UK Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Feb 2026

- VI0935

- 115

-

UK Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

- Consumer lending in UK outstanding balance is estimated at USD 2.95 trillion and gross lending is estimated at USD 784.59 billion in 2025.

- An outstanding balance market size is expected to grow to USD 3.22 trillion and gross lending USD 842.73 billion by 2032.

- Market to register an outstanding balance cagr of around 1.26% and gross lending cagr of around 1.03% during 2026-32.

- Loan Type Shares

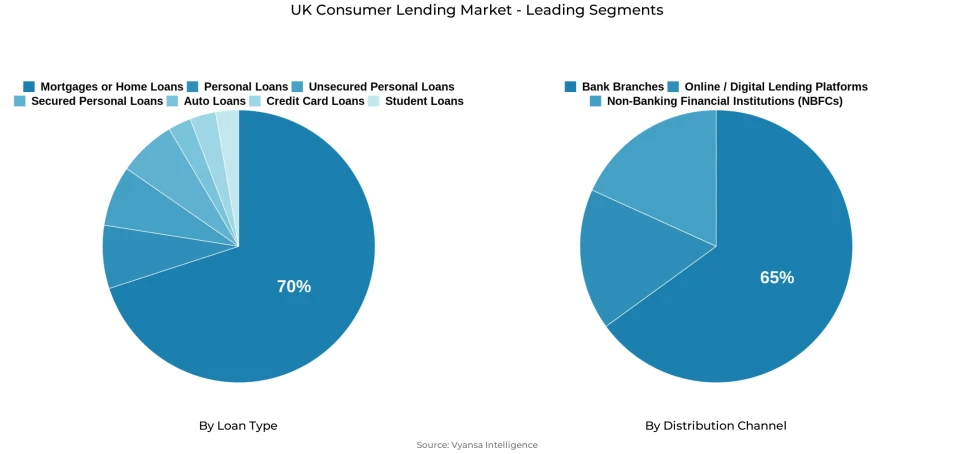

- Mortgages / home loans grabbed market share of 70%.

- Competition

- Consumer lending in UK is currently being catered to by more than 10 companies.

- Top 5 companies acquired the maximum share of the market.

- Lloyds group; Nationwide Building Society; Monzo Bank Ltd; Barclays Plc; Lloyds Banking Group Plc etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 65% of the market.

UK Consumer Lending Market Outlook

The UK consumer lending market is expected to grow slowly over 2026–2032 as the economy continues to stabilise after years of disruption from high inflation and rising interest rates. In 2025, outstanding balance is estimated at USD 2.95 trillion and gross lending at USD 784.59 billion. By 2032, outstanding balance is projected to reach USD 3.22 trillion, while gross lending is expected to rise to USD 842.73 billion. This reflects a modest growth path, with outstanding balance growing at around 1.25% CAGR and gross lending at about 1.03% CAGR during 2026–32.

Growth will mainly come from consumer credit rather than mortgages. Many consumers still depend on credit cards, overdrafts, and personal loans to manage daily expenses, especially as service prices remain high. Education and auto lending will also continue to add to outstanding balance, as repayments are becoming harder due to high interest rates and salaries not rising fast enough. Even as the Bank of England is expected to slowly reduce interest rates, many households will remain cautious about taking new loans.

Mortgages and home loans will continue to dominate the market, holding around 70% share. However, gross lending in housing is likely to stay weak in the early part of the period because of high house prices, strict lending rules, and low confidence. Many borrowers will choose longer loan tenures of 30–35 years to make repayments more affordable, while others will refinance as their low fixed-rate deals expire.

Bank branches will remain the main distribution channel, holding about 65% share. At the same time, Buy Now Pay Later will keep growing, although its future speed will depend on how strict new regulations become. Overall, the market will grow slowly, supported by consumer credit, but limited by cautious borrowing and ongoing cost-of-living pressures.

UK Consumer Lending Market Growth DriverEasing Inflation Supporting Consumer Confidence and Credit Demand

Easing inflation continues to support the expansion of consumer lending in the UK. The Bank of England reports that inflation declined to 2.0% in May 2024, marking the first time in nearly three years that the official inflation target has been achieved. Eased inflationary pressures have contributed to stabilizing consumer spending and allaying fears over price volatility, which negatively affected the UK over the past years. Rising service prices notwithstanding, eased inflationary pressures have assisted in making it easier for the UK consumer to spend.

With the stabilization of inflation, consumer confidence has increased, which can be seen with the steady growth in the categories of non-mortgage credit, such as card lending and personal loans. Notwithstanding the high cost of borrowings, more consumers continue to seek the use of credit to support and preserve their current standard of living, considering the cost-of-living pressures.

UK Consumer Lending Market ChallengeHigh Interest Rates Reducing Affordability and Suppressing Borrowing

High interest rates are the greatest challenge facing consumer lending in the UK. Although the base interest rate has been cut by the Bank of England to 5.0% in August 2024, the cost of borrowing, although down, remains high in comparison with the pre-2022 levels. This has resulted in increased mortgage payments, especially for the 1.6 million existing borrower mortgages whose fixed, low-rate deals expired in 2024. This has limited affordability and new mortgage lending, resulting in net housing lending declining sharply.

This has been accompanied by a high level of interest rates, which has also affected the labour market. Figures from the ONS indicate a rise in unemployment, as the unemployment rate increased to 4.2% as of February 2024, as companies cut their workforce due to high-priced credit and reduced investment activity. Job insecurity and reduced investment have been shown to be decreasing loan volumes across several categories.

UK Consumer Lending Market TrendRapid Expansion of BNPL Adoption Across All Demographics

Buy Now Pay Later (BNPL) is continuing to spread rapidly in the UK, with the Bank of England reporting that the number of households using BNPL rose to 14% in 2023. With the adoption of BNPL options at major retailers such as Sainsbury’s and Boots in 2024, usage has increased further. Partnerships such as Klarna with Xero now allow BNPL to be used for payments related to home services and small businesses.

The popularity of BNPL is further fueled by ease of access, minimal entry barriers, and interest-free instalments, especially in a high-interest-rate environment. However, the largely unregulated structure has raised concerns about overspending and debt accumulation. With upcoming regulation, BNPL will continue as a defining trend in the market.

UK Consumer Lending Market OpportunityImproved Borrowing Conditions Expected as Interest Rates Decline

Improving loan terms are set to create favorable conditions for expanded consumer lending over the outlook period The Bank of England is expected to continue cutting its base rate in line with stabilizing inflation. Lower interest rates will allow consumers to refinance existing loans and take new credit more comfortably.

Mortgage affordability will also ease. As more borrowers adopt longer terms of 30–35 years, monthly repayments will fall, supporting refinancing even if new mortgage demand remains modest. Improving economic stability and better lending terms will create opportunities for structured lending post-2025.

UK Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment has the highest share around the loan type, and the highest market share is of Mortgages / Home Loans, which account for around 70% of the market. This dominance comes from the large size and long duration of home loans compared to other credit types. Even though high interest rates have reduced new mortgage applications, the huge base of existing borrowers keeps this segment far ahead of others. Housing remains the biggest financial decision for most UK households.

Many borrowers are now moving from low fixed-rate deals to much higher rates, which is pushing up monthly repayments and outstanding balances. At the same time, strict lending rules, high house prices, and slow income growth are making it harder for new buyers to enter the market. Still, because mortgages involve large amounts and long repayment periods, they continue to hold the leading position among all loan types.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment has the highest share around the distribution channel, and the highest market share is of Bank Branches, holding around 65% of the market. Physical branches remain important because many borrowers prefer face-to-face support when taking large or long-term loans, especially mortgages and refinancing. These products often involve complex checks, paperwork, and personal financial advice.

In a time of high interest rates and rising repayment stress, banks also rely on branches to carefully assess income, job stability, and repayment ability. Direct interaction helps reduce risk for lenders and gives borrowers more confidence in their decisions. Although digital lending is growing, bank branches still lead because trust, guidance, and personal service matter most when people take on serious, long-term debt.

List of Companies Covered in UK Consumer Lending Market

The companies associated with the UK consumer lending market are outlined below.

- Lloyds group

- Nationwide Building Society

- Monzo Bank Ltd

- Barclays Plc

- Lloyds Banking Group Plc

- HSBC Bank Plc

- Santander UK Plc

- NatWest

- Revolut Ltd

- American Express Co

Competitive Landscape

The UK consumer lending market is shaped by traditional banks, credit card issuers, fintech lenders, and fast-growing Buy Now Pay Later (BNPL) providers. High interest rates have strengthened the position of major banks in mortgages and housing loans, though stricter criteria and weak demand limit growth. Credit card companies and personal lenders benefit from rising reliance on consumer credit for everyday spending. BNPL players such as Klarna have become key disruptors, expanding usage across retail and services through easy access and interest-free instalments. However, growing regulatory scrutiny is expected to reshape competition. Overall, rivalry is driven by pricing, accessibility, digital platforms, and the ability to support consumers under financial pressure.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Consumer Lending Market Policies, Regulations, and Standards

4. UK Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. UK Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. UK Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Barclays Plc

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Lloyds Banking Group Plc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.HSBC Bank Plc

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Santander UK Plc

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.NatWest

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Lloyds group

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Nationwide Building Society

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Monzo Bank Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Revolut Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. American Express Co

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.