Australia Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Jan 2026

- VI0763

- 115

-

Australia Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

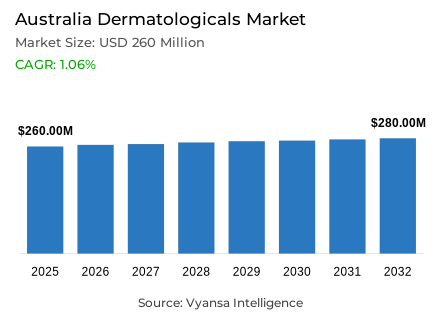

- Dermatologicals in Australia is estimated at USD 260 million in 2025.

- The market size is expected to grow to USD 280 million by 2032.

- Market to register a cagr of around 1.06% during 2026-32.

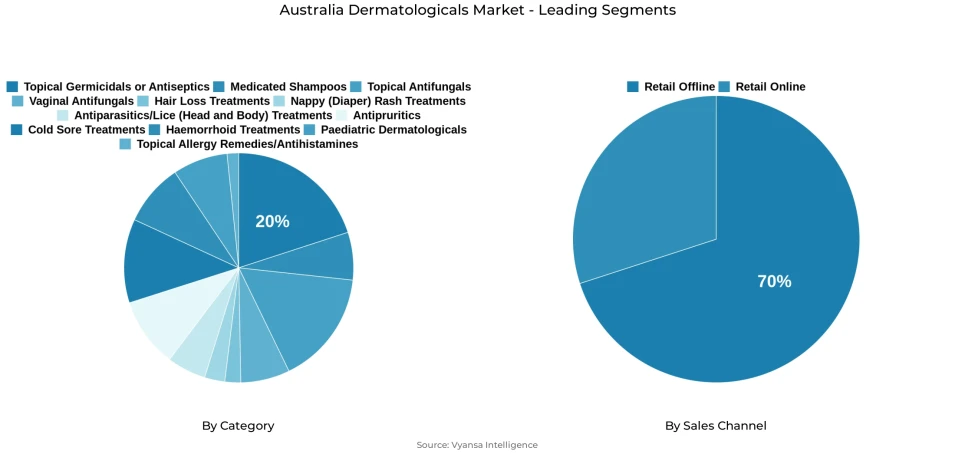

- Category Shares

- Topical germicidals/antiseptics grabbed market share of 20%.

- Competition

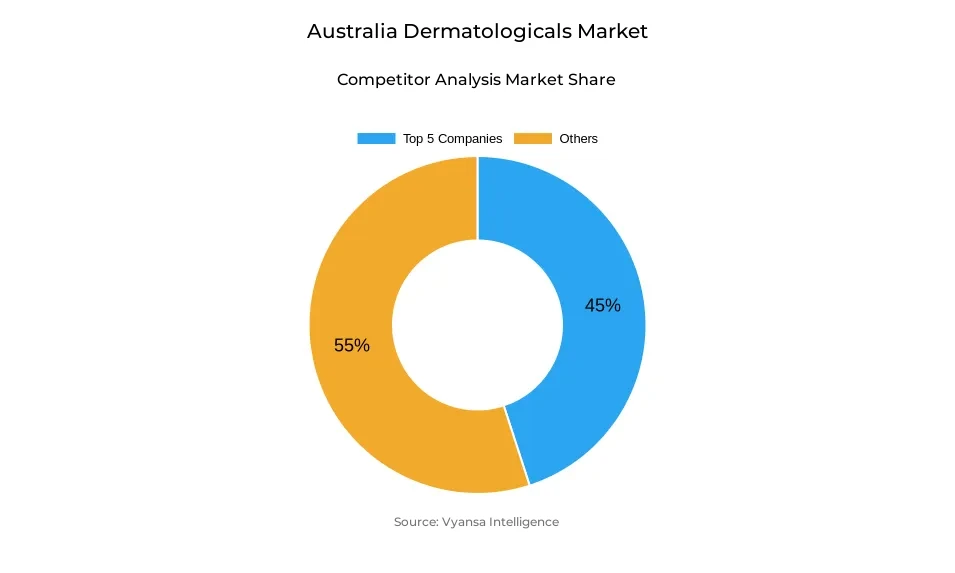

- More than 20 companies are actively engaged in producing dermatologicals in Australia.

- Top 5 companies acquired around 45% of the market share.

- Ego Pharmaceuticals Pty Ltd; Haleon Australia Pty Ltd; AFT Pharmaceuticals Ltd; Bayer Australia Pty Ltd; Johnson & Johnson Pacific Pty Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Australia Dermatologicals Market Outlook

The Australia dermatologicals market will grow from USD 260 million in 2025 to USD 280 million in 2032, marking a CAGR of approximately 1.06%. This will be driven by an increasing awareness level about dermatological concerns, in addition to an increasing demand for targeted treatments. The key segments like topical germicidals/antiseptics, contributing about 20%, will continue to fuel growth in this market, in addition to others like nappy rash, antiparasitics/lice, haemorrhoid treatments, and cold sore medications. Hair loss will continue to be one of the most evolving segments, not only due to an increasing awareness level about men’s health conditions but also due to the rising influence of digital healthcare platforms that make discussions about personal health issues genuine and natural.

The competitive scene shall remain highly fragmented, with Bayer, Johnson and Johnson, Nice Pak Products, and iNova Pharmaceuticals at the forefront. Homegrown brand Ego Pharmaceuticals shall continue to be profiled because of a broad portfolio that takes in antiparasitics, antipruritics, nappy rash products, and topical antifungals. Being Australian made and a family business shall be a standpoint for this brand, apart from it being a well-recognized brand with broad retail reach. Unusual portfolio strategies, such as that of Reckitt, shall emerge as a criterion for strategies to be pursued for leading brands.

The retail offline distribution segment has the leading market share of 70% thanks to the importance of pharmacies. Personal consultations offered by chemists, along with the foot traffic, have led to physical stores being the key point of contact for dermatalogicals. Even with the rise in retail online, most purchases come through the online platforms of pharmacies. The merger of Chemist Warehouse and Sigma Healthcare will increase the retail pharmacies available for dermatalogicals.

During the period of 2026–2032, there are expected rises in end user awareness about conditions such as eczema, acne, and rosacea owing to awareness campaigns, internet awareness initiatives, and growing awareness about ingredients. This will boost demand for products that contain well-known ingredients like niacinamide, ceramides, and salicylic acid. Demand for natural and traditional remedies, particularly those pertaining to the eradication of head lice, would continue; but official promotion of mechanical treatments may restrain the volume growth in the antiparasitics category.

Australia Dermatologicals Market Growth DriverRising Skin-Disease Burden and Public Awareness Expand Demand for Dermatological Treatments

The burden of skin diseases in Australia and public awareness fuel the demand for dermatological products by 2025. Cancer Australia further estimates that there would be 17,443 new cases of melanomas in 2025, assuming that Australia has a higher incidence of skin cancer, pushing the demand for dermatological drugs for some banking on cancer treatments. Apart from this, complementing each other on cancer pressure, non-melanomas (or keratinocyte carcinomas/skin cancers) are also still a common phenomenon with an estimated 400,000 new cases in Australia every year.

These disease burdens heighten public and medical caution concerning skin ailments, thus driving demand in the dermatological prescription and over-the-counter markets. Public health education campaigns and medical screenings driving diagnosis rates and precipitating earlier treatment-seeking behavior help fuel volume-driven development in markets such as topical germicides/antiseptics, nappy rash remedies, topical antifungals, and hair loss products. These heightened disease awareness levels continue to underscore the crucial role that dermatological products play in health and disease management.

Australia Dermatologicals Market ChallengeUnder-Diagnosis, Limited Clinical Help-Seeking and Service Pressures Constrain Market Conversion

A challenge is found in the gap existing today between the prevalence of symptoms and seeking medical care this is evidenced by national survey and service data, which shows that a substantial proportion of the population with skin issues does not attend specialists, thus hindering the use of prescriptions. The ABS National Health Survey reveals that in 2022, about 61% of Australians, or 15.4 million individuals, were living with at least one long-term condition.

On the other hand, the severity of managing cases of skin cancer creates substantial workload in dermatology treatment. In fact, there are more than one million Medicare administrations regarding non-melanoma skin cancer every year, forming part of the substantial workload concerned with general practitioners or dermatology referrals. This situation indicates that despite substantial general caseloads relating to chronic diseases, patients encounter limitations regarding prompt referrals to dermatologists with regard to non-urgent dermatological conditions, an oft-underappreciated determinant of the significance of in-pharmacy patient counseling regarding dermatological product use.

Australia Dermatologicals Market TrendEnd users Shift Between Medical Solutions and Cosmeceuticals with Ingredient Knowledge and Safety Issues at Hand

There is a growing convergence of clinical and conventional skincare products and technologies on the part of the end user, loosely driven by ingredient knowledge and concerns about the adverse effects of clinical products. This is supported by the existence of national clinical evidence regarding the prevalence rate of atopic and inflammatory skin conditions. The lifetime prevalence rate of eczema has been estimated at 40%, and the adult prevalence rate for physician-diagnosed psoriasis has been estimated at 2.4% in the Australian population.

Parallel to the above, public awareness about the side-effects associated with the use of topical steroids and the increased adoption of active cosmetic ingredients such as niacinamide, ceramides, and salicylic acid may drive some end users to switch to over the counter or cosmeceutical solutions, which may result in increased adoption of pharmacy-friendly clinical cosmeceuticals. This, in turn, may create a hybrid market, where efficacy, skin conditions, and gentle formulation may become factors in selecting the right clinical cosmeceutical.

Australia Dermatologicals Market OpportunityEducation, Clinical Triage, and Adjunct Product Development Will Capture Untapped Demand

There is a clear opportunity for symptom management to be translated into effective treatment. The situation in Australia has been highlighted by the Burden of Disease Study and the statistics on cancers, indicating a clear level of unmet need within the community the cost of skin diseases as a community burden and high rates of skin cancers indicate a clear opportunity for pharmacy-appropriate treatment with high levels of incidence for skin cancers such as melanoma and non-melanoma skin cancers.

Additionally, national clinical workforce assessments emphasize the demand for expanded capacity government workforce data indicate continued pressure on dermatological care, and licensed over-the-counter medicines and pharmacy-based care models are poised to offer managed access. Such brands as Eco and Eco5 engaging in the evidence-based education of end users on the proper use of steroid creams, the manual removal of head lice, and the recognition of red-flag dermatological lesions, combined with the development of licensed over the counter medicines and pharmacy delivery programs based on clinical efficacy, can satisfy the latent demand in the areas of nappy rash treatments, antiprurients, antiseptics, and affordable hair loss products.

Australia Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

The segment with highest market share under Category is Topical Germicidals/Antiseptics with about 20% of the market share. This product has the foremost market in the Australian market for dermatologicals. This particular product continues to lead the market since end users have been looking for effective products to treat common skin conditions such as cuts and irritation, insect bites, and general skin care. The acceptance and strong positioning of this product in both pharmacies and supermarkets enable the market to remain stable.

Looking ahead, this market will continue to develop as Australians put a greater emphasis on skin health and swift solutions available for skin ailments. Greater education about infection and skin irritation control fuels the adoption of disinfectant and antiseptic items on a regular household basis. Additionally, the trend toward preventive care and greater access to dermatological solutions sees this category retain the primary market share over the forecasted period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is Retail Offline with around 70% of share. Reatil offline continued to be the principal method of shopping for dermatological agents within the Australian market. The pharmacies are greatly trusted by end users regarding advice, the availability of goods, and convenience, and, thus, they continue to be the first point of contact by end users experiencing any skin-related problems.

Retail Offline leads in this market, thanks to the personalized assistance that can be provided in offline retailing, which is not feasible in the case of online retailing, especially when it comes to conditions like eczema, rashes, acne, or possibly head lice. With an increase in the in-store experience and the product offerings being extensive, an array of pharmacies that offer such an in-store experience have ensured that the offline market gets an enhanced market share.

List of Companies Covered in Australia Dermatologicals Market

The companies listed below are highly influential in the Australia dermatologicals market, with a significant market share and a strong impact on industry developments.

- Ego Pharmaceuticals Pty Ltd

- Haleon Australia Pty Ltd

- AFT Pharmaceuticals Ltd

- Bayer Australia Pty Ltd

- Johnson & Johnson Pacific Pty Ltd

- Nice Pak Products Pty Ltd

- iNova Pharmaceuticals (Australia) Pty Ltd

- Reckitt Benckiser (Australia) Pty Ltd

- Key Pharmaceuticals Pty Ltd

- Church & Dwight (Australia) Pty Ltd

Competitive Landscape

The dermatological market for Australia in the year 2025 is vastly unorganized, dominated by the coexistence of several large multinational, along with some key local, players. Bayer leads the list in value, closely followed by Johnson & Johnson, Nice Pak Products, and then finally by the newly acquired company, iNova Pharmaceuticals, with the help of its purchase of Mundipharma's end user healthcare business, including the highly valued Betadine brand, in the year 2023. Reckitt Benckiser is the player with the least varied portfolio, including its highly popular antiseptics Dettol & Savlon. The highly prominent competitors within the market are the ever-trusted Australiamer brand, Ego Pharmaceuticals, which has been producing dermatological products under several highly prominent brands such as Moov, Pinetarsol, QV, Soov, Resolve, and finally, Egozite. This has been done by the company to stay vastly noticeable to the public, including the end users. The rivalries are most evident within the pharmacies, with the additional push given by the combined efforts of the merged Chemist Warehouse & Sigma.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Dermatologicals Market Policies, Regulations, and Standards

4. Australia Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Australia Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Australia Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Australia Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Australia Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Australia Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Australia Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Australia Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Australia Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Australia Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. Australia Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. Australia Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. Australia Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. Bayer Australia Pty Ltd

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Johnson & Johnson Pacific Pty Ltd

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Nice Pak Products Pty Ltd

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. iNova Pharmaceuticals (Australia) Pty Ltd

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. Reckitt Benckiser (Australia) Pty Ltd

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. Ego Pharmaceuticals Pty Ltd

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. Haleon Australia Pty Ltd

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. AFT Pharmaceuticals Ltd

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. Key Pharmaceuticals Pty Ltd

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Church & Dwight (Australia) Pty Ltd

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.