Global Aluminum Sulfate Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Ferric Alum, Non-ferric Alum), By Grade (Standard Grade, Low Iron Grade, Iron Free Grade), By Form (Solid, Liquid), By Application (Water Treatment, Paper & Pulp Manufacturing, Textile & Dyeing, Food & Beverages, Pharmaceutical, Personal Care, Others), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

- Chemical

- Feb 2026

- VI0975

- 210

-

Global Aluminum Sulfate Market Statistics and Insights, 2026

- Market Size Statistics

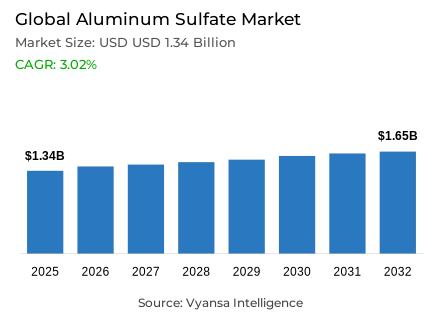

- Global aluminum sulfate market is estimated at USD 1.34 billion in 2025.

- The market size is expected to grow to USD 1.65 billion by 2032.

- Market to register a CAGR of around 3.02% during 2026-32.

- Product Type Shares

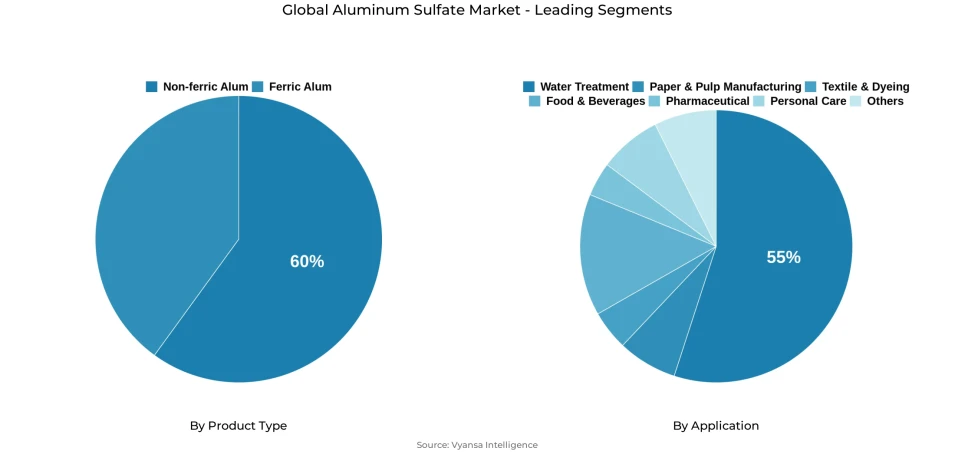

- Non-ferric alum grabbed market share of 60%.

- Competition

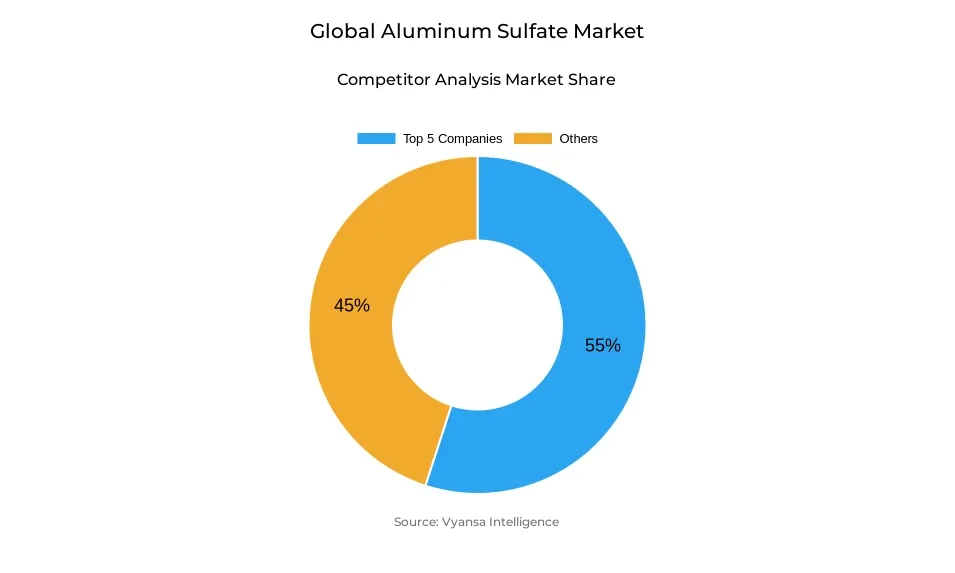

- Global aluminum sulfate market is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 55% of the market share.

- GAC Chemical Corporation; C & S Chemicals Inc.; Feralco AB; Kemira Oyj; Chemtrade Logistics Inc. etc., are few of the top companies.

- Application

- Water treatment grabbed 55% of the market.

- Region

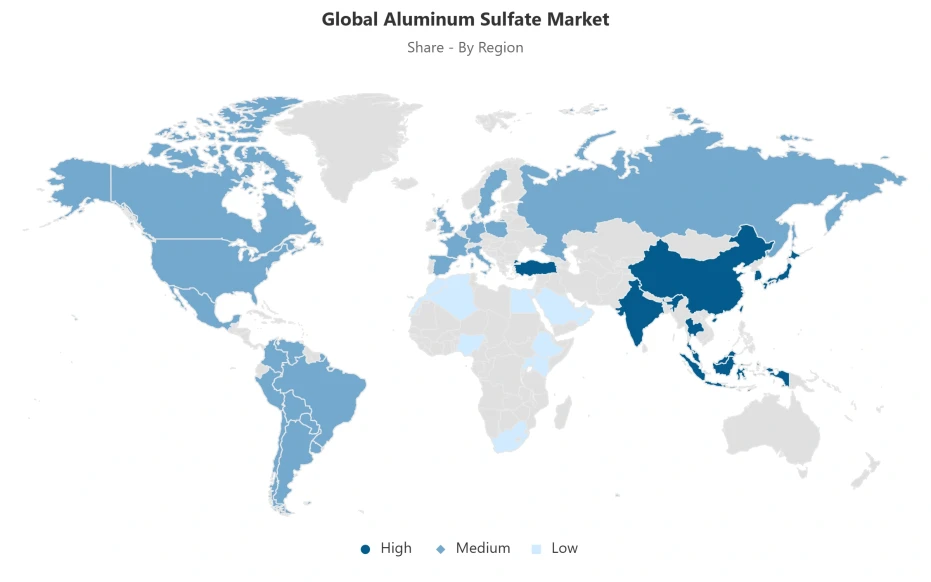

- Asia Pacific leads with a 40% share of the global market.

Global Aluminum Sulfate Market Outlook

The Global market of aluminum sulfate is estimated at about USD 1.34 billion in 2025 and is expected to be valued at about USD 1.65 billion in 2032 with a stable CAGR of about 3.02% in 2026-2032. This average yet consistent growth is an indication of the vitality of aluminum sulfate in water treatment systems across the globe. The increasing urban populations and the continued disparities in access to safe drinking water are generating long-term, structural demand on proven and cost-effective treatment chemicals, which will enable steady market growth throughout the forecast period.

One of the determinants of market outlook is rapid urbanisation. The current urban population is estimated to be about 58% of the world population and the majority of future population increase will be in urban centers and towns in the developing world. Nevertheless, over 2 billion individuals continue to lack access to safely managed drinking water, forcing governments to increase and modernize municipal treatment systems. With the increase in the volume of water that can be treated in treatment plants and the decline in the quality of the source water, the use of coagulation processes has been high. Aluminum sulfate is the most commonly used coagulant in municipal systems, which highlights its significance in addressing the health and regulatory needs of the population.

This stability is based on product-and-application trends. Approximately 60% of the total market demand is occupied by non-ferric aluminum sulfate, which is a product with a long history of operation, predictable performance, and compatibility with the existing infrastructure. The greatest use is water treatment, which is about 55% of the market, with both municipal and industrial systems relying on aluminum sulfate to treat turbidity, colour, and organic-matter. The intensification of water-quality surveillance and compliance standards are raising the intensity of treatment, which is continuing to support chemical demand.

The Asia Pacific region is the top consumer of aluminum sulfate in the world with a 40% share. High volumes of demand are being caused by rapid urbanization, high populations, and heavy investments in water and wastewater systems in China, India, and Southeast Asia. As North America and Europe exhibit a stable consumption due to the developed systems and regulatory improvements, Asia Pacific remains the key driver of volumetric growth in the global aluminum sulfate market until 2032.

Global Aluminum Sulfate Market Growth Driver

Urban Expansion Driving Structural Demand for Water Treatment Infrastructure

Global water requirements in infrastructures are being dramatically affected by the rapid rates of urbanization in the world today. As of 2025, the world has a population of 8.2 billion people of which 45% dwell in cities across the globe, while an additional 13% of the people are in the towns, thus creating an approximate of 58% of the global population that can be found in the urban cities across the globe. According to United Nations projections, an approximate of two-thirds of the new population expected in the globe from 2025 to 2050 will be concentrated in the cities in countries such as India, Nigeria, Pakistan, the Democratic Republic of Congo, Egypt, Bangladesh, Ethiopia, while an additional 500 million people are projected to be added in the urban cities in the mentioned countries in the near future.

Yet access gaps still exist on a large scale. Moreover, 2.1-2.2 billion people still do not have access to safely managed drinking water services-yet access is rising globally to 74% from 68% across the globe between 2015 and 2024, respectively. For urban water treatment plants, coagulation is a critical process for managing rising turbidity and contaminant loads, with the U.S. Environmental Protection Agency identifying aluminum sulfate as the primary coagulant, accounting for approximately 45% of total domestic aluminum sulfate consumption in the United States.

Global Aluminum Sulfate Market Challenge

Regulatory Tightening Increasing Cost and Operational Complexity

Treating water with enhanced environmental regulations is placing escalating pressure on the need for compliance in operators. The European Union's revised Urban Wastewater Treatment Directive 2024/3019, valid from January 1, 2025, requires that treatment plants serving a population of 150,000 or more accomplish 90% phosphorus removal, with a maximum limit of 0.5 mg/L, and 85% nitrogen removal at a target of 6 mg/L or less, by 2036. In addition, the document requires an 80% removal of micropollutants from pharmaceutical residues and cosmetics-derived contaminants, significantly expanding the scope of treatment.

The demands of these requirements greatly increase the capital and operating costs for utilities, especially those dealing with aging infrastructure. According to the World Bank, the estimated global funding gap for universal access to safe water and sanitation is USD 131.4-140.8 billion annually from 2025 until 2030, which would require an almost threefold increase over current investment levels. Multilateral development banks approved water-related financing totaling USD 19.6 billion in 2024, 73% of which went toward low- and middle-income countries. However, funding remains one of the biggest barriers in the expansion of infrastructure upgrade activities across several parts of the world.

Global Aluminum Sulfate Market Trend

Expansion of Water Quality Monitoring Reinforcing Treatment Intensity

The enhancement of water quality monitoring in the world is raising the intensity of treatment and the demand of chemicals. According to UN-Water, 120 countries were actively reporting water quality indicators in 2023, compared to 89 countries in 2020, which has greatly increased the global monitoring footprint. Nevertheless, the outcomes show that there are still significant issues such as only 56% of the 91,000 monitored water bodies met “good ambient water quality” standards and only 56% of the world’s 332 billion cubic meters of domestic wastewater generated annually is safely treated.

The WHO drinking-water quality guidelines still acknowledge the use of aluminium-based coagulation as a primary treatment step, with doses of 2-5 mg/L-1 of aluminium as coagulant recommended to be used to effectively remove suspended solids, organic matter, and microorganisms. Jar testing is used by utilities to optimise dosing based on changing raw water conditions. With the growth of monitoring coverage and compliance demands, the treatment systems are increasingly relying on the reliability of coagulation performance, which strengthens the central role of aluminium sulfate.

Global Aluminum Sulfate Market Opportunity

Infrastructure Investment Across Municipal and Industrial Systems

The increasing water shortage is increasing the pace of infrastructure investment in both municipal and industrial systems. United Nations estimates that by 2050, the number of urban dwellers who will be affected by water scarcity will rise to between 1.7 and 2.4 billion people, with the greatest burden in the rapidly urbanising, water-stressed areas. Governments and development institutions are increasingly focusing on water security programmes on a large scale due to this risk profile.

This is reflected in World Bank-funded projects, such as the Water Security and WASH Access Improvement Project in Sierra Leone, which integrates a USD 40 million initial grant with USD 180 million in total commitments over the coming ten years to serve approximately 5 million individuals. Food processing, textile, chemical, power generation, and metals manufacturing industrial end users also support demand, using aluminium sulfate to clarify process water and meet wastewater discharge requirements, continuing the momentum of long-term consumption.

Global Aluminum Sulfate Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific accounts for 40% of global aluminum sulfate consumption, driven by rapid urbanization, population growth, and intensive water infrastructure investment. The region captures more than 60% of projected global urban population growth through 2050, sharply increasing demand for municipal treatment capacity. China operates the world’s largest integrated water treatment network, while India continues to expand urban water and wastewater infrastructure to support demographic and industrial growth.

Regulatory intensity is also increasing across the region, with governments adopting stricter discharge limits and aligning standards with international benchmarks. ASEAN economies are expanding treatment capacity to address urban pollution and water scarcity, while World Bank and multilateral financing initiatives continue to support water security projects. Although North America and Europe maintain stable demand from mature systems, Asia Pacific’s 40% market share positions it as the primary driver of volumetric growth in the Global aluminum sulfate market through 2032.

Global Aluminum Sulfate Market Segmentation Analysis

By Product Type

- Ferric Alum

- Non-ferric Alum

Non-ferric aluminum sulfate accounts for 60% of product-type demand within the Global aluminum sulfate market, reflecting its entrenched role as the industry-standard coagulant. Water utilities favor standard alum due to its proven cost-effectiveness, consistent floc formation across a pH range of 6-8, and compatibility with existing treatment infrastructure, as outlined in WHO guidelines. Decades of operational experience have created institutional confidence and regulatory acceptance worldwide.

Alternative coagulants, including ferric sulfate and polyaluminum chloride, collectively represent the remaining 40% of demand and serve niche applications where specific water chemistries or performance characteristics are required. However, higher costs, narrower operating windows, and switching complexities limit widespread substitution. As emerging markets prioritize reliable, scalable technologies during initial infrastructure buildout, non-ferric aluminum sulfate is expected to retain its dominant position through the forecast period.

By Application

- Water Treatment

- Paper & Pulp Manufacturing

- Textile & Dyeing

- Food & Beverages

- Pharmaceutical

- Personal Care

- Others

Water treatment represents 55% of total demand in the Global aluminum sulfate market, establishing it as the most significant end-use segment. Municipal drinking water and wastewater facilities depend on aluminum sulfate to remove turbidity, color, suspended solids, and organic contaminants, forming the backbone of regulatory compliance across both developed and developing economies. WHO guidance reinforces coagulation as a non-negotiable treatment stage for surface water systems globally.

Industrial water treatment further strengthens this dominance. End users across food and beverage processing, pharmaceuticals, steel, chemicals, and power generation rely on aluminum sulfate for process water clarification and final effluent treatment prior to discharge. While paper and pulp applications remain relevant, their relative importance has declined as mills adopt alternative additives. In contrast, tightening discharge standards ensure water treatment remains the largest and most resilient application segment.

Market Players in Global Aluminum Sulfate Market

These market players maintain a significant presence in the Global aluminum sulfate market sector and contribute to its ongoing evolution.

- GAC Chemical Corporation

- C & S Chemicals Inc.

- Feralco AB

- Kemira Oyj

- Chemtrade Logistics Inc.

- GEO Specialty Chemicals Inc.

- Nippon Light Metal Co. Ltd.

- USALCO LLC

- Drury Industries Ltd.

- Nankai Chemical Co. Ltd.

- Affinity Chemical LLC

- Merck KGaA

- Hawkins Inc.

- American Elements

- Henan Fengbai Industrial Co. Ltd.

Market News & Updates

- USALCO LLC, 2025:

USALCO acquired Fontus Blue, an innovative digital solutions provider for water utilities, marking a significant expansion of its product portfolio beyond traditional chemical coagulants into digital water treatment optimization. The acquisition integrates Fontus Blue's proprietary Decision Blue® software-as-a-service platform, which leverages advanced artificial intelligence and computational models to provide real-time insights enabling water treatment plants to forecast and enhance water quality with precision. This strategic move allows USALCO to provide a comprehensive combination of leading chemical solutions and digital decision-support services to drinking and wastewater treatment facilities nationwide.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Aluminum Sulfate Market Policies, Regulations, and Standards

4. Global Aluminum Sulfate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Aluminum Sulfate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Ferric Alum- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Non-ferric Alum- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Grade

5.2.2.1. Standard Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Low Iron Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Iron Free Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Form

5.2.3.1. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Liquid- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Application

5.2.4.1. Water Treatment- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Paper & Pulp Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Textile & Dyeing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Food & Beverages- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Pharmaceutical- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Personal Care- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Region

5.2.5.1. North America

5.2.5.2. South America

5.2.5.3. Europe

5.2.5.4. Middle East & Africa

5.2.5.5. Asia Pacific

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. North America Aluminum Sulfate Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Country

6.2.5.1. US

6.2.5.2. Canada

6.2.5.3. Mexico

6.2.5.4. Rest of North America

6.3. US Aluminum Sulfate Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

6.3.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Aluminum Sulfate Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

6.4.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Aluminum Sulfate Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

6.5.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

7. South America Aluminum Sulfate Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Country

7.2.5.1. Brazil

7.2.5.2. Rest of South America

7.3. Brazil Aluminum Sulfate Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

7.3.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Aluminum Sulfate Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Country

8.2.5.1. Germany

8.2.5.2. France

8.2.5.3. UK

8.2.5.4. Italy

8.2.5.5. Spain

8.2.5.6. Rest of Europe

8.3. Germany Aluminum Sulfate Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

8.3.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Aluminum Sulfate Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

8.4.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Aluminum Sulfate Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

8.5.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Aluminum Sulfate Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

8.6.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Aluminum Sulfate Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

8.7.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Aluminum Sulfate Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Country

9.2.5.1. Saudi Arabia

9.2.5.2. UAE

9.2.5.3. South Africa

9.2.5.4. Rest of Middle East & Africa

9.3. Saudi Arabia Aluminum Sulfate Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

9.3.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Aluminum Sulfate Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

9.4.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. South Africa Aluminum Sulfate Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

9.5.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Aluminum Sulfate Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Country

10.2.5.1. China

10.2.5.2. Japan

10.2.5.3. India

10.2.5.4. Rest of Asia Pacific

10.3. China Aluminum Sulfate Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

10.3.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Aluminum Sulfate Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

10.4.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. India Aluminum Sulfate Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.3. By Form- Market Insights and Forecast 2022-2032, USD Million

10.5.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Kemira Oyj

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Chemtrade Logistics Inc.

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. GEO Specialty Chemicals Inc.

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Nippon Light Metal Co. Ltd.

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. USALCO LLC

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. GAC Chemical Corporation

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. C & S Chemicals Inc.

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Feralco AB

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Drury Industries Ltd.

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Nankai Chemical Co. Ltd.

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Affinity Chemical LLC

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Merck KGaA

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Hawkins Inc.

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. American Elements

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Henan Fengbai Industrial Co. Ltd.

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Grade |

|

| By Form |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.