UK Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), By Nature (Disposable, Reusable), By Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

UK Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

- Menstrual care in UK is estimated at USD 625 million in 2025.

- The market size is expected to grow to USD 670 million by 2032.

- Market to register a cagr of around 1% during 2026-32.

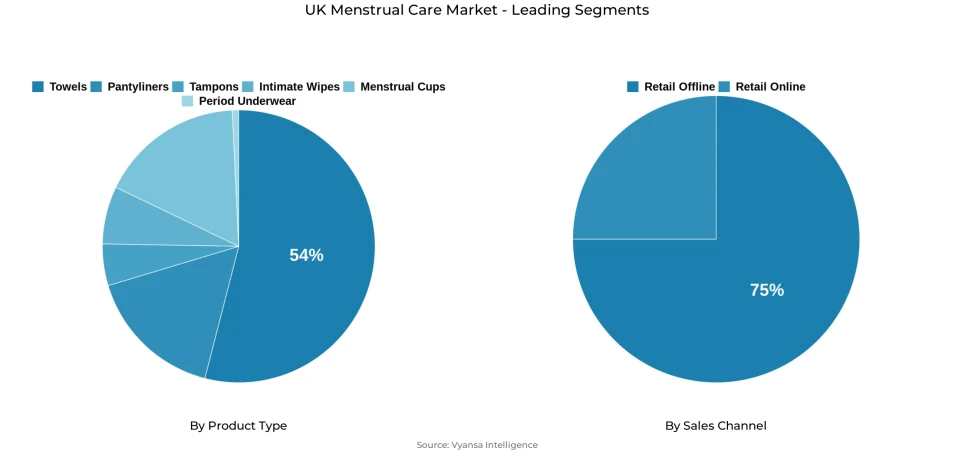

- Product Type Shares

- Towels grabbed market share of 54%.

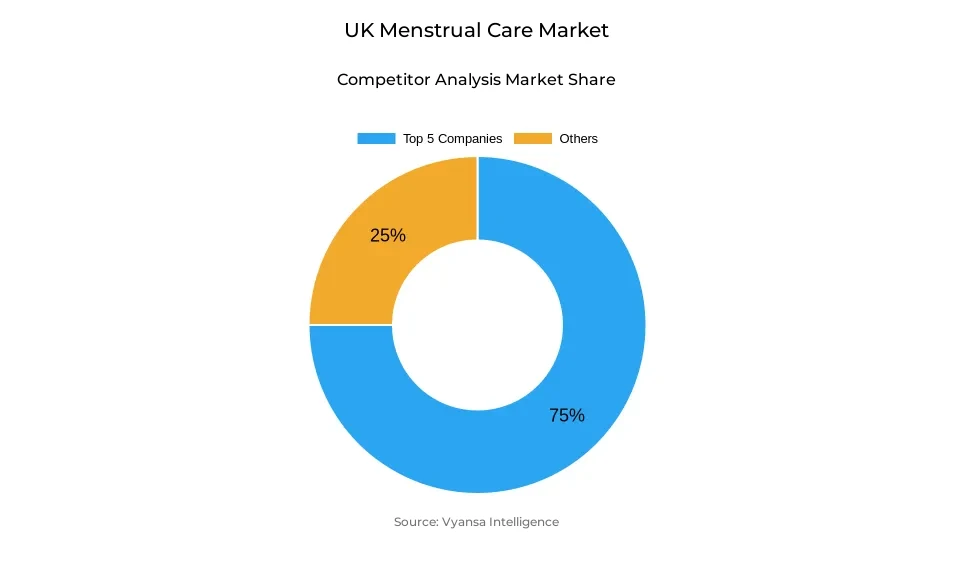

- Competition

- More than 10 companies are actively engaged in producing menstrual care in UK.

- Top 5 companies acquired around 75% of the market share.

- J Sainsbury Plc; Kimberly-Clark Holding Ltd; Asda Stores Ltd; Procter & Gamble UK Ltd; Essity AB etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

UK Menstrual Care Market Outlook

The UK menstrual care market is projected to grow to USD 625 million in 2025 and is expected to grow to about USD 670 million in 2032 with a relatively low compound annual growth rat of about 1% over the forecast period of 2026–2032. Towels, which occupy 54% of the market, will continue to be the biggest product category, with their popularity among end user, their reliability nature, and convenience of operation. The slim, thin, and ultra-thin towel designs with wing features will remain in the growth due to their low profile of fit, comfort features, and high protection features, which attract a wide end user demographic base. Pantyliners are also expected to maintain consistent demand patterns, as they are used together with complementary products or to maintain freshness on a daily basis.

Distribution infrastructure is dominated by retail offline channels, which control about 75% of the market volume. The formats of health and beauty specialists, supermarket operations, and hypermarket establishments are still important points of purchase, which offer convenient procurement, product diversity, and competitive pricing systems. Even though retail online channels have a lower market share percentage, they are still enjoying a consistent growth as end user populations are valuing convenience features, discrete delivery procedures, and subscription services. Online platforms also offer the possibility of smaller and niche brand entities to access end user populations directly, especially when it comes to eco-conscious or high-end product offerings.

The growth drivers are likely to be sustainability and premiumisation during the forecast period. It is expected that end user interest in environmentally friendly products, such as organic or biodegradable material compositions, will continue to grow. The major brand players will also be seeking innovation in terms of sustainable design structures, better comfort functions, and multifunctional integration to suit the changing end user demands and distinguish their products in a competitive and mature market environment.

The increased use of reusable products, such as menstrual cups and period underwear, will affect the market dynamics, prompting the established brand players to consider the sustainable practices as part of their product portfolio. Although this is an evolutionary trend, the disposable products will remain highly relevant in the market, especially towels and pantyliners, as hygiene products. The UK menstrual care market, in general, is set to experience stable growth, as the demand continuity, the momentum of product innovation, and the growing awareness of sustainable product alternatives drive its growth.

UK Menstrual Care Market Growth DriverRising Unit Prices and Growing Consumer Base

The UK Menstrual Care Market is driven by the upward unit price trends and a continuously growing end user population base. Although inflationary pressures have been moderated, manufacturing entities are still adopting price adjustment strategies that are indicative of high production cost structures. This pricing strategy maintains value addition in the category, especially to well established brand entities such as Always and Tampax, which still have a trusted positioning among the local end user groups.

Moreover, the regularity of the demand of the necessary menstrual products guarantees the stability of the market. The trend towards slim, thin and ultra-thin towel designs, valued by comfort features and discrete fit features, and the growing use of pantyliners during monthly cycles, supports consistent sales results. The UK Office of National Statistics reported that inflation was at an average of 2.6% in 2024, which has been lower than the previous high rates. These core drivers allow brand entities to sustain profitability trends and to support changing end user needs of both comfort addition and functional delivery.

UK Menstrual Care Market ChallengeHigh Market Consolidation and Entry Barriers

The UK Menstrual Care Market is faced with the challenge of a high level of market consolidation and maturity. Established brand players control end user selection due to their reputation equity of trust, which poses a major obstacle to new or niche market entrants who want to gain a significant market share. The orientation of end user preference to well-established products is especially strong due to the fact that menstrual care is a sensitive and necessary category that demands high levels of hygiene maintenance, health protection, and material quality.

Moreover, large market players will be able to invest heavily in product development and specific offering development to eco-conscious or price-sensitive end user groups, which will further strengthen their competitive advantage. World Bank statistics indicate that the UK has a total female population of around 34.5 million in 2024, which is about 50.8% of the total population, thus offering a large end user demographic base. This large base of demographics, which is enhanced by the established positioning of the brand entities, poses a daunting entry barrier. This competitive landscape limits the opportunities of smaller brand players, creating structural barriers to market growth and balancing diversity in product offerings.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UK Menstrual Care Market TrendShift Toward Sustainability and Eco-Friendly Products

Rising end user preference for sustainable and environmentally friendly products is emerging as a defining trend in the UK Menstrual Care Market. Brand organizations like Flo have experienced market penetration with their biodegradable and organic cotton products, which is a larger societal shift towards environmental accountability. The concept of premiumisation and sustainability is also playing a growing role in the purchasing decision models as end user are demanding products that match their own value systems and priorities in environmental concerns.

The trend path is also supported by the rise of online retail infrastructure, which allows eco-oriented and niche brand organizations to access end user groups in a convenient manner. Empirical studies have shown that a large percentage of end user, especially younger demographic groups, consider environmental sustainability as a factor when choosing menstrual products. By marketing eco-friendly attributes and practical benefit provision, brand entities can attract responsible end user groups, making sustainability a market driver that is driving across the UK menstrual care market.

UK Menstrual Care Market OpportunityRetail Online Expansion for Smaller and Niche Brands

The UK Menstrual Care Market has a significant growth potential in terms of expansion of retail online platforms. The online retail infrastructure allows smaller and niche brand organizations to build direct end user relationships without relying on the traditional retail distribution network structures. Implementations of subscription-based models and promotional discounts strategies stimulate repeat purchase behaviors, which underpin brand loyalty consolidation and incremental sales growth paths.

Since convenience and accessibility continue to be key factors that define end user populations, retail online platforms offer strategic opportunities to newer market entrants to distinguish themselves based on sustainability positioning, innovation provision, or feature integration. The UK Office for National Statistics estimates that online retail contributed about 27–30% of all retail sales in 2024–2025, which shows the potential reach and scalability nature of digital platforms to niche brand organizations. The online expansion will help these brands to overcome the traditional distribution limitations and leverage on the end user preferences of using the digital shopping channels.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UK Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

Towels constitute the dominant segment within the product, commanding approximately 54% of the UK menstrual care market share. Towels retain their leadership positioning attributable to their comfort attributes, discreet fit characteristics, and functional performance delivery, establishing them as the preferred choice among female end user across age demographic groups. Slim, thin, and ultra-thin towel configurations, particularly those incorporating wing features, are highly valued for their secure fit assurance and enhanced protection capabilities. Continuous innovation by leading brand entities, encompassing improvements in absorbency performance, flexibility characteristics, and eco-friendly material integration, facilitates end user trust maintenance and supports ongoing value growth trajectories.

Despite the ascending popularity of pantyliners and reusable alternative products, towels maintain dominant category positioning in both value and volume metrics. Their comprehensive acceptance, consistent performance reliability, and premium variant offerings targeting comfort optimization and sustainability integration ensure towels will continue functioning as the primary product type throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels maintain dominant positioning within the sales channel segmentation, representing approximately 75% of the UK menstrual care market. Health and beauty specialist formats, supermarket operations, and pharmacy establishments dominate this distribution channel, offering end user the convenience of immediate product access and comprehensive selection portfolios of trusted brand entities including Always and Tampax. Retail offline infrastructure benefits from robust end user loyalty dynamics, with shopper populations appreciating the capability to physically compare product alternatives, access in-store promotional activities, and execute expedient purchase transactions.

Investment in retail offline infrastructure remains a strategic priority for manufacturing entities, ensuring products sustain visibility and comprehensive availability. Promotional campaign deployment, strategic product placement optimization, and accessibility across multiple retail outlet formats reinforce retail offline channel dominance, establishing it as the principal channel for menstrual care purchases throughout the forecast period.

List of Companies Covered in UK Menstrual Care Market

The companies listed below are highly influential in the UK menstrual care market, with a significant market share and a strong impact on industry developments.

- J Sainsbury Plc

- Kimberly-Clark Holding Ltd

- Asda Stores Ltd

- Procter & Gamble UK Ltd

- Essity AB

- Lil-Lets UK Ltd

- Johnson & Johnson Ltd

- Tesco Plc

- Wm Morrison Supermarkets Plc

- Superdrug Stores Plc

Competitive Landscape

The UK menstrual care market is led by Procter & Gamble through its Always and Tampax brands, supported by strong distribution, high consumer trust, and ongoing product innovation such as slim, thin, and ultra-thin towels with wings, while Essity AB recorded the fastest value growth driven by premium and sustainable ranges despite only modest gains in overall share; at the same time, private label and value-oriented brands strengthened their presence among price-sensitive end users, niche sustainable players such as Flo expanded via online platforms and selected retail chains to reach eco-conscious buyers, and e-commerce continued to intensify competition by enabling direct-to-end-user models, subscriptions, and convenience-focused offerings alongside traditional channels including health and beauty stores, supermarkets, and discounters.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Menstrual Care Market Policies, Regulations, and Standards

4. UK Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. UK Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UK Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UK Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UK Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. UK Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. UK Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble UK Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Essity AB

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Lil Lets Uk Ltd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Johnson & Johnson Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Tesco Plc

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. J Sainsbury Plc

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Kimberly-Clark Holding Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Asda Stores Ltd

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Wm Morrison Supermarkets Plc

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Superdrug Stores Plc

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.