Turkey Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), By Nature (Disposable, Reusable), By Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Turkey Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

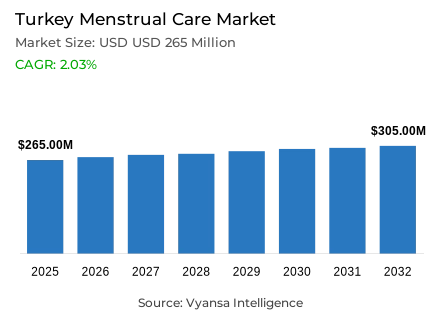

- Menstrual care in Turkey is estimated at USD 265 million in 2025.

- The market size is expected to grow to USD 305 million by 2032.

- Market to register a cagr of around 2.03% during 2026-32.

- Product Type Shares

- Towels grabbed market share of 85%.

- Competition

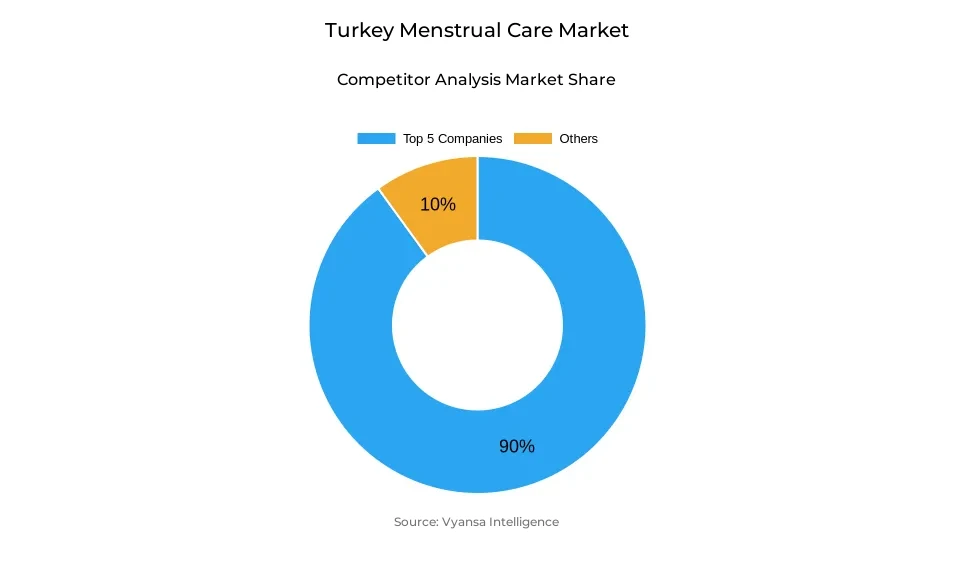

- More than 5 companies are actively engaged in producing menstrual care in Turkey.

- Top 5 companies acquired around 90% of the market share.

- Johnson & Johnson Sıhhi Malzeme Sanayi ve Ticaret AŞ; Ontex Tüketim Ürünleri Sanayi ve Ticaret AŞ; Rozi Kağıt ve Temizlik Ürünleri Sanayi ve Ticaret AŞ; Procter & Gamble Tüketim Malları Sanayi Ltd Şti; Kimberly-Clark Tüketim Malları Sanayi ve Ticaret AŞ etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Turkey Menstrual Care Market Outlook

The Turkey menstrual care market is projected to grow to USD 265 million in 2025 and to USD 305 million by 2032 with a compound annual growth rate of about 2.03% in the forecast period of 2026-2032. Towels will continue to dominate the market with a market share of about 85 % of total value sales, which will be backed by the increasing end user preference of slim, thin and ultra-thin product variants. Pantyliners are expected to perform well, as they will be based on the need to have a discreet, modern, and comfortable product formulation. Nevertheless, tampons will not be culturally popular, which will restrict the diversification of categories in general. The growing end user demand towards products that provide greater comfort and convenience is still influencing the buying-behaviour trends and the rising disposable income levels and the dampening inflationary pressures are likely to keep the market growing.

The competitive environment is even between international companies, local producers, and own-label competitors. Through its brand, Orkid, Procter and Gamble continues to lead the market in terms of value and volume, whereas Eruslu Saglik Urunleri San and Hayat Kimya Sanayi AS are making inroads into the market with product-innovation and competitive pricing strategies. Other brands like Molped and Sleepy are focusing on the introduction of eco-friendly products, including organic cotton and sugarcane-based biopolymers, which emit fewer carbon emissions and respond to end user needs of sustainable products.

It is estimated that retail offline channels will continue to dominate sales, with almost 85 percent of the total market value, with discounter chains like BIM, A101, and SOK as the dominating distribution networks. These retail chains have outdone the traditional supermarkets by providing competitively priced own-labeled products, such as Scarlett and LAL brands, which are effectively serving the price-sensitive end user market of the country. At the same time, retail online will keep its upward trend of growth, which is facilitated by online stores such as Trendyol, Hepsiburada, and N11, which provide unique promotional discounts and increased product diversity.

Premium product designs, sustainable innovation programs, and product-portfolio diversification are expected to continue to be key drivers of growth throughout the forecast period. The market players will probably launch thinner, more absorbent versions of towels with wings, antibacterial versions, and night-use versions with greater protection features. The further evolution of the environmentally-friendly production practices and omnichannel retailing will guarantee the stable long-term growth of the menstrual care market in Turkey.

Turkey Menstrual Care Market Growth DriverRising Disposable Income and Urban Women's Awareness Fuel Market Growth

The Turkey menstrual care market is currently undergoing a long-term growth, which is mostly due to macroeconomic growth and increased hygiene consciousness among urban women end user. World Bank statistics show that Turkey Gross Domestic Product has recorded 4.5 % growth in 2023, thus boosting the purchasing power of the urban population. This economic trend, combined with a rise in the female labour-force participation, has increased the pace of demand of high-quality menstrual care products, which focus on comfort and convenience.

The process of urbanisation and exposure to international hygiene standards have led to a faster uptake of slim and thin towel variants by end user who view them as more convenient and discrete. With the growing focus of female end user on convenience and optimisation of hygiene, brands with dermatologically tested, breathable and environmentally friendly formulations are gaining market penetration faster. The growth of locally produced brands like Molped and Sleepy has also enhanced the accessibility of the products and strengthened the resilience of the domestic market, thereby contributing to the long-term market growth patterns.

Turkey Menstrual Care Market ChallengeCultural Barriers and Lack of National Menstrual Health Programme

Despite the growth of the market, cultural perceptions and policy infrastructure gaps still limit the full growth potential of the market. Menstruation is a stigmatised topic in the Turkey society; studies have shown that a large percentage of women consider menstrual talk as shameful and embarrassing, especially in conservative areas. Tampons are still culturally unpopular, which is a sign of unease in society with internal menstrual care products. This ongoing stigmatisation restricts the diversification of product categories and prevents the emergence of new forms of menstrual care.

Moreover, Turkey does not have a national policy or subsidy system on menstrual health at the moment. Although some municipalities and charitable organisations provide free sanitary items to low-income women, there is no systematic government initiative to tackle menstrual equity. This lack leads to unequal access to hygiene products, especially in rural geographies. The absence of formalized public-health programs makes the affordability and end user-education disparities unaddressed, thus making it difficult to achieve inclusive market development in the market.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Turkey Menstrual Care Market TrendGrowing Preference for Healthier and Sustainable Menstrual Products

Rising end user preference for environmentally friendly and dermatologically sensitive formulations is emerging as a transformative trend in Turkey menstrual care market. The growing preference of end user towards products that are free of dyes, chlorine, and synthetic materials is indicative of a wider sustainability awareness and increased health awareness. According to end user-research records, Turkey end user are increasingly becoming conscious of environmental and health issues when choosing menstrual care products.

Brands such as Sleepy and Molped, which are market leaders, are taking advantage of this change in behaviour by introducing products that use biopolymer-based materials and sustainable design concepts. Women end user in diverse income groups are becoming more concerned with the quality of the products, their dermatological safety, and their environmental friendliness. This overlap of wellness and environmental awareness is setting new standards of product innovation in the menstrual care market in Turkey, thus contributing to the long-term growth of the category.

Turkey Menstrual Care Market OpportunityProduct Innovation and Premiumisation to Drive Market Expansion

The future direction of the menstrual care market in Turkey lies in the field of innovation and premiumisation. With the macroeconomic environment still changing, high-performance products, especially thin and ultra-thin towels with wings alongside pantyliners are expected to grow in demand among urban and higher-income end user groups. According to the World Bank, Turkey is expected to grow by about 3.1 % in 2025, which will help to sustain end user confidence in discretionary spending on personal-care products.

This is a better macroeconomic environment that allows brands to add high-end product attributes, such as improved absorbency technologies, night-use designs, and biodegradable materials. The success of eco-friendly product lines in the domestic market shows that there is a significant potential of brands that combine sustainability concepts with comfort features. Focusing on organic, dermatologically safe, and innovative product formats, businesses can respond to changing end user priorities and contribute to the overall sustainability goals of Turkey and inclusive market growth.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Turkey Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

The dominant segment within the product type classification of the Turkey Menstrual Care Market is Towels, commanding approximately 85% of total market share. Towels maintain their position as the preferred option among end users due to their comfort attributes, affordability, and robust product availability throughout the country. The increasing popularity of slim/thin/ultra-thin towel variants with wings has further strengthened this segment's performance, as these products deliver enhanced comfort, superior absorbency, and discreet fitting characteristics aligned with contemporary end user preferences.

Continuous product innovations, including extended-length thin towels engineered for overnight protection and formulations incorporating skin-friendly, dye-free, and antibacterial materials, continue to generate end user interest. The sustained end user confidence in towels as a dependable and hygienic solution ensures their continued market dominance within the Turkey menstrual care sector throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The predominant segment within the sales channel classification of the Turkey Menstrual Care Market is Retail Offline, representing approximately 85% of total sales volume. This dominance is primarily driven by discounter retail formats, which have surpassed supermarkets as the leading distribution channel for menstrual care products. The success of discounters stems from their provision of affordable yet reliable product offerings that resonate with price-conscious end user segments.

Discount retail chains including BIM, A101, and SOK have significantly expanded their national footprint, providing extensive product assortments and robust private label portfolios. Notwithstanding the steady growth trajectory of retail online channels, Turkey end user continue to demonstrate preference for the accessibility and reliability associated with offline shopping experiences. This established end user behavior pattern ensures that retail offline will maintain its position as the dominant distribution channel for menstrual care products throughout the forecast period.

List of Companies Covered in Turkey Menstrual Care Market

The companies listed below are highly influential in the Turkey menstrual care market, with a significant market share and a strong impact on industry developments.

- Johnson & Johnson Sıhhi Malzeme Sanayi ve Ticaret AŞ

- Ontex Tüketim Ürünleri Sanayi ve Ticaret AŞ

- Rozi Kağıt ve Temizlik Ürünleri Sanayi ve Ticaret AŞ

- Procter & Gamble Tüketim Malları Sanayi Ltd Şti

- Kimberly-Clark Tüketim Malları Sanayi ve Ticaret AŞ

- Hayat Kimya Sanayi AŞ

- BIM Birleşik Mağazacılık AŞ

- Eruslu Sağlık Ürünleri Sanayi ve Ticaret AŞ

Competitive Landscape

Procter & Gamble Tüketim Mallari Sanayi Ltd Sti retained its leading position in Turkey’s menstrual care market, with its Orkid (Always) brand dominating both value and volume sales, supported by a broad portfolio of slim, thin, and ultra-thin towels. Eruslu Saglik Ürünleri San ve Tic AS recorded strong value growth, driven by product innovation and competitively priced offerings targeting middle-income end users. Hayat Kimya Sanayi AS also maintained a solid presence through its Molped and Sleepy brands, emphasising eco-friendly and health-focused products, including Sleepy’s thin long towel with wings for overnight use. At the same time, BIM Birlesik Magazacilik AS expanded its influence through private labels Scarlett and LAL, catering to price-sensitive end users and intensifying competition among global, local, and private label brands.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Turkey Menstrual Care Market Policies, Regulations, and Standards

4. Turkey Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Turkey Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Turkey Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Turkey Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Turkey Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Turkey Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Turkey Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Turkey Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble Tuketim Mallari Sanayi Ltd Skt

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Kimberly-Clark Tuketim Mallari San ve Tic AS

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Hayat Kimya Sanayi AS

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. BIM Birlesik Magazacilik AS

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Eruslu Saglik Urunleri San ve Tic AS

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Johnson & Johnson Sihhi Malzeme San ve Tic AS

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Ontex Tüketim Ürünleri San ve Tic AS

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Rozi Kagit ve Temizlik Urunleri Sanayi ve Ticaret

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.