Global Anion Exchange Membrane Chemicals Market Report: Trends, Growth and Forecast (2026-2032)

By Membrane Type (Homogeneous, Heterogeneous), By Performance Attribute (Ion Exchange Capacity, Chemical Stability), By Application (Fuel Cells, Water Treatment, Electrolysis, Chlor-Alkali Process), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Anion Exchange Membrane Chemicals Market Statistics and Insights, 2026

- Market Size Statistics

- Global anion exchange membrane chemicals market is estimated at USD 320 million in 2025.

- The market size is expected to grow to USD 750 million by 2032.

- Market to register a CAGR of around 12.94% during 2026-32.

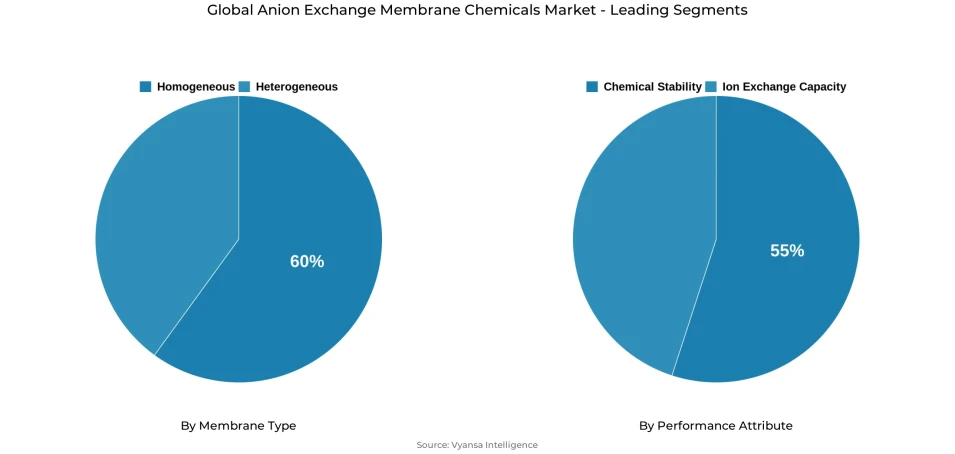

- Membrane Type Shares

- Homogeneous grabbed market share of 60%.

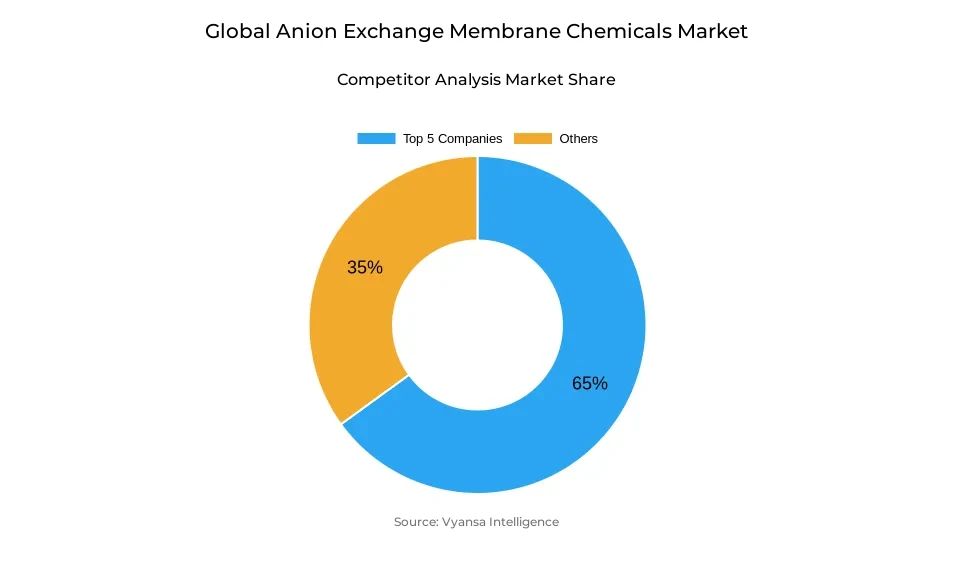

- Competition

- Global anion exchange membrane chemicals market is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 65% of the market share.

- DuPont de Nemours Inc.; AGC Inc.; Asahi Kasei Corporation; Fumatech GmbH; Chemours etc., are few of the top companies.

- Performance Attribute

- Chemical stability grabbed 55% of the market.

- Region

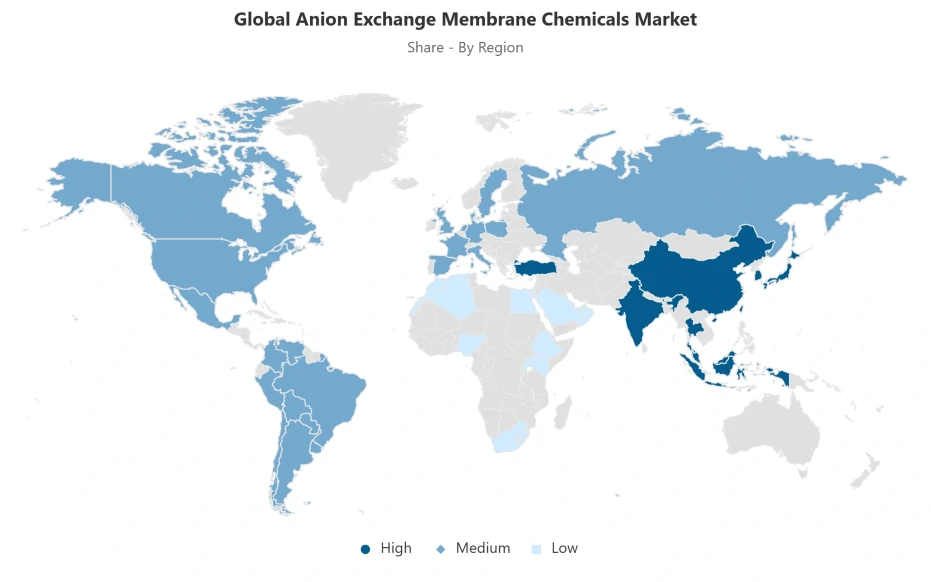

- Asia Pacific leads with a 45% share of the global market.

Global Anion Exchange Membrane Chemicals Market Outlook

The Global anion exchange membrane chemicals market is estimated at USD 320 million in 2025 and is projected to reach around USD 750 million by 2032 with a CAGR of about 12.94% in 2026-2032. This expansion perspective is directly associated with the fast-paced expansion of electrolysis-based hydrogen generation as national decarbonisation policies shift to implementation. The International Energy Agency Global Hydrogen Review 2024, reported that the announced global electrolysis capacity has reached almost 520 gigawatts, and final investment decisions have been made with approximately 20 gigawatts. This change to infrastructure-scale hydrogen projects is directly converting to long-term demand of anion-exchange membrane chemicals that facilitate stable, long-duration alkaline electrolysis.

Alkaline electrolysis now represents about 75% of the world electrolyzer manufacturing capacity, which further supports the key position of anion-exchange membranes in hydrogen systems. These membranes are used by end users to provide a reliable ion transport, chemical resistance, and continuous operation. Homogeneous membranes are the most popular with a 60% share, as they have been shown to work in large-scale alkaline conditions where predictable lifetime and low replacement rate are essential to the stability of hydrogen production and operating economics.

Durability of materials is also a characteristic factor that determines the demand in the market. Intermittent renewable power sources that are associated with variable operating conditions contribute to accelerated degradation of electrochemical systems, which raises maintenance expenses and reduces equipment lifetimes. As a result, chemical stability has become the most popular performance characteristic, with 55% of the market demand. The long-term effect of membrane chemistries on system reliability is that end users are always willing to pay higher initial costs in order to have membrane chemistries that can withstand highly alkaline conditions and thermal stress.

Asia Pacific dominates the global market with 45% share, which is backed by China dominance in the production of electrolyzers and approvals, and growing water and industrial infrastructure in India, Southeast Asia, and Northeast Asia. This hydrogen investment, scale of manufacturing, and water treatment demand combination makes the region the key driver for the market.

Global Anion Exchange Membrane Chemicals Market Growth Driver

Structural Expansion of Electrolysis-Driven Hydrogen Supply

The hydrogen production led by electrolysis is growing at a very high rate as national decarbonisation policies and industrial energy transition plans are shifting to practice. The Global Hydrogen Review 2024 by the International Energy Agency confirms that the proclaimed global electrolysis capacity is now approaching 520 gigawatts, which is a sign of transitioning to pilot-scale ambition to infrastructure-scale investment. The total amount of electrolyser capacity currently under final investment is around 20 gigawatts, of which 6.5 gigawatts were granted in the last year, indicating a faster pace of project bankability. The concentration of near-term deployment and manufacturing momentum in the Asia-Pacific region is demonstrated by China having over 40% of the world approvals.

This growth is the direct basis of the long-term demand in the global anion-exchange membrane chemicals market. As of 2024, alkaline electrolysis represents approximately 75% of the total worldwide electrolyser manufacturing capacity due to its cost-effectiveness and operational maturity. Anion-exchange membranes are relied upon by end users to deliver stable ion transport, chemical resistance, and continuous operation, making membrane chemistry essential to the 1.9 megatons per annum of electrolytic hydrogen projected by the IEA by 2030.

Global Anion Exchange Membrane Chemicals Market Challenge

Durability Constraints Under Intermittent Renewable Operation

The large-scale implementation of alkaline electrolyzers is limited by material degradation under varying operating conditions. According to peer-reviewed studies published in 2025, electrolyzers that are paired with intermittent solar and wind power experience faster nickel, iron, and cobalt electrode film degradation. Shutdown and restart cycles cause reverse currents, which trigger crystal-structure changes, compositional instability, film thinning, and high metal-dissolution rates, which are mostly absent in steady-state conditions. These processes directly lower the efficiency of the system and shorten equipment life.

The operational evidence also highlights the harshness of this challenge. Electrochemical durability experiments, such as those conducted on fuel cell systems subjected to similar electrochemical stresses, have found degradation rates of up to 0.124% per day under challenging load, humidity, and temperature cycling. To the end users, these dynamics translate to increased maintenance costs and reduced asset reliability. In the global anion exchange membrane chemicals market, this requires a ruthless focus on chemical stability, compatibility with electrode-protection, and membrane robustness that can withstand varying electrical and thermal stress profiles.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Anion Exchange Membrane Chemicals Market Trend

Emergence of Electrochemical Water Purification Architectures

Electrochemical water treatment is becoming a unique application route of advanced membrane chemistry with the support of electrode and membrane design breakthroughs. In 2024, research published in Nature Water introduced electrochemical ion pumping, a circuit-switching method that enables continuous, unidirectional ion pumping without switching the solution. This approach eliminates mixing in the treatment cycles and allows rapid charge-discharge operation, which overcomes long-standing constraints of traditional electrosorption, minimizing side reactions and maximizing separation efficiency.

The implications cut across several water-treatment issues. The literature supports the fact that electrochemical techniques offer high selectivity of targeted contaminants, low cost of operation, and ease of system integration compared to conventional chemical dosing. They are used in the softening of water, selective ion removal, recovery of nutrients, and recovery of metals in industrial effluents. These systems are run at high current densities and oxidative conditions, thus creating differentiated demand in the global anion exchange membrane chemicals market in formulations that are specifically designed to run in continuous electrochemical purification conditions as opposed to conventional alkaline electrolysis conditions.

Global Anion Exchange Membrane Chemicals Market Opportunity

Capital Inflows Reshaping Advanced Water Treatment Demand

The world is investing in water infrastructure at a faster rate, thus creating a favourable demand climate to membrane-based treatment technologies. In 2024, multilateral development banks allocated around $19.6billion to water-related projects, one of the highest annual funding rates in history. The European Investment Bank alone has provided more than a quarter of this sum and has declared its intention to lend more to the water sector by 50% to 15 billion euros by 2025-2027, and has the potential to trigger up to 40 billion euros of wider global investment.

These undertakings are coupled with ongoing structural shortages in water-treatment capacity. According to UN Water, 42% of domestic wastewater in the world is poorly or not treated at all, which is 113 billion cubic metres per year. The World Bank estimates that there is a financing gap of 138 billion dollars per year to attain universal access to water and sanitation by 2030. To end users and utilities, these converging pressures increase the use of sophisticated purification solutions, and thus directly increase the number of applications to which anion-exchange membrane chemicals can be applied in secondary and advanced treatment systems.

Global Anion Exchange Membrane Chemicals Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific holds approximately 45% of the global market share, positioning the region as the central hub of production and consumption. This dominance is anchored by China’s leadership in electrolyzer manufacturing, where final investment decisions account for more than 40% of global commitments. Extensive electrochemical equipment manufacturing capacity, integrated supply chains, and cost-competitive production have established the region as a primary supplier of anion exchange membrane chemicals to global end users.

Demand-side fundamentals further reinforce regional leadership. India and Indonesia are expanding municipal and industrial water infrastructure in response to urbanization and rising industrial water requirements, while Japan and South Korea remain focal points for fuel cell and semiconductor development. These diverse application drivers sustain broad-based demand growth across energy and water sectors. Compared with North America and Europe, where infrastructure maturity moderates expansion, Asia-Pacific’s combination of manufacturing scale, policy-backed hydrogen investment, and water treatment needs underpins its market share.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Anion Exchange Membrane Chemicals Market Segmentation Analysis

By Membrane Type

- Homogeneous

- Heterogeneous

Homogeneous membranes remain the dominant architecture within the global anion exchange membrane chemicals market, accounting for approximately 60% of total demand due to their proven performance in continuous alkaline electrolysis environments. Their uniform chemical composition ensures consistent ionic conductivity, strong resistance to alkaline degradation, and high pressure tolerance under prolonged operation. End users prioritize these membranes where operational reliability, predictable lifetime performance, and reduced replacement frequency directly influence hydrogen output stability and total operating costs in large-scale electrolyzer installations.

Heterogeneous and composite membranes together represent the remaining 40% market share, addressing applications where design flexibility and cost efficiency are critical decision factors. These membrane structures allow tailored ion selectivity, lower material usage, and adaptable manufacturing processes, supporting adoption in electrochemical water treatment systems, fuel cell platforms, and cost-sensitive markets. While long-term durability may be lower than homogeneous alternatives, their customization potential enables performance optimization for specialized operating conditions, reinforcing a clear performance-cost segmentation across applications.

By Performance Attribute

- Ion Exchange Capacity

- Chemical Stability

Chemical stability represents the dominant performance criterion, accounting for 55% of market share within the global anion exchange membrane chemicals market. This prioritization reflects the chemically aggressive environments encountered in alkaline electrolyzers and fuel cell systems, where membranes operate in 6-12 molar potassium hydroxide at temperatures ranging from 60 to 80 degrees Celsius. Under these conditions, inferior chemistries experience backbone chain scission, quaternary ammonium degradation, and support material corrosion, leading to catastrophic failure.

Achieving high chemical stability requires deliberate material engineering. Aromatic polymer backbones resistant to nucleophilic attack, bulky cationic groups that suppress Hofmann elimination, and optimized cross-linking densities are essential to balancing durability with mechanical integrity. End users consistently favor high-stability formulations despite premium pricing, as replacement costs and downtime far exceed upfront material expenses. The remaining 45% share spans attributes such as ionic conductivity, mechanical strength, and controlled water uptake, which enhance efficiency and reliability but remain secondary to alkaline durability.

Market Players in Global Anion Exchange Membrane Chemicals Market

These market players maintain a significant presence in the Global anion exchange membrane chemicals market sector and contribute to its ongoing evolution.

- DuPont de Nemours Inc.

- AGC Inc.

- Asahi Kasei Corporation

- Fumatech GmbH

- Chemours

- 3M Company

- Ion Power Inc.

- Dioxide Materials Inc.

- Lanxess AG

Market News & Updates

- Chemours, 2025:

In its Q4 2024 and full-year 2024 disclosure dated 17 February 2025, Chemours confirmed that under its Pathway to Thrive portfolio management pillar the Advanced Performance Materials segment approved in January 2025 a restructuring program to exit its Surface Protection Solutions Capstone business, with manufacturing of Capstone products in Europe expected to end by the end of the second quarter of 2025 subject to local regulatory approvals. In its Q1 2025 results release, the company reported net sales of 1.4 billion dollars, broadly in line with the prior-year quarter, as a 5% increase in sales volumes was offset by a 4% decline in average price and a modest negative currency impact. Complementing these portfolio measures, Chemours is executing a 200 million dollar investment to expand capacity and advance technology for Nafion ion exchange materials at its Villers-Saint-Paul site in France, a platform that underpins proton and ion exchange membranes for water electrolyzers, flow batteries, and fuel cell vehicles in the growing hydrogen economy, and the project is expected to create around 80 new full-time roles and approximately 50 long-term contracted positions in the region.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Anion Exchange Membrane Chemicals Market Policies, Regulations, and Standards

4. Global Anion Exchange Membrane Chemicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Membrane Type

5.2.1.1. Homogeneous- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Heterogeneous- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Performance Attribute

5.2.2.1. Ion Exchange Capacity- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Chemical Stability- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Fuel Cells- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Water Treatment- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Electrolysis- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Chlor-Alkali Process- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. Latin America

5.2.4.3. Europe

5.2.4.4. Middle East & Africa

5.2.4.5. Asia Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. US

6.2.4.2. Canada

6.2.4.3. Mexico

6.2.4.4. Rest of North America

6.3. US Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

6.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

6.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

6.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Rest of Latin America

7.3. Brazil Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

7.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. France

8.2.4.3. UK

8.2.4.4. Italy

8.2.4.5. Spain

8.2.4.6. Netherlands

8.2.4.7. Belgium

8.2.4.8. Russia

8.2.4.9. Poland

8.2.4.10. Turkey

8.2.4.11. Rest of Europe

8.3. Germany Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.9.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.11.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

8.12.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. Saudi Arabia

9.2.4.2. UAE

9.2.4.3. Rest of Middle East & Africa

9.3. Saudi Arabia Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

9.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

9.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Country

10.2.4.1. China

10.2.4.2. India

10.2.4.3. Japan

10.2.4.4. South Korea

10.2.4.5. Australia

10.2.4.6. Thailand

10.2.4.7. Rest of Asia Pacific

10.3. China Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. India Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Anion Exchange Membrane Chemicals Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Membrane Type- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Performance Attribute- Market Insights and Forecast 2022-2032, USD Million

10.8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Fumatech GmbH

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Chemours

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. 3M Company

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Ion Power, Inc.

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Dioxide Materials, Inc.

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. DuPont de Nemours, Inc.

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. AGC Inc.

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Asahi Kasei Corporation

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Lanxess AG

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Membrane Type |

|

| By Performance Attribute |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.