Global Acetone Market Report: Trends, Growth and Forecast (2026-2032)

By Grade (Industrial Grade, Laboratory Grade), By Application (Solvent, Pharmaceuticals, Cosmetics, Paints), By End-Use Industry (Chemical, Pharmaceuticals, Cosmetics, Paint & Coatings), By Region (North America, South America, Europe, Asia Pacific)

- Chemical

- Jan 2026

- VI0906

- 180

-

Global Acetone Market Statistics and Insights, 2026

- Market Size Statistics

- Global acetone market is estimated at USD 7.21 billion in 2025.

- The market size is expected to grow to USD 9.72 billion by 2032.

- Market to register a CAGR of around 4.36% during 2026-32.

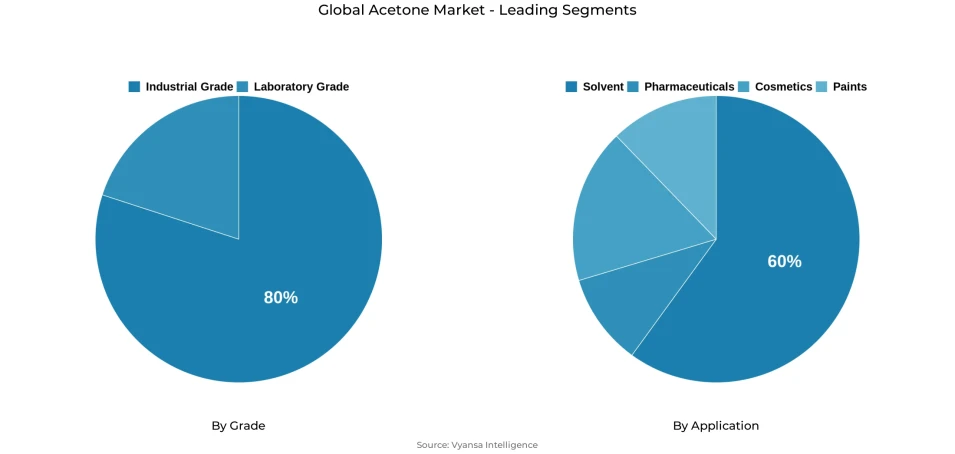

- Grade Shares

- Industrial grade grabbed market share of 80%.

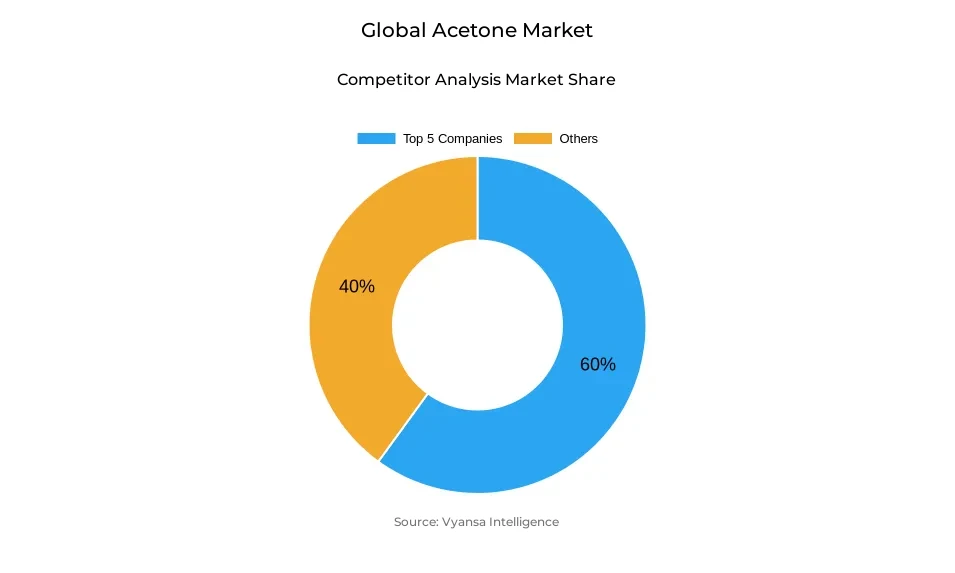

- Competition

- Global acetone market is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 60% of the market share.

- Formosa Plastics; LG Chem; Mitsui Chemicals; Shell Chemicals; INEOS etc., are few of the top companies.

- Application

- Solvent grabbed 60% of the market.

- Region

- Asia Pacific leads with a 45% share of the global market.

Global Acetone Market Outlook

The Global acetone market is estimated at USD 7.21 billion in 2025 and and is projected around USD 9.72 billion in 2032, with a compound annual growth rate of about 4.36% between the years 2026-2032. The growth in demand is supported by the increasing disposable incomes and the fast industrialisation in the emerging economies which are still contributing to the growth in consumption of manufactured goods. The growing use of paints, coatings, plastics, pharmaceuticals, and adhesives are direct contributors to the demand of acetone as it is a key solvent and chemical intermediate in these value chains. This interaction between macroeconomic development and chemical processing activity will guarantee the stable growth in volume within the forecast period.

Asia-Pacific is the epicenter of the world consumption with an estimated 45% market share, which is backed by massive infrastructure development, urbanization, and export-oriented production. The large chemical manufacturing base in China, combined with the growing industrialization in India, Indonesia, and Vietnam, keeps the regional demand high. The expansion in textiles, automotive parts, electronics, personal-care products, and pharmaceutical production strengthens the position of acetone in a wide range of downstream sectors, and increasing end-user purchasing power ensures high utilisation levels in regional manufacturing resources.

The industrial grade acetone occupies about 80% of the total market volume, which indicates its superiority in high volume, cost-effective manufacturing settings. The grade is commonly used in the production of phenol-acetone co-products, methyl methacrylate and bisphenol-A, and in the production of bulk solvents in coatings and adhesives. Its uniformity, reliability in supply and cost-effectiveness makes it the favorite of large-scale chemical manufacturers, which constitute the structural foundation of the world acetone demand.

The largest area of application is solvent usage, which is approximately 60% of total consumption. High solvency, fast evaporation, and low residue properties have guaranteed extensive application in paints and coatings, adhesives, pharmaceutical processing, and industrial cleaning. Simultaneously, the chemical intermediate of demand is also important, especially the production of methyl methacrylate and bisphenol-A, which connects the consumption of acetone directly to the construction sector, lightweighting of automobiles, and the production of advanced materials.

Global Acetone Market Growth Driver

Expanding Emerging Economies Strengthening Downstream Chemical Consumption

Increasing disposable incomes and faster industrialisation in the emerging economies are strengthening structural demand growth of acetone in various downstream uses. The World Bank prognosis on chemical production underscores the continued growth in the global chemical sales, which is mainly propelled by Asia Pacific, South Asia, Middle East, Africa, and Latin America. With the increase in income and the growth of middle-income groups, the demand on manufactured goods grows, which directly contributes to the increase in the consumption of paints, coatings, plastics, pharmaceuticals, and adhesives. Acetone is still essential in these value chains as a solvent and chemical intermediate, connecting macro-economic development with stable volume growth in chemical processing and formulation processes.

Asia Pacific illustrates this dynamic demand majorly in infrastructure investment, urban construction, and export-oriented manufacturing are still growing. India, Indonesia, and Vietnam are experiencing growth of chemical-intensive industries such as textiles, automotive parts, personal-care products, and pharmaceutical formulations. The increasing purchasing power of end-users supports the increased utilisation rates of regional manufacturing resources, which anchors the consumption of acetone as the new economies shift to higher value-added industrial production.

Global Acetone Market Challenge

Environmental Compliance Pressures Elevating Cost and Entry Barriers

Strict environmental laws on volatile organic compounds emissions are limiting operational flexibility in acetone production and in downstream application. The regulatory frameworks implemented by the U.S. Environmental Protection Agency under the Clean Air Act and National Emission Standards of Hazardous Air Pollutants, as well as the REACH regulation of the European Union, necessitate a large amount of emissions monitoring, safety documentation, and downstream risk communication. Similar controls are in place in Asia, such as regulations by the Central Pollution Control Board of India to restrict industrial VOC emissions. These frameworks add material complexity to compliance to manufacturers at scale.

The compliance with the regulatory requirements requires a long-term capital investment in vapor recovery systems, catalytic oxidation units, and carbon filtration technologies. The Consumer Products Regulation of California sets specific VOC limits on formulations containing acetone, which directly affects the economics of production. In the case of smaller and mid-sized manufacturers, these compliance costs increase the barriers to market entry, strengthening competitive advantages of large, integrated manufacturers with established environmental control infrastructure and regulatory expertise.

Global Acetone Market Trend

Transition Toward Renewable and Low-Carbon Chemical Pathways

The long-term positioning in acetone value chains is being redefined by strategic changes towards renewable and lower-carbon production models. The Net Zero Roadmap of the International Energy Agency highlights the shift towards chemical feedstocks to non-fossil-based inputs, such as renewable and captured-carbon sources. The IEA Bioenergy documentation has identified established renewable methanol production routes, showing significant greenhouse-gas emission cuts over conventional processes and confirming technical feasibility at commercial levels. These trends affect upstream feedstock policies that are pertinent to the economics of acetone production.

The Chemicals Sector Guidance of the Science-Based Target Initiative is one of the frameworks that set standardised approaches to emissions reduction commitments in manufacturing operations. Industry roadmaps in emerging economies are increasingly focusing on specialty chemicals and integration of renewable feedstock, with intended investment in research and industrial infrastructure. This policy direction, technological capability, and corporate sustainability goal alignment is transforming production strategies and affecting long-term competitiveness.

Global Acetone Market Opportunity

Expanding Chemical Trade Supporting Diverse Demand Channels

The increasing volumes of international trade and the growing specialty chemical demand are providing several growth opportunities in the consumption of acetone. The World Trade Statistical Review by the World Trade Organisation indicates that chemicals constitute a significant portion of the world manufactured goods exports, which highlights the centrality of the sector in global supply chains. World Bank trade indicators also indicate further growth in the volume of global chemical trade, indicating sustained downstream demand in both industrial and formulation-driven applications.

The example of India is an opportunity to create a rapidly growing chemical manufacturing base with the help of national industrial policy. According to government investment promotion agencies, specialty chemicals constitute about 80% of national chemical export value, which underscores the significance of the segment in global trade flows. With the growth of pharmaceutical manufacturing, advanced materials and performance coatings internationally, acetone enjoys the diversification of application exposure in solvent use and chemical intermediates to construction, automotive, electronics and personal-care end users.

Global Acetone Market Regional Analysis

By Region

- North America

- South America

- Europe

- Asia Pacific

Asia Pacific commands approximately 45% of global demand, positioning the region as the primary consumption and production center. Extensive chemical manufacturing infrastructure in China, including large-capacity phenol-acetone and bisphenol-A facilities, anchors regional supply and export activity. Southeast Asian economies contribute through expanding automotive manufacturing, infrastructure development, and electronics production, all requiring acetone for coatings, adhesives, and precision cleaning.

India’s expanding chemical industry and supportive industrial framework strengthen South Asia’s role within regional demand growth. Japan’s advanced semiconductor and electronics manufacturing base sustains consistent demand for high-purity acetone in precision fabrication processes. The region’s scale, industrial depth, and diversified end-user base collectively reinforce Asia-Pacific’s leadership position.

Global Acetone Market Segmentation Analysis

By Grade

- Industrial Grade

- Laboratory Grade

Industrial-grade acetone holds a dominant 80% share of total market volume, reflecting its critical role in large-scale chemical manufacturing and commodity-driven applications. This grade is optimized for high-volume usage where cost efficiency, supply reliability, and consistent performance are prioritized. Industrial-grade acetone supports phenol-acetone co-production units, methyl methacrylate manufacturing, bisphenol-A synthesis, and bulk solvent applications in paints, coatings, and adhesives, forming the structural backbone of demand.

Pharmaceutical-grade and specialty-grade acetone together account for the remaining 20% of market volume, supported by stringent purity requirements typically exceeding 99.5%. These grades are essential for regulated end-user industries such as pharmaceutical manufacturing, semiconductor fabrication, and precision electronics, where compliance with USP, BP, and EP standards is mandatory. While smaller in volume, specialty grades contribute higher value and reinforce quality-driven demand segments.

By Application

- Solvent

- Pharmaceuticals

- Cosmetics

- Paints

Solvent applications account for approximately 60% of total demand, establishing the segment as the primary consumption base for acetone. Exceptional solvency strength, rapid evaporation rates, and low residue characteristics make acetone indispensable across paints and coatings, adhesive formulations, pharmaceutical processing, and industrial cleaning operations. Compatibility with a wide range of polymers and chemical compounds ensures consistent adoption across diverse formulation environments where performance reliability is critical for end users.

Chemical intermediate applications represent the second-largest segment, driven primarily by methyl methacrylate and bisphenol-A production. The acetone cyanohydrin route remains integral to global MMA manufacturing, sustaining structural demand. Expanding construction activity and automotive lightweighting initiatives increase PMMA utilization, reinforcing acetone consumption through downstream polymer production and advanced material applications.

Market Players in Global Acetone Market

These market players maintain a significant presence in the Global acetone market sector and contribute to its ongoing evolution.

- Formosa Plastics

- LG Chem

- Mitsui Chemicals

- Shell Chemicals

- INEOS

- LyondellBasell

- ExxonMobil Chemical

- Eastman Chemical Company

- BASF SE

- Celanese Corporation

- SABIC

- Dow Chemical Company

- Sasol Limited

- China National Bluestar

- Jubilant Life Sciences

Market News & Updates

- DOMO Chemicals, 2026:

In January 2026, DOMO Chemicals’ German subsidiaries filed for insolvency after failed short-term financing negotiations, affecting integrated production at the Leuna site, which manufactures phenol, acetone, cumene, cyclohexanone, and caprolactam. The insolvency impacts roughly 585 employees, with temporary wage coverage secured under statutory protections, while operations continue during restructuring. The situation reflects prolonged demand weakness, persistently high energy costs, and competitive pressure from lower-cost Asian imports, with administrators exploring restructuring options including asset sales or investor-led recovery.

- INEOS, 2025:

INEOS Phenol announced the permanent closure of its Gladbeck, Germany facility in June 2025, attributing the decision to structurally uncompetitive European energy costs and EU CO₂ taxation. The plant, operational since 1954, had capacity to produce 400,000 tonnes per year of acetone and 650,000 tonnes per year of phenol, and its shutdown eliminates 279 direct jobs with significant indirect employment impacts. While phenol production is planned to shift to Antwerp by 2027, acetone output will not be replaced at Gladbeck, tightening regional supply and reshaping European acetone trade flows amid global oversupply and weak downstream demand.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Acetone Market Policies, Regulations, and Standards

4. Global Acetone Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Acetone Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Grade

5.2.1.1. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Laboratory Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Solvent- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Pharmaceuticals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Cosmetics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Paints- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-Use Industry

5.2.3.1. Chemical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Pharmaceuticals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cosmetics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Paint & Coatings- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. South America

5.2.4.3. Europe

5.2.4.4. Asia Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Acetone Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. US

6.2.4.2. Canada

6.2.4.3. Mexico

6.2.4.4. Rest of North America

6.3. US Acetone Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Acetone Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Acetone Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. South America Acetone Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Rest of South America

7.3. Brazil Acetone Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Acetone Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. France

8.2.4.3. UK

8.2.4.4. Italy

8.2.4.5. Spain

8.2.4.6. Netherlands

8.2.4.7. Belgium

8.2.4.8. Poland

8.2.4.9. Russia

8.2.4.10. Turkey

8.2.4.11. Rest of Europe

8.3. Germany Acetone Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Acetone Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Acetone Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Acetone Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Acetone Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Acetone Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Acetone Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Poland Acetone Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Russia Acetone Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Acetone Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Asia Pacific Acetone Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End-Use Industry- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. China

9.2.4.2. India

9.2.4.3. Japan

9.2.4.4. South Korea

9.2.4.5. Australia

9.2.4.6. Thailand

9.2.4.7. Rest of Asia Pacific

9.3. China Acetone Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. India Acetone Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. Japan Acetone Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. South Korea Acetone Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Acetone Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Acetone Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in USD Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Shell Chemicals

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. INEOS

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. LyondellBasell

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. ExxonMobil Chemical

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Eastman Chemical Company

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Formosa Plastics

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. LG Chem

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Mitsui Chemicals

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. BASF SE

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Celanese Corporation

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

10.1.11. SABIC

10.1.11.1.Business Description

10.1.11.2.Product Portfolio

10.1.11.3.Collaborations & Alliances

10.1.11.4.Recent Developments

10.1.11.5.Financial Details

10.1.11.6.Others

10.1.12. Dow Chemical Company

10.1.12.1.Business Description

10.1.12.2.Product Portfolio

10.1.12.3.Collaborations & Alliances

10.1.12.4.Recent Developments

10.1.12.5.Financial Details

10.1.12.6.Others

10.1.13. Sasol Limited

10.1.13.1.Business Description

10.1.13.2.Product Portfolio

10.1.13.3.Collaborations & Alliances

10.1.13.4.Recent Developments

10.1.13.5.Financial Details

10.1.13.6.Others

10.1.14. China National Bluestar

10.1.14.1.Business Description

10.1.14.2.Product Portfolio

10.1.14.3.Collaborations & Alliances

10.1.14.4.Recent Developments

10.1.14.5.Financial Details

10.1.14.6.Others

10.1.15. Jubilant Life Sciences

10.1.15.1.Business Description

10.1.15.2.Product Portfolio

10.1.15.3.Collaborations & Alliances

10.1.15.4.Recent Developments

10.1.15.5.Financial Details

10.1.15.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.