Thailand Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Feb 2026

- VI0915

- 120

-

Thailand Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

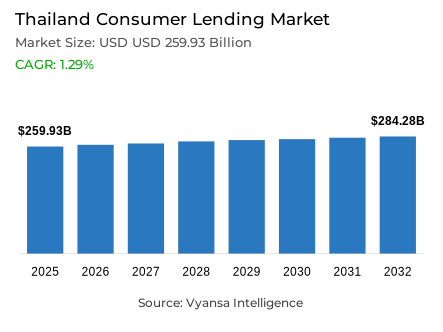

- Consumer lending in Thailand outstanding balance is estimated at USD 259.93 billion and gross lending is estimated at USD 127.41 billion in 2025.

- An outstanding balance market size is expected to grow to USD 284.28 billion and gross lending USD 149.56 billion by 2032.

- Market to register an outstanding balance cagr of around 1.29% and gross lending cagr of around 2.32% during 2026-32.

- Loan Type Shares

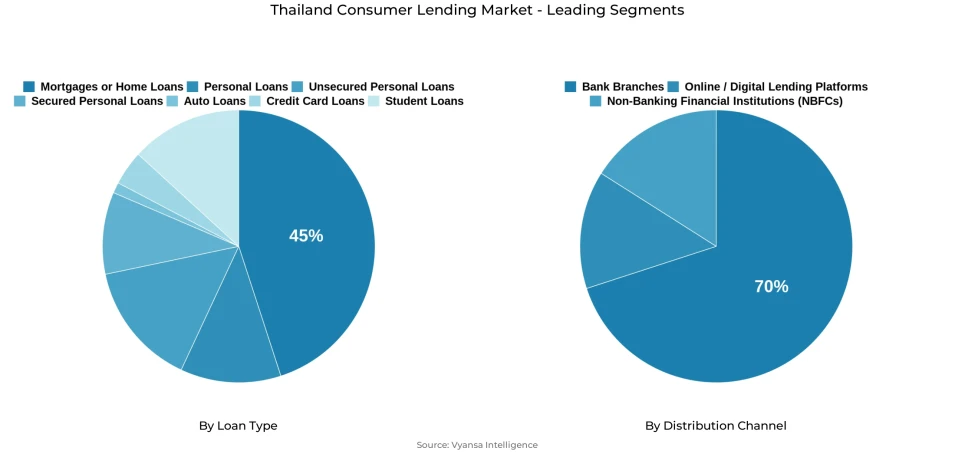

- Mortgages / home loans grabbed market share of 45%.

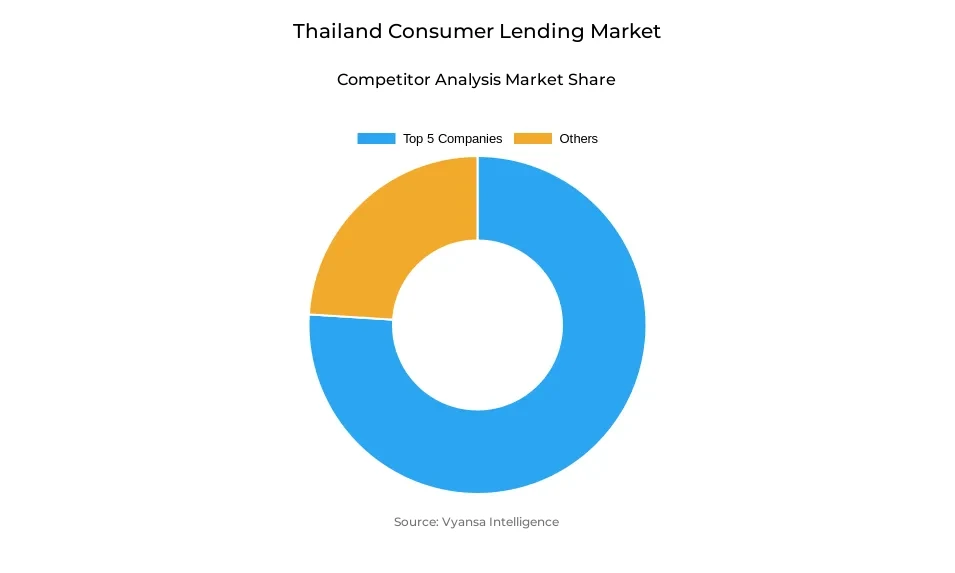

- Competition

- Consumer lending in Thailand is currently being catered to by more than 10 companies.

- Top 5 companies acquired the maximum share of the market.

- Krungthai Card Public Co Ltd; TMBThanachart Bank (TTB); Aeon Thana Sinsap (Thailand) PCL; Siam Commercial Bank (SCB); Kasikornbank (KBank) etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 70% of the market.

Thailand Consumer Lending Market Outlook

The Thailand Consumer Lending Market will remain on track to grow through 2026-2032, though it will be operating under challenging economic conditions with debt reaching record high levels. The amount outstanding in 2025 is forecasted to be USD 259.93 billion, reaching USD 284.28 billion by 2032, with a CAGR of 1.29%. The gross amount of consumer lending is forecasted to rise from USD 127.41 billion to USD 149.56 billion, with an accelerated pace of 2.32% CAGR. Although credit demand will continue to be driven by high living expenses with low wage growth, lending will gradually become less robust with consumers under the strain of high debt levels with uncertain future earnings.

Home loans/housing mortgages, with a market share of 45%, are expected to be accompanied by difficulties in their structure since the new generation of customers prefers not to take out big home loans in favor of personal and auto loans with smaller amounts and shorter repayment terms. The high number of NPLs, stricter standards of lending, and stagnant incomes are expected to contain the growth of home loans, although an agreement between banks and property developers may revive home loans through special rate campaigns. Credit card debts are also expected to be at risk since a million credit cards are already considered NPLs, and banks’ cautious approach to new loan approvals continues.

The traditional banks' retail branches, which have 70% market distribution in lending, shall also be at the forefront of lending despite new lending platforms like BNPL becoming popular. The popularity of BNPL services in this period, especially for Gen Y and lower-income groups, shall help boost short-term loans. However, prudent lending practices shall become standard despite impulsive purchases and debts being amassed. Proper regulation shall become evident between 2026-2032.

Moving forward, the consumer lending sector in Thailand will continue to experience growth, but under a higher level of financial scrutiny. This is due to headwinds within the economy, a high level of household debt, and a tightening of lending criteria, balanced by innovations such as digital scoring models, financial sector reform, and increased transparency.

Thailand Consumer Lending Market Growth DriverLower Inflation Supporting Monetary Adjustments and Debt Relief

The easing inflation had contributed to an improvement in household budgets and an accommodating lending environment in 2024. According to the Bank of Thailand (BOT), inflation in 2024 averaged around 0.8%, down substantially from the average annual inflation figure in 2022 at 6.1%, well within the target range at 1-3%. The ease in inflation has given room for BOT to introduce new measures such as the two-pot retirement scheme, beginning in September 2024, that would allow members to withdraw not exceeding 10% or baht 30,000 to repay short-term loans.

Such monetary changes were necessary in the face of continued difficulties posed by high household debt and sluggish income expansion. The stabilizing impact of borrowing costs was particularly valuable at a time when other difficulties, like job market uncertainties and rising cost-of-living costs, continued to exist.

Thailand Consumer Lending Market ChallengeExcessive Household Debt Constraining Borrowing Capacity

The household debt remains very high at an estimated THB 16.42 trillion by 2024, or 88.4% of GDP, which is one of the largest ratios in Asia, based on Bank of Thailand statistics. The growth of the economy increasingly relies on consumption-driven borrowing through credit cards, personal, and car loans, while younger people, especially, are Deep in long-term debt from which many never recover, even in retirement, according to National Credit Bureau.

Non-mainstream lending is predominant, putting end user at risk of unregulated elements. A combination of high leverage, stagnant wages, and growth in consumer lending is maintaining financial risk. However, it is restraining demand for significant loan products, including mortgage and hard goods loaning.

Thailand Consumer Lending Market TrendSurge in Credit Card NPLs Amid Changes to Minimum Payments

Credit card non-performing loans climbed significantly in the early months of 2024 due to loan repayment issues. In March 2024, the NCB reported over 1 million credit cards to be categorized as NPLs amounting to THB 64 billion, including another 190,000 special mention loans amounting to THB 12 billion. This came after BOT elevated the minimum credit card payment from 5% to 8%, which is expected to speed up loan repayment, but most cardholders struggled to repay with elevated standards.

Policy circles also debate reducing the minimum payment due from credit card customers as a way to relieve pressures on the borrower. This increased number of delinquencies also proves that end user have been struggling with living expenses and sluggish growth in their incomes, as credit card lending becomes the top market concern.

Thailand Consumer Lending Market OpportunityGrowing BNPL Adoption Among Younger and Low-Income Consumers

Buy Now, Pay Later (BNPL) services offer a quickly growing market in Thailand Consumer Lending Market. With a penetration rate for the internet at 85% in 2024, the growing online shopping market makes the BNPL method more appealing to younger generations and low-income earners who want the option of interest-free payments that have easier terms than credit card loans. Market research indicates that payment volumes in the BNPL market in 2024 will reach about USD 4.3 billion, growing at a rate of 10.7% from 2024 to 2029.

Although there may be issues concerning impulsive consumption, regulation bodies and the market are slowly embracing the move towards BNPL formalization and sound lending practices. The use of BNPL services benefits credit participation and helps retailers as it offers cheap methods of payment this is one of the major drivers of the credit market in the Thai economy.

Thailand Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with highest market share under loan type, is Mortgages/Home Loans, which account for about 45% of the market. This fact illustrates the significant role that housing finance has played in the Thai economy, even in these challenging economic times. Housing loans still form the biggest chunk of household borrowing, even though the accessibility of home loans has been made tougher due to the stagnation of incomes, living expenses, and tougher standards set by lenders. Younger people postpone purchasing homes, but current owners, together with the well-off, still need home loans, which are the biggest financial burden for them.

Although it is challenged by non-performing loans due to rising residential mortgage lending, housing finance remains significant as housing is viewed as an important aspiration as well as a savings asset. There is collaboration between banks and developers to facilitate demand through special interest rates, discounts, and waiving of fees to ensure that mortgage loans continue to remain leaders among various types of loans, although it grows more selectively.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with highest market share under distribution channel, is Bank Branches, which accounts for about 70% of consumer lending. The presence of physical bank branches is core, as high-value loans, such as mortgage and car loans, cannot be discussed over the phone or online, as the customer has to be physically consulted. It is also the same with consumers who want to be met physically, especially with products like consumer loans. The branches for banks are very essential for risk management, as banks can quantify risk as a result of their interaction with their customers.

In a country characterized by high domestic debt, together with a rise in non-performing loans, branches for banks are very important for screening end user before offering them the terms for repayment. Even though online banking continues to exhibit increased popularity, the use of branches still rules, as end user need assistance.

List of Companies Covered in Thailand Consumer Lending Market

The companies associated with the Thailand consumer lending market are outlined below.

- Krungthai Card Public Co Ltd

- TMBThanachart Bank (TTB)

- Aeon Thana Sinsap (Thailand) PCL

- Siam Commercial Bank (SCB)

- Kasikornbank (KBank)

- Bangkok Bank

- Krungthai Bank

- Bank of Ayudhya (Krungsri)

- United Overseas Bank (Thailand)

- American Express

Competitive Landscape

Thailand consumer lending market is shaped by intense competition among banks, finance companies, and fast-growing alternative credit providers. Traditional banks remain dominant in mortgages, auto loans, and credit cards, but face rising pressure from non-performing loans and stricter risk controls. Credit card issuers are under scrutiny as higher minimum payment rules strain borrowers, increasing defaults. Housing loan providers compete through partnerships with real estate developers, offering special rates and bundled incentives to stimulate demand. At the same time, fintech platforms and retailers are rapidly expanding Buy Now, Pay Later services, especially among younger and low-income groups. This mix of traditional lenders, developer-linked financiers, and digital credit platforms is intensifying rivalry while pushing lenders to balance growth with tighter risk management.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Consumer Lending Market Policies, Regulations, and Standards

4. Thailand Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Thailand Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Thailand Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Siam Commercial Bank (SCB)

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Kasikornbank (KBank)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Bangkok Bank

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Krungthai Bank

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Bank of Ayudhya (Krungsri)

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Krungthai Card Public Co Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.TMBThanachart Bank (TTB)

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Aeon Thana Sinsap (Thailand) PCL

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.United Overseas Bank (Thailand)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. American Express

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.