UAE Wearable Electronics Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Activity Wearables, Smart Wearables), By Application (Healthcare, Entertainment, Industrial, Others), By Sales Channel (Offline, Online)

|

Major Players

|

UAE Wearable Electronics Market Statistics, 2025

- Market Size Statistics

- Wearable Electronics in UAE is estimated at $ 395 Million.

- The market size is expected to grow to $ 665 Million by 2030.

- Market to register a CAGR of around 9.07% during 2025-30.

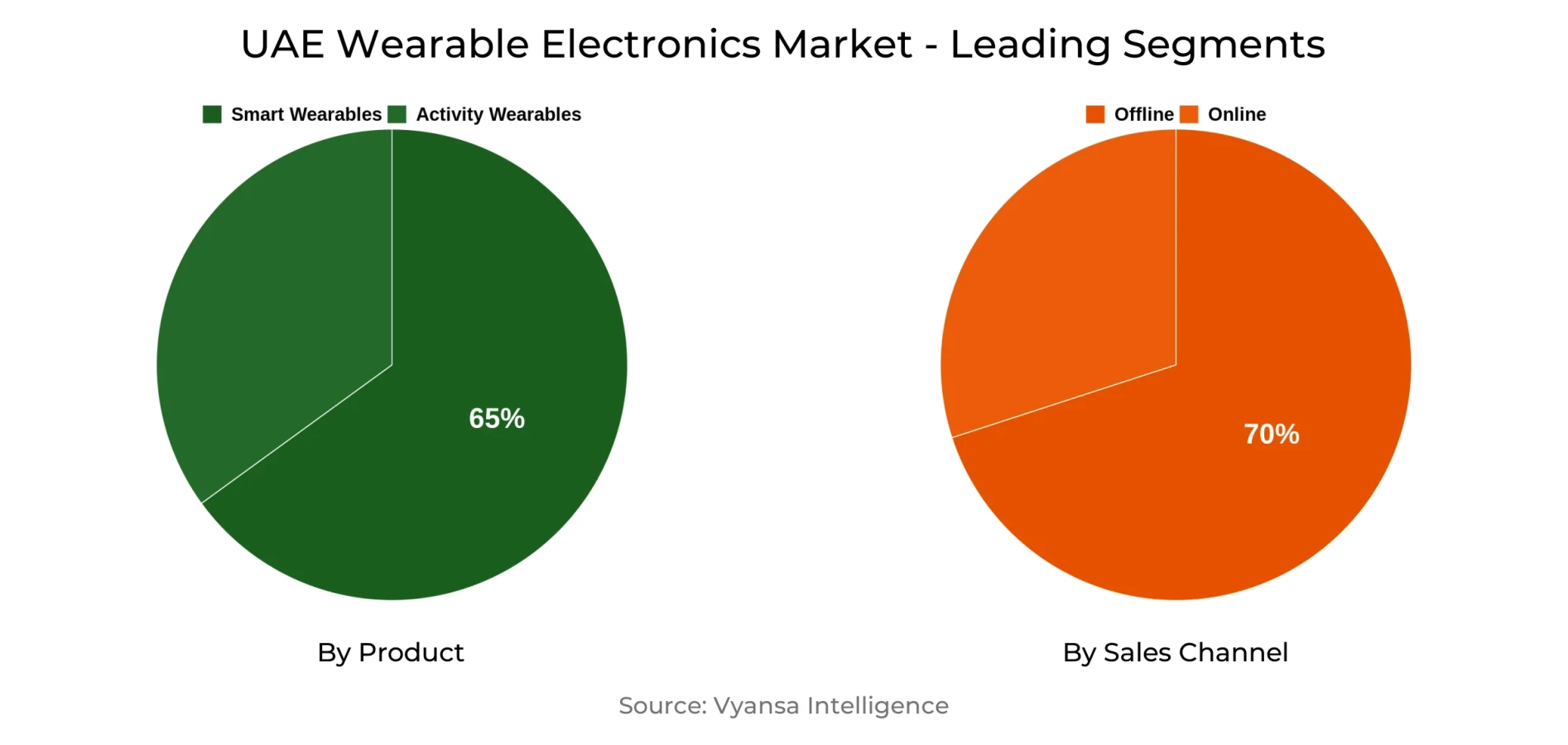

- Product Shares

- Smart Wearables grabbed market share of 65%.

- Smart Wearables to witness a volume CAGR of around 13.54%.

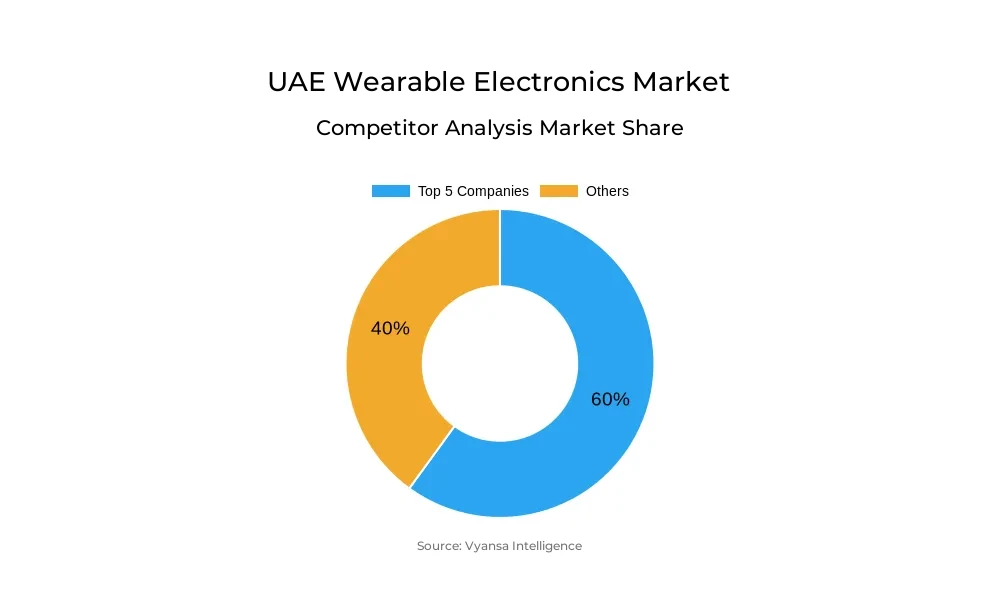

- Competition

- More than 10 companies are actively engaged in producing Wearable Electronics in UAE.

- Top 5 companies acquired 60% of the market share.

- Polar Electro Inc, Fossil Group Inc, Huawei Technologies Co Ltd, Samsung Gulf Electronics FZE, Fitbit Inc etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 70% of the market.

UAE Wearable Electronics Market Outlook

The UAE wearable electronics market will continue to grow steadily in 2025–30, as consumer demand for smartwatches and other feature-laden devices increases. As consumers lose interest in fitness trackers, demand for health monitoring, contactless payments, and smartphone connectivity through smartwatches increases. The trend shows that consumers' post-pandemic emphasis on health and well-being continues, with many consumers wearing wearable electronics to track their sleep, stress levels, and exercise.

As inflation affects consumer spending, shoppers are demonstrating a distinct inclination towards smart wearables that are mid-range or low-cost. The notion of "affordable indulgence" is taking hold, whereby consumers want functionality-laden devices at affordable prices. This has presented brands with the option to produce simpler versions of high-end models or emphasize cost-effective options in order to cater to increasing demand from value-driven customers. The emergence of "value hackers" who value functionality over luxury also testifies to this change in the purchasing patterns of consumers.

The market competition is changing with Chinese brands such as Xiaomi and Oppo capturing market share through delivering sophisticated features at a lower price. Although Samsung and Apple still enjoy strong brand dominance, expanding popularity of Chinese brands is expanding market choices and competition. AI-powered health monitoring and personal coaching features are also likely to shape customer decisions, but price will continue to be a determining factor in the face of economic constraints.

Finally, e-commerce is increasingly involved in distribution, providing convenience, greater choice, and usually better value. Nevertheless, physical stores remain significant, particularly when they offer a hands-on experience and expert staff. With online reviews carrying greater weight, brands will need to concentrate on digital trust-building in order to remain competitive in the changing UAE wearable electronics marketplace.

UAE Wearable Electronics Market Growth Driver

The pandemic has deeply influenced consumer behavior, particularly in health and wellness. Individuals are becoming more aware of their physical and mental health, prompting a boom in demand for intelligent wearables. The wearables are extensively utilized for fitness, sleep tracking, and stress levels. Fears surrounding unhealthy diets and sedentary lifestyles are also motivating consumers to embrace wearable electronics to remain ahead of their health objectives.

Moreover, the increasing adoption of contactless payment methods has driven up demand for wearables. As awareness of keeping oneself clean and the demand for secure payments increases, more consumers are opting to use smartwatches and other wearable technology to make payments. The trend is likely to continue to increase as greater numbers of consumers move to digital wallets for enhanced convenience and ease of use for daily purchases.

UAE Wearable Electronics Market Trend

One of the key trends driving the market for wearable electronics is the emergence of "value hackers" – consumers who are more interested in functional benefits than sophisticated or high-end features. This trend is compelling brands to expand their product offerings to meet the needs of both high-end and low-end users. The market is also witnessing high emphasis on profitability as opposed to volume share, leading players to position their products strategically on the basis of fundamental user requirements.

Meanwhile, AI-based integration for health monitoring and customized wellness coaching is becoming a big selling factor. Leaders in such initiatives will be likely to have a competitive edge. Inflation and general economic uncertainties can influence purchases in the near term, with most consumers opting for affordable choices. To adjust, participants might have to re-approach pricing strategies to make them accessible without diminishing essential functionalities.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Wearable Electronics Market Opportunity

The UAE wearable electronics market is observing a rising demand for cost-effective yet efficient devices, particularly with the continuing increase in inflation. Although demand is still high owing to the smartwatch boom, fundamental fitness trackers are being pushed aside more and more. People are increasingly interested in value-for-money offerings, and this is opening doors for manufacturers to launch pared-down versions of flagship products or increase their mid-range offerings. This transformation is driving the introduction of intelligent wearables that find favor with both tech-savvy customers and those shopping on a budget.

With the culture of spending becoming more conservative, the practice of "affordable indulgence" is gaining momentum. Mid-segment models that provide basic functionality at an affordable price will be in demand. Companies that specialize in providing affordable, feature-filled wearables will have an edge as increasing numbers of UAE consumers look for inexpensive alternatives without sacrificing functionality.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 395 Million |

| USD Value 2030 | $ 665 Million |

| CAGR 2025-2030 | 9.07% |

| Largest Category | Smart Wearables segment leads with 65% market share |

| Top Drivers | Rising Focus on Health & Digital Convenience Post Pandemic |

| Top Trends | Growing Preference for Functional and Affordable Devices |

| Top Opportunities | Rising Preference for Affordable Yet Feature-Rich Wearables |

| Key Players | Polar Electro Inc, Fossil Group Inc, Huawei Technologies Co Ltd, Samsung Gulf Electronics FZE, Fitbit Inc, Apple Inc, Xiaomi Corp, Garmin Ltd, Sony Middle East & Africa FZE, LG Electronics Gulf FZE and Others. |

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Wearable Electronics Market Segmentation Analysis

The most significant market share segment in the UAE Wearable Electronics Market for 2025-30 will be retail offline. Even with the increasing use of e-commerce, physical stores remain the most prominent, primarily because they can provide an experiential shopping experience. Displays in-store, information from knowledgeable staff, and the ability to try out and learn about product specifications firsthand provide consumers with more confidence in their purchases. These drivers maintain bricks-and-mortar retail very relevant, particularly for tech-based products such as wearables.

At the same time, e-commerce is quickly emerging as an important distribution channel, boosted by its convenience, wider product range, and competitive prices through reduced overhead expenses. With more customers shopping online, the significance of positive reviews online is growing, enabling brands to establish trust and drive purchasing decisions. However, to compete, offline retailers need to pay attention to providing personalized, engaging in-store experiences.

Top Companies in UAE Wearable Electronics Market

The top companies operating in the market include Polar Electro Inc, Fossil Group Inc, Huawei Technologies Co Ltd, Samsung Gulf Electronics FZE, Fitbit Inc, Apple Inc, Xiaomi Corp, Garmin Ltd, Sony Middle East & Africa FZE, LG Electronics Gulf FZE, etc., are the top players operating in the UAE Wearable Electronics Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Wearable Electronics Market Policies, Regulations, and Standards

4. UAE Wearable Electronics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Wearable Electronics Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Activity Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Activity Bands- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Activity Watch- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Analogue- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Digital- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Smart Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Eye Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Body Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Healthcare- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Entertainment- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Industrial- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Activity Wearable Electronics Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. UAE Smart Wearable Electronics Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Samsung Gulf Electronics FZE

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Fitbit Inc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Apple Inc

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Xiaomi Corp

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Garmin Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Polar Electro Inc

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Fossil Group Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Huawei Technologies Co Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Sony Middle East & Africa FZE

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. LG Electronics Gulf FZE

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.