Vietnam Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

- Energy & Power

- Jan 2026

- VI0760

- 125

-

Vietnam Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

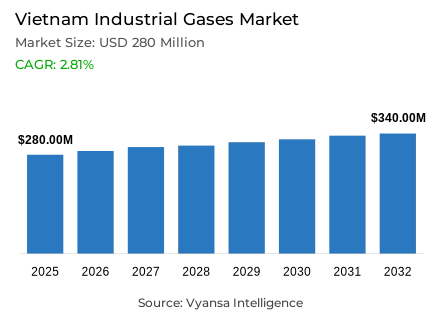

- Industrial gases in Vietnam is estimated at USD 280 million in 2025.

- The market size is expected to grow to USD 340 million by 2032.

- Market to register a cagr of around 2.81% during 2026-32.

- Gas Type Shares

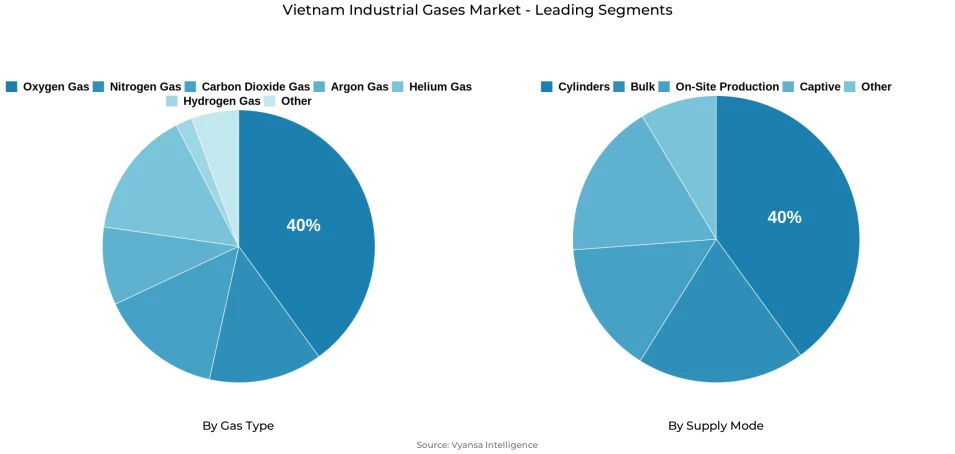

- Oxygen gas grabbed market share of 40%.

- Competition

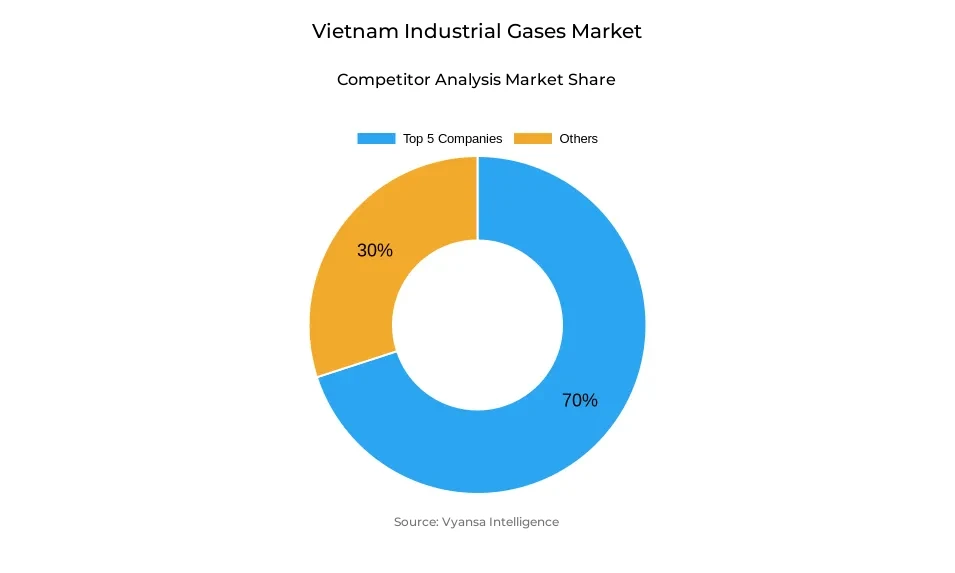

- More than 10 companies are actively engaged in producing industrial gases in Vietnam.

- Top 5 companies acquired around 70% of the market share.

- Taiyo Nippon Sanso; Iwatani; Air Water; Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 40% of the market.

Vietnam Industrial Gases Market Outlook

The industrial gases market in Vietnam should witness regular growth between 2026 and 2032, driven by growing manufacturing strength in the country and increasing demand from major sectors such as automotive, food processing, and metal fabrication. Industrial gases had created a value of USD 280 million in 2025 and are projected to touch USD 340 million by 2032, growing at a CAGR of around 2.81%. An impressive growth in the country's industrial output, with an increase in manufacturing activities by 11.4%, a strong growth in vehicle production and sales, and an overall growth in power supply, water supply, and other utilities continuously raise demand for oxygen, nitrogen, and argon used in welding and fabrication processes.

Health growth also significantly enhances market outlook, whereby the increase in both respiratory disease prevalence and medical service consumption extends the demand for medial oxygen through both hospital and primary settings. With COPD affecting 10.3% of the population, and asthma at 3.9%, long-term consumption is reinforced by essential treatment involving oxygen therapy. Such a shift is further facilitated by improved health infrastructure and greater access to diagnostic and emergency services.

New investments in advanced production facilities, such as the USD 35 million Cái Mép Industrial Gases project integrating European cryogenic technology that boosts capacity and energy efficiency, spur market development. Such initiatives improve domestic supply reliability and help meet increasing industrial and medical requirements while supporting Vietnam's sustainability goals.

On the gas type, oxygen will continue to hold the largest share of about 40%, due to its crucial consumption in various manufacturing and healthcare. By supply mode, cylinders have captured around 40% of the market share; these are quite appropriate and accessible for end users along the dispersed small and medium-scale industrial areas. With these elements coming together, the market can experience stable growth on a medium-term basis through 2032.

Vietnam Industrial Gases Market Growth DriverExpanding Industrial Activity Strengthens Core Gas Requirements

Growth in the Vietnam industrial gases market is increasingly anchored to the country's expanding manufacturing base, which continues to stimulate demand for essential gases across multiple industrial processes. Industrial production was up 10.8% year-on-year in October 2025, with manufacturing output moving forward 11.4%, underscoring solid momentum from operations. The automotive industry remains a key contributor, supported by a 35% year-on-year rise in domestically assembled vehicles in Q1 2025 and a 60% surge in passenger vehicle sales to 105,000 units. Events like these increase demand for oxygen, nitrogen, and argon used in welding and metal fabrication.

Rapid growth within the food and beverage sector, with a 10% increase in production for December 2024, further supports the consumption of industrial gases. Nitrogen and carbon dioxide are used as major contributors to preservation and carbonation processes. Advanced welding technologies, along with increasing foreign investment in the country's industrial zones, further increase dependency on a continuous supply of these industrial gases.

Vietnam Industrial Gases Market ChallengeInfrastructure Gaps and Operational Constraints Affect Market Efficiency

In Vietnam, the Industrial Gases Market faces persistent infrastructure limitations and distribution inefficiencies, which test operational reliability. Given a high reliance on imported automotive parts of around 80%, disruptions in supply may lead to impacts on production continuity and fluctuating gas consumption patterns. Shortages in skilled labor, particularly in advanced welding operations, further limit the ability of suppliers to scale their production and meet growing industrial demand.

The distribution challenges are more severe in rural and semi-urban areas where the logistics network remains poor, increasing the cost of delivery and also affecting supply consistency. Competitive pricing pressures add to the operational margins strain for gas suppliers, while intensifying environmental compliance requirements are very capital-intensive. Any new production facility has to introduce compatible, environmentally friendly technologies in response to changing emission standards, adding more financial burden to operators who need to expand capacity and create better regional supply coverage.

Vietnam Industrial Gases Market TrendExpanding Healthcare Services Intensify Medical Gas Utilization Patterns

Vietnam Industrial Gases Market dynamics are significantly influenced by the increasing demand from the growing healthcare industry, wherein medical oxygen is administered to patients to provide life support and is an integral part of respiratory care. COPD affects 10.3% of Vietnam's population, while asthma affects 3.9%—about 4 million people—which contributes to continued oxygen therapy. From February 2023 to January 2024, patient visits at commune health stations have almost doubled for hypertension and have increased almost fourfold for diabetes, reflecting deeper integration of primary healthcare services.

Continuous modernization of healthcare infrastructure and WHO-supported pilot programs for strengthening NCD management contribute to heightened access to key therapies. In this evolution, there is greater diffusion of oxygen across hospitals, clinics, and emergency services. Given the prevailing burden of respiratory ailments and expanding medical service utilization, end users increasingly depend on stable oxygen supply, reinforcing its strategic importance in the market's long-term growth trajectory.

Vietnam Industrial Gases Market OpportunityStrategic Investments in Production Infrastructure Enhance Market Prospects

The outlook for industrial gases in Vietnam is increasingly shaped by major investments in advanced gas production facilities that support the country's growing industrial ecosystem. An important recent development involves a $35 million joint venture between Petrovietnam Chemical and Services Corporation and Messer SE & Co to develop the Cái Mép Industrial Gases Co in Ho Chi Minh City, with plans to integrate European Cryogenic Air Separation technology and LNG cold energy recovery to drastically reduce the energy used and environmental impact.

Government incentives for high-tech industrial development also enhance investor confidence and expedite technology transfer into major manufacturing zones. These improvements present gas suppliers with the opportunity to conform to environmentally friendly production models in order to serve growing manufacturing clusters and healthcare networks. Resulting infrastructure modernization places the market in a position to realize continued growth through 2032, with reliable, efficient, and scalable gas supply.

Vietnam Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

The oxygen gas segment maintains clear leadership in the Vietnam Industrial Gases Market with approximately 40% market share, reflecting its indispensable role across diverse sectors. Oxygen remains central to welding and metal fabrication processes essential for the rapidly expanding automotive industry, where strong production and vehicle sales growth continue to elevate usage. Its role in food processing for preservation and quality enhancement further strengthens oxygen’s position, ensuring steady adoption by end users requiring reliable and consistent supply.

In the healthcare sector, rising respiratory disease prevalence and broader treatment accessibility significantly increase oxygen consumption. Hospitals, clinics, and emergency care facilities depend on oxygen for critical and routine medical applications, reinforcing its dominance. As Vietnam’s manufacturing capabilities advance and healthcare demand intensifies, oxygen remains the most widely required gas, sustaining its leadership and contributing substantially to overall market expansion.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder supply mode accounts for the largest share of approximately 40% in the Vietnam Industrial Gases Market, underscoring its importance as the most accessible distribution method for end users across varied sectors. Small and medium-sized enterprises in manufacturing, welding, healthcare, and food processing rely extensively on cylinders due to their cost efficiency and minimal infrastructure requirements. This flexibility is particularly valuable in a market characterized by dispersed industrial activity and widespread use of welding-intensive processes.

The dominance of cylinders is further reinforced by Vietnam’s fragmented industrial landscape, where many facilities operate outside major hubs with limited access to centralized infrastructure. Cylinder-based distribution enables suppliers to service remote and semi-urban regions effectively, supporting market penetration and operational continuity. As industrial production grows and gas usage expands across automotive, metal fabrication, and healthcare sectors, cylinders remain the most practical, scalable, and widely adopted supply mode across the country.

List of Companies Covered in Vietnam Industrial Gases Market

The companies listed below are highly influential in the Vietnam industrial gases market, with a significant market share and a strong impact on industry developments.

- Taiyo Nippon Sanso

- Iwatani

- Air Water

- Linde

- Air Liquide

- Air Products

- PetroVietnam Gas (PV Gas)

- Messer

- Yingde Gases (NovaAir)

- Hangzhou Hangyang

Market News & Updates

- Messer, 2025:

Officially signed joint venture agreement with PetroVietnam Chemical and Services Corporation (PVChem) on November 10, 2025, to establish Cái Mép Industrial Gases Co with $35 million investment and annual production capacity of 200,000 tons; facility located in Cái Mép Industrial Park will utilize European Cryogenic Air Separation technology with cold energy recovery from PVGas LNG storage system; construction commences end of 2026 with commercial operations by late 2028; represents Messer's first global cold energy recovery solution for air separation units aligned with Vietnam's carbon neutrality goals.

- PetroVietnam Gas (PV Gas), 2025:

Signed landmark Memorandum of Understanding (November 15-16, 2025) with Nghi Son Refinery and Petrochemical (NSRP) to build integrated chemical-petrochemical value chain; partnership includes joint feasibility studies for ammonia and sulfuric acid projects, potential downstream petrochemical investments (carbon black, lube oil, bitumen, vinyl chloride monomer), and exploration of new facilities to support expanded production and industrial gas applications.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Vietnam Industrial Gases Market Policies, Regulations, and Standards

4. Vietnam Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Vietnam Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Vietnam Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

7. Vietnam Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

8. Vietnam Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

9. Vietnam Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

10. Vietnam Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

11. Vietnam Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Products

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. PetroVietnam Gas (PV Gas)

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Messer

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Taiyo Nippon Sanso

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Iwatani

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Air Water

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Yingde Gases (NovaAir)

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Hangzhou Hangyang

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.