UAE Corrugated Board Packaging Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Slotted Containers, Die-cut Containers, Five-Panel Folder Boxes, Rigid Set-up Boxes, Others), Material Type (Recycled Liner/Fluting, Virgin Kraft Liner/Fluting, Coated/printed Grades, Specialty Grades (Moisture-Resistant, Heavy-Duty)), Board Grade (Single Face, Single Wall, Double Wall, Triple Wall), Flute Type (C-Flute, B-Flute, E-Flute, F/N Microflute, Others), Printing Technology (Flexography, Digital, Litho-laminate, Value-added (coatings, die-cuts, laminations), Others), End User Industry (Food, Beverage, Electrical and Electronics, Personal and Home Care, E-commerce, Others), Sales Channel (Retail Offline, Retail Online)

- Packaging

- Dec 2025

- VI0639

- 130

-

UAE Corrugated Board Packaging Market Statistics and Insights, 2026

- Market Size Statistics

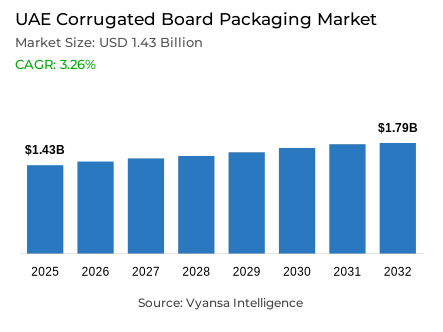

- Corrugated board packaging in UAE is estimated at USD 1.43 billion.

- The market size is expected to grow to USD 1.79 billion by 2032.

- Market to register a cagr of around 3.26% during 2026-32.

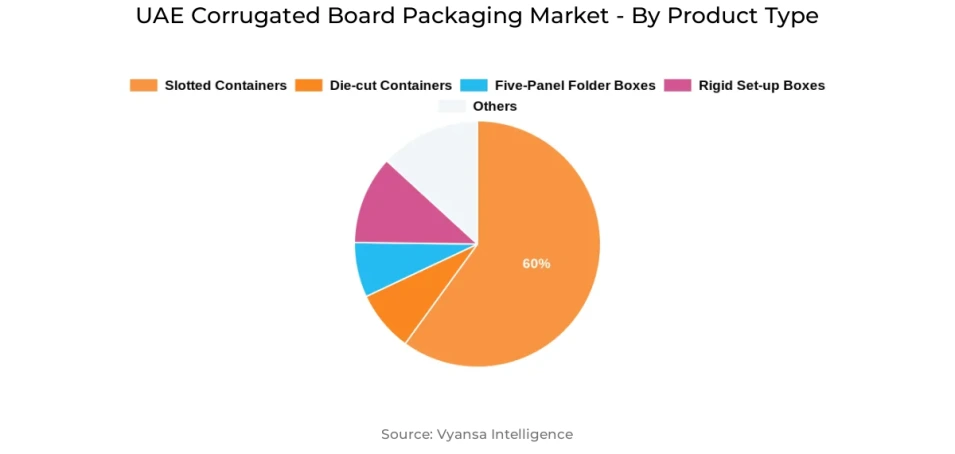

- Product Type Shares

- Slotted containers grabbed market share of 60%.

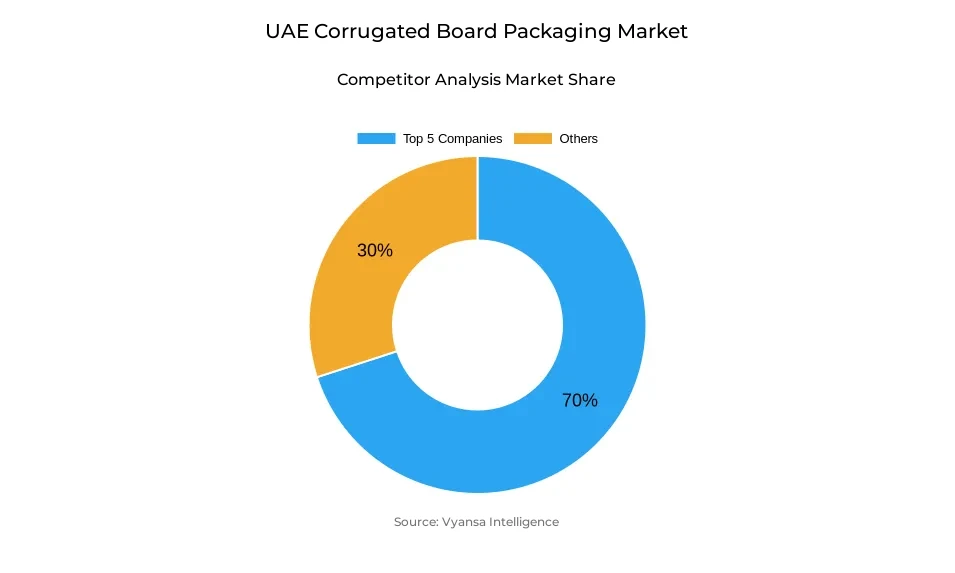

- Competition

- More than 20 companies are actively engaged in producing corrugated board packaging in UAE.

- Top 5 companies acquired around 70% of the market share.

- Unipack Containers & Carton Products LLC, Tarboosh Packaging Co. LLC, Green Packaging Boxes IND. LLC, Arabian Packaging Co. LLC, Queenex Corrugated Carton Factory LLC etc., are few of the top companies.

- End User Industry

- Food grabbed 30% of the market.

UAE Corrugated Board Packaging Market Outlook

The UAE Corrugated Board Packaging Market is estimated at USD 1.43 billion in 2025 and is projected to reach USD 1.79 billion by 2032, registering a CAGR of around 3.26% during 2026–32. The rapid growth of e-commerce has been a key factor driving demand, as end users increasingly shift to digital purchasing for safety and convenience. Corrugated packaging has become essential for the UAE’s expanding e-commerce ecosystem, offering durability, stackability, and protection for goods during last-mile delivery, while supporting efficient warehouse management and cost-effective transportation.

Slotted containers hold the largest share of around 60% in the market, due to their simple design, cost efficiency, and compatibility with automated packing systems. These boxes provide quick assembly, optimal protection, and minimal material wastage, making them ideal for high-volume operations across e-commerce and FMCG supply chains. Other formats such as die-cut boxes and five-panel folders remain secondary, while slotted containers continue to dominate due to their adaptability and structural reliability.

The food industry commands the largest end-user share at approximately 30% of the market. Increasing packaged food consumption, expanding cold-chain logistics, and the need for hygienic transport solutions are driving demand. Food-grade corrugated packaging, including moisture-resistant and grease-proof liners, ensures product integrity across long supply routes. While beverage and electronics sectors also use corrugated packaging, stringent hygiene standards and temperature-sensitive requirements in food distribution maintain its leadership position.

The market is also shaped by fluctuations in raw material costs, with manufacturers exploring long-term procurement and localized recycling initiatives to stabilize prices. Regulatory changes, such as the Federal Decree Law 14/2023 banning certain single-use plastics, are accelerating the shift toward fiber-based solutions. Innovations in lightweight, high-graphic microflute packaging and digital printing technologies are further enabling brands to achieve both sustainability and enhanced end-user engagement, supporting the market’s steady growth through 2032.

UAE Corrugated Board Packaging Market Growth DriverExpanding E-Commerce Accelerates Corrugated Packaging Demand

The surge in online shopping has significantly increased demand for corrugated packaging across the UAE. As end users shifted to digital purchasing for safety and convenience, e-commerce experienced rapid growth, placing immense pressure on logistics providers and packaging converters to enhance capacity, driving investment in high-speed automated lines and improved material handling solutions.

Corrugated packaging has become indispensable to the UAE’s expanding e-commerce ecosystem. Its durability and stackability ensure efficient warehouse management and safe last-mile delivery. With the rise of omnichannel retailing and same-day delivery services, brands are prioritizing versatile corrugated solutions that protect goods during rapid distribution while optimizing space and reducing transportation costs.

UAE Corrugated Board Packaging Market ChallengePrice Instability Challenges Packaging Producers

Fluctuations in raw material costs remain a persistent challenge for UAE corrugated packaging manufacturers. Heavy reliance on imported kraft paper and recycled fibers exposes the market to volatile global pulp prices and freight rate surges. These unpredictable cost shifts complicate pricing strategies, making it difficult for producers to maintain profitability while delivering competitively priced solutions to end users.

Margins are further squeezed in a landscape marked by intense competition and rising quality expectations. To counteract these pressures, manufacturers are increasingly exploring long-term procurement contracts, strategic supplier partnerships, and localized recycling initiatives. Such approaches aim to stabilize input costs, enhance supply-chain resilience, and ensure consistent product availability amid global disruptions.

UAE Corrugated Board Packaging Market TrendSustainability Mandates Redefine Packaging Design

The UAE’s implementation of Federal Decree Law 14/2023, which bans selected single-use plastics, is reshaping the country’s packaging landscape. Retailers and brand owners are now turning to fiber-based alternatives, with corrugated board emerging as a preferred option. This regulatory push has accelerated innovation in lightweight, high-graphic microflute packaging that combines recyclability with strong visual appeal.

These advancements support both environmental compliance and branding objectives. By adopting thinner corrugated structures with enhanced printability, companies achieve material efficiency without sacrificing durability. Collaborations between converters, designers, and sustainability experts are expanding, fostering new product lines that align with the UAE’s environmental targets while maintaining cost and performance standards.

UAE Corrugated Board Packaging Market OpportunityCustomization Technologies Unlock New Growth Avenues

Rapid progress in digital printing is transforming corrugated packaging production across the UAE. High-resolution inkjet systems now enable short-run, on-demand printing, eliminating the need for costly plates and lengthy setup times. This flexibility allows brands to experiment with seasonal graphics, limited-edition designs, and serialized security features tailored to specific campaigns or product lines.

Omnichannel retailers are leveraging these capabilities to differentiate offerings and enhance end-user engagement through personalized packaging. The ability to swiftly modify designs supports faster product rollouts and localized marketing efforts. As converters invest in digital infrastructure and agile workflows, the sector is witnessing stronger partnerships between packaging producers and brand owners to deliver dynamic, high-quality packaging at competitive turnaround speeds.

UAE Corrugated Board Packaging Market Segmentation Analysis

By Product Type

- Slotted Containers

- Die-cut Containers

- Five-Panel Folder Boxes

- Rigid Set-up Boxes

- Others

Slotted containers hold the dominant share of around 60% in the UAE corrugated packaging market. Their simple design, cost efficiency, and compatibility with automated packing systems make them the preferred option for large-scale shipping and warehousing. These boxes ensure optimal protection, quick assembly, and minimal material wastage-key attributes supporting the high throughput of e-commerce and FMCG operations.

Other formats such as die-cut boxes and five-panel folders follow but remain secondary in volume. Slotted containers continue to lead due to their adaptability across diverse end-use industries and supply chains. Their structural reliability and ease of stacking make them ideal for fast-moving goods distribution, reinforcing their position as the backbone of the UAE’s corrugated packaging segment.

By End User Industry

- Food

- Beverage

- Electrical and Electronics

- Personal and Home Care

- E-commerce

- Others

The food industry commands the largest share of around 30% of the UAE corrugated packaging market. Rising packaged food consumption, expanding cold-chain logistics, and the need for hygienic transport solutions underpin this dominance. Corrugated boxes safeguard bakery, dairy, produce, and frozen items during transit and storage, ensuring product integrity across long supply routes.

In addition to durability, the segment benefits from advances in moisture-resistant and grease-proof liners designed specifically for food-grade applications. While beverage and electronics sectors also utilize corrugated packaging, stringent hygiene standards and temperature-sensitive requirements within food distribution continue to sustain robust demand, securing its leadership position in the overall market.

Top Companies in UAE Corrugated Board Packaging Market

The top companies operating in the market include Unipack Containers & Carton Products LLC, Tarboosh Packaging Co. LLC, Green Packaging Boxes IND. LLC, Arabian Packaging Co. LLC, Queenex Corrugated Carton Factory LLC, Falcon Pack Industries LLC, Universal Carton Industries LLC, World Pack Industries LLC, Express Pack Print LLC, Al Salam Carton Manufacturing LLC, etc., are the top players operating in the UAE corrugated board packaging market.

Market News & Updates

- Company 1, Year 1:

asdasd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Corrugated Board Packaging Market Policies, Regulations, and Standards

4. UAE Corrugated Board Packaging Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Corrugated Board Packaging Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Slotted Containers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Die-cut Containers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Five-Panel Folder Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Rigid Set-up Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Material Type

5.2.2.1. Recycled Liner/Fluting- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Virgin Kraft Liner/Fluting- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Coated/printed Grades- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Specialty Grades (Moisture-Resistant, Heavy-Duty)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Board Grade

5.2.3.1. Single Face- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Single Wall- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Double Wall- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Triple Wall- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Flute Type

5.2.4.1. C-Flute- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. B-Flute- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. E-Flute- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. F/N Microflute- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Printing Technology

5.2.5.1. Flexography- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Digital- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Litho-laminate- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Value-added (coatings, die-cuts, laminations)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User Industry

5.2.6.1. Food- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Electrical and Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Personal and Home Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. E-commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.6.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. UAE Slotted Containers Corrugated Board Packaging Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Board Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Flute Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UAE Die-cut Containers Corrugated Board Packaging Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Board Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Flute Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UAE Five-Panel Folder Boxes Corrugated Board Packaging Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Material Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Board Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Flute Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UAE Rigid Set-up Boxes Corrugated Board Packaging Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Material Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Board Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Flute Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Printing Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User Industry- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Arabian Packaging Co. LLC

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Queenex Corrugated Carton Factory LLC

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Falcon Pack Industries LLC

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Universal Carton Industries LLC

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. World Pack Industries LLC

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Unipack Containers & Carton Products LLC

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Tarboosh Packaging Co. LLC

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Green Packaging Boxes IND. LLC

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Express Pack Print LLC

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Al Salam Carton Manufacturing LLC

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Material Type |

|

| By Board Grade |

|

| By Flute Type |

|

| By Printing Technology |

|

| By End User Industry |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.