UAE Flexible Plastic Packaging Market Report: Trends, Growth and Forecast (2026-2032)

By Material Type (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Others), By Product Type (Bags, Pouches & Sachets, Films & Laminates, Tapes & Labels, Tubes, Others), By End User Industry (Food & Beverage, Healthcare, Home Care, Personal Care, Agriculture, E-commerce, Others), By Printing Technology (Flexography, Rotogravure, Digital, Others), By Type (Consumer Packaging, Industrial Packaging)

- Packaging

- Feb 2026

- VI0645

- 130

-

UAE Flexible Plastic Packaging Market Statistics and Insights, 2026

- Market Size Statistics

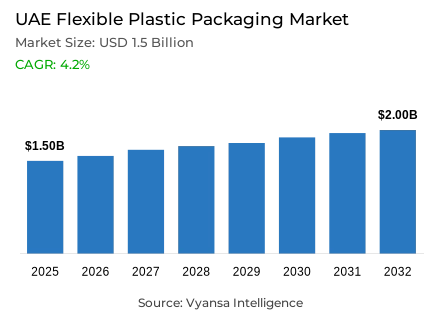

- Flexible plastic packaging in UAE is estimated at USD 1.5 billion.

- The market size is expected to grow to USD 2 billion by 2032.

- Market to register a cagr of around 4.2% during 2026-32.

- Material Type Shares

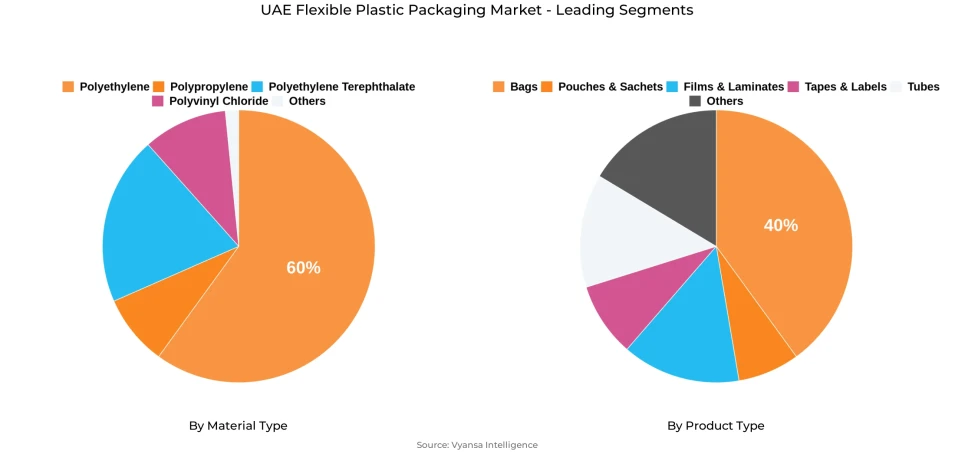

- Polyethylene grabbed market share of 60%.

- Competition

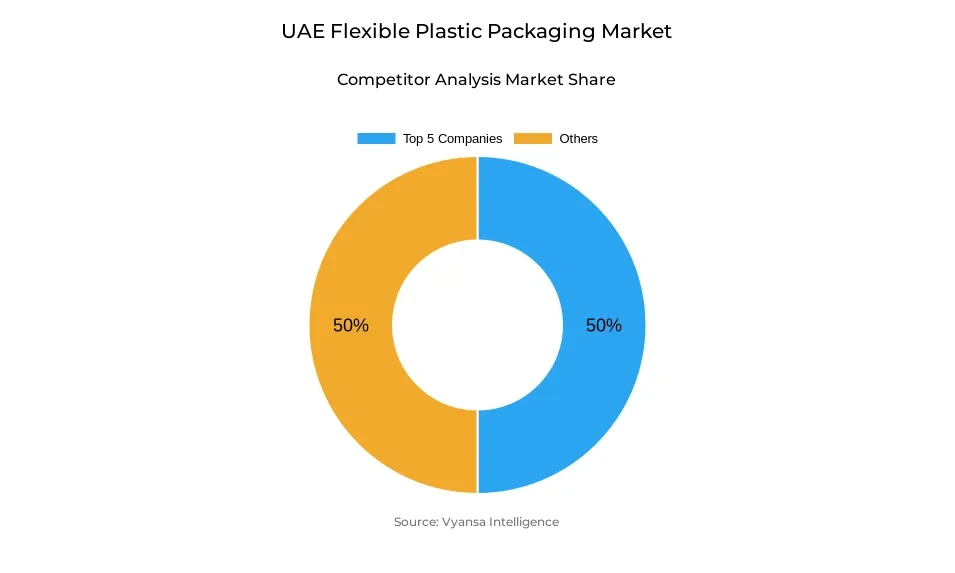

- More than 10 companies are actively engaged in producing flexible plastic packaging in UAE.

- Top 5 companies acquired around 50% of the market share.

- Amber Packaging Industries LLC; Swiss Pac UAE Packaging Industries LLC; ENPI Group (Emirates National Factory for Plastic Industries); Hotpack Packaging Industries LLC; Huhtamaki Flexible Packaging Middle East etc., are few of the top companies.

- Product Type

- Bags grabbed 40% of the market.

UAE Flexible Plastic Packaging Market Outlook

The flexible plastic packaging market in the UAE is projected to exhibit steady growth, increasing from a forecasted $1.5 billion in 2025 to $2 billion by 2032, reflecting a CAGR of 4.2% during the 2026-32 period. Polyethylene is expected to maintain its leading position with around 60% share based on its low cost, strength, and versatility across various industries. Polypropylene and polyethylene terephthalate also continue to be ubiquitous materials, with their sale furthers supported by their wide ranging versatility and ability to contribute to recycling efforts, re-use, or re-purposing. The increasing popularity of recycled-content and compostable polymers is evidence of an increasingly regulatory climate and consumer pressure for sustainable choices.

Bags comprise the largest segment by product type, with around 40% of share, primarily due to their wide availability appeal, low cost, and functional use in the retail and consumer packaging space. Their popularity has led manufacturers to increase the recyclability of bags, along with using recycled polymers to comply with regulations and market shifts in bag use. The other product types, such as pouches and films, continue to experience steady growth as brands are looking for various forms to gain functional use and showcase branding.

Several government-led initiatives, including the ban on single-use plastic bags and incentive schemes, including the Bottle Return Scheme, are changing end-user behaviors in the interests of enabling environmentally friendly disposal and recycling behavior. Although only 7% of today’s plastic waste is recycled, the general public awareness and participation is increasing, in addition to forecasted investment in recycling and waste-to-energy initiatives, will boost recovery rates during the forecast period.

End-user and corporate interest in environmental sustainability is also generating demand for sustainable packaging alternatives, including compostable films, recycled-content laminates, and light-weight barrier materials. A combination of regulatory support, changes to consumer behavior and materials development, will create the conditions required for continued growth of the UAE flexible plastic packaging market, which will mean that manufacturers will achieve sustainability objectives without degrading either performance or economics.

UAE Flexible Plastic Packaging Market Growth DriverRising Environmental Pressures Shaping Market Dynamics

The UAE produces around 3.2 million tonnes of plastic waste each year, recycling a mere 7% and sending a whopping 90% to landfill, placing tremendous environmental pressure on the country. Not only does this strain landfill capacity but also makes up a large share of greenhouse gas emissions, putting tremendous pressure on the country's environmental objectives. The sheer amount of plastic waste clearly indicates the need for more effective waste management systems in accordance with sustainability objectives.

Government-driven policies, like the countrywide ban on single-use plastic bags, are starting to have an impact. Since becoming law in 2022, Abu Dhabi has kept 364 million plastic bags, or 2,400 tonnes' worth of plastic waste, out of landfills, cutting bag distribution by 95%. These findings prove that policy can make a difference in combating plastic pollution, as well as drive uptake of sustainable packaging solutions right across the industry.

UAE Flexible Plastic Packaging Market ChallengeInfrastructure and Policy Barriers Limiting Recycling Adoption

Even with increased awareness, recycling in the UAE is still low, with less than 7% of plastic being sorted for recovery in 2021. A lack of adequate sorting and processing facilities for mixed plastic streams prevents recyclable material from circulating back into production, and precious resources end up in landfill waste, retarding the movement towards a circular economy. This shortfall highlights the urgent requirement for investment in scalable recycling.

Public participation holds potential, as 84% of the population in Abu Dhabi are aware of plastic policies and 82% have acknowledged positive effects on quality of life. Awareness, however, cannot address inherent hindrances in waste segregation, collection, and processing. There is a need for greater incentives and improved infrastructure to translate participation into quantifiable recycling results nationwide.

UAE Flexible Plastic Packaging Market TrendEmergence of Incentive-Based Recycling Programs

Incentive-based programs are demonstrating success in leading end users to adopt sustainable behavior. The UAE's 'Bottle Return Scheme,' established in 2023, has collected more than 130 million single-use plastic bottles through reverse vending machines and smart bins, amounting to 2,000 tonnes of material. The system actively engages end users, redirecting large volumes of recyclable plastics into formal recycling streams and supporting behavioral change toward responsible disposal.

Concurrent investments in waste-to-energy plants and proposed refuse-derived fuel facilities demonstrate an even wider shift towards resource recovery. Through the implementation of circular economy principles in waste management, such ventures allow the UAE to transition from a linear disposal model into a more sustainable, value-creating system to serve regulatory requirements and market innovation alike.

UAE Flexible Plastic Packaging Market OpportunityRising Demand for Sustainable Packaging Solutions

UAE end users and companies both are becoming highly interested in green packaging, driving demand for lightweight barrier materials, compostable films, and recycled-content laminates. Retailers have witnessed a 2,000% adoption rate of reusable bags in the space of a year following the introduction of the single-use bag ban, demonstrating the market's willingness to adopt sustainable solutions and indicating a change in shopper behavior toward more environmentally friendly choices.

This trend opens doors for packaging suppliers to design products that are compliant with stringent environmental requirements without compromising performance and affordability. Through adopting circular economy approaches, manufacturers can capture greater market shares, service changing end-user needs, and support the UAE's wider sustainability goals.

UAE Flexible Plastic Packaging Market Segmentation Analysis

By Material Type

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Others

The segment with the maximum share in terms of material type in the Product Material category is polyethylene with share around 60%. Polyethylene takes the lead because of its very good combination of strength, flexibility, and cost-effectiveness, making it the most sought-after for a broad array of flexible plastic packaging applications. Its ready availability and compatibility with a large number of printing and barrier coatings also add to its leadership in retail, food service, and industrial packaging.

Other resins like polypropylene, polyester, and bioplastics fill out the rest of the market, but none come close to polyethylene's volume or versatility. As manufacturers focus on lightweight, resilient, and readily recyclable options, polyethylene's well-established infrastructure for recycling and reprocessing retains support for its dominant position during the forecast period.

By Product Type

- Bags

- Pouches & Sachets

- Films & Laminates

- Tapes & Labels

- Tubes

- Others

Bags is the largest segment under Product Type, representing around 40% share, it is due to the versatile, inexpensive and common in consumer and retail uses. The prevalence across industries supports the prominence in flexible plastic packaging mix, which has led manufacturers to improve recyclability and use recycled polymers to meet changing regulations and end user demands.

Moreover, the other pack types such as films and pouches etc are increasing steadily as companies seek differentiated package forms to serve particular functional and branding needs. However, bags are still central to the market, fostering innovation in design and sustainability while retaining their top spot in terms of volume and market impact.

List of Companies Covered in UAE Flexible Plastic Packaging Market

The companies listed below are highly influential in the UAE flexible plastic packaging market, with a significant market share and a strong impact on industry developments.

- Amber Packaging Industries LLC

- Swiss Pac UAE Packaging Industries LLC

- ENPI Group (Emirates National Factory for Plastic Industries)

- Hotpack Packaging Industries LLC

- Huhtamaki Flexible Packaging Middle East

- Falcon Pack Flexible Pack

- Arabian Flexible Packaging LLC (acquired Napco National)

- Integrated Plastics Packaging LLC

- Gulf East Paper & Plastic Industries LLC

- Emirates Printing Press (EPP)

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Flexible Plastic Packaging Market Policies, Regulations, and Standards

4. UAE Flexible Plastic Packaging Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Flexible Plastic Packaging Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Material Type

5.2.1.1. Polyethylene- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Polyethylene Terephthalate- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Polyvinyl Chloride- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Product Type

5.2.2.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Pouches & Sachets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Films & Laminates- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Tapes & Labels- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Tubes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User Industry

5.2.3.1. Food & Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Home Care- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Personal Care- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Agriculture- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. E-commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Printing Technology

5.2.4.1. Flexography- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Rotogravure- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Digital- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Type

5.2.5.1. Consumer Packaging- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Industrial Packaging- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. UAE Polyethylene Flexible Plastic Packaging Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Type- Market Insights and Forecast 2022-2032, USD Million

7. UAE Polypropylene Flexible Plastic Packaging Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Type- Market Insights and Forecast 2022-2032, USD Million

8. UAE Polyethylene Terephthalate Flexible Plastic Packaging Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Type- Market Insights and Forecast 2022-2032, USD Million

9. UAE Polyvinyl Chloride Flexible Plastic Packaging Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User Industry- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.4. By Type- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. Hotpack Packaging Industries LLC

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Huhtamaki Flexible Packaging Middle East

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Falcon Pack Flexible Pack

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Arabian Flexible Packaging LLC (acquired by Napco National)

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Integrated Plastics Packaging LLC

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Amber Packaging Industries LLC

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Swiss Pac UAE Packaging Industries LLC

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. ENPI Group (Emirates National Factory for Plastic Industries)

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Gulf East Paper & Plastic Industries LLC

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Emirates Printing Press (EPP)

10.1.10.1. Business Description

10.1.10.2. Product Portfolio

10.1.10.3. Collaborations & Alliances

10.1.10.4. Recent Developments

10.1.10.5. Financial Details

10.1.10.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Material Type |

|

| By Product Type |

|

| By End User Industry |

|

| By Printing Technology |

|

| By Type |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.