France Plastic Caps and Closures Market Report: Trends, Growth and Forecast (2026-2032)

By Resin Type (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Others), By Product Type (Threaded (Screw Caps, Vacuum, etc.), Dispensing, Unthreaded (Overcaps, Lids, Aerosol-based Closures), Child-resistant), By End User (Beverage (Bottled Water, Carbonated Soft Drinks, Alcoholic Beverages, Juices & Energy Drinks, Others), Food, Personal Care & Cosmetics, Household Chemicals, Others)

- Packaging

- Dec 2025

- VI0560

- 130

-

France Plastic Caps and Closures Market Statistics and Insights, 2026

- Market Size Statistics

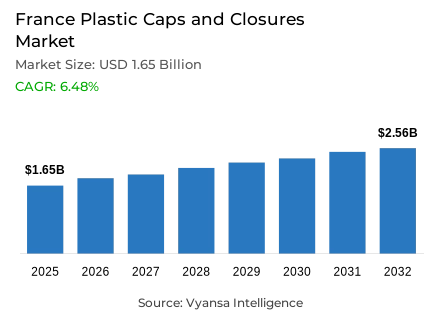

- Plastic Caps and Closures in France is estimated at $ 1.65 Billion.

- The market size is expected to grow to $ 2.56 Billion by 2032.

- Market to register a CAGR of around 6.48% during 2026-32.

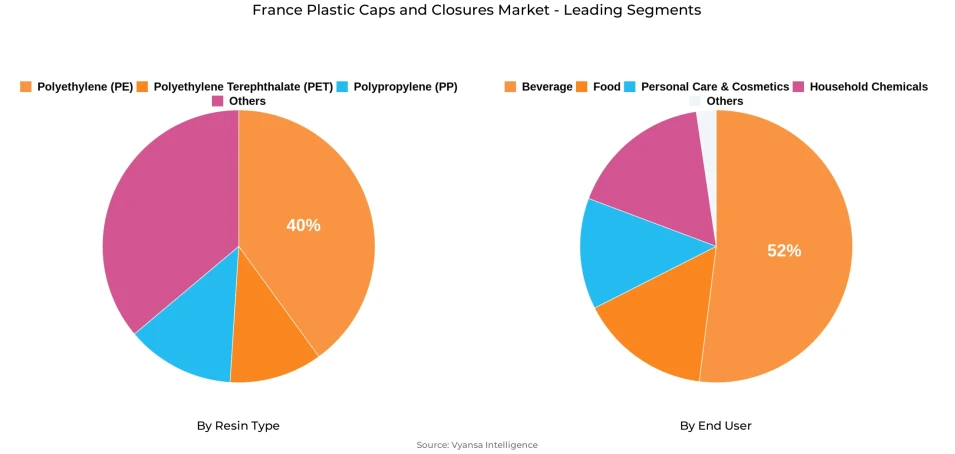

- Resin Type Shares

- Polyethylene (PE) grabbed market share of 40%.

- Competition

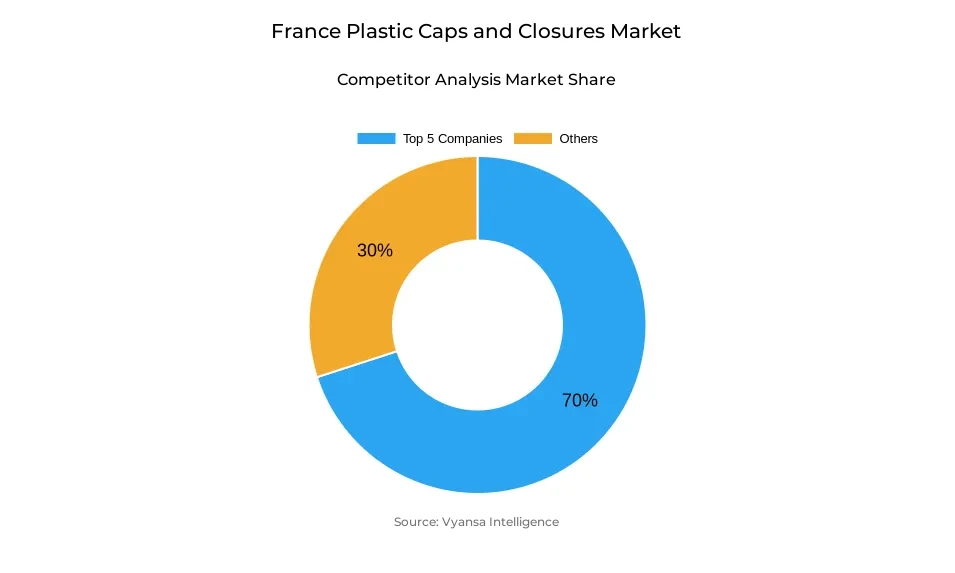

- More than 10 companies are actively engaged in producing Plastic Caps and Closures in France.

- Top 5 companies acquired around 70% of the market share.

- Tri-Sure Closures Australia Pty. Ltd (Grief Inc.), Aptar Group, Jokey Group, Retal Industries Ltd, Bericap Holding GmbH etc., are few of the top companies.

- End User

- Beverage grabbed 50% of the market.

France Plastic Caps and Closures Market Outlook

The France Plastic Caps and Closures Market, with an estimated value of around USD 1.65 billion in 2025 and is expected to grow around USD 2.56 billion by 2032 with a CAGR of approximately 6.48% from 2026–2032. The growth of the market is primarily fueled by France's initiative to make all plastic packaging recyclable or reusable by 2025, which forces manufacturers to design closures with mono-material and reduced structure. The designs respond to the Circular Economy Roadmap of the Ministry for the Ecological Transition and assist manufacturers with environmental objectives which includes enhancing recyclability and optimizing operational efficiency.

Growth in end user affinity for convenience also influences product development. Around 75% of end users in France preferred resealable bottles of water and juice in 2023, encouraging manufacturers to emphasize easy-open and reclosable cap styles. Liquid food applications drive the market with approximately 50% share in 2025, with end users seeking safety, resealability, and ergonomic functionality.The beverage industry enjoys high-speed capper lines and precision molding that enhance sealing consistency and efficiency in production.

Material choice is still changing under the tight environmental regulations and increasing recycling practices. Polyethylene (PE) leads the resin type segment with a 40% market share because it is recyclable, flexible, and economical, and is perfectly suited for packaging beverages and personal care products. Relying on recycled content, between 20–30% in closures, also helps achieve France's goal of reducing virgin plastic use by half by 2030.

Technological innovation and cooperation are transforming the market environment. Clever closures with NFC capabilities and producer-recycler cooperation have opened up new possibilities, while 3D-printed closures provide customized offers and accelerated production cycles. These trends reflect how sustainability, digitalization, and circularity are shaping the future development of France's plastic caps and closures market.

France Plastic Caps and Closures Market Growth Driver

Sustainability Mandates Accelerating Design Innovation

France determination to make all the plastic packaging reusable or recyclable by end of 2025 is leading towards major improvements in closure design. Manufacturers increasingly use mono-material and simplified construction to maximize compatibility with recycling streams, consistent with the Ministry for the Ecological Transition-led Circular Economy Roadmap. This change prompts end users to prefer sustainable products while allowing producers to comply with stringent environmental requirements. The shift also improves operating efficiency through lower material complexity and facilitation of large-scale recyclability.

Convenience-driven innovations are also influencing product design simultaneously. About 75% of French end users favored resealable bottles of water and juice in 2023, reflecting the increasing significance of easy-open and reclosable closures. Manufacturers are focusing on functionality to improve day-to-day functionality, improving product differentiation and end-user satisfaction in beverage and household applications.

France Plastic Caps and Closures Market Challenge

Regulatory Pressure and Recycling Inefficiencies Increasing Production Costs

France's ban on single-use plastics, imposed in 2021, has radically altered material selection and manufacturing economics for closure makers. The necessity of shifting to substitute, compliant materials has driven manufacturing cost upwards by as much as 15%, putting a strain on small and medium businesses especially. These policy changes are compelling companies to rethink their supply chain and invest in sustainable design substitutes in order to stay competitive and regulatory compliant.

To boot, national collection and sorting inefficiencies sabotage circularity. As a matter of fact, only some 34% of light caps make it to recycling streams because their size bars proper capture once the waste is processed. As such, manufacturers are directing resources to end users education programs and redesign for closure that facilitates recyclability, hoping to close the material loop and address France's aggressive environmental goals

France Plastic Caps and Closures Market Trend

Integration of Recycled Content and Smart Technology Redefining the Market

The rising use of recycled content shows a pivotal development in the market. Numerous manufacturers now use 20–30% recycled content in closures without loss of performance, helping directly towards the national goal of cutting virgin plastic consumption by half by 2030. The practice enhances brand reputation and evidence of compliance with sustainable production guidelines, supporting longer-term competitiveness in a progressively more sustainable market.

Moreover, technology advancement is transforming product interaction. Intelligent closures equiped with NFC features emerged in 2024 on more than 20% of premium drink launches. This enablied end users to get recycling information and authenticate product authenticity through smartphones. The engaging solutions not only provide high transparency but also facilitate data-driven insights for brands looking to build end user loyalty and trust.

France Plastic Caps and Closures Market Opportunity

Collaborative Recycling and Additive Manufacturing Expanding Market Potential

The growth in collaborative recycling programs offers French closure producers robust growth opportunities. In 2023, producer-recycler partnerships converted about 25,000 tonnes of post-consumer caps into secondary raw materials, which opened up new uses for the automotive and construction industries. Such value-chain integration reflects how circular principles are being converted into real commercial opportunities in several sectors.

In addition, 3D-printed closures have high customization value, and craft beverage and cosmetic brands find this especially attractive. Such on-demand production eliminates up to 40% of lead times, permitting flexible production of niche or seasonal lines. With end users progressively embracing personalized packaging, 3D printing technologies will revolutionize short-run manufacturing economics as well as broaden closure suppliers' revenue streams.

France Plastic Caps and Closures Market Segmentation Analysis

By Resin Type

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Others

Polyethylene (PE) has the highest share of around 40% under the resin type segment in 2025. The combination of flexibility, affordability and recyclability makes it a perfect fit for large-volume applications, especially in beverages and personal care. PE's compatibility with the ongoing recycling infrastructure also supports France's commitment to the circular economy, reinforcing the predominant use by manufacturers committed to sustainable manufacturing practices.

Moreover, other resins types, such as polypropylene (PP) and polyethylene terephthalate (PET), are used for more niche applications. PP is preferred for its strength and thermal resistance, to be used in hot-fill beverages and household chemical products, and PET facilitates clarity-based packaging where transparency is the priority. The group of these resins represents the industry's struggle to balance performance demands with sustainability and manufacturing effectiveness.

By End User

- Beverage

- Food

- Personal Care & Cosmetics

- Household Chemicals

- Others

Beverage is the largest product segment, around 50% share in 2025. The leadership of this segment is a result of strong demand for bottled water, soft drinks, and spirits, where secure and tamper-evident closure guarantees freshness and safety. End users seek resealable, ergonomic, and convenient closures, leading to ongoing improvements in sports caps and child-resistant closures that conform to rigorous quality and safety requirements.

Producers are making investments in high-speed capping lines to meet the beverage segment's growing production levels. New molding methods and exacting tooling have improved closure uniformity and sealing integrity, aiding brand consistency and efficiency of operations. Such constant development further solidifies the beverage segment's leadership role and supports stable market growth on both mass-market and premium lines.

Top Companies in France Plastic Caps and Closures Market

The top companies operating in the market include Tri-Sure Closures Australia Pty. Ltd (Grief Inc.), Aptar Group, Jokey Group, Retal Industries Ltd, Bericap Holding GmbH, Berry Global Inc., Silgan Holdings Inc., United Caps, Berlin Packaging, Closure Systems International, etc., are the top players operating in the France Plastic Caps and Closures Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Plastic Caps and Closures Market Policies, Regulations, and Standards

4. France Plastic Caps and Closures Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Plastic Caps and Closures Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Resin Type

5.2.1.1. Polyethylene (PE)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Polyethylene Terephthalate (PET)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Polypropylene (PP)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Threaded (Screw Caps, Vacuum, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Dispensing- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Unthreaded (Overcaps, Lids, Aerosol-based Closures)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Child-resistant- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Carbonated Soft Drinks- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Alcoholic Beverages- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.4. Juices & Energy Drinks- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Food- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Personal Care & Cosmetics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Household Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. France Polyethylene Plastic Caps and Closures Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Polyethylene Terephthalate Plastic Caps and Closures Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Polypropylene Plastic Caps and Closures Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Retal Industries Ltd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Bericap Holding GmbH

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Berry Global Inc.

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Silgan Holdings Inc.

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.United Caps

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Tri-Sure Closures Australia Pty. Ltd (Grief Inc.)

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Aptar Group

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Jokey Group

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Berlin Packaging

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Closure Systems International

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Resin Type |

|

| By Product Type |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.