Argentina Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), Price (Premium, Mass), Gender (Men, Women, Unisex), Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), Form (Creams/Gels, Lotions, Sprays, Solid, Others), Nature (Organic, Inorganic), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0694

- 120

-

Argentina Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

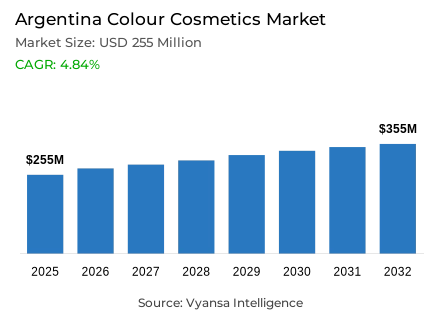

- Colour cosmetics in Argentina is estimated at USD 255 million in 2025.

- The market size is expected to grow to USD 355 million by 2032.

- Market to register a cagr of around 4.84% during 2026-32.

- Category Shares

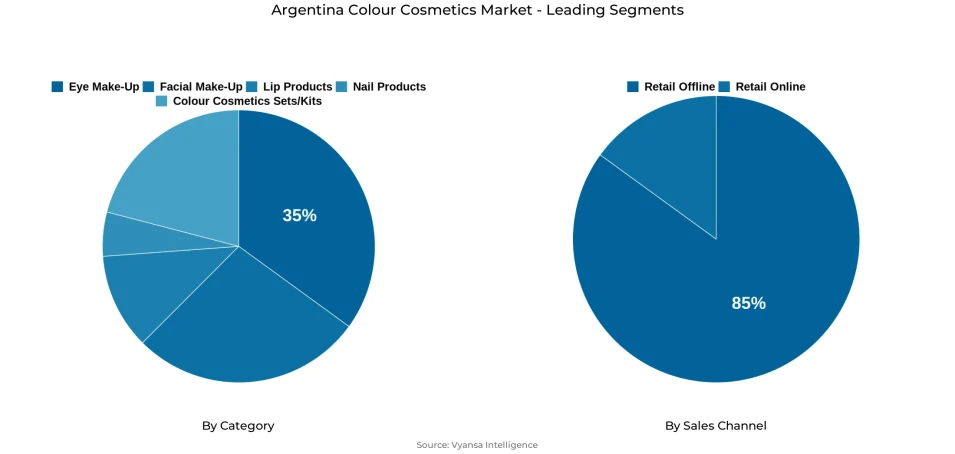

- Eye make-up grabbed market share of 35%.

- Competition

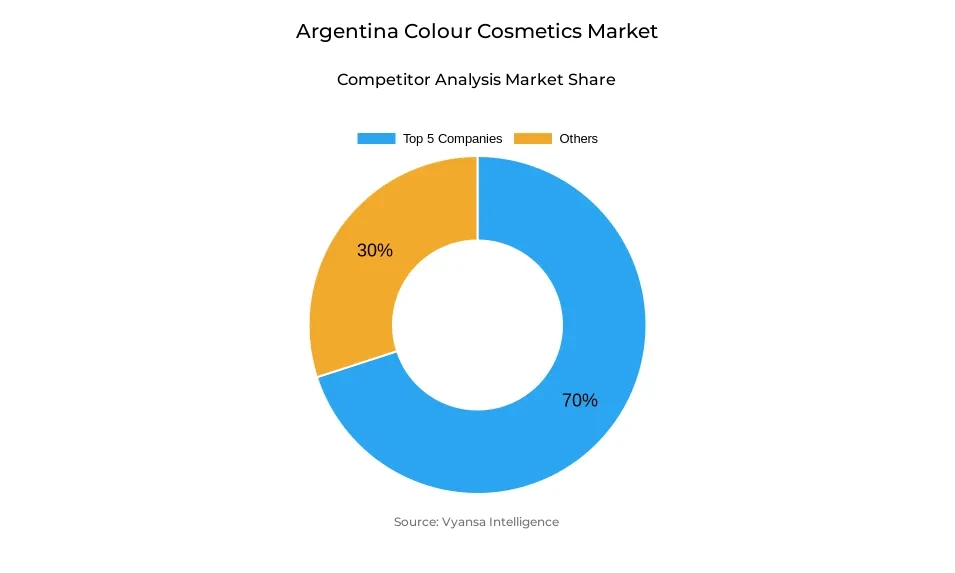

- More than 15 companies are actively engaged in producing colour cosmetics in Argentina.

- Top 5 companies acquired around 70% of the market share.

- Lady Way SRL; Revlon de Argentina SAIC; Naturel SA; L'Oréal Argentina SA; Cosméticos Avon SACI etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Argentina Colour Cosmetics Market Outlook

The Argentina Colour Cosmetics Market is expected to recover steadily, rising from USD 255 million in 2025 to USD 355 million by 2032, registering a CAGR of around 4.84%. After the sharp contraction caused by hyperinflation, reduced social activity and falling employment, the forecast period is set to bring renewed growth as economic conditions stabilise. Increased social outings, higher employment levels, and a return to out-of-home lifestyles will support a rebound in usage. Eye make-up, with a 35% share, will remain a core driver as hybrid work sustains demand for products suited to virtual communication, while lip products and nail products are also expected to benefit from improving end user confidence.

Retail dynamics will continue to evolve, with retail offline channels holding 85% of market share, supported by strong performance from pharmacies and beauty specialists. Private label-particularly lines such as Farmacity’s Studio 9 will maintain momentum due to competitive pricing. Meanwhile, direct selling, although still influential, is expected to recover more slowly as end users increasingly choose affordable alternatives. Growth in retail online will persist, supported by celebrity-led digital campaigns and marketplace expansion from leading companies like Coty.

Looking ahead, colour cosmetics sets/kits are projected to be the fastest-growing segment through 2032, driven by recovering purchasing power and renewed gifting occasions such as Mother’s Day. The removal of import restrictions will enable improved availability of premium and mass brands, lifting assortment depth and product variety across retail channels. Ethical and vegan cosmetics will also gain traction as end users become more ingredient-conscious and inclined toward cruelty-free choices.

Local innovators and multinationals are expected to expand offerings such as vegan powders, serums, and treatment-based lip products, reinforcing the market shift toward cleaner and more purposeful beauty. Overall, easing inflationary pressures, broader product access, and rising beauty engagement will collectively support a steady and dynamic upward trajectory for Argentina colour cosmetics market.

Argentina Colour Cosmetics Market Growth Driver

Hyperinflation Reshaping Value Growth and Price Sensitivity

The triple-digit inflation observed in 2024 fundamentally reshaped the market landscape, with retail current-value sales surging despite a concurrent decline in real demand. Official CPI data for January 2024 reported a 20.6% monthly rise and 254.2% year-on-year increase a stark signal of runaway prices. In this context, end users became intensely price-conscious. That very pressure powered growth for lower-cost options private labels in chained pharmacies and beauty specialists gained ground, and direct sellers lost share as shoppers switched to more affordable brands. The resulting market dynamism-explosive nominal growth, shifting shares, and new price anchors-drives how players compete, innovate and distribute today.

Beyond pricing alone, hyperinflation catalysed rapid tactical moves. Health and beauty specialists leaned on private labels and promotions direct sellers and multinationals had to adjust portfolios, retail online and celebrity tie-ups increased visibility for budget or aspirational lines. All these reactions to inflation create a forceful market driver that determines winners, channel strategies, and product mixes for the category now and into recovery.

Argentina Colour Cosmetics Market Challenge

Weak Real Demand Under Severe Economic Strain

Argentina extreme macroeconomic instability in 2024 created one of the strongest headwinds for the colour cosmetics category. Retail volume dropped sharply despite nominal current-value growth, as triple-digit inflation eroded purchasing power and reduced discretionary spending. Employment weakness further limited usage occasions, mirroring national labour pressures according to the World Bank argentina unemployment rate was 6.14% in 2023, with conditions tightening further into 2024.

Lower real incomes, fewer social outings, and high inflation combined to depress true demand across all subcategories, even those supported by virtual-work trends. The challenging environment also disrupted channel stability and brand loyalty. High inflation encouraged substitution toward cheaper alternatives and reduced willingness to purchase premium lines. With real GDP contracting by 1.6% in 2023, the broader economic slowdown constrained consumption cycles and limited rebound capacity. This macro pressure creates a persistent structural challenge that companies must navigate even as conditions gradually improve.

Argentina Colour Cosmetics Market Trend

Rising At-Home Beauty Routines and Demand for Functional Cosmetics

A sustained structural trend evident in Argentina reflects a rising preference for at-home beautification practices. Financial constraints, prevailing habit drifts, and transforming personal hygiene values have brought about these changes. End users today increasingly carry out nail care, fundamental procedures, and common touch-ups at home as against going to salons. Notably, per capita changes in nominal consumption expenditure on improvements at households rose a mere 0.75% in 2023 before drastically declining in 2024, as per data obtained from The World Bank.

It fosters and enhances these daily practices for self-reliance, testing, and ease of access. Conversely, there is a convergence towards more task-executing and essence-enriched color cosmetic products. It mirrors global shifts within end user cultures as inflation cuts the value of money, shoppers seek global services from products they buy. The rising inflation impact on buying power meant that annual inflation rates topped 200% in early 2024. Magazines and online sources will need to be more multi-functional. Products with multiplied uses, such as makeup with hydrating and strengthening features, will be on a surged demand.

Argentina Colour Cosmetics Market Opportunity

Economic Recovery, Supply Expansion, and Ethical Innovation

The Argentina Colour Cosmetics Market holds meaningful upside potential as macroeconomic conditions stabilise. Rising employment and improved purchasing power will likely restore real consumption, supported by Argentina forecasted inflation moderation beginning in 2025, with the International Monetary Fund projecting inflation to decline to approximately 45% in 2025 from much higher levels in 2024. Better labour conditions matter significantly in this category, as beauty usage rises with social outings and income confidence. Higher employment levels translate into greater frequency of product use, seasonal gifting, and adoption of kits and sets categories expected to outperform during recovery.

Equally important is the removal of import barriers, which will expand product variety, especially in premium segments previously constrained by foreign currency shortages. Under argentina IMF-supported stabilisation program beginning in 2024, import restrictions are being eased to improve external balances and remove the FX access delays that previously constrained product supply. This allows new brands, ethical lines, and vegan cosmetic innovators to enter more freely. Combined with rising idealism among beauty end users, this environment positions cruelty-free and ingredient-transparent offerings for accelerated growth.

Argentina Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Facial Make-Up

- Lip Products

- Nail Products

- Colour Cosmetics Sets/Kits

The segment with the highest share around segment under the By Category is Eye Make-Up, which holds around 35% of the market. This category leads because hybrid and remote work continue to shape beauty routines, encouraging end users to emphasise their eyes during virtual meetings and social calls. Eye make-up also benefits from constant innovation, with new mascaras and eyebrow products driving renewed interest even during periods of reduced social outings.

During the forecast period, eye make-up is expected to retain its leadership as end users prioritise visible impact at an affordable price point. As economic conditions gradually improve, demand for mascaras, eyeliners, and eyebrow enhancers is likely to rise further, supported by strong brand activity and expanding product ranges appealing to both mass and premium users.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share around segment under sales channel IS Retail Offline accounting for about 85% of share, even with the decline of direct selling, retail offline has remained at the forefront of the segment due to the large volume of pharmacies, beauty specialists, and mass market retailers carrying large product lines and offering competitive prices. The increase in price-sensitive shoppers looking for product alternatives has resulted in many shoppers using the private label and budget brands available through these channels, helping to sustain the retail offline segment position.

Over the forecast period, retail offline will continue to dominate the market, as more stable economic conditions will help to increase foot traffic at beauty specialist stores and pharmacies. As a result, these channels will continue to have a strong impact on end users purchasing decisions through promotions, in-store visibility, and convenient access to popular brands. Retail online will continue to grow, but offline stores are still expected to serve as the most important touchpoint for colour cosmetics, due to their immediacy, proximity to shoppers, and ongoing promotional efforts.

List of Companies Covered in Argentina Colour Cosmetics Market

The companies listed below are highly influential in the Argentina colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Lady Way SRL

- Revlon de Argentina SAIC

- Naturel SA

- L'Oréal Argentina SA

- Cosméticos Avon SACI

- Natura Argentina SA

- Coty Argentina SA

- MAC Cosmetics Ltd

- Mary Kay Cosméticos SA

- Matiz SA

Competitive Landscape

L’Oréal Argentina remained the leading player in colour cosmetics in 2024, supported by strong performances from Lancôme, Maybelline, L’Oréal Paris and Vogue, particularly in eye and facial make-up. However, Cosméticos Avon dominated lip and nail products and, alongside Natura Argentina, continued to shape the competitive field through its large direct selling networks. Avon posted the highest retail value growth in 2024 as lip and nail categories surged. Hyperinflation accelerated the shift toward affordable alternatives, boosting the influence of private label brands in chains such as Farmacity, Look and Pigmento. While direct selling stayed the main Sales Channels channel, its share declined as resellers and end users switched to lower-priced brands and private label. Beauty specialists gained momentum through promotions and strong private label lines like Studio 9, while retail online grew modestly, supported by Coty’s MercadoLibre store and influencer-driven campaigns.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Argentina Colour Cosmetics Market Policies, Regulations, and Standards

4. Argentina Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Argentina Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Argentina Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Argentina Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Argentina Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Argentina Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Argentina SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Cosméticos Avon SACI

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Natura Argentina SA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Coty Argentina SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. MAC Cosmetics Ltd

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Lady Way SRL

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Revlon de Argentina SAIC

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Naturel SA

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Mary Kay Cosméticos SA

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Matiz SA

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.