US Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), By Nature (Disposable, Reusable), By Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

US Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

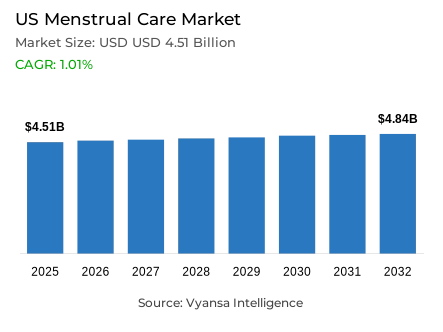

- Menstrual care in US is estimated at USD 4.51 billion in 2025.

- The market size is expected to grow to USD 4.84 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Product Type Shares

- Towels grabbed market share of 45%.

- Competition

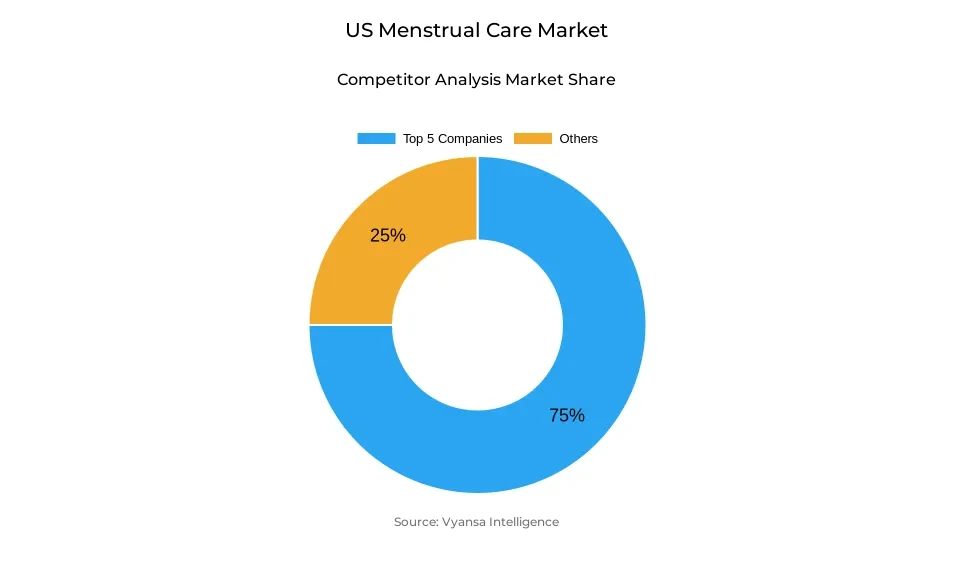

- More than 15 companies are actively engaged in producing menstrual care in US.

- Top 5 companies acquired around 75% of the market share.

- Lyv Life Inc; Honey Pot Co LLC; Walgreen Co; Procter & Gamble Co; Kimberly-Clark Corp etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

US Menstrual Care Market Outlook

The U.S menstrual care market is projected to have a value of USD 4.51 billion in 2025 and is expected to grow to about USD 4.84 billion in 2032 with a compound annual growth rate of about 1.01 billion in the forecast period of 2026–2032. Towels, which occupy 45% of the market, are likely to continue leading the market because of their convenience features, comfort features, and high end user trust bases. Pantyliners will maintain a strong performance, as they will be used by increasing numbers of female populations who are treating light urinary incontinence conditions and by those who are interested in maintaining freshness on a daily basis. The trend towards thinner format designs and plant-based pad options will influence the development of the product environment, with end user becoming more concerned with dermal health, comfort maximisation, and natural material compositions.

The retail offline channels will remain dominant in terms of distribution infrastructure with the supermarket format, hypermarket operations, and drugstore establishments that offer accessibility and affordability to the essential categories of menstrual care products. However, retail online platforms will gain an increased functional role, as they will enjoy the advantages of increasing end user preference towards convenience features, discrete delivery procedures, and the availability of subscription-based options. The infrastructure of online platforms will also help the growth paths of smaller and environmentally conscious brand organizations, helping them reach the target audience groups directly.

Sustainability will continue to be a central point of focus in the market development, and brand entities will continue to shift to plant-based, biodegradable, and chemical-free material compositions. The products produced using bamboo, organic cotton, and other natural fibre materials will likely find their way to the market due to their high breathability properties and ability to control odour. A number of brand entities are strategically placed to increase their eco-friendly product lines, with packaging made of compostable or water-soluble materials to enhance their environmental credentialing.

Moreover, the further assimilation of menstrual health technology and wellness solution models is likely to characterize the next stage of market evolution. The rise of diagnostic wearable devices, at-home testing solutions, and telehealth partnership models is an indication of a strategic change in the paradigm of holistic menstrual health management. Alongside corporate and community partnership initiatives aimed at addressing period poverty challenges, these innovation trajectories will reinforce steady growth patterns and evolving end user engagement dynamics within the US menstrual care market.

US Menstrual Care Market Growth DriverRising Awareness and Government Initiatives Supporting Menstrual Health

The increasing consciousness about menstrual hygiene, alongside the policy frameworks implemented by the U.S. state governments, is significantly driving the menstrual care market. The median age of menarche in the U.S is 11.9 years (CDC data, 20132017), and recent 2024 research confirms that the trend has not changed, which means that the tween population is in need of educational materials and hygiene products. By 2024, 28 states and Washington D.C. have passed legislative frameworks requiring the distribution of free menstrual products in schools, thus considering equity in menstrual health access.

Moreover, there is an increase in funding allocations to menstrual equity initiatives. In 2024, a number of states, such as Minnesota and Pennsylvania, included grant systems into their budgetary systems to guarantee product accessibility in the public school systems. Such policy measures promote inclusivity goals and normalize the discourse of menstrual health, thus maintaining consistent product demand curves and promoting innovation in reusable, organic, and tween-centered menstrual care product lines.

US Menstrual Care Market ChallengeSafety Concerns and Raw Material Supply

Heightened safety concerns have emerged as a critical challenge in the U.S. menstrual care market following a July 2024 study reporting the presence of trace metals, including lead, in tampons from several brands. The NIH-funded research, which was published in Environment International, found metallic elements in tampon products, but noted that more research is needed to establish whether the metals can leach out of tampons into the body systems. The FDA has since declared autonomous research inquiries and literature review procedures, which have concluded that no safety issues have been found using the existing evidence frameworks.

Market factors that are still relevant include supply chain considerations and inflationary pressure dynamics. Even as U.S. cotton production is projected to rise to 16 million bales in 2024-2025, reflecting a 28.7% increase over the previous year, manufacturing organisations continue to operate under persistent cost pressures.. All these reasons highlight the need of the market to have better transparency, further research, and better end user communication strategies to remain confident in the offerings of menstrual products.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Menstrual Care Market TrendIncreasing Influence of Tween-Focused Brands and Digital Education

The rise of tween-focused menstrual care products, supported by digital education initiatives, is becoming a defining trend in the market. The CDC attests that the median age of menarche in U.S. girls is 11.9 years, which prompts earlier exposure to menstrual health products. Brand organizations like RedDrop and Pinkie have taken advantage of this demographic change, launching colourful, confidence-building product lines and encouraging menstrual literacy via Tik Tok and other social media.

This trend pattern is in line with a larger societal development of destigmatising menstruation. By incorporating interactive educational materials, product design innovation, and social media campaign implementation, brand entities are essentially transforming the perception of menstrual care among young user populations. The incorporation of functional performance with empowerment positioning can be seen in the tween-oriented innovations, including noise-free pouch designs and educational bundle packages to caregivers, so that the next generation will have positive attitudes towards menstrual hygiene management.

US Menstrual Care Market OpportunityExpansion of Reusable and Plant-Based Menstrual Products

The future growth potential lies in the shift towards sustainable and health-conscious menstrual product options. The demand of plant-based pad formulations and reusable product formats is being driven by end user interest in skin-friendly, environmentally responsible products. Bamboo, organic cotton, and hemp products are becoming more popular among end user groups that are interested in chemical-free, breathable products. According to market research findings, there is an increasing trend towards product safety, transparency of ingredients and environmental considerations in the selection of menstrual products.

Brand organizations, such as Tampon Tribe, August, and Sparkle, are setting new standards in the market by introducing biodegradable and compostable packaging solutions. The increasing correspondence between eco-friendly design and personal wellbeing optimisation places this segment in strong growth paths. With the growing environmental consciousness, and the favorable government policy frameworks on sustainable manufacturing practices and school provision of products on menstrual care, the market is set to see a wide adoption of natural and reusable menstrual care solutions.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

Towels constitute the dominant segment within the product of the US Menstrual Care Market, commanding approximately 45% of total market share. Towels continue to maintain dominance attributable to strong end user preference for comfort attributes, reliability characteristics, and operational convenience. The popularity of slim/thin/ultra-thin format configurations has increased substantially, appealing to user populations who prioritize discreteness and high absorbency performance. Pantyliners have additionally gained market traction, addressing overlapping requirements including menstrual spotting and light incontinence conditions, particularly among new mother demographics and menopausal female populations.

Meanwhile, tampons and reusable products including menstrual cups and disc configurations maintain smaller market share proportions but continue evolutionary development through innovation initiatives and awareness campaign deployment. The towel segment's sustained leadership positioning is supported by product diversification strategies, improved comfort technology integration, and enhanced accessibility across retail format structures, ensuring its continued dominance throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels maintain dominant positioning within the sales channel segmentation of the US Menstrual Care Market, capturing approximately 75% of total market volume. Supermarket and hypermarket formats remain the primary sales points, as end user populations frequently purchase menstrual products concurrently with regular grocery procurement activities. The convenience of product availability, frequent promotional discount offerings, and trusted brand presence have facilitated offline channel maintenance of a strong competitive position.

However, retail retail online channels are experiencing the most accelerated value growth trajectories, driven by convenience attributes, comprehensive product variety, and facilitated access to natural and niche brand portfolios. Online platform infrastructure additionally enables end user to conduct price comparison evaluations and access subscription-based delivery model options. Despite this growth dynamic, retail offline distribution will continue to sustain leadership positioning during 2026–2032, supported by robust distribution network infrastructure and the essential nature classification of menstrual care products.

List of Companies Covered in US Menstrual Care Market

The companies listed below are highly influential in the US menstrual care market, with a significant market share and a strong impact on industry developments.

- Lyv Life Inc

- Honey Pot Co LLC

- Walgreen Co

- Procter & Gamble Co

- Kimberly-Clark Corp

- Edgewell Personal Care Brands LLC

- Playtex Products Inc

- Walmart Inc

- Rael Inc

- CVS Health Corp

Competitive Landscape

Procter & Gamble remained the dominant force in the US menstrual care market , driven by its Always, Tampax, Radiant, and L brands, which maintained strong retail value and volume shares. The company leveraged continuous innovation, such as ultra-thin and flexible pads, alongside cause-driven marketing campaigns to strengthen consumer trust. Kimberly-Clark followed closely with Kotex and Thinx, boosting its position through collaborations with retailers like Walgreens and CVS to address period poverty and reinforce brand loyalty. Emerging brands such as Cora, RedDrop, and Pinkie gained traction by targeting niche demographics—especially tweens—and focusing on education, sustainability, and inclusivity. Meanwhile, reusable and plant-based product innovators like Thinx, Saalt, and Tampon Tribe intensified market competition through eco-friendly designs and direct-to-consumer outreach.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Menstrual Care Market Policies, Regulations, and Standards

4. US Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. US Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. US Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. US Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. US Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. US Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. US Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble Co, The

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Kimberly-Clark Corp

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Edgewell Personal Care Brands LLC

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Playtex Products Inc

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Walmart Inc

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Lyv Life Inc

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Honey Pot Co LLC, The

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Walgreen Co

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Rael Inc

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. CVS Health Corp

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.