UAE Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), By Nature (Disposable, Reusable), By Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

UAE Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

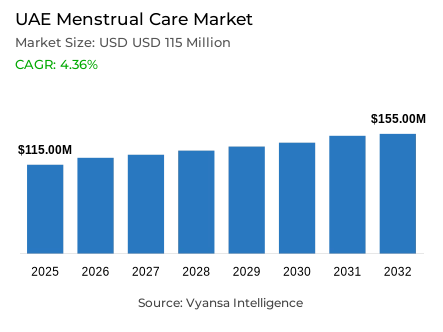

- Menstrual care in UAE is estimated at USD 115 million in 2025.

- The market size is expected to grow to USD 155 million by 2032.

- Market to register a cagr of around 4.36% during 2026-32.

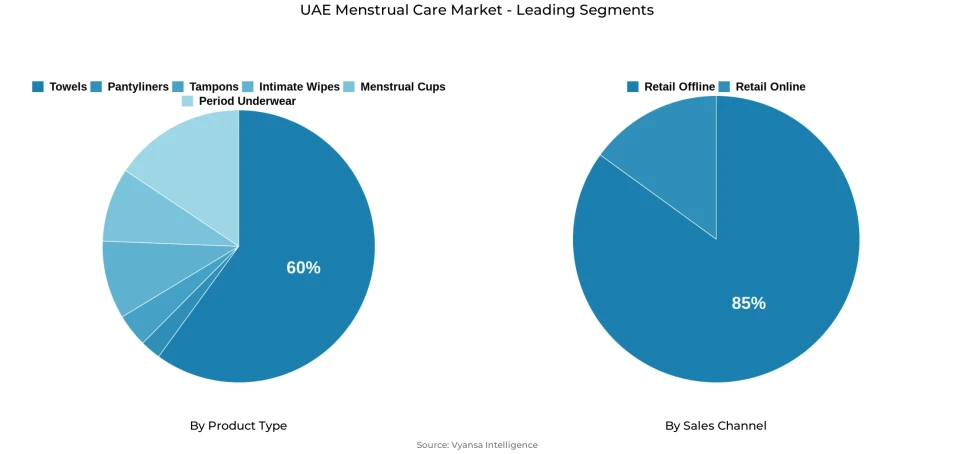

- Product Type Shares

- Towels grabbed market share of 60%.

- Competition

- More than 5 companies are actively engaged in producing menstrual care in UAE.

- Top 5 companies acquired around 85% of the market share.

- Johnson & Johnson Middle East FZ-LLC; National Paper Products Co.; Essity AB; Procter & Gamble Gulf FZE; Olayan Kimberly-Clark Arabia Co. etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

UAE Menstrual Care Market Outlook

The UAE menstrual care market is expected to exhibit a sustained growth, with a market valuation of USD 115 million in 2025 to USD 155 million in 2032, with a compound annual growth rate of about 4.36% in the forecast period of 2026–2032. The necessity of menstrual products will facilitate growth trends, despite the sensitivity of end user groups to price changes. Towels will remain the market leader with a market share of 60% due to their high usage habits and presence, especially wing-shaped designs that have better protection and comfort features. Slim, thin and ultra-thin towels will continue to be the most vibrant sub-segment in towels, as end user show preference to lightweight and discreet towels that fit the daily routine needs.

The issue of affordability will significantly influence the behavioural patterns of purchasing during the outlook period. Inflation is expected to stabilise, but end user populations will still pursue the best value propositions, which will favour demand of the portfolios of the private-label and value brands. At the same time, retail value metrics will be steadily increasing, which can be explained by the continuity of demand and the gradual increase in the sets of product features. Pantyliners and tampons will also have healthy growth curves, and reusable and cup-based products will have a slow growth curve in younger and environmentally conscious end user groups that are interested in long-term cost savings and sustainability advantages.

Sustainability will become a strategic necessity to manufacturing entities. Brand organisations will invest in biodegradable packaging, chlorine-free production processes, and plant-based or organic material compositions. Even though organic and reusable menstrual products are currently at low market penetration rates, their availability is expected to grow as brand entities continue to add product range portfolios to support the rising popularity of eco-friendly options. Period underwear and menstrual cups will keep on disrupting the conventional product formats especially in the demographics of educated and environmentally conscious end user.

retail offline channels will continue to be the main distribution infrastructure, with about 85% of sales volume, driven by the power of hypermarket formats and physical store networks. Nevertheless, retail retail online platforms will see a faster increase, which will be backed by the implementation of subscription models, promotional offers in the form of bundles, and price reduction policies. High-end product lines, such as organic cotton towels and high-performance menstrual cup designs, will grow in high-income end user groups, which will show readiness to pay premium prices to improve comfort, performance, and sustainability features, which will contribute to the sustainability of market growth in the long term.

UAE Menstrual Care Market Growth DriverGrowing Health Awareness and Personal Care Prioritisation

The growing health awareness of the female population groups in the United Arab Emirates is pushing the demand of menstrual care products that focus on optimising comfort, providing hygienic assurance, and dermal protection. end user are increasingly appreciating products that prevent irritation, provide high absorbency performance, and meet personal needs, such as differences in flow intensity and activity level. Empirical data show that menstrual discomfort is a significant percentage of women; research indicates that 15–35% of women across the globe skip daily activities because of menstrual-related problems, which highlights the need to develop better menstrual products and increase awareness.

This emphasis on individual care has led brand entities to be innovative and personalise their products. Period underwear, menstrual cups, and reusable pad alternatives have become popular among younger demographic groups that want long-term health advantages and increased comfort. The major market players, such as Procter and Gamble Gulf FZE and Olayan Kimberly-Clark Arabia Co, have diversified their product line portfolios to include the integration of features like antibacterial layers and flexible absorbent core technologies, which have increased the functional performance and brand loyalty in an increasing market segment.

UAE Menstrual Care Market ChallengeInflation and Price Sensitivity Limit Consumer Spending

The macroeconomic situation in the UAE still influences the end user behavioural pattern, especially in the allocation of expenditure on menstrual care. As per the World Bank and the Central Bank of the UAE statistics, the inflation rate in 2024 was between 1.6 and 2.3, which affected the purchasing behavior and retail pricing policies. Despite the fact that the inflation rates are relatively moderate in comparison with the global standards, household budgets are still aware of discretionary spending on personal care merchandise.

The younger end user groups and price-sensitive household segments are particularly sensitive to price, which has led to a shift towards value-based and own-label products. The retail organizations are reacting by implementing promotional campaigns, bundling offering structures, and discounting mechanisms to strike a balance between affordability goals and profitability sustainability. The core product lines such as towels and pantyliners have consistent demand patterns, but the competition is more intense in terms of pricing systems and perceived value propositions in this market segment.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Menstrual Care Market TrendShift Towards Eco-Friendly Products Gains Momentum

The concept of sustainability is an increasingly significant factor in the purchasing behavior of menstrual care in the UAE market environment. end user studies show that around 60–70% of end user in the global market are more inclined to buy products with lower environmental impact profiles, which is especially high among younger and wealthier demographic groups. The interest in sustainable hygiene products is enhanced by social media campaigns and awareness programmes driven by the changing end user preferences and corporate environmental commitment frameworks.

Established brand players are exploring biodegradable packaging options and plant-based formulations of sanitary products, and new startup businesses are providing reusable alternatives, such as menstrual cups and washable pad products, to reduce the amount of waste produced. This sustainability orientation facilitates product differentiation capacities and fosters innovation momentum throughout the market environment, which is in line with growing international and regional environmental efforts and changing end user demands.

UAE Menstrual Care Market OpportunityPremium Segments to Drive Growth

High-quality menstrual care products with a focus on comfort optimisation, performance improvement, and sustainability integration have significant growth potential in the UAE market. Organic cotton towels, high-tech menstrual cup designs, and period underwear are gaining popularity among high-income and eco-conscious end user groups. UNICEF data shows that 90% of young women in the MENA region state that they have increased awareness of personal health and hygiene factors, which means that they are ready to spend money on high-quality product offerings.

Through providing high-quality absorption properties, ergonomic design structures, and sustainable material structures, brand entities can appeal to end user groups that demand increased comfort, reliability guarantees, and environmentally conscious options. Premium product ranges allow manufacturers to differentiate their products, set high price positioning, and build brand equity as they react to the increased focus on wellness and long-term value optimisation.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

Towels constitute the dominant segment within the product, commanding approximately 60% of the UAE menstrual care market share. Towels maintain their leadership positioning attributable to their convenience attributes, reliability characteristics, and comprehensive acceptance across diverse end user segments. Slim, thin, and ultra-thin towel configurations, particularly those incorporating wing features, represent the most preferred formats, offering enhanced comfort, fit optimization, and security assurance. These products appeal to female end user seeking discreet and functional protection for everyday usage, with manufacturers continuing to innovate through absorbent technology advancement, flexible design implementations, and eco-friendly material integration to accommodate evolving end user preferences.

Despite escalating interest in modern and reusable menstrual solutions, towels retain dominant positioning in both value and volume metrics. Their established end user trust foundation, combined with product innovations such as Always Zero Feel Sanitary Pads, ensures robust performance sustainability. Towels' broad accessibility and ongoing enhancements in comfort and sustainability attributes position this segment for steady growth throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels maintain dominant positioning within the sales channel segmentation, representing approximately 85% of the UAE menstrual care market. Hypermarket formats, supermarket operations, and drugstore establishments dominate this distribution channel, offering end user immediate product availability, comprehensive product selection portfolios, and trusted brand entities including Always and Kotex. Retail offline infrastructure continues to benefit from robust end user loyalty dynamics, as shopper populations demonstrate preference for the convenience of physical product examination, comparative option evaluation, and access to in-store promotional activities.

Manufacturers and retail entities are expected to maintain strategic investment in retail offline infrastructure, ensuring product visibility optimization and accessibility enhancement. The emphasis on convenience attributes, combined with promotional strategy deployment and comprehensive availability, reinforces the dominance of retail offline channels, establishing them as the primary distribution methodology for menstrual care purchases throughout the forecast period.

List of Companies Covered in UAE Menstrual Care Market

The companies listed below are highly influential in the UAE menstrual care market, with a significant market share and a strong impact on industry developments.

- Johnson & Johnson Middle East FZ-LLC

- National Paper Products Co.

- Essity AB

- Procter & Gamble Gulf FZE

- Olayan Kimberly-Clark Arabia Co.

- Paul Hartmann Middle East FZE

Competitive Landscape

The competitive landscape of the UAE menstrual care market is led by Procter & Gamble Gulf FZE, supported by the strong performance of its Always and Tampax brands. Always holds leadership in the slim, thin, and ultra-thin towel segment, strengthened by innovations such as Flex Foam technology and ultra-absorbent micro-pore structures that improve comfort, fit, and leak protection.Olayan Kimberly-Clark Arabia Co emerged as the most dynamic player in 2024, gaining market share through its Kotex brand across pantyliners and towels, backed by product enhancements and targeted marketing campaigns. Alongside major brands, private label and value-focused players expanded their presence by appealing to price-sensitive end users amid inflationary conditions. At the same time, eco-friendly alternatives such as menstrual cups and period underwear gained visibility among younger, environmentally aware groups, while e-commerce platforms intensified competition through convenience, bundled offerings, and subscription-based models.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Menstrual Care Market Policies, Regulations, and Standards

4. UAE Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. UAE Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UAE Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UAE Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UAE Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. UAE Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. UAE Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble Gulf FZE

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Olayan Kimberly-Clark Arabia Co

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Johnson & Johnson Middle East FZ-LLC

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. National Paper Products Co

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Essity AB

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Paul Hartmann Middle East FZE

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.