UK Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

UK Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

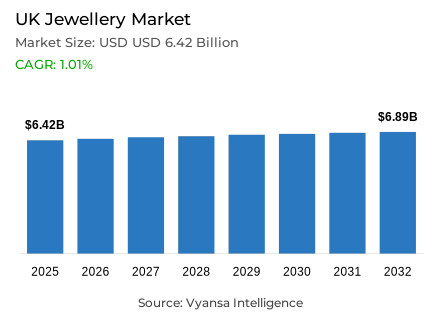

- Jewellery in UK is estimated at USD 6.42 billion in 2025.

- The market size is expected to grow to USD 6.89 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Category Shares

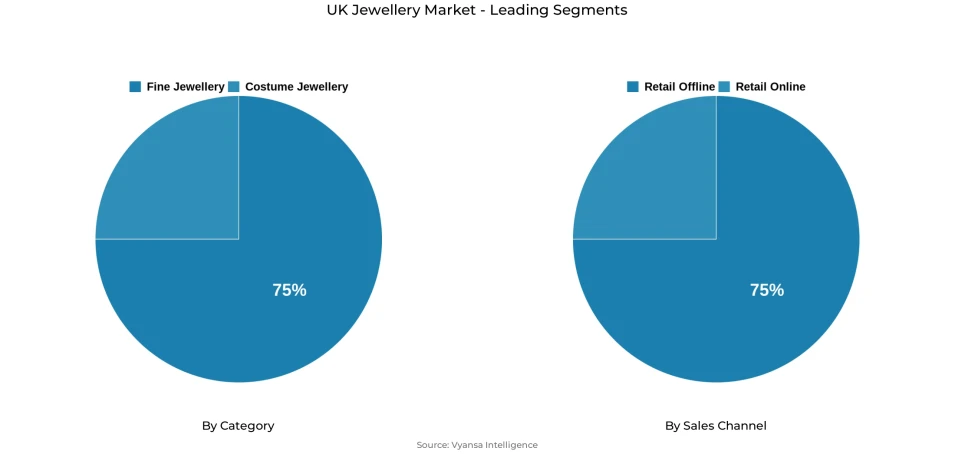

- Fine jewellery grabbed market share of 75%.

- Competition

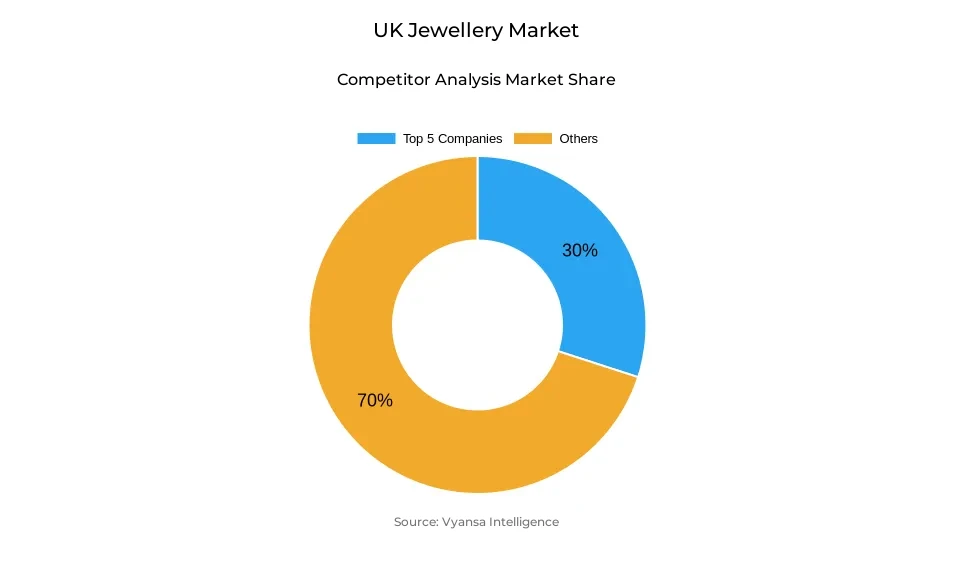

- More than 20 companies are actively engaged in producing jewellery in UK.

- Top 5 companies acquired around 30% of the market share.

- Monsoon Accessorize Ltd; Claire's Accessories UK Ltd; Bulgari UK Ltd; Pandora Jewellery UK Ltd; Cartier Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

UK Jewellery Market Outlook

The UK jewellery market is expected to record a slow but consistent recovery in the years 2026 to 2032 as the economic pressures are expected to reduce gradually and end user confidence is expected to rise. The market is estimated to be USD 6.42 bn in 2025 and USD 6.89 bn in 2032 with a compound annual growth rate of about 1.01%. After a few years of prudent spending due to high cost of living and rising prices of precious metals, the end users will start making discretionary purchases, but with a low value growth since affordability still prevails in the buying decision.

Fine jewellery, which comprises about 75% of total market value, will continue to dominate, but will grow at a modest rate because of the high production costs, stricter diamond traceability policies, and persistent upheavals in global diamond supply chains. Russian diamond sanctions have increased compliance costs, which have led brands to strengthen certification and transparency frameworks. These pressures can slowly create interest in lab-grown diamonds, but it will be adopted more broadly with more transparent advertising laws and long-term end user confidence.

It is expected that costume jewellery will perform better than fine jewellery in terms of volume, as younger, price-sensitive end users seek trend-driven, personalised designs. Charms, engraving, and mix-and-match ideas are quite consistent with the self-expression and low-cost preferences of Generation Z.

retail offline, with a market share of about 75%, will continue to be the core of high-value purchases, whereas online and social commerce are expected to grow at a high rate. Social media platforms like Tik Tok Shop and Instagram Shop will become influential as Generation Z influences purchasing behaviour. Those brands that invest in sustainability, traceability, craftsmanship, and strong digital interaction will be in the best position to grow by 2032.

UK Jewellery Market Growth DriverWeak Consumer Spending and High Precious Metal Prices Restrain Fine Jewellery Purchases

The fine jewellery market in the UK is influenced by restrained end user spending, which continues to limit overall demand growth. The Office for National Statistics (ONS) reported that real household disposable income rose by only 0.8% in 2023, which is one of the poorest gains in recent years. At the same time, inflation, though declining, was still high at approximately 4.0% in January 2024, as reported by the Bank of England, and it still strains discretionary budgets.

Gold prices have also been sharply increasing, with the data of the London Bullion Market showing that in 2024, the price of gold will grow by about 15% per year. The increased cost of raw-materials, logistics and production has pushed the retail prices upwards, reducing the affordability of fine jewellery by value-conscious households. This climate makes the price inflation itself a major force that influences the demand trends, restricting the volumes of the fine jewellery and shifting the focus of the end users to the less expensive options.

UK Jewellery Market ChallengeStricter Advertising Oversight Creates Compliance Pressure for Lab-Grown Diamond Brands

Lab-grown diamond brands are encountering increasing regulatory oversight and compliance pressures within the UK market. In 2024, the Advertising Standards Authority decided that SkyDiamond had violated advertising regulations by not explicitly stating that its stones were synthetic. The Competition and Markets Authority has also provided guidance that requires clear application of the lab-grown terminology to prevent misleading claims.

With the growing acceptance of lab-grown diamonds in the mainstream market by price-sensitive end users, the need to disclose information accurately has increased. Compliance costs and reputational risk to brands like Pandora, Swarovski, and Kimai increase with enforcement actions as they grow lab-grown lines. Takedowns, fines, and end user mistrust are real threats, and regulatory compliance is one of the most important structural issues of this segment.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UK Jewellery Market TrendG7 Diamond Sanctions Increase Focus on Traceability and Ethical Sourcing

The concept of traceability has become a trend in the wake of new geopolitical regulations. The G7 declared that diamonds over 0.50 carats into the UK and the European Union would be required to be certified as originating in March 2025, specifically Russian-origin stones. According to UN Comtrade statistics, Russia is the source of approximately 30% of the world rough diamond production, which highlights the magnitude of the supply shock.

These laws force jewellers to record sourcing in a more stringent manner, which increases the cost and complexity of operations. At the same time, end users are becoming more and more demanding of evidence of ethical and conflict-free sourcing. This climate increases the appeal of traceable alternatives, such as lab-grown diamonds and ethically certified natural stones, making transparency not only a legal requirement but also a competitive edge.

UK Jewellery Market OpportunityPersonalisation and Affordable Luxury Strengthen Growth in Costume Jewellery

The costume jewellery market presents favorable growth potential as end users increasingly prioritize affordable luxury over high-priced discretionary items. According to the UK Office for National Statistics, spending on lower-priced accessories and clothing rose by 2.8% in 2024, while expenditure across luxury discretionary categories recorded a decline. As the price of gold increases by about 15% annually in 2024, costume jewellery will be more appealing to cost-sensitive end users.

Generation Z also enhances this opportunity. According to HM Treasury statistics, Generation Z will constitute approximately 30% of the discretionary spending power in the UK by 2030. This group of people favours customised jewellery, engraving, charms, and fashion-driven designs. Cost-effective customisation enables brands to meet these preferences without charging a high price, making costume jewellery the main driver of growth during the forecast period.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UK Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery is the largest category, accounting for about 75% of the UK jewellery market. This dominance reflects cultural preference for precious metals and diamonds as long-term value assets. ONS commodity data shows gold prices rose sharply in 2023–24, increasing fine jewellery prices but not eliminating demand.

From 2026–2032, fine jewellery will retain leadership as inflation stabilises. Bank of England data shows inflation fell to 2% in May 2024, gradually improving purchasing power. Expanded traceability rules under G7 diamond sanctions will further reinforce trust in certified fine jewellery, supporting its long-term dominance.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline holds about 75% of UK jewellery sales. Physical stores remain essential for authentication, certification checks, and personalised consultation, especially amid concerns over counterfeits. Enforcement by the UK Intellectual Property Office against counterfeit goods reinforces reliance on trusted brick-and-mortar outlets.

Over 2026–2032, retail offline will remain dominant as fine jewellery buyers continue to value secure, in-person purchasing. As economic conditions stabilise, store footfall is expected to improve. IMF projections of gradual UK economic growth from 2025 support recovery in discretionary spending. While social commerce will grow rapidly for costume jewellery, high-value fine jewellery will remain anchored to offline channels, ensuring their leading role through the forecast period.

List of Companies Covered in UK Jewellery Market

The companies listed below are highly influential in the UK jewellery market, with a significant market share and a strong impact on industry developments.

- Monsoon Accessorize Ltd

- Claire's Accessories UK Ltd

- Bulgari UK Ltd

- Pandora Jewellery UK Ltd

- Cartier Ltd

- Tiffany & Co Ltd

- Swarovski UK Ltd

- De Beers UK Ltd

- Monica Vinader Ltd

- Goldsmiths Group Plc

Competitive Landscape

The UK jewellery market in 2025 remained highly fragmented, with Pandora Jewellery UK Ltd and Cartier Ltd holding the only double-digit shares across costume and fine jewellery respectively. Pandora continued to benefit from strong demand for affordable, customisable pieces, while Cartier sustained its leadership in fine jewellery despite weakened discretionary spending and rising gold prices. Competition intensified as sustainably positioned and cost-conscious brands targeted younger, value-driven consumers, expanding choices across demi-fine and personalised offerings. Lab-grown diamond specialists such as Kimaï gained visibility through investment and media exposure, even as the segment faced regulatory scrutiny and fluctuating market positioning. Independent designers and emerging labels also played a growing role, leveraging craftsmanship, bespoke services, and influencer collaborations to attract consumers seeking differentiated designs. This mix of luxury houses, mid-range brands, and agile newcomers reinforced the UK’s highly diverse and competitive jewellery landscape.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Jewellery Market Policies, Regulations, and Standards

4. UK Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. UK Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. UK Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Pandora Jewellery UK Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Cartier Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Tiffany & Co Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Swarovski UK Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.De Beers UK Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Monsoon Accessorize Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Claire's Accessories UK Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Bulgari UK Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Monica Vinader Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Goldsmiths Group Plc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.