US Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

US Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

- Jewellery in US is estimated at USD 77.51 billion in 2025.

- The market size is expected to grow to USD 83.2 billion by 2032.

- Market to register a cagr of around 1.02% during 2026-32.

- Category Shares

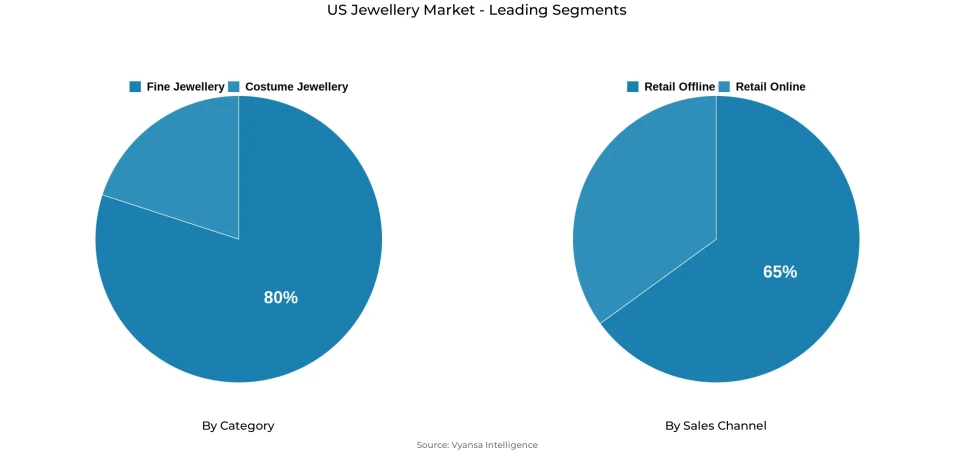

- Fine jewellery grabbed market share of 80%.

- Competition

- More than 15 companies are actively engaged in producing jewellery in US.

- Top 5 companies acquired around 10% of the market share.

- Swarovski AG; Claire's Stores Inc; Piaget SA; LVMH Moët Hennessy Louis Vuitton Inc; Cartier International Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 65% of the market.

US Jewellery Market Outlook

The US jewellery market is expected to grow steadily but at a modest rate over the period 2026 to 2032 as inflationary pressures ease and discretionary consumption slowly rebounds. The market is estimated to be USD 77.51 billion in 2025 and is predicted to be USD 83.2 billion in 2032, with a compound annual growth rate of about 1.02%. The fine jewellery, representing about 80% of the total market value, will still be the main source of revenue, but its growth will be restrained by high gold prices, wary luxury spending, and a bridal market that is still gradually recovering after the pandemic.

Lab-grown diamonds are expected to become more important in both high-end and mass-market brands. Their affordability, sustainable status, and quality that is getting better are very attractive to younger end users who want affordable luxury. Despite the fact that advertising and labeling laws will be very strict, this category is likely to grow gradually, thus redefining the positioning of fine jewellery. At the same time, iconic collections of brands like Tiffany & Co. and Cartier will still be used to anchor brand value and differentiation.

Costume jewellery will perform better in terms of volume than fine jewellery due to affordability and keeping up with the current trends. The brands like Kendra Scott, Pandora, and Swarovski enjoy the advantages of social media presence, partnerships, and fashion-driven ideas like stacking, charms, and personalization. This is in line with the Generation Z tastes of expressive and affordable styles.

retail offline, which constitutes about 65% of all sales, will continue to dominate, with high-value jewellery continuing to be favoured in brick-and-mortar stores. However, the stores are changing with immersive layouts, visual merchandising, and services like engraving. The diversification of the category will also be supported by the increasing interest in men jewellery and unisex designs due to the changes in fashion and the impact of celebrities.

US Jewellery Market Growth DriverRising inflation and cautious consumer budgets reshape jewellery demand

Inflation and tight household budgets continue to influence jewellery demand in the US. The U.S. Bureau of Labor Statistics reported that the end user Price Index increased 2.9% in December 2023 to December 2024. The increasing prices of food, utility and housing are still limiting discretionary spending, including fine jewellery.

At the same time, the bridal segment is still less hard than it was before the pandemic because engagements and marriages are slowly recovering. This has decreased the demand of high-value engagement rings, which has traditionally been a main source of fine jewellery sales. Most end users delay buying or switch to cheaper products, thus maintaining the demand at a low level. Other discretionary income competitors like travel and entertainment also pose a threat to jewellery spending.

US Jewellery Market ChallengeCompetitive pressure from retail online and lower-cost alternatives compress jewellery ASPs

The market is increasingly constrained by intensifying competition from online sales channels and the growing availability of lower-priced jewellery alternatives.The U.S. Census Bureau estimates that retail online contributed to about 16.3% of all retail sales in the second quarter of 2025, indicating a further transition to online shopping. Online platforms enable price comparison and heighten competition with costume jewellery and low-end brands.

The cheaper materials and lab-grown diamonds allow the competitors to cut the prices of the traditional fine jewellery. Meanwhile, inflation increases the cost of labor, logistics, and materials, which narrows margins. Retailers have the option of increasing prices and losing demand, or absorbing costs and undermining profitability. This online competition and pricing pressure combination restricts strong value development of fine jewellery.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Jewellery Market TrendGrowth of lab-grown diamonds and shift toward accessible, fashion-led jewellery

The jewellery market is witnessing a significant shift marked by the rising adoption of lab-grown diamonds and the expansion of more affordable jewellery collections.According to trade classification information under HS code 7105, there are increasing global movements of synthetic diamonds, which indicates their growing importance in jewellery production. Lab-grown stones are becoming more popular among brands as a way to provide high-quality jewellery at a lower cost.

At the same time, end users are moving away in considering jewellery as a symbol of status or long-term investment to fashion-driven self-expression. Stacking styles, costume jewellery and trend-driven designs are becoming increasingly popular, particularly among younger and cost-conscious end users. This trend favours expansion in accessible, fashion-focused jewellery as opposed to heritage luxury jewellery.

US Jewellery Market OpportunityEnhanced retail experience and lab-grown assortments can regain appeal and broaden reach

The jewellery brands can re-accelerate by enhancing physical retail experiences and increasing lab-grown collections. Since much of the jewellery value sales is still done offline, immersive store experiences, including custom gifting areas, in-store engraving, and curated displays, can reinforce emotional appeal over price competition.

Another opportunity is lab-grown diamonds. With the increase in technology and the growth of acceptance, both price-sensitive and environmentally conscious end users can be drawn to the transparent and sustainability-positioned lab-grown collections. Experiential retail with easily available, ethically positioned products provides a solid avenue through which brands can expand their end user base by 2032.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery is the largest category, accounting for about 80% of the US jewellery market. Its dominance reflects cultural preference for gold and certified diamonds as symbols of value and longevity. According to U.S. Bureau of Economic Analysis, discretionary spending slowed in 2023–24 as households prioritised essentials, limiting premium growth, yet fine jewellery retained its leading role.

From 2026–2032, fine jewellery will continue to dominate as inflation cools and purchasing power gradually improves. U.S. Federal Reserve data shows easing inflation through 2024, supporting recovery in discretionary categories. Lab-grown diamonds will help broaden fine jewellery’s appeal by offering lower entry prices, sustaining its leadership.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline holds around 65% of total jewellery sales in the US. Physical stores remain critical because end users prefer in-person evaluation, certification checks, and personalised consultation for high-value purchases. U.S. Census Bureau retail surveys show jewellery store sales exceeding USD 33 billion in recent years, highlighting the importance of brick-and-mortar formats.

From 2026–2032, retail offline will remain the leading channel as trust in physical inspection stays strong. IMF projections of steady US economic growth support stable retail footfall. While online and social commerce will expand—especially for costume jewellery—fine jewellery will remain anchored to physical stores due to authentication needs, ensuring offline dominance through the forecast period.

List of Companies Covered in US Jewellery Market

The companies listed below are highly influential in the US jewellery market, with a significant market share and a strong impact on industry developments.

- Swarovski AG

- Claire's Stores Inc

- Piaget SA

- LVMH Moët Hennessy Louis Vuitton Inc

- Cartier International Inc

- Pandora A/S

- Van Cleef & Arpels Inc

- Chanel USA Inc

- Harry Winston Inc

- Bulgari SpA

Competitive Landscape

The US jewellery market remained highly fragmented, with competition shaped by shifting consumer priorities, weakened demand for fine jewellery, and rising appeal of lab-grown diamonds. Luxury leaders such as Tiffany & Co, Cartier, and Harry Winston focused heavily on strengthening iconic collections, using design innovation and selective price increases to preserve brand equity as lab-grown alternatives pressured unit prices and challenged traditional value perceptions. In costume jewellery, Pandora and Kendra Scott accelerated brand-building efforts through social-media virality, Target shop-in-shops, and celebrity collaborations, capturing cautious spenders seeking trend-led, affordable options. Players such as Swarovski and emerging online-first brands gained traction as consumers embraced accessible styles through Amazon, Temu and Shein. Meanwhile, lab-grown-focused brands including Brilliant Earth intensified competition by offering engagement and fashion pieces at lower price points, reshaping fine jewellery dynamics. As men’s jewellery and unisex designs gained relevance, the competitive field broadened further, reinforcing a diverse and rapidly evolving landscape.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Jewellery Market Policies, Regulations, and Standards

4. US Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. US Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. US Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.LVMH Moët Hennessy Louis Vuitton Inc

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Cartier International Inc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Pandora A/S

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Van Cleef & Arpels Inc

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Chanel USA Inc

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Swarovski AG

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Claire's Stores Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Piaget SA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Harry Winston Inc

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Bulgari SpA

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.