Global Aluminum Powder Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Atomized Aluminium Powder, Flake Aluminium Powder), By Form (Spherical, Flaked, Powdered), By Application (Industrial, Automotive, Aerospace & Defense, Building & Construction, Electronics & Semiconductors, Pharmaceutical, Others), By Purity Level (High Purity, Standard Purity, Low Purity), By Process (Atomization, Milling, Aluminium Dross), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Aluminum Powder Market Statistics and Insights, 2026

- Market Size Statistics

- Global aluminum powder market is estimated at USD 2.45 billion in 2025.

- The market size is expected to grow to USD 3.87 billion by 2032.

- Market to register a CAGR of around 6.75% during 2026-32.

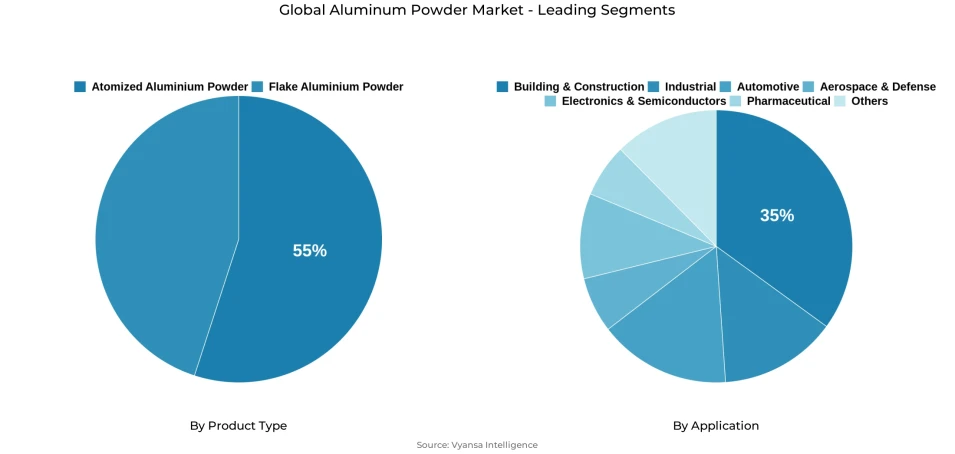

- Product Type Shares

- Atomized aluminium powder grabbed market share of 55%.

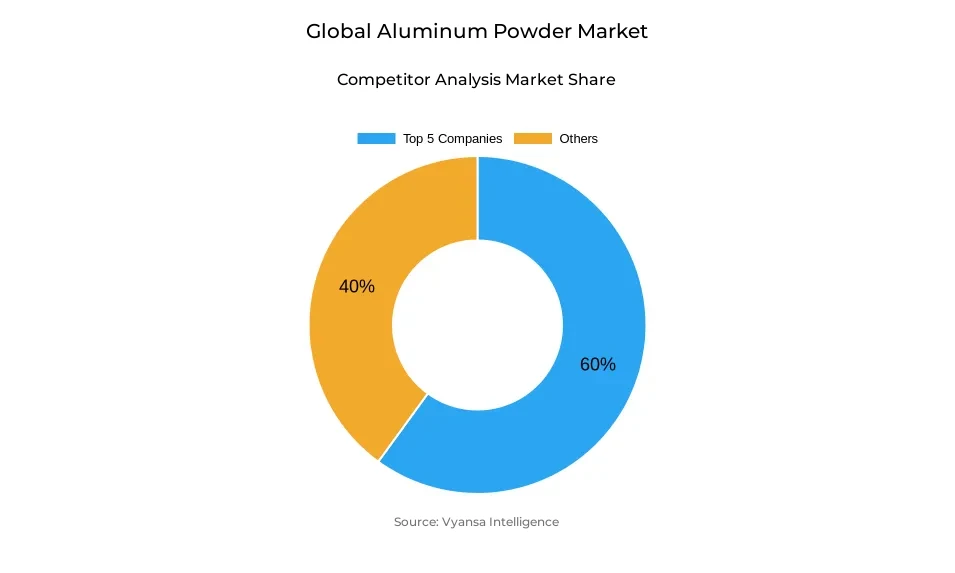

- Competition

- Global aluminum powder market is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 60% of the market share.

- NovaCentrix; SCHLENK SE; Angang Group Aluminium Powder Co. Ltd; Alcoa; AMG Advanced Metallurgical Group NV etc., are few of the top companies.

- Application

- Building & construction grabbed 35% of the market.

- Region

- Asia Pacific leads with a 50% share of the global market.

Global Aluminum Powder Market Outlook

The Global market in aluminum powder is estimated at USD 2.45 billion in 2025 and projected to reach around USD 3.87 billion in 2032 representing a CAGR of about 6.75% during the years 2026-2032. This consistent trend is supported by the growing presence of aluminum in renewable energy, electric mobility, construction, and high-tech manufacturing value chains. The current electrification and massive implementation of renewable energy technologies are structurally incorporating demand on aluminum into long-term infrastructure investment, thus providing a consistent base of consumption of aluminum powder among industrial end users globally.

The development of renewable energy is one of the key drivers that influence the market perspective. Averaging approximately 21 tonnes of aluminum per megawatt, solar photovoltaic installations place solar deployment as a sustainable source of material demand. This trend is further supported by electric vehicles, where lightweighting made of aluminum is necessary to improve the range and efficiency of battery-electric systems. The use of aluminum-intensive components in wind turbines, solar mounting systems, grid transmission lines, and energy storage enclosures is also rising due to policy-driven shifts away to fossil fuels, further enhancing long-duration demand visibility.

The market faces structural limitations on the supply side which affect pricing and availability. Aluminum powder production is associated with the risks of combustible dusts, which requires significant investment in safety mechanisms, compliance measures, and training of workers. At the same time, the flexibility in supply has been limited by production limits in China and a shrinking primary smelting capacity in the United States, increasing dependence on imports and vulnerability to fluctuations as downstream demand speeds up in the transportation and energy sectors.

Structurally, atomised aluminum powder is the dominant player with a 55% market share because of its uniform particle size, purity, and flow characteristics, which facilitates precision-driven industrial usage. The largest application segment is building and construction with 35% of the global demand, which is mainly used in autoclaved aerated concrete, insulation, and coatings. The Asia Pacific region is the leader region with a 50% share, anchored by the scale of the Chinese industry and supported by the growing demand of India, Japan, and South Korea in the construction, automotive, and advanced manufacturing industries.

Global Aluminum Powder Market Growth Driver

Structural Role of Aluminum in the Global Energy Transition

The current electrification and use of renewable energy still strengthens the strategic value of aluminum in industrial value chains. The world is estimated to need almost 40% more aluminum by 2030, which will be driven by renewable energy infrastructure and the growth of electric mobility. A solar photovoltaic system needs about 21 tonnes of aluminum per megawatt, which places large-scale solar implementation as a structural source of long-term material demand. The spread of electric vehicles also supports this trend, with lightweighting, which is highly aluminum-intensive, continuing to be the focus of range and efficiency improvements, especially in battery-electric systems that are intended to be adopted by the majority of major automotive markets.

This demand perspective is reinforced by policy-based changes in favor of renewable electricity production. With countries hastening their efforts to abandon fossil fuels, wind turbines, solar mounting systems, grid transmission lines, and energy-storage enclosures are becoming more and more aluminum-intensive. This multi-sector exposure generates a sustainable consumption base, thus making aluminum powder a key input that facilitates long-term infrastructure investment cycles and predictable demand by industrial end users globally.

Global Aluminum Powder Market Challenge

Operational and Supply-Side Constraints Shaping Industry Risk

Production of the aluminum powder poses a continuous operational hazard due to the fact that it is a combustible dust substance. When suspended in the air, fine aluminum particles may create explosive clouds, which is why the industrial safety standards should be followed strictly. Plants will have to invest heavily in dust-collection systems, explosion venting, surface-cleaning regimes and workforce training programmes. These compliance costs raise fixed costs, lengthen qualification timeframes, and impede capacity growth, particularly to smaller manufacturers serving high-volume industrial end users.

Market constraints are further exacerbated by supply-side rigidity. The production caps in China by the government have been effective in restricting incremental production of primary aluminum, and the reduction in smelting capacity in the United States has reduced domestic supply choices. There are few major smelters that are still in operation and this has led to the reliance on imports. These structural constraints increase vulnerability to supply shocks and price fluctuations, especially as downstream demand in transportation and renewable-energy uses keeps growing.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Aluminum Powder Market Trend

Additive Manufacturing Reshaping Material Utilization Patterns

New manufacturing technologies are transforming the consumption patterns of aluminum powder, especially in the aerospace and defense value chains. Laser powder-bed fusion and selective laser melting are additive manufacturing methods that are increasingly dependent on aluminum powders to produce complex, lightweight parts. These processes allow accurate geometries, minimize waste of materials, and maximize the performance of structural aerospace components, which is in line with industry concerns regarding fuel efficiency and emissions mitigation. Adoption is not limited to prototyping but is moving to serial production of airframes, engine components and structural assemblies.

This shift is supported by research-based material innovation. Developed specialized aluminum alloy powders are designed to achieve high aerospace performance requirements such as thermal stability and fatigue. Research institutions and industrial programmes that are publicly funded are still developing powder-qualification standards, which are speeding up certification in next-generation aircraft platforms. With the growth of aviation activity and the development of lighter and more efficient designs by manufacturers, additive manufacturing based on aluminum powder is becoming a standard production route, not a niche application.

Global Aluminum Powder Market Opportunity

Decarbonized Production Creating Competitive Differentiation

The low-carbon production routes are becoming a major value-generation opportunity to the suppliers of aluminum powder. Recycled aluminum consumes about 5% of the energy consumed in primary production, which can afford significant emissions and cost benefits. Carbon intensity market mechanisms allow suppliers to distinguish between low-emission powders of aluminum and reach high-end industrial markets. The dynamics are especially applicable to end users who are working under stricter sustainability disclosure and procurement regulations in Europe and North America.

Manufacturers who are incorporating renewable energy in smelting and downstream processing are enhancing long-term competitiveness. Hydroelectricity, biomethane, or wind-connected grid facilities have a much lower carbon footprint than the global average. With the growth of renewable-electricity infrastructure, the aluminum demand of grid systems, solar installations, and wind assets is projected to demand tens of millions of tonnes by mid-century. This match between low-carbon supply and clean-energy demand establishes sustainable growth opportunities of certified aluminum powder products.

Global Aluminum Powder Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific leads the Global aluminum powder market with approximately 50% market share, underpinned by its dominant position in global aluminum consumption and manufacturing output. China anchors regional demand through extensive automotive, construction, and industrial manufacturing networks, while large-scale infrastructure development continues to absorb significant material volumes. Expanding vehicle production and ongoing urban development projects reinforce aluminum powder utilization across multiple end-use industries.

India contributes rising incremental demand as aluminum powders gain traction in construction materials, automotive coatings, and chemical processing. Japan and South Korea add specialized consumption through advanced aerospace, electronics, and precision manufacturing applications requiring high-purity powders. The region’s leadership reflects a combination of industrial scale, policy-supported manufacturing growth, and diversified end-user industries, positioning Asia-Pacific as the primary consumption hub for both commodity-grade and specialty aluminum powder products.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Aluminum Powder Market Segmentation Analysis

By Product Type

- Atomized Aluminium Powder

- Flake Aluminium Powder

Atomized aluminum powder holds a dominant 55% share of the Global aluminum powder market, reflecting its superior performance characteristics across industrial applications. Controlled atomization produces powders with consistent particle size distribution, high purity, and excellent flowability, making them well suited for precision-dependent processes. Aerospace, automotive, and additive manufacturing end users favor atomized powders due to their reproducibility and compatibility with automated production systems that demand tight process control.

Within this category, spherical atomized powders represent the premium segment, offering enhanced packing density and flow behavior essential for powder bed fusion and advanced powder metallurgy. These attributes enable improved build consistency and component integrity in high-value manufacturing. Non-atomized powders, including flaked and irregular forms, continue serving traditional applications such as coatings and thermal sprays but account for smaller volumes. Ongoing advancements in atomization technology continue reinforcing this segment’s leadership.

By Application

- Industrial

- Automotive

- Aerospace & Defense

- Building & Construction

- Electronics & Semiconductors

- Pharmaceutical

- Others

Building and construction represents the largest application segment, accounting for 35% of global aluminum powder demand. Aluminum powders play a critical role in autoclaved aerated concrete production, refractory materials, insulation systems, and protective coatings. Rapid urbanization, infrastructure renewal, and energy-efficient building mandates are driving sustained adoption, particularly in regions prioritizing lightweight construction materials and improved thermal performance. These structural trends ensure consistent demand from construction-focused end users.

Automotive and transportation applications form the second-largest segment, supported by vehicle lightweighting initiatives and electric drivetrain integration. Aluminum powders are increasingly used in coatings, structural components, and emerging manufacturing techniques. Aerospace and defense applications also contribute meaningful demand, spanning solid propellants, pyrotechnics, thermal spray coatings, and advanced composites. Additive manufacturing adoption within aerospace further strengthens this segment, creating incremental volume growth tied to high-performance and specialized component production.

Market Players in Global Aluminum Powder Market

These market players maintain a significant presence in the Global aluminum powder market sector and contribute to its ongoing evolution.

- NovaCentrix

- SCHLENK SE

- Angang Group Aluminium Powder Co. Ltd

- Alcoa

- AMG Advanced Metallurgical Group NV

- United States Metal Powders Inc.

- VALIMET Inc.

- AVL METAL POWDERS n.v.

- MMP Industries Limited

Market News & Updates

- United States Metal Powders Inc., 2025:

AMPAL Inc., a wholly owned subsidiary of United States Metal Powders Inc., announced a new aluminum powder production line at its Palmerton, Pennsylvania facility, described as the largest producer of aluminum powder in North America. The new line is designed with capability to produce both nodular and spherical aluminum powder, and a June 2025 ribbon-cutting event by the local economic development corporation highlighted that the expansion uses state-of-the-art technology to enhance safety, productivity, and quality while supporting USMP’s growth ambitions and strengthening supply reliability.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Aluminum Powder Market Policies, Regulations, and Standards

4. Global Aluminum Powder Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Aluminum Powder Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Atomized Aluminium Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flake Aluminium Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Spherical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Flaked- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Powdered- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Automotive- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Aerospace & Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Building & Construction- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Electronics & Semiconductors- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Pharmaceutical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Purity Level

5.2.4.1. High Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Low Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Process

5.2.5.1. Atomization- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Milling- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Aluminium Dross- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North America

5.2.6.2. South America

5.2.6.3. Europe

5.2.6.4. Middle East & Africa

5.2.6.5. Asia Pacific

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. North America Aluminum Powder Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Form - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Purity Level - Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Process - Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Country

6.2.6.1. US

6.2.6.2. Canada

6.2.6.3. Mexico

6.2.6.4. Rest of North America

6.3. US Aluminum Powder Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

6.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.3.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

6.3.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Aluminum Powder Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

6.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

6.4.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Aluminum Powder Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

6.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

6.5.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

7. South America Aluminum Powder Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Form - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Purity Level - Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Process - Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Country

7.2.6.1. Brazil

7.2.6.2. Argentina

7.2.6.3. Rest of South America

7.3. Brazil Aluminum Powder Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

7.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

7.3.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

7.3.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Aluminum Powder Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

7.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

7.4.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

7.4.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

8. Europe Aluminum Powder Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Form - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Process - Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Country

8.2.6.1. Germany

8.2.6.2. UK

8.2.6.3. France

8.2.6.4. Italy

8.2.6.5. Spain

8.2.6.6. Rest of Europe

8.3. Germany Aluminum Powder Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

8.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.3.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.3.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

8.4. UK Aluminum Powder Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

8.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.4.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

8.5. France Aluminum Powder Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

8.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.5.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Aluminum Powder Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

8.6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.6.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Aluminum Powder Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

8.7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

8.7.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Aluminum Powder Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Form - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Purity Level - Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Process - Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Country

9.2.6.1. UAE

9.2.6.2. Saudi Arabia

9.2.6.3. South Africa

9.2.6.4. Rest of Middle East & Africa

9.3. UAE Aluminum Powder Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

9.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9.3.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

9.3.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Aluminum Powder Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

9.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

9.4.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

9.5. South Africa Aluminum Powder Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

9.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

9.5.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Aluminum Powder Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Country

10.2.6.1. China

10.2.6.2. India

10.2.6.3. Japan

10.2.6.4. South Korea

10.2.6.5. Thailand

10.2.6.6. Vietnam

10.2.6.7. Rest of Asia Pacific

10.3. China Aluminum Powder Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.3.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.3.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.3.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.4. India Aluminum Powder Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.4.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.4.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Aluminum Powder Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.5.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.5.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Aluminum Powder Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.6.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.7. Thailand Aluminum Powder Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.7.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

10.8. Vietnam Aluminum Powder Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Form - Market Insights and Forecast 2022-2032, USD Million

10.8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8.2.4. By Purity Level - Market Insights and Forecast 2022-2032, USD Million

10.8.2.5. By Process - Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Alcoa

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. AMG Advanced Metallurgical Group NV

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. United States Metal Powders Inc.

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. VALIMET Inc.

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. AVL METAL POWDERS n.v.

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. NovaCentrix

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. SCHLENK SE

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Angang Group Aluminium Powder Co. Ltd

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. MMP Industries Limited

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Form |

|

| By Application |

|

| By Purity Level |

|

| By Process |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.