Europe Municipal Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (Germany, UK, France, Italy, Spain, Poland, Benelux, Rest of Europe)

- Energy & Power

- Jan 2026

- VI0762

- 145

-

Europe Municipal Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

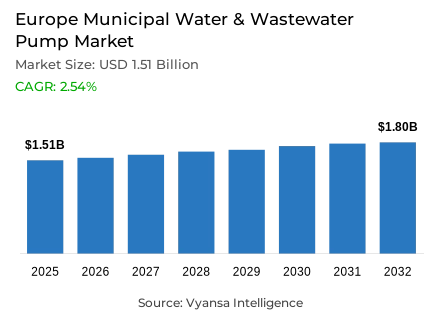

- Europe municipal water & wastewater pump market is estimated at USD 1.51 billion in 2025.

- The market size is expected to grow to USD 1.8 billion by 2032.

- Market to register a cagr of around 2.54% during 2026-32.

- Pump Type Shares

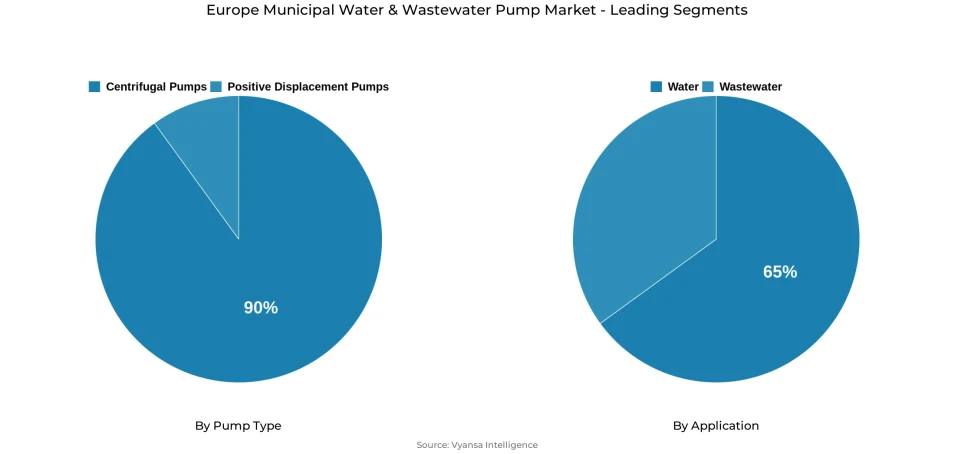

- Centrifugal pumps grabbed market share of 90%.

- Competition

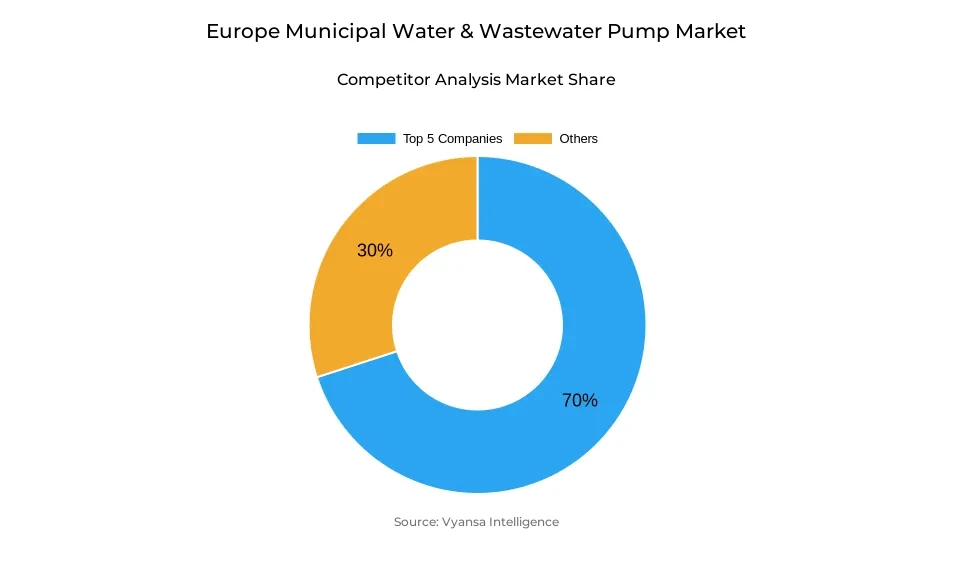

- More than 10 companies are actively engaged in producing municipal water & wastewater pump in Europe.

- Top 5 companies acquired around 70% of the market share.

- WILO SE; Sulzer Limited; Grundfos Holding A/S; Xylem Inc.; KSB SE & Co. KGaA etc., are few of the top companies.

- Application

- Water grabbed 65% of the market.

- Country

- Germany leads with a 25% share of the Europe market.

Europe Municipal Water & Wastewater Pump Market Outlook

Europe municipal water & wastewater pump industry will grow to USD 1.8 billion by the end of the forecast period, expected to be USD 1.51 billion in 2025. This growth will be at a CAGR of 2.54% during the forecast period from 2026 to 2032. This consistent growth will mainly come from the growing need for infrastructure investment across this continent due to the tightening of EU environmental norms and the pressing need to replace outdated municipal water & wastewater infrastructure.

Increased regulation and government support are driving demand. Major infrastructure investment initiatives led by European financial bodies enable authorities to proceed with modernizations of treatment plants, pump stations, and water networks. On the other hand, a set of water-demanding sectors, including digital data centers, semiconductor manufacturers, and renewable hydrogen plants, is driving up demand for water, thereby emphasizing more effective water transfer solutions through modernized systems.

Technology-wise, centrifugal pumps are leading the Europe market for municipal water & wastewater pumps, accounting for approximately 90% of the demand. This is owing to their efficiency in dealing with high flow, adaptability with varying flow rates, and compatibility with efficient control systems. Water supply is the leading application, accounting for around 65% share, as utilities are giving prime focus to its development, owing to its direct relation to public health.

Country-wise, the market in Germany currently holds the largest market share of approximately 25%, thanks to its well-developed infrastructure and strong adherence to EU directives. However, factors such as digitalization, energy efficiency, and achievement of climate neutrality will continue to support steady market expansion in Europe till the end of 2032.

Europe Municipal Water & Wastewater Pump Market Growth DriverExpanding Regulatory and Infrastructure Investment Imperatives

The Europe municipal water & wastewater pump market is propelled by a growing infrastructure investment need sparked by a tightening regulatory environment and a sustainability agenda. The water utilities in the region face a projected €255 billion investment gap by 2030 to meet European environment standards, address ageing infrastructure, and handle annual water stress reported for a substantial population. The growing demand from water-driven sectors like data centers, semiconductor manufacturing, and renewable hydrogen plants is expected to accelerate this demand, with industry water demand set to grow more than double by 2030.

Public financial institutions are helping to drive and maintain this momentum through funding initiatives. The Water Resilience Program of the European Investment Bank, contributing €40 billion worldwide between 2025-2027, demonstrates an understanding that water infrastructure can help lay the foundation for economic competitiveness and climate adaptation solutions. Joint procurement to satisfy energy neutrality and advanced treatment requirements by municipal utilities continues to drive the need for energy-efficient pumping technology solutions.

Europe Municipal Water & Wastewater Pump Market ChallengeStructural Water Scarcity and Uneven Compliance Barriers

Groundwater scarcity and non-compliance within Europe hamper the growth of new developments within the Europe municipal water & wastewater pump market. Seasonal Aridity impacts more than a quarter of the EU area, and southern and island countries face high levels of exploitation. Despite strong access to urban wastewater collection and treatment within the region, non-compliance is a challenge, allowing only a few countries to fully meet EU treatment directives. Companies operating in those areas have no choice but to prioritize investment in affected area remediation rather than growth.

There is also growing regulatory pressure from the EU Drinking Water Directive, requiring the monitoring of leakage reductions from 2026 and enforced penalties from 2030 onwards. Such obligations represent immediate operational challenges, where legacy pipes and leak-prone pumping infrastructure must be renewed before additional network capacity can be added. In other words, water utilities must cope with a two-fold challenge of continuing to provide a service while replacing legacy centrifugal machines with appropriate technology that can support a leakage-reduced distribution network and M-stage treatment processes until 2045.

Europe Municipal Water & Wastewater Pump Market TrendDigitalization and Smart Water System Integration

Digital integration appears to be the hallmark structural change underway for the Europe municipal water & wastewater pump market. This has been largely necessitated by EU regulations on smart metering and compatibility. Water companies have been focusing on the widespread adoption of smart meter technology and digital control systems based on standardized data to support real-time monitoring and optimization. Large pilot projects involving integration with the national smart grid infrastructure and centralized data management systems have been showcased to support greater efficiencies. This has impacted the technical requirements of pump technology and elevated the need for connectivity and compatibility.

On the other hand, digital growth brings its new set of complexity factors. Cybersecurity threats have become an emerging risk that poses serious concerns for European companies in the utilities sector. There have been serious instances reported for many European companies where the data integrity has been affected due to cyber threats. This is partly forcing the procurement for pumps with more factors taken into consideration than ever before. This is accelerating the procurement for pumps that seamlessly integrate security and IoT-capable systems.

Europe Municipal Water & Wastewater Pump Market OpportunityEfficiency Optimization and Climate Neutrality Pathways

The need for energy efficiency is changing the pattern of demand in the Europe municipal water & wastewater pump market as companies begin to align their business strategies with goals of climate neutrality. The WW plants pose a major energy load, although results from benchmarking analyses demonstrate the existent potential for energy recovery opportunities by improving the efficiency levels of best-practice WW plants, as opposed to smaller plants with lower levels of optimization. Improvements in equipment and optimization can deliver worthwhile energy optimization potential, providing more emphasis on energy-efficient pumping technologies. Specific energy reduction potential is directly linked to fulfilling the new treatment directives.

The water streams themselves represent a latent source of energy, carrying several times more energy than needed for treatment. The coupling of energy conversion systems and advanced pumping technology puts plants on a course towards becoming energy neutral or positive. The progressive start of tertiary treatment by 2039 and fourth-stage micropollutant degradation until 2045 further increases the need for pumps that can operate at high efficiency rates over extended periods of time. Economically projected savings and job generation by such investments support long-term acceptance of variable-speed demand-responsive pumps.

Europe Municipal Water & Wastewater Pump Market Country Analysis

By Country

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Benelux

- Rest of Europe

Germany leads the Europe municipal water & wastewater pump market with an estimated 25% regional market share, reflecting its advanced infrastructure maturity and full compliance with EU treatment directives. Continuous modernization of aging assets, combined with strong municipal investment capacity, sustains consistent demand for high-specification pumping equipment. The country’s large and stable base of municipal utilities positions it as one of the most significant revenue contributors within the European landscape.

Leadership in digitalization further reinforces Germany’s market position. Large-scale smart metering integration with national energy systems has established reference standards for interoperability, efficiency, and data-driven water management. Alignment with EU digital and climate initiatives, supported by a robust domestic manufacturing ecosystem, enables rapid adoption of advanced pumping technologies. Germany’s combination of regulatory compliance, technological leadership, and sustained infrastructure investment establishes it as the bellwether market influencing procurement trends across Europe during the 2026–2032 period.

Europe Municipal Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Pump type segmentation within the Europe municipal water & wastewater pump market is overwhelmingly led by centrifugal pumps, which command approximately 90% market share. This dominance reflects fundamental hydraulic requirements of municipal systems, where vast volumes of water must be transported across extensive networks under variable flow conditions. Centrifugal designs are inherently suited to these demands, offering high flow capacity at moderate pressure heads, mechanical simplicity, and cost efficiency relative to alternative technologies. Their reliability and ease of maintenance align closely with the operational realities faced by municipal utilities.

Regulatory evolution further reinforces centrifugal pump adoption. The transition toward multi-stage treatment processes under revised EU directives requires multiple sequential pumping applications, each favoring large-volume transfer capabilities. Compatibility with variable frequency drives is particularly critical, enabling utilities to modulate flow in line with treatment demand and energy availability. This alignment with energy neutrality targets and automated control systems consolidates centrifugal pumps as the default specification across municipal procurement frameworks throughout Europe.

By Application

- Water

- Wastewater

Capital constraints further reinforce this focus, as utilities tend to prioritize drinking water projects over wastewater upgrades when funding is limited. Smart metering and digital monitoring initiatives are also deployed first within water supply networks, where real-time consumption data supports non-revenue water reduction and tariff protection. With average leakage levels remaining significant across Europe, investments in advanced pumping technology within the supply segment deliver immediate economic returns, sustaining its 65% share of overall market activity.

Various Market Players in Europe Municipal Water & Wastewater Pump Market

The companies mentioned below are highly active in the Europe municipal water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- WILO SE

- Sulzer Limited

- Grundfos Holding A/S

- Xylem Inc.

- KSB SE & Co. KGaA

- Kirloskar Brothers Limited (KBL)

- Flowserve Corporation

- Ebara Corporation

- Franklin Electric

- Pentair PLC

Market News & Updates

- Wilo SE, 2025:

Wilo’s intelligent submersible sewage pump Wilo‑Rexa SOLID‑Q with Nexos Intelligence is promoted as a smart sewage pump‑station solution that combines high‑efficiency hydraulics, permanent‑magnet motor technology with efficiency comparable to IE5, and patented control algorithms that automatically adjust pump speed to system conditions, improving operational reliability, energy efficiency and connectivity, and is being deployed as part of broader sustainable water management initiatives, including solar‑powered clean‑water projects such as the Pembane, Mozambique installation delivering about 25,000 liters of drinking water daily to 6,000 people.

- KSB SE & Co. KGaA, 2025:

KSB’s 2025 launch of a new wastewater pump series for municipalities and industries is positioned as a “game‑changer” for municipal and industrial pump stations by Wastewater Market Area Manager Hugo du Plessis, with the series engineered for reliability, durability and energy efficiency to address long‑standing wastewater management challenges and reduce operating costs, complementing KSB’s established presence in major European wastewater projects through its high‑efficiency Sewatec and related pump solutions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Europe Municipal Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Europe Municipal Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Europe Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. Germany

5.2.3.2. UK

5.2.3.3. France

5.2.3.4. Italy

5.2.3.5. Spain

5.2.3.6. Poland

5.2.3.7. Benelux

5.2.3.8. Rest of Europe

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Germany Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. UK Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. France Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. Italy Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. Spain Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Poland Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Units Sold in Million Units

11.2. Market Segmentation & Growth Outlook

11.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

12. Benelux Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.1.2. By Units Sold in Million Units

12.2. Market Segmentation & Growth Outlook

12.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Xylem Inc.

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. KSB SE & Co. KGaA

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Kirloskar Brothers Limited (KBL)

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Flowserve Corporation

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Ebara Corporation

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. WILO SE

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Sulzer Limited

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Grundfos Holding A/S

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Franklin Electric

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Pentair PLC

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.