Mexico Footwear Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Children's Footwear (Infants (0-9 Months) Foot Length (CM) (8.3-8.9, 9.2-9.5, 10.1-10.5), Toddlers (9 Months - 4 Years) Foot Length (CM) (10.8, 11.4-11.7, 12.1-12.7, 13.0-13.3, 14.0-14.3, 14.6-15.2, 15.6-15.9, 16.5), Little Kids (4-7 Years) Foot Length (CM) (16.8, 17.1-17.8, 18.1-18.4, 19.1-19.4, 19.7-20.6, 21.0-21.6), Big Kids (7-12 Years) Foot Length (CM) (21.9, 22.2-23.5, 24.1-24.8)), Women's Footwear (Foot Length (CM) (20.8, 21.3-21.6, 22.2-22.5, 23.0-23.8, 24.1-24.6, 25.1-25.9, 26.2-26.7, 27.6)), Men's Footwear (Foot Length (CM) (23.5, 24.1-24.8, 25.4-25.7, 26.0-26.7, 27.0-27.9, 28.3-28.6, 29.4, 30.2, 31.0-31.8))), By Product Type (Casual, Athletic/Sports, Formal, Others), By Sales Channel (Retail Online, Retail Offline), By Material (Leather, Textile, Rubber, Synthetic, Canvas), By Price (Mass, Premium), By Footwear Type (Shoes (Sneakers, Boots), Sandals & Slippers (Flip-Flops)), By Application (Conventional Footwear (Daily Wear, Work/Office Wear, Outdoor & Adventure, Sports & Fitness, Party/Occasion Wear), Functional/Therapeutic Footwear (Therapeutic/Orthopedic, Medicated Slippers, Acupressure Slippers))

|

Major Players

|

Mexico Footwear Market Statistics and Insights, 2026

- Market Size Statistics

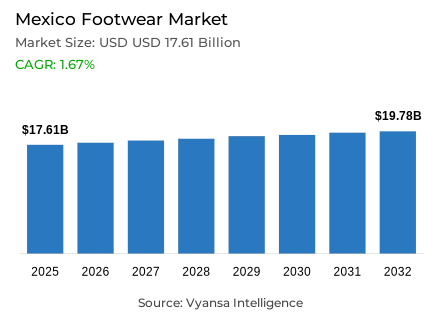

- Footwear in Mexico is estimated at USD 17.61 billion in 2025.

- The market size is expected to grow to USD 19.78 billion by 2032.

- Market to register a cagr of around 1.67% during 2026-32.

- Category Shares

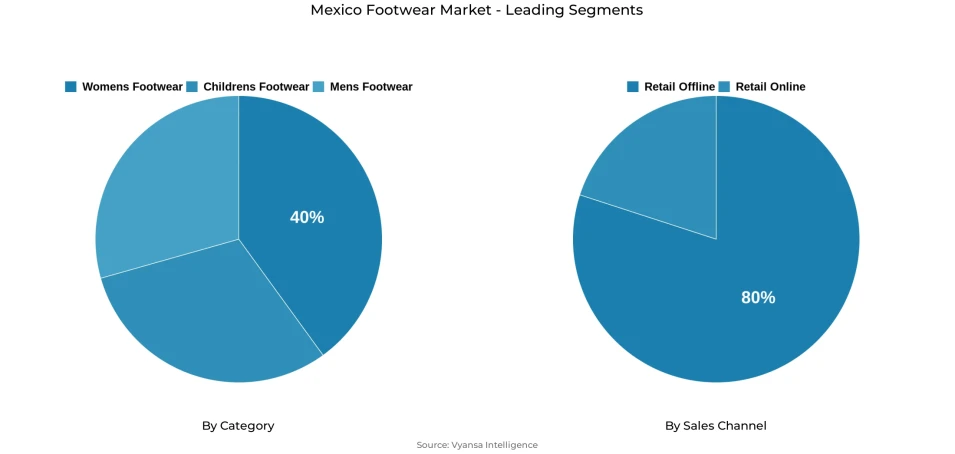

- Women's footwear grabbed market share of 40%.

- Competition

- More than 20 companies are actively engaged in producing footwear in Mexico.

- Top 5 companies acquired around 30% of the market share.

- Industrias CKlass S de RL de CV; Grupo Charly; Verochi SA de CV; Flexi SA de CV; Fábricas de Calzado Andrea SA de CV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Mexico Footwear Market Outlook

Mexico footwear market will experience a slow rate of growth in the period of 2026–32, after stabilising after a high growth in the post-pandemic period. The market is estimated to be worth 17.61 billion in 2025 and 19.78 billion in 2032 with a CAGR of approximately 1.67%. The growth is kept at a low level because sales have already exceeded the pre-pandemic levels and end users are still modifying their spending patterns in reaction to inflationary pressures. The increased prices have prompted some households to postpone purchases or purchase in smaller quantities, especially in non-essential footwear.

The footwear of women remains the anchor of the market demand, with approximately 40% of the total value sales. Nevertheless, the domestic footwear market is under intense headwinds of low-priced Asian imports, particularly Chinese. These products have increased price competition, which has put pressure on local manufacturers and led to factory shutdowns and loss of jobs in major production centers. To counter this, temporary compensatory tariffs will be implemented in late 2024, which will somewhat alleviate the situation during the forecast period, allowing domestic players to stabilise their operations and save jobs.

Brand dynamics remain mixed. The existing local brands still enjoy the advantage of high recognition and positioning based on comfort, but they are also changing with the structural changes in the market. Design, personalisation, and customer engagement investment in artificial intelligence as a strategic response to competition is becoming a way of brands to increase efficiency and the shopping experience. Meanwhile, fashion trends like the resurgence of skate-inspired footwear are generating new interest among younger end users, which is helping to recover selective demand.

Over the forcast period, sustainability and responsible production will become more significant as brands reevaluate materials, waste minimization, and on-demand production. retail offline still holds a dominant position of approximately 80% of the market, as the physical stores are still relevant. In general, the footwear market in Mexico will expand gradually yet cautiously due to the price sensitivity, policy actions, and slow innovation until 2032.

Mexico Footwear Market Growth Driver

Casualisation of Dress Codes Sustaining Footwear Demand

The Mexico footwear market is being structurally supported by the continued shift toward more relaxed dress codes across both professional environments and social settings. With the trend of hybrid working patterns continuing, end users are increasingly preferring casual and versatile shoes that can be used in various activities throughout the day. This change helps sustain the base demand when the overall market growth slows down.

This behavioural trend is supported by demographic data. As per INEGI, the population in the age group of 15–29 years constitutes more than 24% of the Mexican population, a group that is highly oriented towards casual, street, and lifestyle-based footwear consumption according to INEGI. This younger generation is a key factor in the demand of sneakers and casual footwear, which can offset the declining replacement rates of formal footwear. The ongoing fusion of fashion, comfort, and daily utility maintains category relevance despite inflationary pressures, and casual footwear is a structural pillar of demand in the forecast period.

Mexico Footwear Market Challenge

Inflation and Import Pressure on Domestic Footwear market

A key constraint shaping the Mexico footwear market is the combined impact of persistent inflationary pressures and intensifying competition from low-priced imports. The National end user Price Index of INEGI showed that inflation was still above the target range of the central bank in 2024–2025, limiting discretionary spending and affecting end user trade-down behaviour according to INEGI. On the market level, the official declarations of the trade authorities in Mexico point to the increasing concerns about unfair importation practices. The Ministry of Economy affirmed that the Chinese footwear imports were getting into the country in dumping terms, which were hurting the local production.

Consequently, in October 2024, provisional compensatory tariffs of 78.4% were introduced on Chinese footwear imports after an anti-dumping inquiry as per the Ministry of Economy. These pressures have broken local manufacturing ecosystems, especially in footwear-producing areas like Guanajuato, exacerbating employment risks and constraining investment potential throughout the domestic value chain.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Footwear Market Trend

Artificial Intelligence Integration in Footwear Design and Retail

A notable trend shaping the footwear market in Mexico is the increasing integration of artificial intelligence across product design processes and retail operations. AI-enabled design tools were presented at SAPICA, the biggest footwear market show in Mexico, to help companies develop products faster and compete better with mass-produced imports. These tools enable real-time visualisation of design variations, enhancing efficiency without substituting human designers.

The trend is not limited to production but also to end user engagement. Data-driven systems are being adopted by domestic brands to personalise shopping experiences and enhance customer interaction. This is in line with the overall digital transformation agenda in Mexico, which is backed by increasing internet penetration and retail online adoption recorded by official digital economy indicators by INEGI according to INEGI. The use of AI is a strategic move towards value-added differentiation, and technology is viewed as a long-term competitiveness driver, not a cost-reduction instrument.

Mexico Footwear Market Opportunity

Trade Protection Enabling market Reinforcement

A notable opportunity for the footwear market in Mexico lies in the strengthening of trade protection measures alongside closer alignment with national industrial policy frameworks. The move by the Ministry of Economy to introduce 78.4% provisional anti-dumping duties on the imports of Chinese footwear provides a more balanced competitive environment to the domestic producers as per the Ministry of Economy. This policy measure gives local manufacturers a chance to invest in modernisation, automation and sustainable production without the threat of immediate price reduction. Trade protection also helps in saving jobs in major manufacturing areas, which strengthens the contribution of footwear to the development of the local economy.

The domestic brands have room to build brand equity, design and material innovations, and restore export competitiveness as the government keeps checking on import practices and implementing customs controls. This stabilisation supported by policy provides a vital basis to long-term market stability.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Footwear Market Segmentation Analysis

By Category

- Children's Footwear

- Infants (0-9 Months) Foot Length (CM)

- 8.3-8.9

- 9.2-9.5

- 10.1-10.5

- Infants (0-9 Months) Foot Length (CM)

- Toddlers (9 Months - 4 Years) Foot Length (CM)

- 10.8

- 11.4-11.7

- 12.1-12.7

- 13.0-13.3

- 14.0-14.3

- 14.6-15.2

- 15.6-15.9

- 16.5

- 10.8

- Little Kids (4-7 Years) Foot Length (CM)

- 16.8

- 17.1-17.8

- 18.1-18.4

- 19.1-19.4

- 19.7-20.6

- 21.0-21.6

- 16.8

- Big Kids (7-12 Years) Foot Length (CM)

- 21.9

- 22.2-23.5

- 24.1-24.8

- 21.9

- Women's Footwear

- Foot Length (CM)

- 20.8

- 21.3-21.6

- 22.2-22.5

- 23.0-23.8

- 24.1-24.6

- 25.1-25.9

- 26.2-26.7

- 27.6

- 20.8

- Foot Length (CM)

- Men's Footwear

- Foot Length (CM)

- 23.5

- 24.1-24.8

- 25.4-25.7

- 26.0-26.7

- 27.0-27.9

- 28.3-28.6

- 29.4

- 30.2

- 31.0-31.8

- 23.5

- Foot Length (CM)

The segment with the highest share under the category structure is Women’s Footwear, accounting for around 40% of the Mexico footwear market. This dominance reflects frequent replacement cycles, fashion-driven purchasing behaviour, and broad usage across professional, casual, and social settings.

Women’s footwear also demonstrates relative resilience during inflationary periods, supported by strong brand loyalty and diversified style offerings. As casualisation and streetwear trends gain traction, women’s sneakers and hybrid footwear styles continue to expand their role within this segment, ensuring sustained leadership throughout the forecast period.

By Sales Channel

- Retail Online

- Retail Offline

The segment with the highest share under the sales channel structure is Retail Offline, capturing around 80% of total footwear sales in Mexico. Physical retail remains dominant due to the importance of fit, comfort assessment, and immediate product availability in footwear purchasing decisions.

Department stores, brand outlets, and independent retailers continue to anchor distribution, particularly in urban centres and manufacturing regions. While retail online adoption is rising, official retail structure data confirms that offline channels remain the primary route to market, ensuring their continued dominance through forcast period.

List of Companies Covered in Mexico Footwear Market

The companies listed below are highly influential in the Mexico footwear market, with a significant market share and a strong impact on industry developments.

- Industrias CKlass S de RL de CV

- Grupo Charly

- Verochi SA de CV

- Flexi SA de CV

- Fábricas de Calzado Andrea SA de CV

- Nike de Mexico S de RL de CV

- Price Shoes SA de CV

- adidas de Mexico SA de CV

- Puma Mexico Sport SA de CV

- Steve Madden Ltd

Competitive Landscape

Mexico’s footwear market remains competitive but under pressure, dominated by domestic brands alongside rising low-cost Asian imports. Flexi continues to lead the market with around a 10% value share in 2024, supported by strong brand recognition for comfort, quality materials, and innovation, despite recent factory closures reflecting wider industry strain. Andrea remains another key domestic player, although it has lost ground since its peak earlier in the decade. The competitive environment has been significantly reshaped by Chinese imports, which compete aggressively on price and have eroded the position of local manufacturers. In response, industry bodies and government intervention through anti-dumping tariffs are reshaping competitive dynamics. Meanwhile, brands are increasingly turning to artificial intelligence, design innovation, and sustainability initiatives to defend market share and differentiate from low-priced imports.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Footwear Market Policies, Regulations, and Standards

4. Mexico Footwear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Footwear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Children's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Infants (0-9 Months) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. 8.3-8.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. 9.2-9.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. 10.1-10.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Toddlers (9 Months - 4 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. 10.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. 11.4-11.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.3. 12.1-12.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.4. 13.0-13.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.5. 14.0-14.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.6. 14.6-15.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.7. 15.6-15.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.8. 16.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Little Kids (4-7 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. 16.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. 17.1-17.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. 18.1-18.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.4. 19.1-19.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.5. 19.7-20.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.6. 21.0-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Big Kids (7-12 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. 21.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. 22.2-23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.3. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Women's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. 20.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. 21.3-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.3. 22.2-22.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.4. 23.0-23.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.5. 24.1-24.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.6. 25.1-25.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.7. 26.2-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.8. 27.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Men's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. 23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.3. 25.4-25.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.4. 26.0-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.5. 27.0-27.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.6. 28.3-28.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.7. 29.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.8. 30.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.9. 31.0-31.8- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Casual- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Athletic/Sports- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Formal- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material

5.2.4.1. Leather- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Textile- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Rubber- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Synthetic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Canvas- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Price

5.2.5.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Footwear Type

5.2.6.1. Shoes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Sneakers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Boots- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Sandals & Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Flip-Flops- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Application

5.2.7.1. Conventional Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Daily Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Work/Office Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Outdoor & Adventure- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Sports & Fitness- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.5. Party/Occasion Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Functional/Therapeutic Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Therapeutic/Orthopedic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Medicated Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Acupressure Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Mexico Children's Footwear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Women's Footwear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Men's Footwear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Thousand Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Flexi SA de CV

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Fábricas de Calzado Andrea SA de CV

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Nike de Mexico S de RL de CV

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Price Shoes SA de CV

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.adidas de Mexico SA de CV

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Industrias CKlass S de RL de CV

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Grupo Charly

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Verochi SA de CV

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Puma Mexico Sport SA de CV

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Steve Madden Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Sales Channel |

|

| By Material |

|

| By Price |

|

| By Footwear Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.