Saudi Arabia Foodservice & Disposable Packaging Market Report: Trends, Growth and Forecast (2026-2032)

By Material Type (Plastic Resins (PP, PET, PE, PS, PLA, Others), Bioplastics and Plant-Fiber, Paper and Paperboard, Aluminium Foil, Bagasse and Moulded Fiber, Others), By Product (Cups, Lids, Tubs and Containers, Bowls, Trays, Clamshells, Plates, Cutlery, Bags and Wraps, Cartons, Straws, Others), By Order Type (Dine-in, Take-away, Delivery), By Application (Quick-Service Restaurants (QSR), Full-Service Restaurants, Coffee and Snack Outlets, Retail Establishments, Institutional and Hospitality, Mobile Vendors and Food Trucks, Catering Services, Others), By Price Range (Economy, Mid-Range, Premium), By Sales Channel (Retail Offline, Retail Online)

- Packaging

- Jan 2026

- VI0627

- 120

-

Saudi Arabia Foodservice & Disposable Packaging Market Statistics and Insights, 2026

- Market Size Statistics

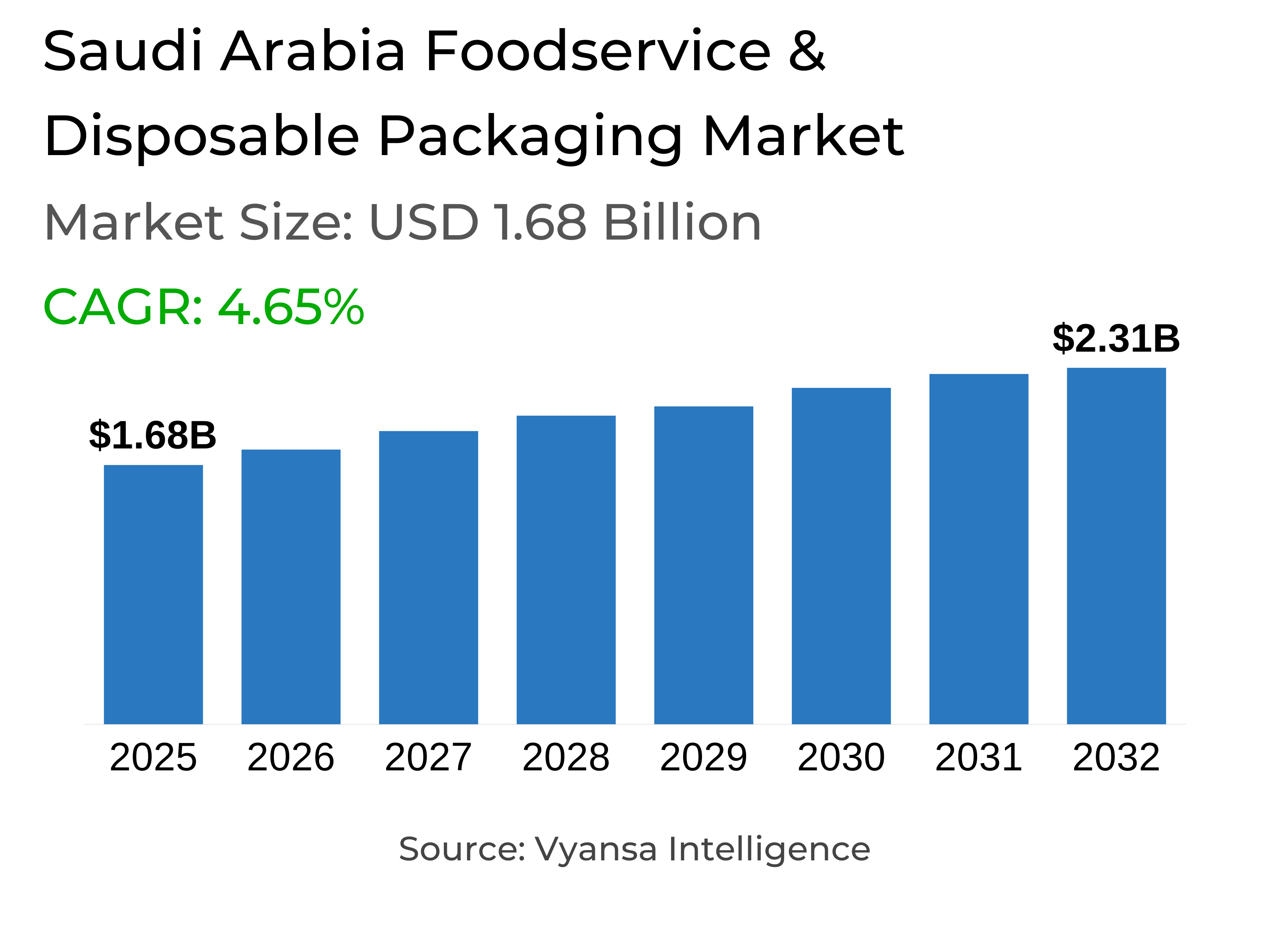

- Foodservice & disposable packaging in Saudi Arabia is estimated at USD 1.68 billion.

- The market size is expected to grow to USD 2.31 billion by 2032.

- Market to register a cagr of around 4.65% during 2026-32.

- Material Type Shares

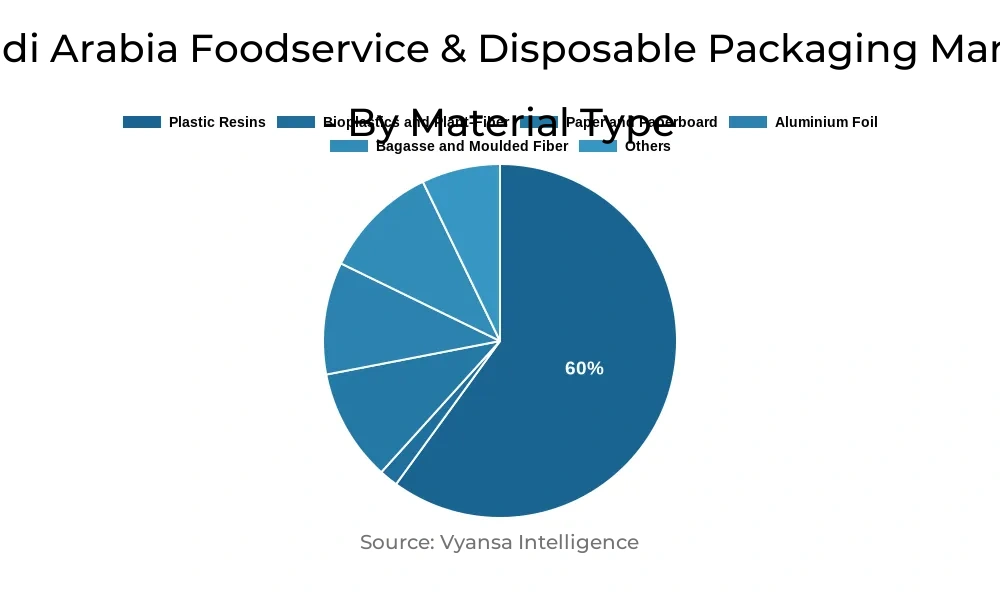

- Plastic resins grabbed market share of 60%.

- Competition

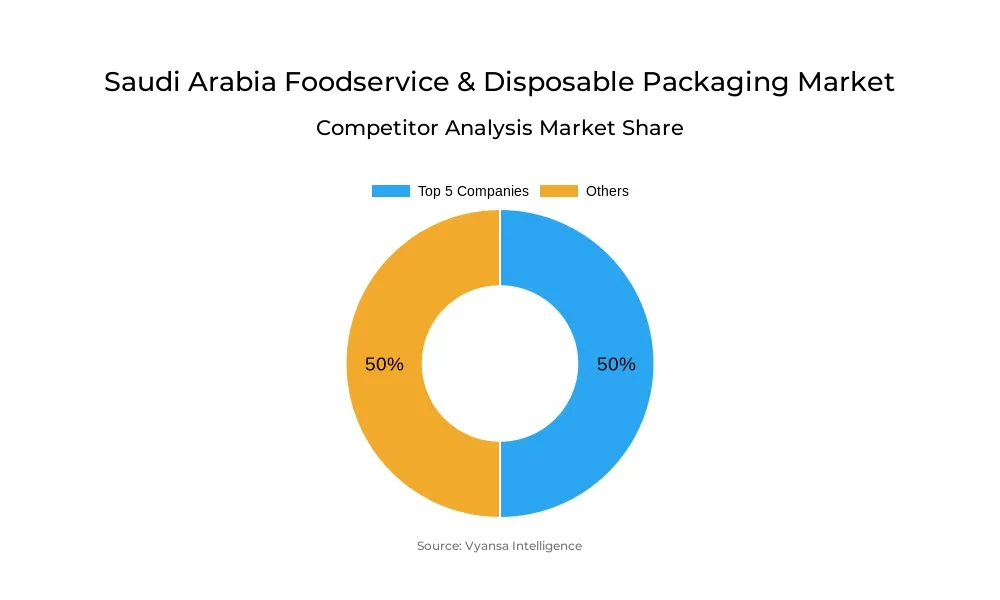

- More than 20 companies are actively engaged in producing foodservice & disposable packaging in Saudi Arabia.

- Top 5 companies acquired around 50% of the market share.

- Arabian Plastic Industrial Co. Ltd., International Food Services LLC, Prestige Packing Industry LLC, Napco National Company, Hotpack Packaging Industries L.L.C etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Saudi Arabia Foodservice & Disposable Packaging Market Outlook

The Saudi Arabia Foodservice Disposable Packaging Market was estimated at USD 1.68 billion in 2025 and is anticipated to reach USD 2.31 billion by 2032, with a CAGR of approximately 4.65% over the period 2026–32. Increased online food ordering and QSR growth is fueling demand, with over 10.3 million active users ordering food online in 2024. This trend of convenience consumption, fueled by a youthful, urban demographic with changing lifestyles, is increasing the demand for dependable, sanitary, and convenient-to-use disposable packaging by both QSRs and full-service restaurants. Restaurants are scaling delivery operations more frequently to handle these changing requirements effectively.

Sustainability efforts and environmental regulations are changing the market dynamics. More stringent regulations by the Saudi Arabian Standards, Metrology, and Quality Organization (SASO) limit non-biodegradable plastics, while Vision 2030 promotes environmentally friendly behavior. End users and foodservice operators are slowly moving towards biodegradable and compostable alternatives, with over 5,000 companies joining eco-certifications since 2022. Consumer choice supports the trend, with over 60% of customers surveyed in 2023 preferring eco-packaging, driving suppliers to increase sustainable options and continue to innovate in green materials.

Materially, plastic resins are the market leaders, with a share of approximately 60% thanks to their lightness, cost-effectiveness, and adaptability for food delivery and takeout businesses. Despite calls for sustainability, traditional plastics remain significant in upholding food safety and durability, while slow integration of recyclable and biodegradable variants indicates a harmonized drive toward environmental responsibility.

Offline Retail channels represent approximately 70% of market volume, remaining the first choice for restaurants, bakeries, and catering businesses that use direct verification, bulk orders, and strong distributor relationships. Even while online channels are beginning to emerge, conventional offline distribution continues to provide stable supply, dependability, and close-to-home-type service in urban and regional markets, supporting its leading role in Saudi Arabia's foodservice Disposable Packaging packaging market.

Saudi Arabia Foodservice & Disposable Packaging Market Growth Driver

Expanding Food Delivery and Quick-Service Operations Fuel Growth

Rapid expansion of online food delivery and QSRs is creating demand for disposable packaging in Saudi Arabia. With over 10.3 million users in the online food delivery space in Saudi Arabia in 2024, there is a rapid trend towards convenience-based eating. Restaurants are expanding delivery businesses that depend on clean, trustworthy packaging to preserve the quality of the food and provide timely delivery to end consumers.

This growth is sustained by an urbanizing, young demographic. Saudi Arabia's General Authority for Statistics indicates that 15–34-year-olds comprise almost 36% of the population, driving demand for convenient, mobile meal solutions. With younger Saudis embracing active lifestyles, dependence on single-serve packaging grows, increasing market activity among quick-service as well as full-service restaurants.

Saudi Arabia Foodservice & Disposable Packaging Market Challenge

Regulatory Pressures Shape Packaging Practices

Environmental conformity is influencing the single-use packaging sector as Saudi Arabia's strict regulations apply. The Saudi Arabian Standards, Metrology, and Quality Organization (SASO) prohibits non-biodegradable plastics and levies fines for non-compliance, leading manufacturers and foodservice businesses to re-evaluate material selection. Businesses experience operational difficulties in acquiring cheaper, conforming alternatives that satisfy hygiene and durability standards.

Vision 2030’s sustainability initiatives, led by the Ministry of Environment, Water, and Agriculture (MEWA), further encourage the adoption of eco-friendly practices. Although these regulations promote environmental responsibility, higher costs and limited availability of sustainable materials create practical constraints. End users face challenges transitioning from conventional plastics, emphasizing the need for accessible, cost-effective green packaging solutions in Saudi Arabia.

Saudi Arabia Foodservice & Disposable Packaging Market Trend

Rising Demand for Sustainable Packaging Solutions

Sustainability is also driving packaging choice, with end users and companies turning towards the green material. According to the Saudi Ministry of Environment, over 5,000 companies have signed up for eco-certifications since 2022, demonstrating broad support for environmentally friendly practices. Restaurants are spending money on biodegradable containers and compostable cutlery in order to meet national environmental goals.

Consumer sentiment supports this shift. According to a Prince Sultan University 2023 survey, more than 60% of participants choose sustainable packaging when they order food. Buyers are answering by growing biodegradable varieties, propelling mass substitution of conventional plastics. The trend is spurring innovation throughout the packaging industry and promoting cross-industry adoption of green solutions fulfilling both regulatory and consumer demands.

Saudi Arabia Foodservice & Disposable Packaging Market Opportunity

Expansion of Domestic Manufacturing Enhances Opportunities

Expansion in domestic packaging manufacturing is generating new prospects in Saudi Arabia's foodservice industry. The Saudi Export Development Authority registered a 15% rise in locally manufactured packaging materials in 2023 on the back of government support for self-sufficiency incentives. Improved local production supports quicker reaction to market needs and less dependence on imports.

Expanded domestic capacity also facilitates innovation in recyclable and compostable solutions that complement Vision 2030's drive for industrial localization. Foodservice operators that procure locally enjoy reduced lead times, cost savings, and the ability to customize. This enhanced domestic ecosystem not only promotes sustainable behaviors but also makes suppliers more competitive and adds to national employment.

Saudi Arabia Foodservice & Disposable Packaging Market Segmentation Analysis

By Material Type

- Plastic Resins

- Bioplastics and Plant-Fiber

- Paper and Paperboard

- Aluminium Foil

- Bagasse and Moulded Fiber

- Others

Plastic Resin have the largest share under the material type segment with market share of around 60%. It is due to the light weight, flexibility, and economic value. They find broad application in food delivery, beverage packaging, and take-out operations, offering safe, moisture-proof containers that fit the busy demands of foodservice end consumers. The Saudi Industrial Development Fund explains that even with environmental laws, plastic resins continue to be at the heart of industry operations.

Sustainability issues are slowly transforming this sector. The Ministry of Environment, Water, and Agriculture finds increased use of biodegradable and recyclable plastic resins to comply with regulation and support brand sustainability strategies. While traditional plastic still serves functional relevance, the slow phase-in of cleaner materials indicates a balanced response between performance and ecological responsibility.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline has the largest percentage under the segment of sales channels, around 70% of the market. According to Saudi Chambers of Commerce, restaurants, bakeries, and catering services mainly buy packaging from local wholesalers and distributors, appreciating direct face-to-face transactions for large orders. Such conventional purchasing method guarantees reliability, personal service, and uniform availability to end consumers.

While digital channels are picking up pace, Retail Offline is rooted as a result of strong supplier relationships and the desire for immediate verification of the quality of products. As per the Saudi Ministry of Commerce, these networks continue to back smaller foodservice operators and sustain steady distribution in urban and regional markets, which cement Retail Offline's leadership in the packaging ecosystem.

Top Companies in Saudi Arabia Foodservice & Disposable Packaging Market

The top companies operating in the market include Arabian Plastic Industrial Co. Ltd., International Food Services LLC, Prestige Packing Industry LLC, Napco National Company, Hotpack Packaging Industries L.L.C, SAQR Pack Company, Falcon Pack Industry LLC, Emirates National Factory for Plastic Industries LLC, Detpak Middle East FZE, Huhtamaki Flexible Packaging Middle East LLC, etc., are the top players operating in the Saudi Arabia foodservice & disposable packaging market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Foodservice Disposable Packaging Market Policies, Regulations, and Standards

4. Saudi Arabia Foodservice Disposable Packaging Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Foodservice Disposable Packaging Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Material Type

5.2.1.1. Plastic Resins- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. PP- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. PET- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. PE- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. PS- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. PLA- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Bioplastics and Plant-Fiber- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Paper and Paperboard- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Aluminium Foil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Bagasse and Moulded Fiber- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Product

5.2.2.1. Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lids- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Tubs and Containers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Bowls- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Trays- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Clamshells- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Plates- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cutlery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Bags and Wraps- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Cartons- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Straws- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Order Type

5.2.3.1. Dine-in- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Take-away- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Delivery- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Application

5.2.4.1. Quick-Service Restaurants (QSR)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Full-Service Restaurants- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Coffee and Snack Outlets- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Retail Establishments- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Institutional and Hospitality- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Mobile Vendors and Food Trucks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Catering Services- Market Insights and Forecast 2022-2032, USD Million

5.2.4.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Price Range

5.2.5.1. Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Mid-Range- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Sales Channel

5.2.6.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.7. By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Saudi Arabia Plastic Resins Foodservice Disposable Packaging Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Product- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Order Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Price Range- Market Insights and Forecast 2022-2032, USD Million

6.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Bioplastics and Plant-Fiber Foodservice Disposable Packaging Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Product- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Order Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Price Range- Market Insights and Forecast 2022-2032, USD Million

7.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Saudi Arabia Paper and Paperboard Foodservice Disposable Packaging Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Product- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Order Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Price Range- Market Insights and Forecast 2022-2032, USD Million

8.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Saudi Arabia Aluminium Foil Foodservice Disposable Packaging Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Product- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Order Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4. By Price Range- Market Insights and Forecast 2022-2032, USD Million

9.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Saudi Arabia Bagasse and Moulded Fiber Foodservice Disposable Packaging Market Statistics, 2020-2030F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By Product- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Order Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Price Range- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1.Company Profiles

11.1.1. Napco National Company

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Hotpack Packaging Industries L.L.C

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. SAQR Pack Company

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Falcon Pack Industry LLC

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Emirates National Factory for Plastic Industries LLC

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Arabian Plastic Industrial Co. Ltd.

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. International Food Services LLC

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Prestige Packing Industry LLC

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Detpak Middle East FZE

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Huhtamaki Flexible Packaging Middle East LLC

11.1.10.1. Business Description

11.1.10.2. Product Portfolio

11.1.10.3. Collaborations & Alliances

11.1.10.4. Recent Developments

11.1.10.5. Financial Details

11.1.10.6. Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Material Type |

|

| By Product |

|

| By Order Type |

|

| By Application |

|

| By Price Range |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.