UAE Cards and Payments Market Report: Trends, Growth and Forecast (2026-2032)

By Instrument Type (Cards (Debit Card, Charge Card, ATM Card, Pre-Paid Card, Credit Card, Store Card), Mobile Wallets, Cheques, Others), By Card Type (Contact Smart Card, Contactless Smart Card, Non-Smart Card), By Type of Payments (B2B, B2C, C2C, C2B (E-commerce Shopping, Payment at POS Terminals)), By Transaction Type (Domestic, Foreign), By Application (Food & Groceries, Health & Pharmacies, Travel & Tourism, Hospitality, Others (Media & Entertainment))

|

Major Players

|

UAE Cards and Payments Market Statistics and Insights, 2026

- Market Size Statistics

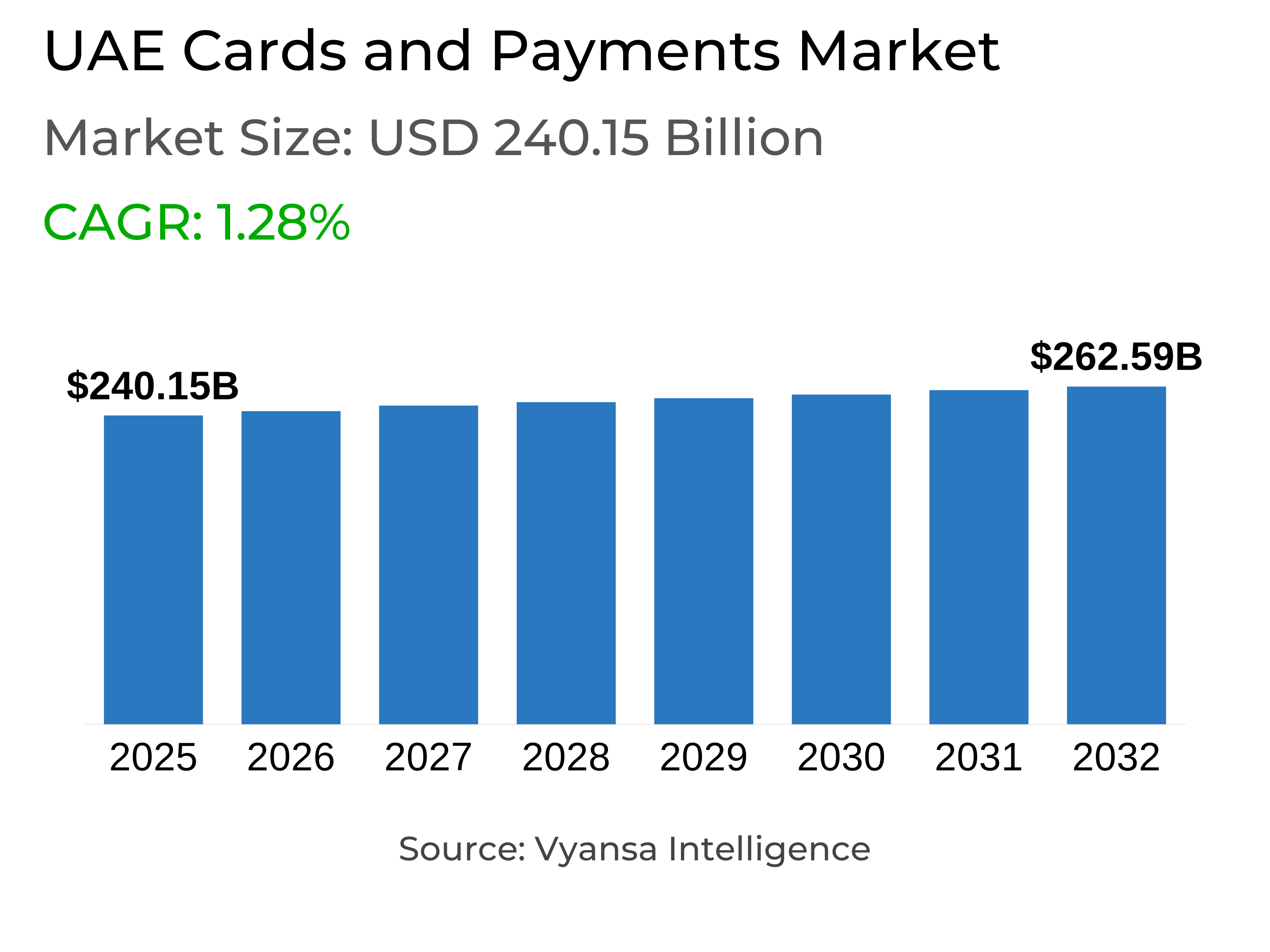

- Cards and Payments in UAE is estimated at $ 240.15 Billion.

- The market size is expected to grow to $ 262.59 Billion by 2032.

- Market to register a CAGR of around 1.28% during 2026-32.

- Instrument Type Shares

- Cards grabbed market share of 80%.

- Cards to witness a volume CAGR of around 2.55%.

- Competition

- More than 15 companies are actively engaged in producing Cards and Payments in UAE.

- Top 5 companies acquired 50% of the market share.

- National Bank of Ras Al-Khaimah, CitiBank, UAE, HSBC Bank Middle East, Emirates NBD, First Abu Dhabi Bank PJSC etc., are few of the top companies.

- Card Type

- Contact Smart Card grabbed 54% of the market.

UAE Cards and Payments Market Outlook

The UAE cards and payments market of USD 240.15 billion is estimated to reach approximately USD 262.59 billion by 2032, with card volumes experiencing a CAGR of 2.55%. Growth will be driven by increasing usage of digital payments, further growth of e-commerce, and government schemes driving a cashless economy. Phone smart cards, now holding 54% of the market, will continue to lead because they are convenient, secure, and universally accepted.

The UAE financial landscape is likely to get even stronger with continuous innovations like the Aani instant payments platform, facilitating near-instant fund transfers and settlements. Both small and large-value transactions will be supported by these platforms, driving financial inclusion and incentivizing end users and businesses to shift from cash to digital payments. Digital wallets and prepaid cards will also further increase adoption with bundled rewards and loyalty programs.

Fintech and digital banks will be the key to determining the direction of the market. Cooperation between conventional banks and fintech companies will further prevail, facilitating ground-breaking payment solutions and improved end users experiences. The growth of embedded finance, as financial services are embedded in common platforms, will also become more prominent, as end users will have access to frictionless financial and lifestyle services across sectors.

Looking forward, the UAE market is set to become progressively cashless. Investments in regulatory infrastructure, cybersecurity, and digital payment infrastructure will make for a secure and efficient payments ecosystem. The synergy between government encouragement, fintech innovation, and adoption of digital banking will continue to fuel the development of the UAE cards and payments market.

UAE Cards and Payments Market Growth Driver

Government and Central Bank Support Driving Digital Payments

The UAE government and the Central Bank also actively promote the development of digital payments, building a solid foundation for the payment landscape to evolve. Schemes like the Wage Protection System and the Financial Infrastructure Transformation (FIT) Program promote broader use of electronic payment solutions, promoting the shift of end users and businesses towards a cashless economy. This emphasis on financial infrastructure develops confidence in digital payments and inspires innovation in the sector.

Concurrently, the Central Bank further strengthens its regulatory system to provide stability, security, and end users protection in the payment system. New regulations for fintech players, such as BNPL providers, ensure responsible lending and sound operations. These initiatives instill confidence among end users and businesses, making digital payments a desired and trustworthy means of transaction in the UAE.

UAE Cards and Payments Market Trend

Growth of Digital Wallets and Integrated Payment Platforms

UAE is seeing a robust growth in digital wallets and fused payment platforms due to increasing end users expenditure, economic expansion, and positive digital environment. National real-time payment platforms and local card networks, like Jaywan, facilitate safe online payments for small and big transactions at low merchant and end users charges. The advancements enhance the country shift to a cashless society and promote increased use of digital payment tools throughout the country.

end users increasingly transact using digital platforms with embedded reward and loyalty schemes on a daily basis, making digital wallets an entrenched phenomenon. Concurrently, threats of online fraud are increasing, pushing the government to take corrective measures to step up cybersecurity. Sustained development of security controls is necessary to ensure continued confidence and further increase the adoption of integrated digital payment technologies in the UAE.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Cards and Payments Market Opportunity

Integration of Embedded Finance Across Industries

The increasing use of digital payment solutions and wallets in the UAE is an enormous opportunity for embedded finance in industries. With the country getting increasingly cashless and fintech continually transforming, businesses will be required to incorporate financial services into their core offerings itself, giving end userss integrated experiences. The emergence of digital banks like Wio Bank signals growing embracement of new-age financial solutions and the potential for more extensive embedded finance uptake.

By integrating payments, credit, and other financial services into day-to-day products and services, businesses can increase convenience, enhance end users interaction, and promote loyalty. Integration between industries is expected to further fuel the digitalisation of the UAE's payment ecosystem, enabling the expansion of new business models and fostering a more integrated financial and lifestyle landscape for end users.

Unlock Market Intelligence

Explore the market potential with our data-driven report

UAE Cards and Payments Market Segmentation Analysis

By Instrument Type

- Cards

- Mobile Wallets

- Cheques

- Others

The segmentation with the highest market share under Instrument Type is Cards, with a market share of approximately 80% of the UAE cards and payments space. This leadership is based on the widespread end user demand for card usage in online and offline payments, given promotional regulatory efforts and expansion in secure payment infrastructure. Cards are the most established and entrenched payment tool due to their convenience, popularity, and synchronization with loyalty and reward schemes.

In the future, cards are anticipated to continue steady growth with a forecasted volume CAGR of roughly 2.55%. The emergence of instant payment systems such as Aani and the creation of the domestic card network Jaywan will continue to bolster the ecosystem, making cards a core pillar of the UAE's journey towards becoming a cashless economy.

By Card Type

- Contact Smart Card

- Contactless Smart Card

- Non-Smart Card

The segmentation with the highest market share under Card Type is Contact Smart Cards and they held 54% share of the UAE market. The dominant position reflects the universal adoption of secure and easy contact-based card transactions by end users. Contact smart cards are facilitated by the sophisticated payment infrastructure of the UAE, enabling easy and safe use in retail, e-commerce, and service industries.

Their prominence also indicates the position of fintech companies and conventional banks in extending card issuance and digital integration. Since end users have expressed robust confidence in them, encouraged by regulatory scrutiny and technological innovation within the industry, contact smart cards are likely to maintain their top position in the future as the nation draws closer to achieving the cashless economy vision.

Top Companies in UAE Cards and Payments Market

The top companies operating in the market include National Bank of Ras Al-Khaimah, CitiBank, UAE, HSBC Bank Middle East, Emirates NBD, First Abu Dhabi Bank PJSC, Abu Dhabi Commercial Bank, Mashreq Bank, Road & Transport Authority (RTA), Union National Bank, Standard Chartered Bank Plc, etc., are the top players operating in the UAE Cards and Payments Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Cards and Payments Market Policies, Regulations, and Standards

4. UAE Cards and Payments Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Cards and Payments Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Instrument Type

5.2.1.1. Cards- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Charge Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. ATM Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Pre-Paid Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Store Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Mobile Wallets- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cheques- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Card Type

5.2.2.1. Contact Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Contactless Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Non-Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Type of Payments

5.2.3.1. B2B- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. B2C- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. C2C- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. C2B- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4.1. E-commerce Shopping- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4.2. Payment at POS Terminals- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Transaction Type

5.2.4.1. Domestic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Foreign- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Application

5.2.5.1. Food & Groceries- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Health & Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Travel & Tourism- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Hospitality- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others (Media & Entertainment)- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. UAE Cards Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Card Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

7. UAE Mobile Wallets Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8. UAE Cheques Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1. Emirates NBD

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2. First Abu Dhabi Bank PJSC

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3. Abu Dhabi Commercial Bank

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4. Mashreq Bank

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5. Road & Transport Authority (RTA)

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6. National Bank of Ras Al Khaimah

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7. CitiBank, UAE

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8. HSBC Bank Middle East

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9. Union National Bank

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Standard Chartered Bank Plc

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Instrument Type |

|

| By Card Type |

|

| By Type of Payments |

|

| By Transaction Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.