Malaysia Footwear Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Children's Footwear (Infants (0-9 Months) Foot Length (CM) (8.3-8.9, 9.2-9.5, 10.1-10.5), Toddlers (9 Months - 4 Years) Foot Length (CM) (10.8, 11.4-11.7, 12.1-12.7, 13.0-13.3, 14.0-14.3, 14.6-15.2, 15.6-15.9, 16.5), Little Kids (4-7 Years) Foot Length (CM) (16.8, 17.1-17.8, 18.1-18.4, 19.1-19.4, 19.7-20.6, 21.0-21.6), Big Kids (7-12 Years) Foot Length (CM) (21.9, 22.2-23.5, 24.1-24.8)), Women's Footwear (Foot Length (CM) (20.8, 21.3-21.6, 22.2-22.5, 23.0-23.8, 24.1-24.6, 25.1-25.9, 26.2-26.7, 27.6)), Men's Footwear (Foot Length (CM) (23.5, 24.1-24.8, 25.4-25.7, 26.0-26.7, 27.0-27.9, 28.3-28.6, 29.4, 30.2, 31.0-31.8))), By Product Type (Casual, Athletic/Sports, Formal, Others), By Sales Channel (Retail Online, Retail Offline), By Material (Leather, Textile, Rubber, Synthetic, Canvas), By Price (Mass, Premium), By Footwear Type (Shoes (Sneakers, Boots), Sandals & Slippers (Flip-Flops)), By Application (Conventional Footwear (Daily Wear, Work/Office Wear, Outdoor & Adventure, Sports & Fitness, Party/Occasion Wear), Functional/Therapeutic Footwear (Therapeutic/Orthopedic, Medicated Slippers, Acupressure Slippers))

|

Major Players

|

Malaysia Footwear Market Statistics and Insights, 2026

- Market Size Statistics

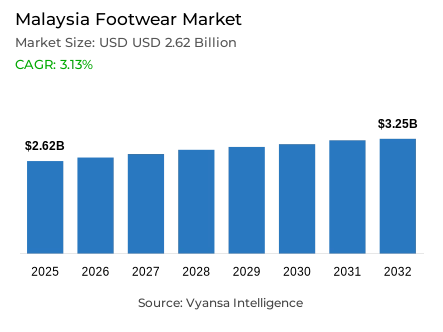

- Footwear in Malaysia is estimated at USD 2.62 billion in 2025.

- The market size is expected to grow to USD 3.25 billion by 2032.

- Market to register a cagr of around 3.13% during 2026-32.

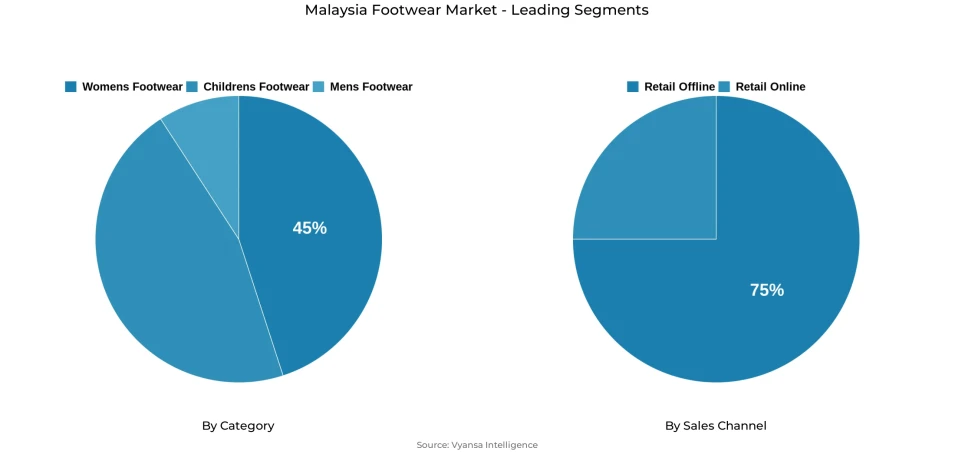

- Category Shares

- Women's footwear grabbed market share of 45%.

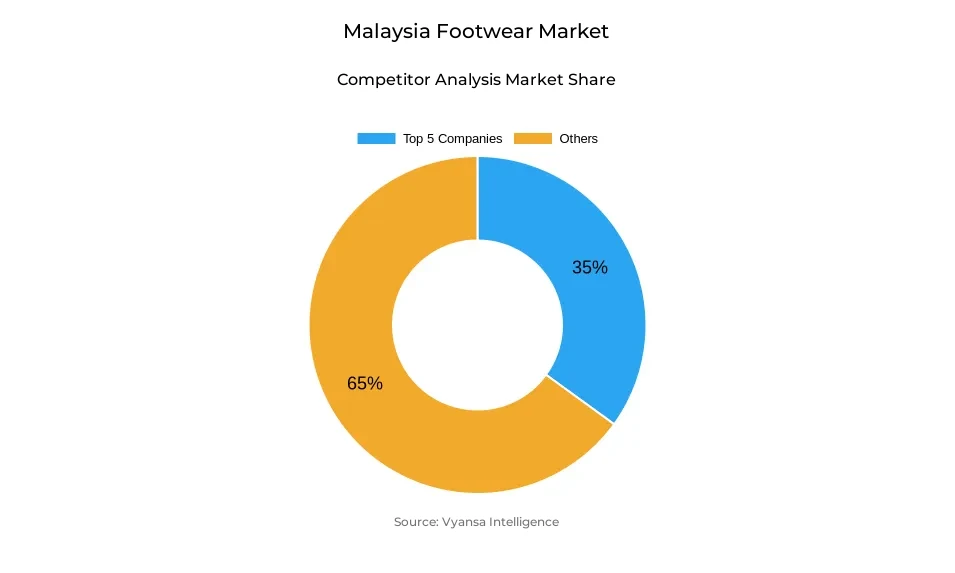

- Competition

- More than 20 companies are actively engaged in producing footwear in Malaysia.

- Top 5 companies acquired around 35% of the market share.

- Roadget Business Pte Ltd; Puma Sports Goods Sdn Bhd; New Balance Athletic Shoes Sdn Bhd; adidas (M) Sdn Bhd; Nike Sales (M) Sdn Bhd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Malaysia Footwear Market Outlook

The Malaysia footwear market will show a consistent growth over the forcast period due to the changing lifestyles, the growth of retailing channels, and the continued interest of end users in fashion and functionality. The market is estimated to reach USD 2.62 billion in 2025, and USD 3.25 billion in 2032, which is a compound annual growth rate of about 3.13%. The growth rate will be less than the post-pandemic recovery years, but demand will be strong due to urban living trends, the popularity of shopping in malls, and continuous brand-driven promotional campaigns that keep driving purchases despite cost of living pressures.

The footwear of women is expected to continue leading the market, which constitutes approximately 45% of the market. High sales performance is motivated by regular style changes, impulse buying that is aroused by promotional efforts, and a broad range of products offered by both local and foreign brands. Limited-time campaigns and discounting are still important tools in appealing to price-sensitive end users, especially with the pressure of inflation and increased production costs on discretionary spending. At the same time, end users are becoming more critical, and they want shoes that have an ideal combination of style, comfort, and perceived value.

Another key growth driver is sports footwear, which enjoys the advantage of the growing active-lifestyle culture in Malaysia and the ongoing popularity of athleisure. The growing involvement in running, gym activities, and outdoor activities has increased the demand of performance-based footwear with advanced cushioning and support. The growth of retail stores by new entrants and specialty stores that provide custom fitting and gait analysis has also contributed to the increased end user involvement, making sports footwear a product that fulfills both functional and lifestyle requirements.

Over the forcastperiod, the market will continue to expand steadily with the entry of new brands and the expansion of physical and online presence by existing players. Although end users will probably be cost-sensitive, the demand will be maintained with the help of promotional campaigns and advances in comfort-oriented technologies. The retailing offline still prevails, and it holds about 75% of the market share, which highlights the significance of mall and in-store experiences. In general, the footwear market in Malaysia is set to develop as a combination of low costs, technology-based products, and lifestyle-based demand up to 2032.

Malaysia Footwear Market Growth Driver

Rising Participation in Physical Activity

The increasing participation of the Malaysia population in organised sports and routine physical activity is structurally reinforcing demand for performance-driven and sports-oriented footwear across the market. The latest National Health and Morbidity Survey indicates that about one out of three adults in Malaysia said they were physically inactive, which means that two out of three adults were physically active or exercised, which drives the use of footwear. This trend is an indication of increased interest by the people in walking, running, gym activities and other recreational activities that require specialised footwear to be comfortable and perform well during the exercise.

Government programs and health education promote physical activity to fight non-communicable diseases and sedentary lifestyles. Sports and leisure activities influence end user preferences to athleisure and performance footwear that offer ergonomic advantages and support active lifestyles. With the increasing number of Malaysians engaging in fitness and outdoor activities as part of their daily lives, the demand of technologically advanced footwear, such as running shoes with cushioning and support, is increasing. The reaction of retailers and brands is the development of sports segments and the demonstration of new technologies in footwear that attract health-conscious end user.

Malaysia Footwear Market Challenge

Affordability Pressure on Discretionary Spending

Price sensitivity among end users remains a notable constraint in the Malaysia footwear market, particularly as sustained inflationary pressures continue to weigh on discretionary spending and purchasing confidence. The Department of Statistics Malaysia reported that the general inflation decreased to 1.8% in 2024, and the Clothing and footwear category showed a -0.3% change, which shows mixed effects on prices in the retail sector. This setting highlights the role of price volatility and cost pressures in influencing end user buying behavior, particularly of non-essential products like fashion footwear.

Inflation impacts the household budgets, reducing purchasing power and forcing end users to switch to value products or postpone purchases. Increased retail prices also result in higher production costs and supply chain disruptions, which may limit demand in price-sensitive segments. With households balancing the cost of living with the purchase of discretionary footwear, promotional activities and discount models are critical in maintaining sales volumes. However, the constant use of promotions may squeeze the retailer margins and restrict profitability, which is a structural issue to the market stakeholders who aim to achieve sustainable growth.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Footwear Market Trend

Growing Active Lifestyle Influence on Footwear Choices

A prominent trend shaping the Malaysia footwear market is the increasing influence of active and athleisure-oriented lifestyles on footwear preferences and purchasing behavior. It has been found out that a significant proportion of Malaysians are involved in sports, exercise or recreational activities and studies have revealed that about 52% of the population engages in sports or exercise at least once a month, which has led to the association between lifestyle behaviours and footwear preferences. This involvement includes jogging, gym sessions, team sports, and outdoor activities that involve supportive and versatile footwear.

With the fitness and wellness culture taking centre stage, end users are increasingly preferring trainers, sneakers, and performance-based footwear that can easily shift between leisure, sport, and everyday wear. These tastes are in line with the larger fashion trends in the world which focus on comfort, utility and functionality. The response of retailers and brands includes the introduction of sports-oriented product lines and the provision of technologically advanced footwear products that serve running, training, and cross-functional purposes, which stimulates the diversification of categories and end user interaction.

Malaysia Footwear Market Opportunity

Digital and Personalised Retail Experiences

The continued expansion of retail online platforms presents a significant opportunity for the footwear market, particularly in strengthening access to price-sensitive and digitally engaged end users. Online stores like Shopee, Lazada, and Zalora offer affordable prices and a wide selection of products in men, women, and children footwear, which appeal to end user who value convenience and affordability. The trend allows brands to access broader audiences and experiment with exclusive online products and bundled deals that are not possible in physical stores.

Simultaneously, customised shopping experiences in physical retail, including gait analysis and custom fitting technology, distinguish high-end footwear segments and increase end user loyalty. Expert shops that provide custom services in running and performance shoes generate value beyond the normal retailing activities. These customised experiences serve end users who want customised footwear solutions, which can help in penetrating the market further and increasing the prospects of specialised retail formats.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Footwear Market Segmentation Analysis

By Category

- Children's Footwear

- Infants (0-9 Months) Foot Length (CM)

- 8.3-8.9

- 9.2-9.5

- 10.1-10.5

- Infants (0-9 Months) Foot Length (CM)

- Toddlers (9 Months - 4 Years) Foot Length (CM)

- 10.8

- 11.4-11.7

- 12.1-12.7

- 13.0-13.3

- 14.0-14.3

- 14.6-15.2

- 15.6-15.9

- 16.5

- 10.8

- Little Kids (4-7 Years) Foot Length (CM)

- 16.8

- 17.1-17.8

- 18.1-18.4

- 19.1-19.4

- 19.7-20.6

- 21.0-21.6

- 16.8

- Big Kids (7-12 Years) Foot Length (CM)

- 21.9

- 22.2-23.5

- 24.1-24.8

- 21.9

- Women's Footwear

- Foot Length (CM)

- 20.8

- 21.3-21.6

- 22.2-22.5

- 23.0-23.8

- 24.1-24.6

- 25.1-25.9

- 26.2-26.7

- 27.6

- 20.8

- Foot Length (CM)

- Men's Footwear

- Foot Length (CM)

- 23.5

- 24.1-24.8

- 25.4-25.7

- 26.0-26.7

- 27.0-27.9

- 28.3-28.6

- 29.4

- 30.2

- 31.0-31.8

- 23.5

- Foot Length (CM)

The segment with the highest share under the Category structure is Women’s Footwear, which captures around 45% of the Malaysia footwear market. Women’s styles continue to lead sales growth, supported by promotional efforts from key brands and strong end user engagement across fashion and functional segments. Promotional discounts and limited-time offers from brands like Vincci, Christy Ng, and Charles & Keith stimulate impulse buying and foot traffic in both online and physical stores.

Women’s footwear benefits from broad appeal across multiple use contexts from casual everyday wear to trendy sneakers and performance-oriented designs reinforcing its position as the dominant category. As lifestyle trends evolve toward comfort and versatility, women’s footwear remains central to overall market value, underpinned by diverse product offerings that resonate with style and practicality preferences.

By Sales Channel

- Retail Online

- Retail Offline

The segment with the highest share under the Sales Channel structure is Retail Offline, accounting for approximately 75% of total footwear sales in Malaysia. Brick-and-mortar stores, including brand outlets, mall retailers, and specialist shops, remain the primary purchase points for end users who value fit assurance, in-person assistance, and immediate product availability.

Traditional retail environments continue to attract significant foot traffic as shoppers browse seasonal collections and take advantage of promotions and discount offers. While retail online growth is reshaping the market by providing competitive pricing and convenience, the offline channel remains foundational due to established end user behaviour and preference for physical fitting experiences, particularly for performance and everyday footwear categories.

List of Companies Covered in Malaysia Footwear Market

The companies listed below are highly influential in the Malaysia footwear market, with a significant market share and a strong impact on industry developments.

- Roadget Business Pte Ltd

- Puma Sports Goods Sdn Bhd

- New Balance Athletic Shoes Sdn Bhd

- adidas (M) Sdn Bhd

- Nike Sales (M) Sdn Bhd

- Skechers Malaysia Sdn Bhd

- Bata (Malaysia) Sdn Bhd

- Padini Holdings Bhd

- Asics Malaysia Sdn Bhd

- Hermes Retail (M) Sdn Bhd

Competitive Landscape

Malaysia’s footwear market is characterised by strong competition between international sportswear brands, established fashion labels, and emerging lifestyle-focused players. Women’s footwear remains a key battleground, with brands such as Vincci, Christy Ng, Charles & Keith, Steve Madden, and Clarks driving sales through frequent promotions and omnichannel presence. In sports footwear, global players including Nike and adidas continue to lead, though rising brands like Hoka and Anta are gaining momentum through aggressive store expansion and performance-focused positioning. Specialist retailers such as REV RUNNR are further intensifying competition by offering premium, technology-enabled shopping experiences. At the same time, e-commerce platforms including Shopee, Lazada, Zalora, and Temu are reshaping competitive dynamics by enabling price-led strategies and wider brand access, reinforcing a market driven by promotions, innovation, and accessibility.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Footwear Market Policies, Regulations, and Standards

4. Malaysia Footwear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Footwear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Children's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Infants (0-9 Months) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. 8.3-8.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. 9.2-9.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. 10.1-10.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Toddlers (9 Months - 4 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. 10.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. 11.4-11.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.3. 12.1-12.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.4. 13.0-13.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.5. 14.0-14.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.6. 14.6-15.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.7. 15.6-15.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.8. 16.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Little Kids (4-7 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. 16.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. 17.1-17.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. 18.1-18.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.4. 19.1-19.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.5. 19.7-20.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.6. 21.0-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Big Kids (7-12 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. 21.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. 22.2-23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.3. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Women's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. 20.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. 21.3-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.3. 22.2-22.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.4. 23.0-23.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.5. 24.1-24.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.6. 25.1-25.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.7. 26.2-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.8. 27.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Men's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. 23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.3. 25.4-25.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.4. 26.0-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.5. 27.0-27.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.6. 28.3-28.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.7. 29.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.8. 30.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.9. 31.0-31.8- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Casual- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Athletic/Sports- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Formal- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material

5.2.4.1. Leather- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Textile- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Rubber- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Synthetic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Canvas- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Price

5.2.5.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Footwear Type

5.2.6.1. Shoes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Sneakers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Boots- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Sandals & Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Flip-Flops- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Application

5.2.7.1. Conventional Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Daily Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Work/Office Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Outdoor & Adventure- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Sports & Fitness- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.5. Party/Occasion Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Functional/Therapeutic Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Therapeutic/Orthopedic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Medicated Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Acupressure Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Malaysia Children's Footwear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Women's Footwear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Malaysia Men's Footwear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Thousand Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.adidas (M) Sdn Bhd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Nike Sales (M) Sdn Bhd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Skechers Malaysia Sdn Bhd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Bata (Malaysia) Sdn Bhd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Padini Holdings Bhd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Roadget Business Pte Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Puma Sports Goods Sdn Bhd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.New Balance Athletic Shoes Sdn Bhd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Asics Malaysia Sdn Bhd

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Hermes Retail (M) Sdn Bhd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Sales Channel |

|

| By Material |

|

| By Price |

|

| By Footwear Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.