Asia Pacific Industrial Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (China, Japan, India, South Korea, Australia, Indonesia, Rest of Asia Pacific)

|

Major Players

|

Asia Pacific Industrial Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

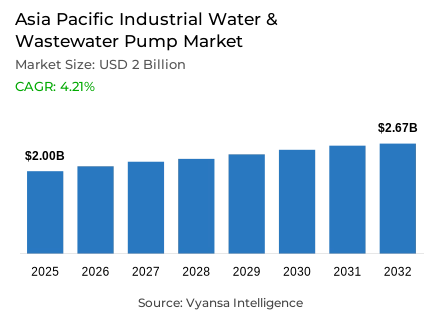

- Asia Pacific industrial water & wastewater pump market is estimated at USD 2 billion in 2025.

- The market size is expected to grow to USD 2.67 billion by 2032.

- Market to register a cagr of around 4.21% during 2026-32.

- Pump Type Shares

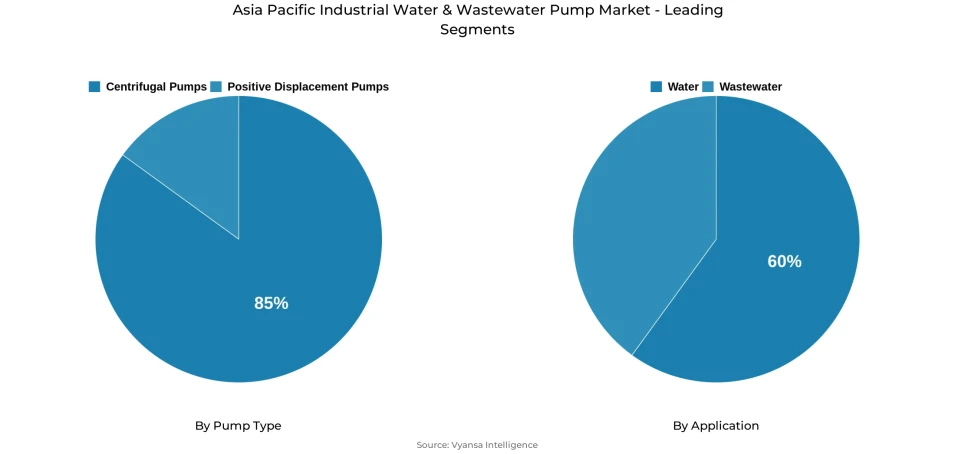

- Centrifugal pumps grabbed market share of 85%.

- Competition

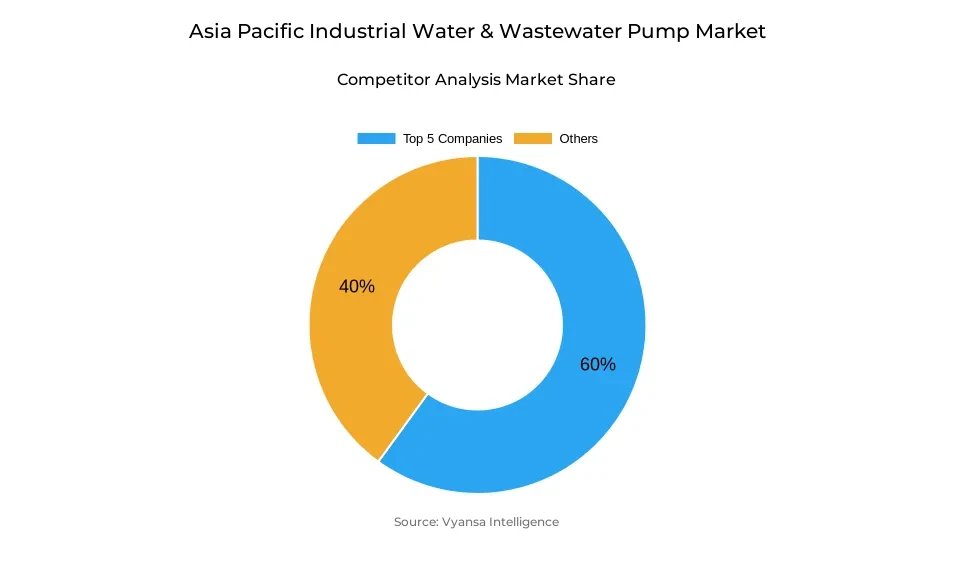

- More than 10 companies are actively engaged in producing industrial water & wastewater pump in Asia Pacific.

- Top 5 companies acquired around 60% of the market share.

- Ebara Corporation; Shanghai Kaiquan Pump Group; Wilo SE; Xylem Inc.; Grundfos Holding A/S etc., are few of the top companies.

- Application

- Water grabbed 60% of the market.

- Country

- China leads with a 40% share of the Asia Pacific market.

Asia Pacific Industrial Water & Wastewater Pump Market Outlook

The Asia Pacific market for industrial water & wastewater pumps in 2025 is approximately $2 billion. It is projected to reach around $2.67 billion by 2032, with a CAGR of 4.21% from 2026 to 2032. The Asia Pacific market is steadily growing because of the increase in the production of industrial wastewater and the improvement of investments in the water & wastewater sectors. The growth in the manufacture of petrochemicals, pharmaceuticals, textiles, semi-conductors, chemicals, and the food processing industry is directly raising the demands for efficient pumps for the treatment of this waste.

The reasons for such achemical industry outlook are closely linked to the speedy industrialization taking place in countries such as China and India. The rapidly growing chemical industry in China is the main reason for the increased chemical industry byproduct discharges, while the rising petrochemical and pharmaceutical industries in India are the primary reasons for the large amounts of chemical industry byproduct discharges in the country. The chemical industry byproduct discharges contain corrosive materials and high levels of suspended solids, making the pumps the most suitable solutions for their collection, transportation, and multi-step treatment processes.

Regulatory drivers and worries about water availability are additionally accelerating market growth. The industrial sector is also increasing spending on efficient treatment and recycling units to meet environmental regulations and alleviate concerns about drawing on already under-stressed groundwater sources. Such trends are also fueling steady market demand for efficient and robust pumping technology.

From market structure analysis, the market is dominated by centrifugal pumps with a share of around 85%. This can be attributed to the fact that these pumps consume less power and have higher capacities. Water applications in the market make up around 60% of the market. China shows a significant market share of around 40% in the region.

Asia Pacific Industrial Water & Wastewater Pump Market Growth Driver

Industrial Expansion Accelerating Wastewater Infrastructure Requirements

The increasing pace of industrialization in the Asia Pacific is contributing substantially to the intensification of wastewater production in petrochemicals, pharmaceuticals, textile mills, semiconductors, chemical industry, and food processing units. The rising growth in China's manufacturing and chemical industry has caused a substantial increase in the wastewater discharged by the industrial units in the country. At the same time, the increasing petrochemical and pharma industry in India is a significant source of complex process wastage. The variability in the flow rates and suspended solid levels in this type of wastewater is high; therefore, it creates a constant market for tailored wastewater transfer systems. The extent and type of industry in the market will ensure that the wastewater volume is proportional to the industry's growth.

The growing need for integrated advanced water recycling infrastructure, due to the pressures imposed on industrial end-users by increasingly strict regulatory norms, is also increasingly challenging the status quo. The more the amount of generated wastewater, the more the need for efficient pumps, hence creating a steady stream of demand for high-performance, energy-conserving pumps with multi-staged processes, hence making the generation of industrial wastewater a systemic growth driver for the Asia Pacific Market for Industrial Water & Wastewater Pumps between 2026 and 2032.

Asia Pacific Industrial Water & Wastewater Pump Market Challenge

Resource Depletion and Cost Pressures Constraining Market Dynamics

Despite strong demand fundamentals, the market faces various constraints related to severe groundwater depletion, escalating operational costs, and infrastructure financing challenges. Over 60% of the world's groundwater withdrawals are for the Asia Pacific, creating high stress on industrial water availability and increasing dependence on treated and recycled sources. This also contributes to supporting long-term pump demand, but at the cost of adding complexity to system design, as pumps need to handle variable water chemistry, higher solid contents, and performance requirements. For many industrial end users, however, the upfront capital expenditure associated with advanced pumping systems and integrated treatment is a considerable barrier to entry, which is especially true for smaller and mid-sized facilities.

Energy costs continue to inhibit market growth, since pumping applications account for a significant percentage of total treatment plant power consumption. Wide power price fluctuations across emerging markets increase sensitivity to life-cycle costs, encouraging end-users to extend replacement cycles or select lower-priced equipment with shorter working lives. In addition, patchy regulatory compliance in some Southeast Asian countries muddles the investment timing and reduces immediate infrastructure renewal. All these factors combine to temper growth rates, despite the fact that basic long-term water security issues underpin market demand.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Asia Pacific Industrial Water & Wastewater Pump Market Trend

Regulatory Tightening and Technology Adoption Shaping Market Evolution

Wastewater treatment across Asia Pacific is becoming a form of obligation for market behavior due to rapidly increasing environmental regulation. For instance, the case of China working towards sewage treatment rates higher than 95% in county-level areas and addition of capacity in millions of cubic meters every day. Similar efforts in India involve programs for river conservation and industrial discharge, driving modern pumping systems integrated with advanced technologies to accord with modern regulatory developments. These regulatory moves force industrial users to upgrade their conventional infrastructure, thereby forcing replacement demand for high-efficiency and automation-ready pumps.

Regulation, on the other hand, is a leading market indicator along with technological advancement. In an effort to lessen energy consumption and further extend uptime, pumping systems are increasingly being embedded with variable-frequency drives, IoT-enabled monitoring, and predictive maintenance. These have become key solutions that appeal more to end users for their alignment with both environmental compliance and operational efficiency. This blend of policy pressure with digitalization is gradually raising performance bars, motivating manufacturers to compete on the basis of efficiency enhancement, innovation in materials, and intelligent system integration within the industrial water & wastewater pump market in Asia Pacific.

Asia Pacific Industrial Water & Wastewater Pump Market Opportunity

Recycling and Reuse Infrastructure Creating Long-Term Growth Pathways

Industrial water recycling and reuse are opening up immense future potential as the scarcity of water increases progressively in the Asia-Pacific region. On a worldwide basis, industrial water reuse has already achieved notable scale, with industrial uses representing close to half of total demand, and governments actively promoting regional reclaimed water utilization. The target of China to add tens of millions of cubic meters per day of reclaimed water capacity and India's drive toward zero-liquid-discharge systems in industrial clusters are creating direct, additional addressable market demand for specialized pumping equipment. These initiatives position recycling infrastructure as a core growth avenue rather than a niche application.

There is growing deployment by end users of multi-stage treatment and closed-loop systems, which demands pumps capable of handling treated effluent, variable salinity, and temperature-sensitive processes. Energy-efficient centrifugal and submersible systems optimised for reuse applications are being increasingly deployed in desalination plants, industrial parks, and integrated recycling facilities. This investment momentum is further amplified by private sector participation in water infrastructure. Demand for advanced pumping solutions is expected to remain structurally strong through the period 2026-2032, with water reuse moving from being a compliance issue to that of strategic resource management.

Asia Pacific Industrial Water & Wastewater Pump Market Country Analysis

By Country

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

China holds a dominant 40% share of the Asia Pacific industrial water & wastewater pump market, supported by unmatched industrial scale, coordinated policy frameworks, and sustained infrastructure investment. Extensive treatment capacity, a mature manufacturing ecosystem, and strong domestic demand provide Chinese producers with structural advantages. Government policies emphasizing water security, environmental compliance, and domestic equipment sourcing reinforce local manufacturing strength, enabling consistent supply to both domestic and regional markets.

Beyond domestic consumption, China functions as a regional export hub for centrifugal and submersible pumping systems. Competitive pricing, broad product portfolios, and established distribution networks allow Chinese manufacturers to serve end users across Southeast and South Asia undertaking water infrastructure upgrades. Continued investment in desalination, recycling, and industrial park development sustains internal demand while reinforcing technological advancement. As neighboring economies accelerate modernization efforts, reliance on China’s manufacturing capacity is expected to persist, consolidating its leadership position throughout the forecast period.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Asia Pacific Industrial Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps have the major share accounting for approximately 85% under the pump type segment. The dominance is rooted in high efficiency, operational reliability, and cost-effectiveness in high-volume, continuous-duty applications typical of municipal treatment plants and industrial recycling facilities. The region’s extensive use of gravity-fed networks, large-diameter pipelines, and multi-stage treatment processes aligns closely with centrifugal pump performance characteristics, reinforcing their widespread adoption across both public and private infrastructure.

This substantial market share reflects fundamental engineering requirements rather than temporary competitive advantages. End users prioritize centrifugal systems for their scalability, ease of maintenance, and compatibility with variable-frequency drives and automation platforms. Manufacturers focusing on corrosion-resistant materials, energy optimization, and digital monitoring continue to capture premium segments within this category. Given the scale of wastewater handled across China and India alone, centrifugal pump technology is expected to maintain its leadership position, underpinning long-term stability within the overall market structure.

By Application

- Water

- Wastewater

The water application segment holds the largest share of approximately 60% in the Asia Pacific industrial water and wastewater pump market, underpinned by the region’s critical focus on drinking water security, treatment, and distribution. Severe water stress across Asia Pacific, affecting an estimated 2.6 billion people, is driving sustained investment in raw water intake, purification, storage, and distribution infrastructure. Municipal utilities are prioritizing high-efficiency pumping systems to modernize aging networks and reduce non-revenue water losses that average nearly 30% across the region, translating into significant operational and financial burdens. Large-scale public investments in water treatment capacity expansion, particularly in China, continue to reinforce demand for reliable and durable pumping solutions.

Industrial water applications represent a secondary but rapidly strengthening segment as manufacturing facilities respond to stricter regulatory compliance and mandatory water recycling requirements. Growth in desalination and advanced treatment systems, especially in coastal and water-scarce economies, is increasing demand for technologically advanced pumps integrated with energy recovery and efficiency-enhancing features.

Various Market Players in Asia Pacific Industrial Water & Wastewater Pump Market

The companies mentioned below are highly active in the Asia Pacific industrial water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Ebara Corporation

- Shanghai Kaiquan Pump Group

- Wilo SE

- Xylem Inc.

- Grundfos Holding A/S

- Flowserve Corporation

- KSB SE & Co. KGaA

- Kirloskar Brothers Limited

- Sulzer Ltd.

- Shakti Pumps

- CRI Pumps

Market News & Updates

- Xylem Inc., 2025:

Xylem raised full-year 2025 earnings forecasts on strong demand for water solutions across the Asia-Pacific region, with Applied Water segment reporting Q2 2025 sales of $483 million exceeding expectations of $462.27 million, while the Water Infrastructure division achieved $650 million in Q2 2025 sales. The company's strategic positioning in regional markets including China, India, and Australia reflects rapid urbanization, water infrastructure modernization, and agricultural expansion driving robust demand across Asia-Pacific's largest industrial pump sector globally.

- Kirloskar Brothers Limited, 2025:

Kirloskar Brothers Limited launched two advanced borewell submersible pumps-KU7P and LEHR-engineered for superior performance, energy efficiency, and durability across domestic, community water supply, and agricultural applications in rural and urban India. The KU7P, India's first 17.5 CM oil-filled submersible pump with solar compatibility, and LEHR, featuring advanced flexi drive motor technology for low-voltage operability, demonstrate the company's continued strategic positioning as a leader in the Indian water pumps market with expanding industrial segment demand driven by manufacturing growth and water scarcity pressures.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Asia Pacific Industrial Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Asia Pacific Industrial Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Asia Pacific Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold (Million Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. China

5.2.3.2. Japan

5.2.3.3. India

5.2.3.4. South Korea

5.2.3.5. Australia

5.2.3.6. Indonesia

5.2.3.7. Rest of Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. China Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold (Million Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. Japan Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold (Million Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. India Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold (Million Units)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. South Korea Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold (Million Units)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. Australia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold (Million Units)

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Indonesia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Units Sold (Million Units)

11.2. Market Segmentation & Growth Outlook

11.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Grundfos Holding A/S

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Flowserve Corporation

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. KSB SE & Co. KGaA

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Kirloskar Brothers Limited

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Ebara Corporation

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Shanghai Kaiquan Pump Group

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Wilo SE

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Sulzer Ltd.

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Shakti Pumps

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. CRI Pumps

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.