Australia Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0566

- 120

-

Australia Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

- Baby and Child-Specific Products in Australia is estimated at $ 335 Million.

- The market size is expected to grow to $ 345 Million by 2032.

- Market to register a CAGR of around 0.42% during 2026-32.

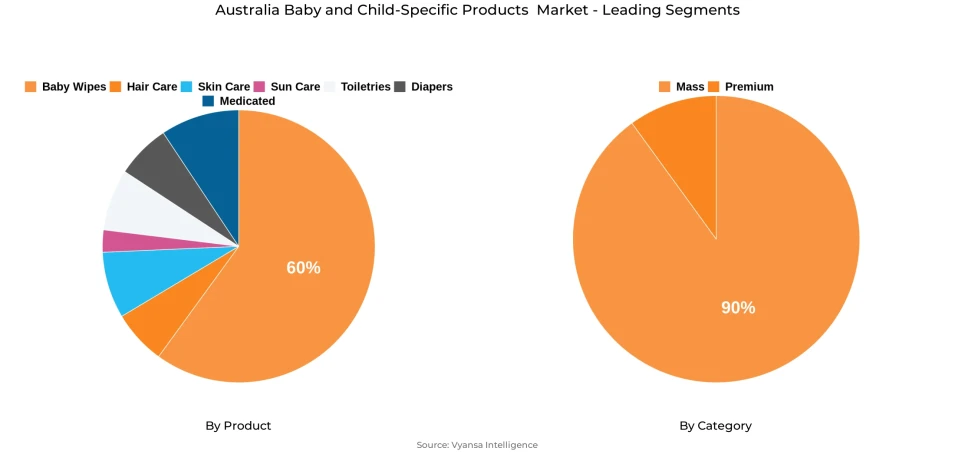

- Product Shares

- Baby Wipes grabbed market share of 60%.

- Competition

- More than 20 companies are actively engaged in producing Baby and Child-Specific Products in Australia.

- Top 5 companies acquired around 50% of the market share.

- Woolworths Group Ltd, WaterWipes UC, Bayer Australia Pty Ltd, Kimberly-Clark Australia Pty Ltd, Nice Pak Products Pty Ltd etc., are few of the top companies.

- Category

- Mass grabbed 90% of the market.

Australia Baby and Child-Specific Products Market Outlook

The Australia baby and child-specific products market is set to rise at a steady pace during the forecast period. It is estimated at $335 million in 2025 and is expected to reach $345 million in 2032. Baby wipes are still the leaders in the category, with their necessity, their regular use, and multipurpose uses in addition to babies, such as adult skincare and cleaning around the house. Baby and children-specific hair and sun care products are also poised for healthy growth as end users become more aware of sensitive skin, hair, and sun protection in children.

top five players maintaining about 50% of the market share. Major brands like Kimberly-Clark's Huggies reinforce their position with robust distribution, extensive end users recognition, and sustained marketing efforts. Innovative players like Rascals International are also picking up pace by launching natural, plant-based, and eco-friendly products, using social media and influencer marketing to target younger, green-oriented end users.

Mass-market items contribute around 90% of overall sales, while supermarkets continue to be the main distribution channel because of convenience, accessibility, and regular promotions. Retail online keeps building up steam as more purchases repeat and bulk purchasing is available, providing smaller brands with the chance to address end users directly and offering price-conscious end users competitive prices.

End users choice is increasingly moving towards natural and sustainable products, and plant-based, biodegradable, and cruelty-free products are likely to perform well. Also, products with more usages, for example baby wipes and creams for older end userss or general domestic usage, will likely drive market growth, even in the midst of decreasing birth rates and an ageing population.

Australia Baby and Child-Specific Products Market Growth Driver

Necessity Nature of Products Driving Consistent Demand

The Australia Baby and Child-Specific Product Market is fueled by the necessity of key products like baby wipes, which are viewed as a necessary part of keeping children clean and healthy. end users keep buying these products every time, since they play a fundamental role in regular childcare activities. Baby wipes especially are extensively used, thus ensuring continuous repurchase and generating a consistent income stream. The multi-purpose utility of these products, such as for use by adults with sensitive skin, further solidifies their market value and makes them a necessity in homes.

Moreover, increasing recognition of the health and personal care of children drives demand for child-specific hair care products. Sensitive hair, tear-free application, and natural or plant-based ingredient formulas attract end users searching for safe and gentle solutions for their children. This emphasis on children-specific requirements secures steady adoption and helps build market resilience even under tough economic times.

Australia Baby and Child-Specific Products Market Challenge

Slowing Birth Rate Poses Growth Constraints

The major issues for the Australia baby and child-specific products market is the nation's falling birth rate, which constrains the potential base of end users for core product categories. As there are fewer children being born, demand for staple items like baby wipes, diapers, and hair care solutions will expand at a slower rate in the forecasting period. This population trend can hinder the market's overall growth even as there is consistent interest in current products.

Economic pressures also impose limitations on market expansion. While end userss express interest in natural and sustainable products, financial constraints can restrict the purchase of more expensive or premium products. end users will likely choose fundamental products over value-added or green varieties in times of economic restraint, posing a challenge to makers who want to increase market share or bring new products to market.

Australia Baby and Child-Specific Products Market Trend

Increasing Demand for Natural and Multi-Purpose Products

Among the most salient trends in the marketplace is the growing trend towards natural, plant-based, and sustainable child- and baby-specific products. end users are increasingly aware of ingredient safety and prefer products that are cruelty-free, biodegradable, and kind to sensitive skin. This trend is propelling the creation of sustainable wipes, herbal creams, and soothing hair care products that cater to children's special requirements.

The market is also experiencing a trend toward multi-functional products that carry over beyond their use purpose. Baby wipes are being taken up by adults for skin care for sensitive skin or cleaning the home, and herbal creams carry benefits for older end users too. This versatility combined with sustainability represents a wider end users shift toward responsible, conscious, and value-driven purchasing habits, influencing product innovation and market growth.

Australia Baby and Child-Specific Products Market Opportunity

Unfolding Potential Through Diversification and Sustainability

The Australia baby and infant-specific products industry is poised to gain from product diversification and broader usage opportunities. Multi-functional formulations, including wipes for adults or creams that offer extra benefits for the skin, will be able to draw new end users and increase the market base. Added functional benefits such as hydrating or calming properties in products can enhance brand loyalty and build differentiation in a crowded market.

Sustainability-driven innovations will also offer growth opportunities. With end users increasingly caring for eco-friendly and plant-based products, businesses can take advantage of biodegradable, cruelty-free, and natural ingredients to respond to end users' demand. Growing these product lines will enable manufacturers to catch up with changing preferences, draw in mindful purchasers, and counter some of the threat of the declining birth rate, opening long-term market opportunity.

Australia Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with the highest market share under Product Type is baby wipes, accounting for around 60% of the Australia baby and child-specific products market. Baby wipes remain essential for end users due to their frequent use, gentle formulation for sensitive skin, and multi-purpose applications, including use by adults for skincare or household cleaning. Their natural ingredients and safe formulations make them highly appealing to health- and safety-conscious end userss.

Other categories, including baby and child-specific hair care, drive overall growth as end users become increasingly aware of the need for hair and scalp care during early years. Innovations based on plant-based and green ingredients drive purchases by environmentally conscious end users, making the segment maintain a stronghold in value and relevance over the market.

By Category

- Premium

- Mass

The segment with highest market share under Category is mass, holding about 90% of the Australia baby and child-specific product market share. Mass products are still very much favored because they are accessible, affordable, and readily available in major retail outlets like supermarkets and pharmacies. Baby wipes are a dominant force within this segment since end users buy these as a regular habit to ensure the health and hygiene of their child. The multi-use character of products like baby wipes also fuels their consumption among mature end userss, leading to further consolidation of the mass segment's market presence.

Other segments, such as high-end and specialty items like child and baby hair care and sun care, are picking up with increasing end users awareness of natural, plant-derived, and eco-friendly formulas. All these trends, combined with continuous innovation in the multi-purpose products, ensure that the mass category continues to remain popular while infusing growth in the overall market in spite of demographic setbacks such as a falling birth rate.

Top Companies in Australia Baby and Child-Specific Products Market

The top companies operating in the market include Woolworths Group Ltd, WaterWipes UC, Bayer Australia Pty Ltd, Kimberly-Clark Australia Pty Ltd, Nice Pak Products Pty Ltd, Church & Dwight (Australia) Pty Ltd, Johnson & Johnson Pacific Pty Ltd, Aldi Stores Supermarkets Pty Ltd, Coles Group Ltd, RASCO Enterprises Pty Ltd, etc., are the top players operating in the Australia Baby and Child-Specific Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Australia Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Australia Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Australia Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Australia Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Australia Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Australia Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Australia Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Australia Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Kimberly-Clark Australia Pty Ltd

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Nice Pak Products Pty Ltd

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Church & Dwight (Australia) Pty Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Johnson & Johnson Pacific Pty Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Aldi Stores Supermarkets Pty Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Woolworths Group Ltd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. WaterWipes UC

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Bayer Australia Pty Ltd

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Coles Group Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. RASCO Enterprises Pty Ltd

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.