UAE Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Feb 2026

- VI0919

- 130

-

UAE Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

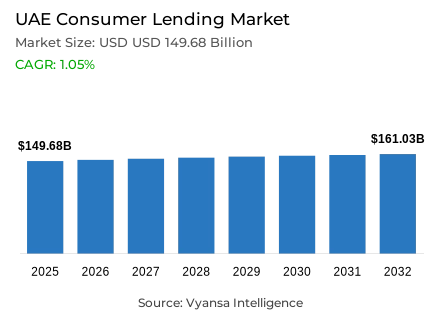

- Consumer lending in UAE outstanding balance is estimated at USD 149.68 billion and gross lending is estimated at USD 141.97 billion in 2025.

- An outstanding balance market size is expected to grow to USD 161.03 billion and gross lending USD 157.23 billion by 2032.

- Market to register an outstanding balance cagr of around 1.05% and gross lending cagr of around 1.47% during 2026-32.

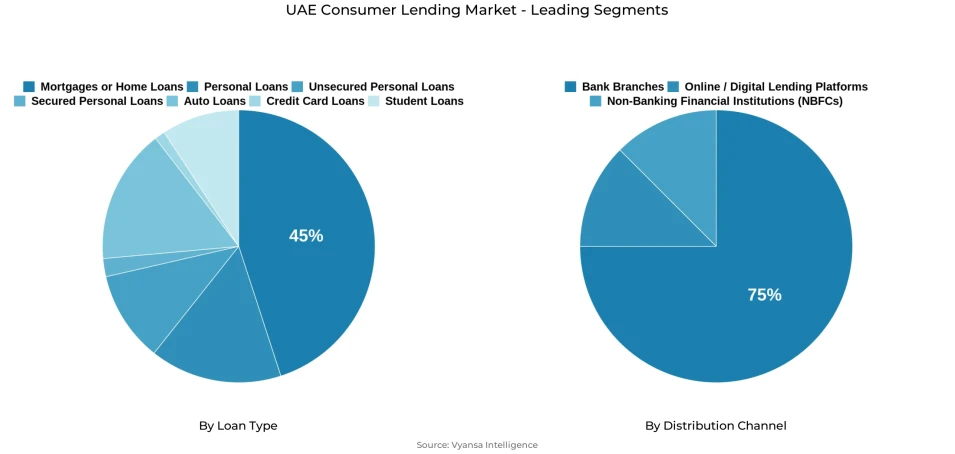

- Loan Type Shares

- Mortgages / home loans grabbed market share of 45%.

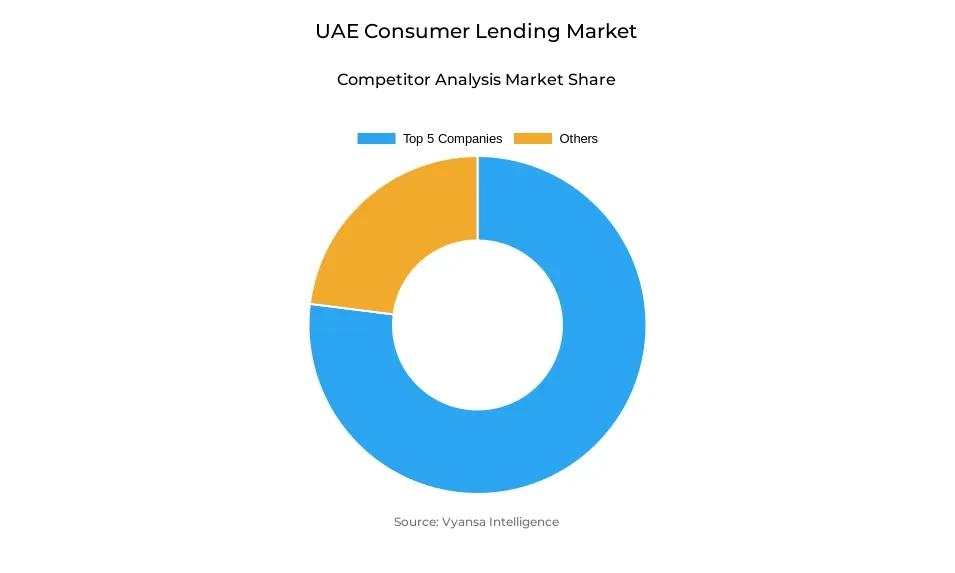

- Competition

- Consumer lending in UAE is currently being catered to by more than 15 companies.

- Top 5 companies acquired the maximum share of the market.

- Citibank UAE; HSBC Bank Middle East; Union National Bank; Emirates NBD; First Abu Dhabi Bank (FAB) etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 75% of the market.

UAE Consumer Lending Market Outlook

The UAE consumer lending market is forecast to continue growing at a steady pace until the year 2032, owing to the favorable economic environment, foreign investments, and the advancement of the online lending platforms. The outstanding amount is also anticipated to grow from USD 149.68 billion in the year 2025 to USD 161.03 billion in the year 2032, at a CAGR of approximately 1.05%, while the gross lending amount is also forecast to grow from USD 141.97 billion to USD 157.23 billion, with a CAGR of about 1.47%. The demand for lending is also expected to remain strong as people continue to rely on lending for various expenses, despite the increasing cost of living and high rates of rentals.

The real estate sector will continue to be a key driver of the lending market. Being 45% of mortgages and/or home loans, the sector could be fueled by the UAE’s attractive investment environment, the expected reduction of US-related interest rates, as well as the growing use of PropTech platforms. Online real estate investment platforms such as fractional ownership and artificial intelligence-assisted property assessment will open up the property sector to everyone, thus persuading consumers on the use of mortgage financing, particularly for smaller properties.

At the same time, credit card lending and Buy Now Pay Later services are set to grow in popularity because of attractive bank offers and an overall increase in retail spending. The new Central Bank regulatory framework that has been rolled out for Buy Now Pay Later services is set to promote transparency and protect consumers in the market. With the integration between fintech, PropTech, and digital payments systems set to intensify, micro-lending solutions are set to be in high demand among younger people.

The market share in the distribution sector remains largely dominated by the bank branch network, with a market share of 75%, buoyed by the popularity and low probability of default in the care of the government-supervised institutions. The market in the future would be benefactors of the steady immigration, investment, and speedy digitalisation of the finance sector, which would see the sector supported in terms of increased loans.

UAE Consumer Lending Market Growth DriverStrong Real Estate Investment Climate Supporting Lending Growth

The strong performance of the real estate investment sector acted as a primary growth catalyst for the UAE consumer lending market during 2024. As stated by the Central Bank of the UAE (CBUAE), real GDP expanded by around 3.1% during 2023, slightly down from the earlier figure, and continues to remain stimulated by non-oil sectors, real estate investment, and the recovery of the tourism and business sectors. Foreign investment from neighboring GCC countries and the UK, Germany, and the US helped stimulate the demand for both consumption and investment real estate.

The real estate market in Dubai had recorded historic transactions worth AED 761 billion in 2024, marking a 20% yearly increase, with the number of procedures reaching an all-time high of 2.78 million, thereby supporting market activity and growth. With banks providing competitive home loan facilities and attractive schemes available for deserving buyers, and with the expatriate population also on the rise UAE population touched 11.3 million in 2024, both loan demand as well as composite spending sentiments across the household sector remain strong.

UAE Consumer Lending Market ChallengeRising Cost of Living and High Borrowing Expenses

The increasing cost of living remains an issue in consumer lending in the UAE. Consumer prices in the UAE reported an increase of around 2.3% yearly in 2024, as reported by the Central Bank, primarily because of the growth in the price of rent, utilities, and services. Although the reported inflation rate remains lower than the previously reported figure of 3.3%, it remains a pressing issue as it accelerates the demand for personal loans.

Mortgage affordability faces challenges: Though there are good numbers of buyers and demand in the property market, higher costs of living and property prices affect the ability to afford property, especially for single-income families and younger generations. Banks and the government balance expansion in lending with managing risks to prevent unaffordable accumulation of debt by households despite increased costs of living and their potential to continue to influence lending opportunities, particularly in managing basic expenses, despite a strong property market.

UAE Consumer Lending Market TrendRapid Expansion of PropTech Platforms and Digital Real Estate

A major highlight of the UAE’s real estate sector remains their digital transformation due to their government being abuzz with smart infrastructure. The government of the UAE, as well as the United Nations E-Government Survey of 2024, verifies that it has exceeded the global average of 99% of internet usage and is ranked as leaders because of their significant digital infrastructure. The government of Dubai, as well as the United Nations E-Government Survey of 2024, ensure that PropTech platforms adhere to real estate regulations.

PropTech technology enables and sustains the streamlined processing of property transactions, increased transparency in the market, and enhanced AML/KYC procedures, particularly with regards to digital mortgage and property valuation services. An enabling regulatory environment is catalyzing the advent of digital property investment as a means of bringing new borrowers into the mainstream economy and inventing new finance products related to property, such as digital home loans and micro-mortgages.

UAE Consumer Lending Market OpportunityRegulatory Framework Strengthening BNPL and Digital Lending Growth

The UAE Central Bank issued regulations for short-term lending products, including the Buy Now Pay Later, in 2023. The regulatory guideline ensures that lenders offering the BNPL services have to be licensed by the central bank or work in partnership with a licensed financial entity, thus promoting safety and fair operations for the market. Essentially, the guideline promotes safety and transparency in the operations of the BNPL services in the UAE.

With continued government support and the digital revolution, the UAE remains a magnet for new expat citizens and continues to facilitate population growth, peaking at 11.3 million in 2024. With the overall population and online shopping on the upswing, BNPL services, embedded finance solutions, and micro lending services have new scopes for expansion, thus fueling further lending volume growth in the future, especially for the young demographic.

UAE Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with the biggest market share under Loan Type is Mortgages/Home Loans, which secured 45% of the consumer lending market in the UAE. The demand for real estate, especially in Dubai and Abu Dhabi, favorable mortgage rates pegged to the US dollar, as well as the attraction of local as well as foreign investments, have acted as major drivers in supporting the mortgage market. The availability of PropTech platforms based on fractional ownership, coupled with easy digital interfaces, have encouraged many consumers to invest in real estate.

During the forecast period, mortgages are expected to maintain their lead position due to their stable credit performance, as credit conditions improve with the softening of interest rates. Expat inflows and increasing investment possibilities will also boost this market position. Banks have been working on improving the facilities associated with mortgages, making this market and other property financing markets the pillars of the entire consumer credit market in the UAE.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The category with the biggest share, under the head of Distribution Channel, is bank branches, which has a total share of 75% of the consumer lending market in the UAE. The conventional system of carrying out transactions in the branches still holds significant importance when it comes to mortgage, personal, and term loans offered to consumers, as they require physical interaction and verification as to the structuring of the loan and related financial advice.

Notwithstanding the acceleration of digital lending and BNPL services, bank branches still lead the way as they enjoy great credibility, government regulations, and their ability to process complex loans. As banks bolster their digital operations alongside their excellent offline services, the offline sector will remain pivotal to consumer lending. Increased real estate investments, rising expat populations, and expanding loan books will ensure that bank branches remain leaders during the forecast period.

List of Companies Covered in UAE Consumer Lending Market

The companies associated with the UAE consumer lending market are outlined below.

- Citibank UAE

- HSBC Bank Middle East

- Union National Bank

- Emirates NBD

- First Abu Dhabi Bank (FAB)

- Abu Dhabi Commercial Bank (ADCB)

- Mashreq Bank

- National Bank of Ras Al-Khaimah (RAKBANK)

- Standard Chartered Bank

- Dubai Islamic Bank (DIB)

Competitive Landscape

The UAE consumer lending market in 2024 is shaped by strong competition among traditional banks, digital banks, fintech firms, and emerging PropTech-linked platforms. Large banks dominate through mortgages, personal loans, and credit cards, supported by stable asset quality and attractive lending schemes, including zero-interest promotions for selected customers. Fintech and Buy Now Pay Later providers are intensifying rivalry by offering fast, digital-first credit solutions integrated into retail and e-commerce. PropTech platforms such as Stake, Huspy, and Baytukum are reshaping real estate-linked lending through crowdfunding, fractional ownership, and tokenisation. Meanwhile, banks are responding by investing in digital lending, embedded finance, and microcredit solutions, creating a competitive landscape driven by innovation, digitalisation, and real estate-linked financing demand.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Consumer Lending Market Policies, Regulations, and Standards

4. UAE Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. UAE Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. UAE Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Emirates NBD

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.First Abu Dhabi Bank (FAB)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Abu Dhabi Commercial Bank (ADCB)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Mashreq Bank

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Dubai Islamic Bank (DIB)

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Abu Dhabi Islamic Bank (ADIB)

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.RAKBANK (National Bank of Ras Al Khaimah)

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Dubai First Bank

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Citibank UAE

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. HSBC Bank Middle East

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.