India Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business), By Region (North, East, West, South)

|

Major Players

|

India Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

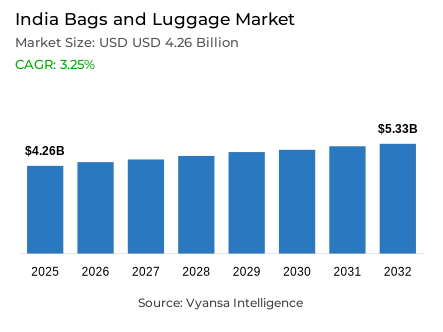

- Bags and luggage in India is estimated at USD 4.26 billion in 2025.

- The market size is expected to grow to USD 5.33 billion by 2032.

- Market to register a cagr of around 3.25% during 2026-32.

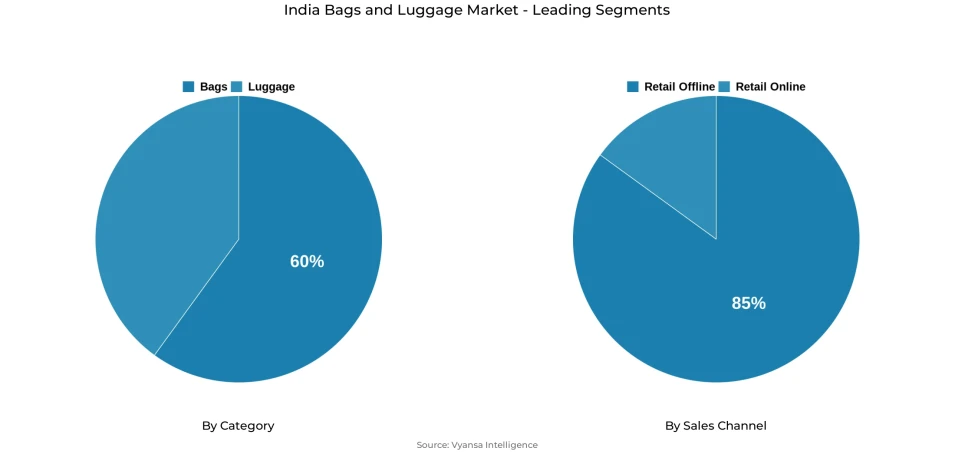

- Category Shares

- Bags grabbed market share of 60%.

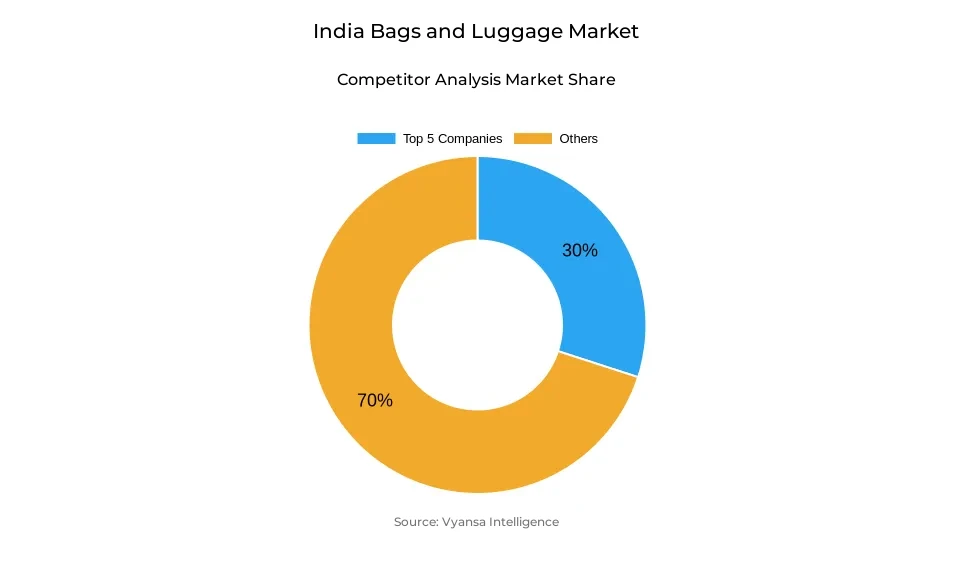

- Competition

- More than 20 companies are actively engaged in producing bags and luggage in India.

- Top 5 companies acquired around 30% of the market share.

- LVMH Watch & Jewellery India Pvt Ltd; Hermès India Ltd; Hidesign India Pvt Ltd; Samsonite South Asia Pvt Ltd; VIP Industries Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

India Bags and Luggage Market Outlook

The India bags and luggage market is expected to record healthy and long-term growth in the next five years 2026-32 due to the structural changes in the travel behaviour and the growing disposable incomes. The market is estimated to be USD 4.26 billion in 2025 and expected to grow to USD 5.33 billion in 2032, being a compound annual growth rate of about 3.25%. Travel spending has increasingly shifted to need based versus discretionary spending particularly among middle- and upper-middle-income end users, which supports consistent demand on luggage and other travel items.

It is expected that luggage will remain one of the key growth drivers during the forecast period due to the higher frequency of domestic and international travel. end users are increasingly purchasing more luggage formats that are tailored to different travel purposes, e.g. short business trips or longer holidays. Simultaneously, a continuous upgrade program between the soft and heavy models to lightweight hard-shell trolleys supports the value increase. Technology-based functions, such as built-in charging power points, RFID security, and anti-theft, also impact buying decisions, especially by professionals and travelers.

Bags still hold a dominant role in the market, accounting about 60% of the total value since they are essential in daily use, work, and short-distance transit. This segment is being transformed by premiumisation, as end users are increasingly viewing bags as lifestyle and identity-oriented accessories, and no longer as functional items. The legacy players, as well as direct-to-end users brands, are moving up the value chain to design-led collections and easy to reach high-end positioning.

Distribution wise, offline retail makes around 85% of the sales which are supported by strong networks of stores and the preference of the end users to touch and feel the products. However, online and omnichannel are set to progressively supplement physical sales particularly as brands expand into Tier 2 and smaller cities.

India Bags and Luggage Market Growth DriverTravel Frequency Making Travel Luggage a Necessity

The rising rate of travel in India is turning luggage into an item of discretion to a useful item of household need. Increased mobility through air, rail and road transportation reflects a structurally high degree of mobility among the middle and upper-income households. Due to the increased propensity of both business and recreational travel as a normal activity, spending on travel-supportive necessities takes on a more significant role in household budgets, further supporting the consistent demand of luggage items.

This shift is supported by the increase in purchasing power. The gross national income per capita in India was estimated by the World Bank to be US 2,540 in 2023, which consequently improved households spending patterns on durable travel products. Increased income reliability drives replacement and upgrading, particularly on products that offer durability and convenience. Therefore, incessant mobility, coupled with the growth in income, places luggage as an essential need and not an occasional luxury item.

India Bags and Luggage Market ChallengeSensitivity to Price in the backdrop of high cost pressures

Price sensitivity still remains a structural limitation to the demand of bags and luggage in India, particularly when it comes to increased cost pressures. According to the Ministry of Statistics and Programme Implementation, in 2023, the retail inflation in India was averaged at 5.4% and is putting strain on household budgets despite the growth in income. As a result, the high prices of discretionary durable products face a closer examination by value-conscious end users.

Input-cost volatility also limits the flexibility of manufacturers to set prices. According to the World Trade Organization, the freight/logistics expenditures in the world have remained higher than before the year 2020, which is explained by the enduring supply-chain inefficiencies and fuel-price volatility. Such limitations limit the ability of brands to internalize costs without passing them to end users. To this end, it is hard to find the balance between product improvement and low price in a market where price is one of the main filters of purchase.

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Bags and Luggage Market TrendTechnology-Embedded Products that Affect Purchase

The use of technology is becoming a major influence in the purchase behavior of the baggage and luggage market. The high rate of digital adoption in India is strengthening demands of products to support connected on-the-go lifestyles. The users of luggage are increasingly choosing convenience, security and organization in their luggage purchase decisions, a move towards changing usage patterns to one where infrequent travel needs are no longer a significant factor.

This change in behavior encourages the brands to consider functional innovation as a fundamental design need and not an upscale addition. Brand perception and repeat purchasing behavior are now determined by features that increase the level of protection, ease of access and smooth mobility of the device. Since digital dependency is becoming part of everyday living, a luggage that fits into the modern mobility trends is gaining more and more significance, hence changing the way end users evaluate the worth of products and their long-term functionality.

India Bags and Luggage Market OpportunityInfrastructure Development in Favor of Travel-Based Consumption

The long-term growth of transport infrastructure in India is still sustaining the production of favorable environment to the demand of luggage. Airports Authority of India confirms that the country has over 150 active airports, and some new terminals have been commissioned in recent years, thus greatly facilitating air connectivity in the region. The enhanced access promotes increased short-haul trips and multi-destinations.

This is supported by parallel investments in rail infrastructure. In FY 2023-24, the Ministry of Railways records capital expenditure of over INR 2.4 trillion which is allocated to station redevelopment and modernization of the networking. There is improved travel efficiency which supports movement of passengers between modes of transport. With more and more journeys becoming common and time conscious, the pressure on durable and travel friendly luggage that can be used on a regular basis increases hence aiding in the long term consumption growth.

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

The segment with the highest share in the India bags and luggage market is bags, accounting for around 60% of total market value. This leadership reflects the everyday relevance of bags across professional, leisure, and travel-related use cases. Backpacks, work bags, and lifestyle-oriented designs continue to see stable demand, as end users prioritise versatility and frequent usage compared to luggage, which is purchased less often.

Over the forecast period, bags are expected to retain their leading position, supported by premiumisation and changing end users perceptions. India end users increasingly see bags as an extension of personal style and brand preference, rather than purely utilitarian items. Design-focused launches, limited-edition collections, and premium materials are encouraging repeat purchases. At the same time, tech-friendly features such as padded laptop compartments and smart organisation are reinforcing the appeal of bags among working professionals and younger end users.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category is retail offline, holding around 85% of the India bags and luggage market. Physical stores remain critical due to the tactile nature of purchase decisions, where end users prefer to assess size, build quality, and durability in person, particularly for luggage and higher-value products.

During 2026–32, retail offline is expected to maintain its dominance, supported by store expansion by leading brands and improved accessibility across urban and semi-urban markets. However, offline retail will increasingly operate alongside digital platforms, as brands adopt omnichannel strategies to enhance convenience and reach. This blended approach will allow companies to capture digitally influenced end users while preserving the trust and engagement associated with in-store shopping.

List of Companies Covered in India Bags and Luggage Market

The companies listed below are highly influential in the India bags and luggage market, with a significant market share and a strong impact on industry developments.

- LVMH Watch & Jewellery India Pvt Ltd

- Hermès India Ltd

- Hidesign India Pvt Ltd

- Samsonite South Asia Pvt Ltd

- VIP Industries Ltd

- Safari Industries (India) Ltd

- Titan Co Ltd

- Wildcraft India Ltd

- Baggit Ltd

- Da Milano India

Competitive Landscape

The competitive landscape of bags and luggage in India in 2024 is shaped by strong travel-led demand, premiumisation, and expanding distribution strategies. Samsonite South Asia remains the clear market leader, driven by the strength of its Samsonite and American Tourister brands and an aggressive expansion plan focused on store refurbishments and nationwide franchise rollout. VIP Industries continues to be its closest rival, leveraging vertical integration through its own manufacturing facility to secure cost efficiencies, quality control, and supply chain resilience. Alongside these incumbents, premium D2C brands such as Mokobara are gaining traction by targeting design-conscious, upwardly mobile consumers with minimalist aesthetics and tech-enabled features. Overall, competition is intensifying as brands balance scale, innovation, and premium positioning.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Bags and Luggage Market Policies, Regulations, and Standards

4. India Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North

5.2.6.2. East

5.2.6.3. West

5.2.6.4. South

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. India Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

7. India Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Samsonite South Asia Pvt Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.VIP Industries Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Safari Industries (India) Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Titan Co Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Wildcraft India Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.LVMH Watch & Jewellery India Pvt Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Hermès India Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Hidesign India Pvt Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Baggit Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Da Milano India

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.