UAE Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

UAE Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

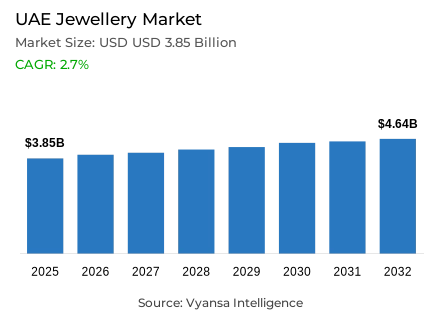

- Jewellery in UAE is estimated at USD 3.85 billion in 2025.

- The market size is expected to grow to USD 4.64 billion by 2032.

- Market to register a cagr of around 2.7% during 2026-32.

- Category Shares

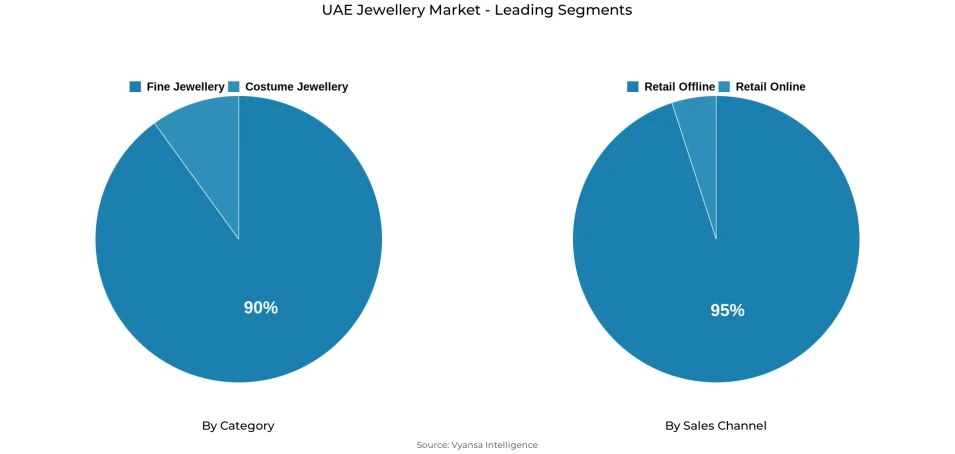

- Fine jewellery grabbed market share of 90%.

- Competition

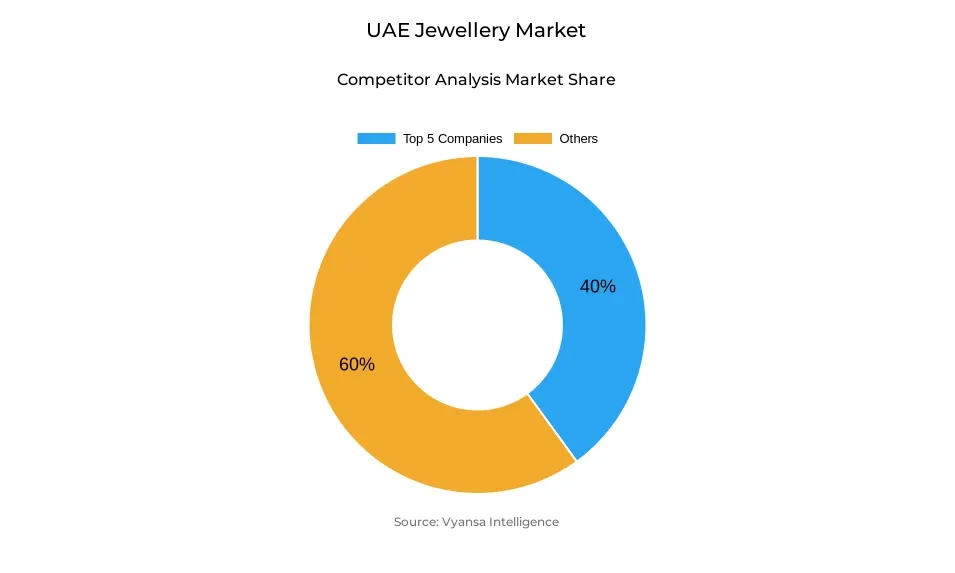

- More than 20 companies are actively engaged in producing jewellery in UAE.

- Top 5 companies acquired around 40% of the market share.

- Tiffany & Co; Pure Gold Group; Apparel Group; Damas LLC; Malabar Group etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

UAE Jewellery Market Outlook

It UAE jewellery market will grow strongly during the forcast period due to high demand by the high-income residents, rising tourism, and rising cultural importance in jewellery design. The market is estimated to be USD 3.85 billion in 2025 and is projected to grow to USD 4.64 billion in 2032, with a compound annual growth rate of about 2.7%. The continued government effort to combat counterfeiting, along with brand investments in authentication and blockchain-based tracking, is strengthening end user trust and long-term demand.

Fine jewellery is the market leader, holding approximately 90% of the market share, which is due to the high-income end user base of the UAE and the increasing number of high-net-worth individuals moving to or visiting the country. Weddings are also a significant source of demand, with recent civil marriage reforms attracting more expatriates and tourists to marry in the country, which has boosted the sales of engagement rings, wedding rings, and bridal jewellery. Global brands are increasingly using Arabic and Islamic-inspired designs, using AI-based design tools to be more creative and attractive to culturally aware end users.

The premium brands and regional leaders like Malabar Gold, Damas, and Cartier are growing with new retail formats, exclusive collections, and localized campaigns. The growing trend towards the purchase of luxury products in the country, as opposed to international markets, also contributes to the growth of the market, with brands prioritizing localisation and the design stories based on Arab identity. Lab-grown diamonds are still a niche market, with end users continuing to equate natural diamonds with luxury, tradition, and value over time.

Retail Offline, which makes about 95% of sales, will continue to be the most popular channel because end users prefer face-to-face verification, consultation and luxury purchasing experience. At the same time, the omnichannel interaction is becoming more robust with the help of social media, live selling, and collaboration with influencers. The use of AI tools, custom design platforms, and enhanced in-store authentication is guaranteeing a smooth and trusted buying experience, thus maintaining consistent growth

UAE Jewellery Market Growth DriverRising Tourism Inflows Fuel Jewellery Spending Across the UAE

Tourism remains the single strongest force driving jewellery sales in the UAE. According to Dubai Department of Economy & Tourism, the emirate welcomed 17.15 million international visitors in 2023, surpassing its pre-pandemic peak of 16.7 million. Complementing this, UNWTO’s 2024 global rankings place the UAE among the top 10 most visited countries worldwide. This surge is reflected in the market, where tourists from India, China, Europe, and Japan significantly boosted fine jewellery purchases, especially gold and diamond pieces.

High-spending visitors are drawn by the UAE’s reputation for authenticity, tax efficiency, and its large presence of global luxury brands. Major retailers—including Malabar Gold—expanded aggressively to capture this inflow. Tourist-heavy districts such as Deira, Dubai Mall, and Abu Dhabi’s Corniche saw increased jewellery traffic in 2024, reinforcing tourism as a sustained growth engine.

UAE Jewellery Market ChallengeSurge in Counterfeit Fine Jewellery Undermining Brand Trust

Counterfeiting is a significant structural issue. In 2023, the Federal Customs Authority announced the seizure of about AED 120 million of fake luxury items, such as jewellery. Dubai Police registered approximately 3,300 counterfeiting and fraud cases in the same year, which highlights the extent of imitation of such well-known brands as Cartier, Bvlgari, and Van Cleef and Arpels.

The growth of advanced imitations undermines brand equity and causes confusion among end users. Even some international brands have stopped authenticating some of their iconic pieces because of the magnitude of imitation. Retailers and resale sites are incurring increasing expenses as they implement blockchain tracking, sophisticated certification, and strict verification processes. Such pressures raise the cost of operation and undermine end user confidence, which makes counterfeiting one of the gravest threats to market stability.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Jewellery Market TrendGrowing Influence of Arabic & Islamic-Inspired Jewellery Designs

Jewellery design in the UAE is increasingly being shaped by Arabic and Islamic artistic influences. According to the Federal Competitiveness and Statistics Centre, approximately 72% of Emirati end users are willing to use products that demonstrate national and cultural heritage. Moreover, the Ministry of Culture indicated that the number of people who attended cultural and heritage events increased by 11% in 2023, which suggests that people are more engaged with traditional aesthetics.

This change has seen international brands like Cartier, Damas, Piaget and Bvlgari to use calligraphy, geometric designs and Islamic designs in new collections. This trend has been strengthened by high-profile exhibitions such as the one at the Louvre Abu Dhabi which showcases Islamic-inspired jewellery design. Brands can now create complex cult

UAE Jewellery Market OpportunityRising Weddings in UAE Boosting Demand for Bridal Jewellery

The development of the UAE as a wedding destination is a huge growth potential. In 2023, the Abu Dhabi Judicial Department announced a 55% rise in the number of civil marriages registered after changes to permit non-Muslims and expatriates to marry legally. The Civil Family Court in Dubai also reported a high increase in marriages following the enactment of the civil marriage law in February 2023.

Destination weddings create a high demand of engagement rings, bridal sets, diamond necklaces, and wedding bands. With the increasing number of expatriates and international couples opting to hold ceremonies in the UAE, jewelers have access to a fast growing customer base. This trend coupled with the large numbers of tourists entering the country is a great boost to the demand of bridal and fine jewellery. The best brands to take advantage of this opportunity are those that provide customisation, bridal packages, and collections that are culturally oriented.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

ine Jewellery is the dominant category, accounting for about 90% of the UAE jewellery market. This leadership is supported by high purchasing power, strong luxury culture, and the country’s role as a global jewellery hub. According to the UAE Ministry of Economy, re-exports of gold and precious stones exceeded USD 27 billion in 2023, highlighting the country’s central role in global jewellery trade.

From 2026–2032, fine jewellery will maintain its lead as luxury spending remains resilient and tourism expands. IMF projections indicate UAE economic growth of about 4.0% in 2025, supporting higher discretionary spending. Cultural influences, rising civil marriages, and demand for authenticity will reinforce fine jewellery’s long-term dominance.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline dominates distribution with about 95% share. end users strongly prefer physical stores because authentication, certification, and trust are critical, especially amid rising counterfeit risks. Government enforcement through customs and economic authorities further strengthens offline retail by ensuring legitimacy of products.

Over the forcast period , retail offline will remain dominant as the UAE continues to expand luxury malls and premium retail districts. Tourist inflows 17.15 million visitors in 2023—drive strong in-store jewellery purchases. Although retail online is growing for costume jewellery, fine jewellery will remain anchored in physical retail due to high transaction values and the cultural importance of in-person consultation, ensuring offline channels retain leadership throughout the forecast period.

List of Companies Covered in UAE Jewellery Market

The companies listed below are highly influential in the UAE jewellery market, with a significant market share and a strong impact on industry developments.

- Tiffany & Co

- Pure Gold Group

- Apparel Group

- Damas LLC

- Malabar Group

- Joyalukkas Holdings

- Kalyan Jewellers India Pvt Ltd

- Richemont (Dubai) FZE

- Chalhoub Group

- Pandora A/S

Competitive Landscape

Fine jewellery in the UAE faced heightened competitive pressures as global luxury brands contended with a surge in counterfeits that diluted brand equity and challenged authentication efforts. This environment increased reliance on government-led anti-counterfeit enforcement and pushed brands such as Cartier and Van Cleef & Arpels to adopt blockchain-based verification technologies. At the same time, Malabar Gold rapidly expanded its footprint, opening multiple large-format stores and leveraging its “Pay 10% Advance” gold-locking scheme to attract value-driven buyers, particularly among the sizeable Indian resident and tourist base. In costume jewellery, Aldo Accessories defended its leadership through a strong retail network and culturally resonant campaigns, including a Ramadan promotion featuring regional icon Myriam Fares. These combined dynamics created a fragmented yet highly active competitive landscape dominated by authenticity-driven luxury brands, fast-expanding regional players, and culturally attuned fashion jewellery specialists.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Jewellery Market Policies, Regulations, and Standards

4. UAE Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. UAE Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. UAE Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Damas LLC

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Malabar Group

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Joyalukkas Holdings

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Kalyan Jewellers India Pvt Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Richemont (Dubai) FZE

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Tiffany & Co

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Pure Gold Group

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Apparel Group

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Chalhoub Group

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pandora A/S

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.