Malaysia Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

|

Major Players

|

Malaysia Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

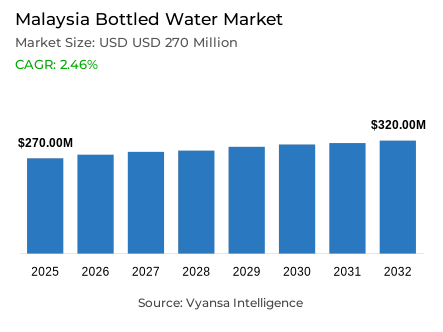

- Bottled water in Malaysia is estimated at USD 270 million in 2025.

- The market size is expected to grow to USD 320 million by 2032.

- Market to register a cagr of around 2.46% during 2026-32.

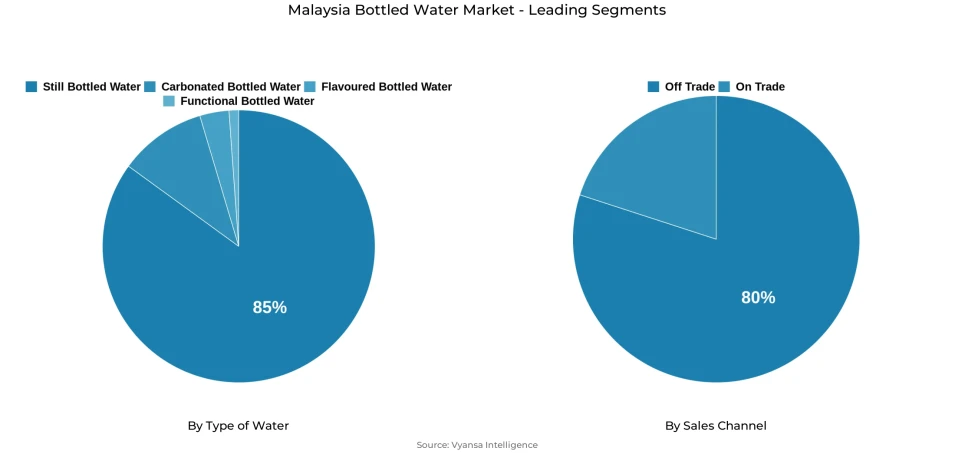

- Type of Water Shares

- Still bottled water grabbed market share of 85%.

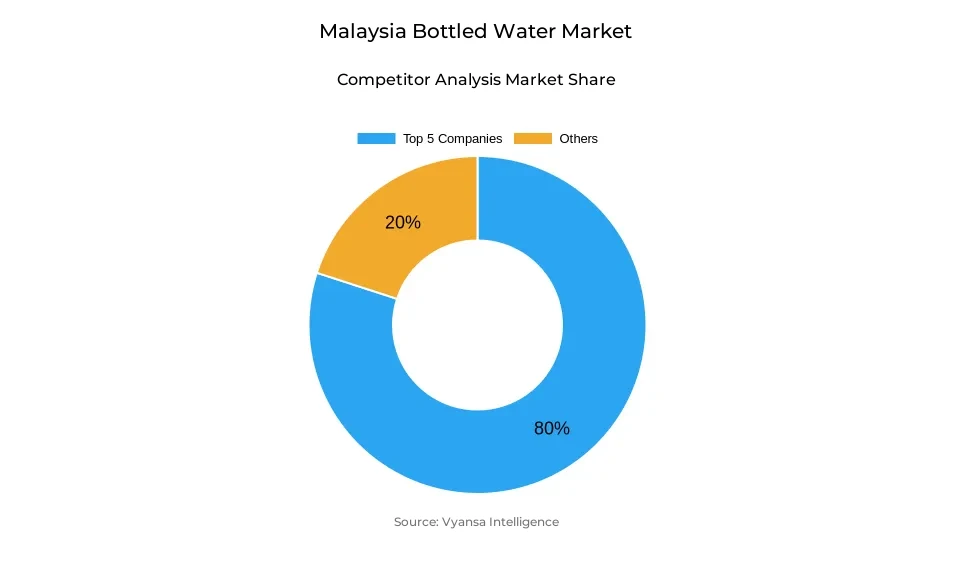

- Competition

- Bottled water in Malaysia is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 80% of the market share.

- Etika Beverages Sdn Bhd; MP Mineral Water Mfg Sdn Bhd; Eau Claire Sdn Bhd; Spritzer Bhd; RO Water Sdn Bhd etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 80% of the market.

Malaysia Bottled Water Market Outlook

The Malaysia bottled water market is estimated at about 270 million in 2025 and is expected to be close to 320 million in 2032, with a CAGR of approximately 2.46% during 2026-32. Bottled water remains the market leader with a 85% market share, which highlights its status as the main daily hydration option. Approximately 80% of the sales are made through off-trade channels, which underscores the importance of supermarkets, convenience stores, and retail outlets in meeting the daily demand in the country.

The hot and humid tropical climate in Malaysia still supports the consistent consumption of bottled-water, since the high temperatures increase the daily hydration requirements of the end users. The need to have a reliable drinking water is also supported by climate-related heat stress and extreme weather risks, especially in outdoor, transit, and urban environments. Bottled water will continue to be a reliable alternative in cases where access to treated tap water is not always available on demand, thus maintaining a minimum level of demand in the household and mobile applications.

Tourism is another source of market stability. In the first eight months of 2025, Malaysia registered 28.2 million international visitor arrivals, equivalent to a 14.5% year-on-year growth. The convenience and perceived safety of the traveller often become the primary consideration, thus bottled water becomes the default choice in hotels, transport hubs, and recreational facilities. This mix of climatic pressure and inflows of tourism assists in maintaining steady off-trade volume flow.

At the same time, growth is moderate due to the increasing price sensitivity of households and the use of filtered-water systems at home. However, the market is being transformed by health awareness and environmental programs. Consumers are abandoning sweetened beverages, and manufacturers are retaliating with recyclable containers and more conscious designs. These considerations support gradual, value-based expansion rather than rapid volume growth through 2032.

Malaysia Bottled Water Market Growth DriverClimate Conditions and Tourism-Led Hydration Needs Sustain Demand

The hot and humid tropical climate that plagues Malaysia still remains one of the key parameters that will support regular bottled water consumption, since higher temperatures mean high levels of hydration requirements among the population. The managing nature of exposure to heat stresses and the threats of extreme weather conditions brought by the climate change effect, thus the importance of adequate and secure drinking water provision is reiterated in the national environmental planning documents. Here, the bottled water can be deemed as a stable source of staying hydrated, particularly in outdoor and transit as well as city-life settings, where a direct access to a treated tap water source might not be ensured. This fact in the environment sustains baseline demand across both home and mobile use occasions.

This demand is further enhanced by tourism which is climate driven. In the first eight months of 2025, Malaysia registered 28.2 million international visitor arrivals, which is equivalent to 14.5% per annum growth. Convenience and perceived safety tend to mark travelling consumers as the main factor, thus making bottled water a default option in hotels, transport facilities, tourist destinations, and shops. In this way, the interplay between the climatic pressure and the strong inflows of tourism supports the stable flows of off-trade volumes of the Malaysian bottled water market.

Malaysia Bottled Water Market ChallengeHousehold Cost Pressures and At-Home Alternatives Constrain Growth

Increasing price sensitivity among Malaysia households presents a structural constraint for bottled water demand, especially in routine, at-home consumption. With the increase in the cost of living, end users are more discriminating on recurrent purchases that can be replaced by cheaper alternatives. According to the statistics provided by the Department of Statistics Malaysia, consumer price inflation has been averaged at around 1.8% in 2024, thus still putting a strain on household budgets and promoting more prudent spending habits. This climate interferes with the capacity of bottled-water brands to attain regular volume development without evident value differentiation. At the same time, filtered-water systems are becoming increasingly popular as an alternative that is perceived to be economical and sustainable.

The use of bottled-water has been put under increased scrutiny by organisations like the Consumers' Association of Penang, which have focused on cost-effectiveness and waste minimisation. Although bottled water is still very pertinent in terms of mobility and travel, these economic and social pressures temper stronger expansion and force producers to protect the relevance of everyday use against at-home filtration systems.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Bottled Water Market TrendHealth-Oriented Beverage Choices Reshape Consumption Patterns

A sharp change in the demand towards health-conscious beverages is transforming the demand trends in the Malaysia bottled-water market. The end users are increasingly abandoning soft drinks that contain sugar and are demanding hydration products that support long-term wellness goals. This change in behaviour is supported by the public-health evidence of the World Health Organization, which indicates that non-communicable diseases constitute about 74% of all deaths in Malaysia, thus supporting the national emphasis on healthier diets and less sugar consumption. This increased awareness has a direct impact on bottled water. In this scenario, flavoured bottled-water versions that do not contain added sugar are becoming more visible as substitutes to conventional carbonated beverages.

They offer taste variety and yet have a health-focused positioning, thus allowing bottled water to compete with more than just basic hydration. With wellness factors becoming more and more important in daily buying behavior, bottled water is becoming a part of lifestyle-based consumption as opposed to discretionary luxury, which enhances its applicability to various age categories and consumption events.

Malaysia Bottled Water Market OpportunitySustainability-Aligned Innovation Opens New Value Pathways

The increasing environmental consciousness of Malaysia end users is creating a space where bottled-water producers can create new ways of packaging beyond traditional paradigms. This transition is encouraged by government policy direction, where the national plastics roadmap aims to achieve a 40% recycling rate by 2025, indicating a greater institutional acceptance of the practices of a circular economy. Such a regulatory climate prompts manufacturers to re-evaluate materials, packaging design, and distribution models in order to keep up with the changing sustainability expectations.

Recyclable PET bottles, reduced-label or label-free designs, and alternative water-delivery formats are some of the innovations that allow brands to respond to environmental issues without losing the convenience benefit of bottled-water. These campaigns rebrand bottled water as a more sustainable option instead of a disposable item. Through the alignment of commercial strategies with national waste-reduction goals and sustainability discourse, producers can access differentiation and long-term brand equity, focusing on value creation rather than incremental volume growth.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still Bottled Water holds the largest market share in the Type of Water category, with a share of approximately 85% in the Malaysia bottled water market. This is because still bottled water is the most widely used type of bottled water and serves as the main drinking water for consumers. Still bottled water is preferred for its simplicity and versatility and is associated with health-driven consumption patterns.

The dominance of the segment is also driven by the presence of established brands with strong distribution channels in modern trade, traditional trade, and convenience stores. This ensures that the product is readily available at competitive prices, regardless of the pack size, to both regular and bulk buyers. Although flavored water is gaining popularity, the basic usage of still bottled water in the daily lives of consumers continues to maintain its leading market share in the overall market structure.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off Trade is the leading Sales Channel in the Malaysia bottled water industry, accounting for about 80% of the overall market share. The off-trade channel includes supermarkets, hypermarkets, convenience stores, traditional grocery stores, and online shopping platforms, which together cater to the regular household and individual requirements. The end-users are mostly dependent on off-trade sales for home storage of bottled water and for their daily use, making it the cornerstone of the market.

Supermarkets and traditional grocery stores are very important in this regard, as they provide multi-pack options and value-for-money deals to attract price-conscious consumers. Convenience stores and online shopping platforms, on the other hand, increase accessibility and convenience, helping consumers make purchases on the go. The off-trade channel, with its wide reach and flexibility, ensures that bottled water is readily accessible in both urban and semi-urban regions, maintaining its leading sales channel status.

List of Companies Covered in Malaysia Bottled Water Market

The companies listed below are highly influential in the Malaysia bottled water market, with a significant market share and a strong impact on industry developments.

- Etika Beverages Sdn Bhd

- MP Mineral Water Mfg Sdn Bhd

- Eau Claire Sdn Bhd

- Spritzer Bhd

- RO Water Sdn Bhd

- Groupe Danone

- Coca-Cola Bottlers (M) Sdn Bhd

- Fraser & Neave Holdings Bhd

- La Boost Health Beverages Mfg Sdn Bhd

- Spring Fresh Manufacturing Sdn Bhd

Competitive Landscape

Malaysia’s bottled water market in 2025 remains highly competitive, led by Spritzer Bhd, which retained its off-trade volume leadership through strong brand portfolios, effective marketing campaigns, and extensive shelf presence across modern and traditional grocery retailers. Its stable local supply chain, packaging innovation, and plans to expand distribution into hotels, cafés, and restaurants further reinforced its position. Coca-Cola Bottlers (M) Sdn Bhd also recorded solid performance, though results were mixed across brands. While Schweppes Soda Water faced off-trade volume pressure following price increases, Dasani performed strongly due to its affordable pricing and wide retail penetration. Overall, competition is shaped by brand strength, pricing strategies, and distribution reach across multiple channels.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Bottled Water Market Policies, Regulations, and Standards

4. Malaysia Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Malaysia Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Malaysia Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Malaysia Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Spritzer Bhd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. RO Water Sdn Bhd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Danone Groupe

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Fraser & Neave Holdings Bhd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Coca-Cola Bottlers (M) Sdn Bhd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Etika Beverages Sdn Bhd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. MP Mineral Water Mfg Sdn Bhd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Eau Claire Sdn Bhd

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. La Boost Health Beverages Mfg Sdn Bhd

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Spring Fresh Manufacturing Sdn Bhd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.