Australia Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps, Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps), By Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), By End-User (Residential, Commercial, Industrial)

|

Major Players

|

Australia Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

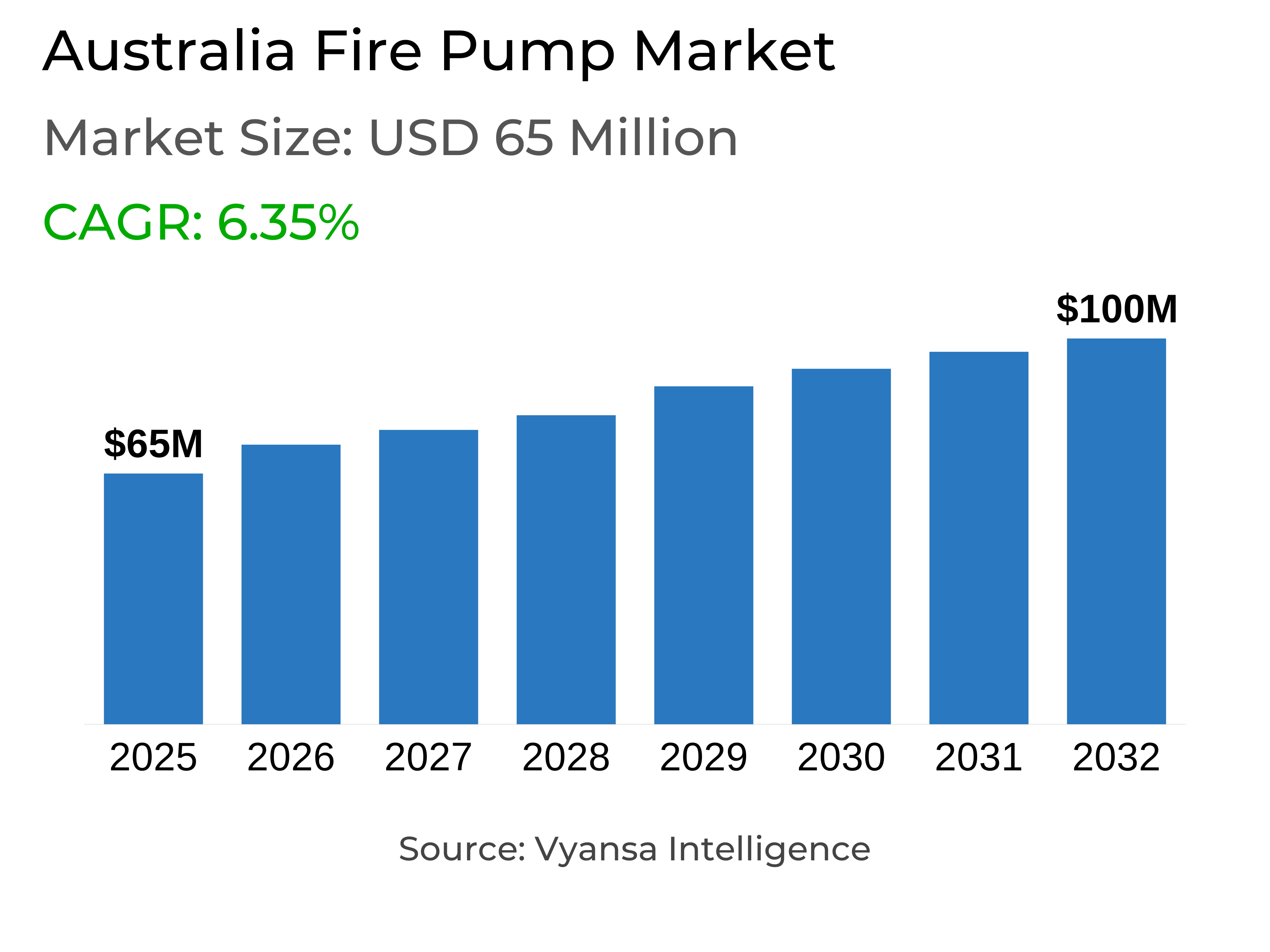

- Fire Pump in Australia is estimated at $ 65 Million.

- The market size is expected to grow to $ 100 Million by 2032.

- Market to register a CAGR of around 6.35% during 2026-32.

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

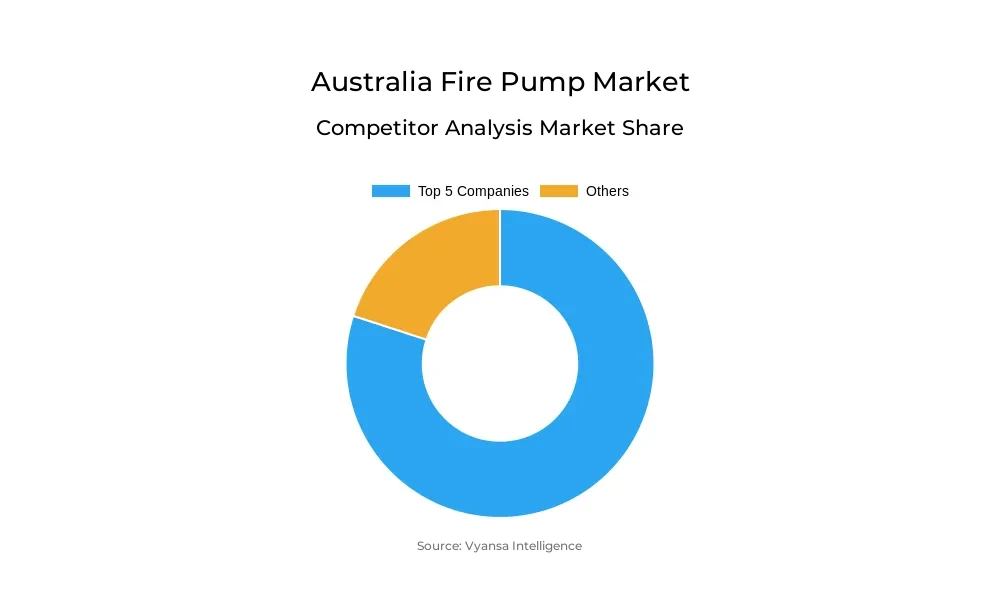

- Competition

- More than 10 companies are actively engaged in producing Fire Pump in Australia.

- Top 5 companies acquired the maximum share of the market.

- WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC etc., are few of the top companies.

- End-User

- Commercial grabbed 55% of the market.

Australia Fire Pump Market Outlook

The Australia fire pump market is to see consistent growth between 2026 and 2032, fueled by increasing fire safety regulations and growing awareness of the threat of fires. In 2025, the market size is estimated at USD 65 Million and is set to grow to USD 100 Million by 2032, showing a robust adoption pattern. Recent legislative changes in fire safety regulations, such as the compulsory compliance with AS1851-2012 regulations, are encouraging building owners in commercial and industrial establishments to install or upgrade compliant fire pump systems to ensure safety as well as regulatory compliance.

Compliance pressures and financial penalties for non-compliance are major growth drivers. Companies not meeting standards risk up to USD 220,000 in fines, promoting proactive investments in dependable, high-performance fire pumps. New regulations also require rigorous maintenance schedules, regular testing, and stringent documentation, further driving demand for technologically superior fire pump solutions across high-rise and industrial buildings.

Technological innovations are transforming the market, and IoT-enabled and smart fire pumps are gaining momentum. Such systems come with real-time monitoring, predictive maintenance, and integration with building management systems, enhancing operational efficiency and minimizing downtime. Such developments track with Australia's overall smart infrastructure initiatives, and intelligent fire pump systems become ever more important in current commercial and residential developments.

The commercial sector is the largest end-user, accounting for 55% of market demand driven by regulatory requirements and insurance conditions. Concurrently, residential development is becoming the fastest-growing segment, driven by increasing fire safety awareness and urban densification. As urbanization, regulatory enforcement, and smart technology take up gather pace, the Australia fire pump market is positioned for long-term sustainable growth until 2032.

Australia Fire Pump Market Growth Driver

Regulatory Compliance Driving Fire Pump Adoption

Australia's fire protection environment is undergoing a drastic change, fueled by strict regulatory demands and increased concern over fire risks. Recent changes in fire safety legislation now require building owners to adhere to AS1851-2012 standards, creating a surge in demand for sophisticated fire protection systems in commercial and industrial applications. Statistics from Fire and Rescue NSW show that more than 40% of audited commercial buildings in 2023 did not pass simple compliance checks, increasing common gaps within current fire protection measures. This pressure for compliance leads building owners to invest in sound, standard-compliant fire pump systems to reduce risk and prevent penalties.

Financial penalties for non-compliance also support market expansion. Fines of up to $220,000 for corporations that do not comply with fire safety regulations make system upgrades financially savvy. Compulsory use of AS1851-2012 in New South Wales from February 2025 adds increased testing, formal documentation, and stricter maintenance schedules. All of these regulations create high demand for trustworthy fire pump solutions, and building owners fulfill compliance while protecting life and property, and thus setting the industry for long-term growth.

Australia Fire Pump Market Challenge

Installation Complexity and Maintenance Constraints

The Australian fire pump industry is confronted with intricate operating issues arising from maintenance and installation necessities. The presence of state-based regulations combined with various Australian Standards such as AS 2941-2013 and AS 2419.1-2021 presents complexity in compliance and driving costs upwards to implement. Moving towards compulsory AS1851-2012 standards requires uniform maintenance schedules, strict record-keeping, and high-level technical expertise, which challenges small-scale operators and creates limits to entry in the market.

Technical installation conditions also make adoption difficult, especially in tall buildings and industrial plants where accurate pressure and capacity calculations are essential. Dual pump arrangements, as required by Australian Standards, also add to installation complexity and regular maintenance requirements. These operational challenges require increased levels of investment by building owners requiring compliant fire protection solutions, hindering adoption rates in some segments even as overall market growth occurs and demonstrating the critical role of competent service providers in maintaining safe and dependable fire pump operation.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Australia Fire Pump Market Trend

Smart Fire Pump Technologies and IoT Integration

Australia is experiencing high adoption rates of smart fire pump technologies, revolutionizing conventional fire protection strategies. With Internet of Things capabilities, systems now offer real-time monitoring of performance, fault detection, and mobile notifications, enabling proactive responses by building managers to possible problems. Solutions like Grosvenor Engineering Group's AlertU™ system are the first in the industry to combine high-tech water pressure sensors and fault-location algorithms to allow predictive maintenance and lower the risk of equipment failure during emergencies.

Tie-up with artificial intelligence and Building Management Systems (BMS) is also influencing the market, providing centralized control, remote monitoring, and data-driven operational insights. Predictive analytics foretell system failures prior to them happening, making systems more reliable and lowering operational costs. These advances are supporting Australia's smart infrastructure efforts, and smart, IoT-connected fire pumps become integral parts of contemporary building management systems that enhance safety, efficiency, and compliance in both commercial and residential developments.

Australia Fire Pump Market Opportunity

Urbanisation and Infrastructure Expansion Opportunities

Urbanisation and infrastructure growth at a fast pace in Australia are paving massive growth opportunities for the market of fire pumps. Urban hubs like Sydney, Melbourne, and Brisbane generate demand for commercial and residential high-rise developments, while the growth of industries like mining, oil and gas, and manufacturing creates a demand for dependable fire protection technology. Smart city growth initiatives sponsored by the government also promote the use of innovative fire safety technologies and integrated solutions.

New opportunities also arise in regional and hitherto under-serviced regions, where urban growth and upgrades to infrastructure require strong fire safety provisions. Adherence to the National Construction Code guarantees steady demand for fire pump installations by different types of buildings. Urbanisation, which is gaining momentum, and increasing regulatory enforcement are making the market ready for steady growth, especially through embracement of IoT-assisted systems, integrated smart technologies, as well as solutions specifically designed to address commercial and residential fire protection requirements.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Australia Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps control the Australia fire pump market with the largest share by virtue of their reliability, performance, and price. They are the first choice for typical commercial and residential applications, offering stable flow rates and pressure levels in compliance with Australian Standards. With low maintenance needs and compatibility with installed base fire protection equipment, they are the market favorite among building owners in pursuit of dependable, regulatory-compliant products.

Ongoing dominance by centrifugal pumps is rooted in their capacity to sustain a variety of building structures, ranging from commercial high-rise towers to residential complexes, with the guarantee of operational efficiency. Other pump types, including positive displacement systems, are usually limited to specialized applications involving stringent low-flow requirements. With regulatory compliance and technology integration fueling market expansion, centrifugal pumps should maintain market leadership during the projection period, with a balance of performance, cost-effectiveness, and maintenance convenience.

By End-User

- Residential

- Commercial

- Industrial

The commercial market under the end-user segment takes the largest portion of the fire pump market with 55% of total demand. Office, retail, and hospitality buildings power this dominance because of strict regulation requirements and insurance needs that necessitate sophisticated fire protection systems. Corporations value assured, compliant solutions to minimize risk, guaranteeing steady market growth in this sector.

Residential projects are being the most rapidly growing end-user segment at a CAGR of 10.03%. High-rise residential towers are becoming increasingly subjected to regulatory compliance needs, and homeowner fire awareness increased after recent bushfires. Government policies that encourage fire-resistance building practices also speed up adoption within this sector. Even though commercial holds majority market share overall, the residential market is a high-growth opportunity and will dictate future demand for fire pump installations in Australia.

Top Companies in Australia Fire Pump Market

The top companies operating in the market include WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC, Sulzer Limited, Grundfos Holding A/S, KSB SE & Co. KGaA, Patterson (Gorman Rupp), Armstrong, etc., are the top players operating in the Australia Fire Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Fire Pump Market Policies, Regulations, and Standards

4. Australia Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Australia Centrifugal Fire Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. Australia Positive Displacement Fire Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pentair PLC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Sulzer Limited

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grundfos Holding A/S

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.KSB SE & Co. KGaA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WILO SE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ebara Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.ITT Goulds Pumps

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Patterson (Gorman Rupp)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Armstrong

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.