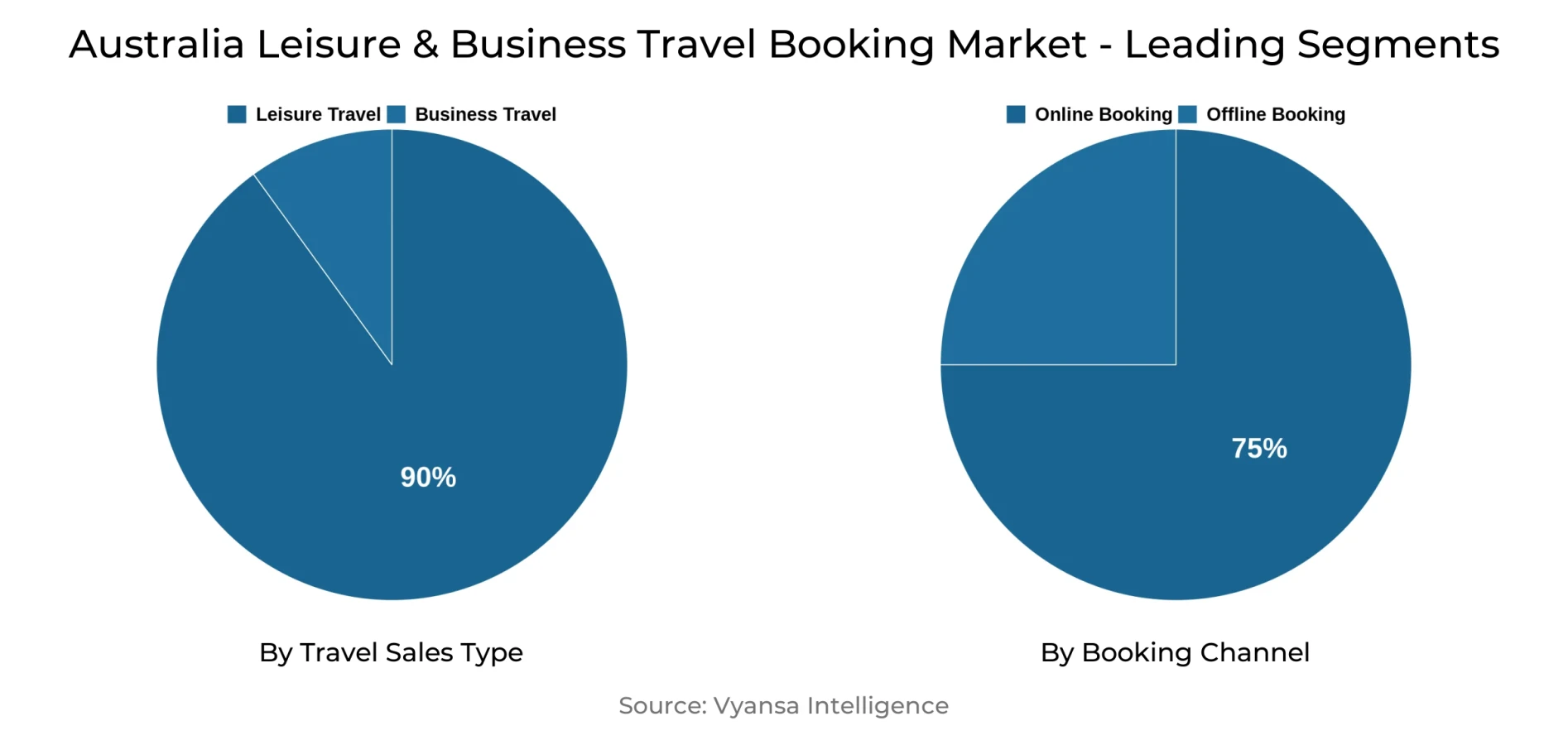

- Leisure Travel grabbed market share of 90%.

- Competition

- Australia Leisure & Business Travel Booking Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired 30% of the market share.

- Corporate Travel Management Ltd, Carlson Wagonlit Travel Australia, BCD Travel (Australia) Holdings Pty Ltd, Flight Centre Travel Group Ltd, Helloworld Ltd etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 75% of the market.

Australia Leisure & Business Travel Booking Market Outlook

Australia Leisure and business travel booking market will grow steadily, with the market valued at USD 63.8 billion and predicted to reach USD 77.94 billion in 2032. Growth will be fueled by increasing demand for leisure experiences in spite of cost-of-living pressures, with end users still focusing on travel. Though average trip lengths will decrease with tighter purse strings, premium and luxury segments will add robust value through longer stays, customized services, and upscale dining.

The change from value-based to volume-based strategies is influencing the market, with luxury travel increasingly focusing on total experiences rather than accommodation. Intermediaries continue to be very relevant as online booking sites become more popular with travelers seeking convenience, choice, and professional advice. Online booking channels already cover 75% of the market by 2026, and this percentage will continue to increase as end users adopt digital solutions for travel planning.

Technological innovation, particularly AI adoption, is shaping the online booking experience. Influencer affiliate platforms and personalized trip planning tools are improving end user engagement, taking online booking to be a leading growth driver. Social media integration and content creators will continue to boost digital travel sales, linking younger audiences with more personalized travel experiences.

Cruise travel also puts pace into the future of the market. Passenger volumes have edged higher than pre-pandemic levels, as robust demand is fueled by return travelers and new customers. The presence of travel agencies in this segment is being increased, such as the resurgence of specialist brands and offline stores focused on cruises. With firm end user passion and shrewd industry investment, Australia leisure and business travel booking market should continue to grow healthily.

Australia Leisure & Business Travel Booking Market Growth Driver

Rising end user Focus on Travel Despite Cost Pressures

End users in Australia continue to prioritise travel and leisure, showing strong willingness to spend on lifestyle-enriching activities even amid high living costs.. This drives leisure and business travel bookings growth as individuals deliberately organize trips to discover locations, immerse themselves in distinctive activities, and visit friends and family. The steady demand reinforces the notion that travelling is a necessary expenditure for the household budget, as opposed to a discretionary luxury.

The desire for convenience and choice leads end users to intermediaries and online booking sites, providing expert advice, an expanded choice set, and tailored experience. Though travelers might choose reduced trip lengths to control expenses, their willingness to book and engage in travel activities sustains stable growth in the market and serves as a solid foundation for the future of leisure and business travel.

Australia Leisure & Business Travel Booking Market Trend

Increasing Demand for High-End Experiences

The luxury travel sector is developing robust momentum, contributing great value to the sector. Travelers in this category attach huge importance to their journey and tend to opt for extended durations of stay, making their total experiences richer. Luxury travel is no longer synonymous with high-end hotels but now concentrates on holistic experiences like outstanding service, exclusive activities, wellness options, gourmet food, and detail orientation. This change is particularly significant as budget-conscious travelers reduce their lengths of stay to control costs. Large intermediaries such as Expedia are committed to investing in high-end travel in order to tap into this value-based segment that values quality service and longer stays.

Lifestyles and experiences of luxury continue to present growth opportunities, with travellers placing more importance on their living, working, and leisure space. Luxury foodservice has been the fastest-growing luxury sector in Asia Pacific following the pandemic, with Sydney having seen a number of new fine dining restaurants opened in 2023 and 2024. The premium dining of hotels is also being enhanced, indicating a bright future for luxury tourism.

Australia Leisure & Business Travel Booking Market Opportunity

Emerging Role of AI in Travel Experiences

AI is playing a growing role in reshaping travel booking, creating experiences that are more personalized and efficient. For example, in 2024 Booking.com introduces an AI trip planner in Australia and New Zealand, allowing travelers to receive personalized recommendations and enhanced experiences directly through the app. By the same token, B2B tech in the form of white-label APIs and affiliate platforms facilitates influencers and smaller players in becoming travel agents, employing AI-based tools to market and sell bookings more efficiently.

Further, the integration of social media with AI is fueling this transition. In China, Douyin and Little Red Book platforms utilize AI-driven systems to bring millions of users into contact with content creators, leading to high engagement and travel bookings. Likewise, Expedia launches Travel Shops, where AI facilitates creators in sharing experiences and collecting commissions, demonstrating how artificial intelligence is revolutionizing end-user journeys as well as industry prospects.

Australia Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with the highest market share under the Travel Sales Type is Leisure Travel, which captured almost 90% of total reservations. Leisure travel remains in command as end customers express strong interest in traveling despite living expenses, with several giving priority to recreation and holidays over other discretionary spending. The growth is sustained due to the increased leisure-business tourism, leisure packages, and inbound travel, which increases demand further.

By contrast, business travel, while recovering, remains short of pre-pandemic levels due to numerous firms restricting long journeys and favoring near-term one-day gatherings or digital substitutes. Yet, recovery in corporate bookings should provide incremental growth, so that both the leisure and business segments contribute to market performance.

By Booking Channel

- Offline Booking

- Online Booking

The segmentation with highest share under the Booking Channel is held by the segment of Online Booking, with an approximately 75% market share. end users are moving more towards digital channels, aided by ease, a broad range of choices, and attractive offers by intermediaries. Supremacy technologies in the form of AI-based trip planners and customized booking tools only further boost customer interaction and enhance the attractiveness of online channels.

Intermediary sales remain ahead of direct sales because travelers pay more for expert advice, selection, and packaged activities. Having incorporated social media into travel platforms, allowing content creators to market reservations, has further fueled the channel strong growth. Such unequivocal end user commitment to online offerings guarantees the dominance of online bookability as the top channel during the forecast period.

Top Companies in Australia Leisure & Business Travel Booking Market

The top companies operating in the market include Corporate Travel Management Ltd, Carlson Wagonlit Travel Australia, BCD Travel (Australia) Holdings Pty Ltd, Flight Centre Travel Group Ltd, Helloworld Ltd, Booking.com BV, Expedia Australia Pty Ltd, Webjet Ltd, Wotif.com Holdings Ltd, Lux Group Ltd, etc., are the top players operating in the Australia Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Australia Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Australia Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Australia Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Flight Centre Travel Group Ltd

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Helloworld Ltd

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Booking.com BV

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Expedia Australia Pty Ltd

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Webjet Ltd

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Corporate Travel Management Ltd

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Carlson Wagonlit Travel Australia

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. BCD Travel (Australia) Holdings Pty Ltd

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Wotif.com Holdings Ltd

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Lux Group Ltd

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.