Turkey Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

Turkey Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

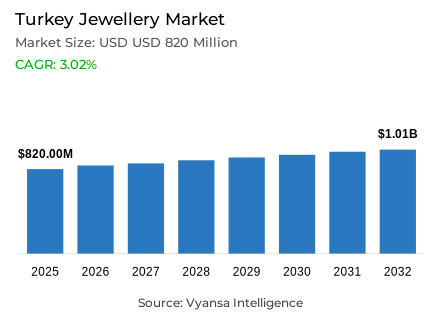

- Jewellery in Turkey is estimated at USD 820 million in 2025.

- The market size is expected to grow to USD 1.01 billion by 2032.

- Market to register a cagr of around 3.02% during 2026-32.

- Category Shares

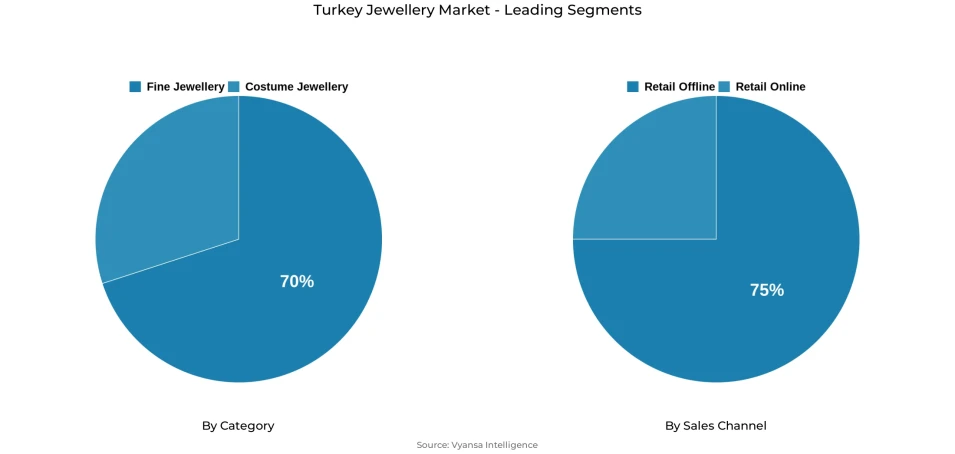

- Fine jewellery grabbed market share of 70%.

- Competition

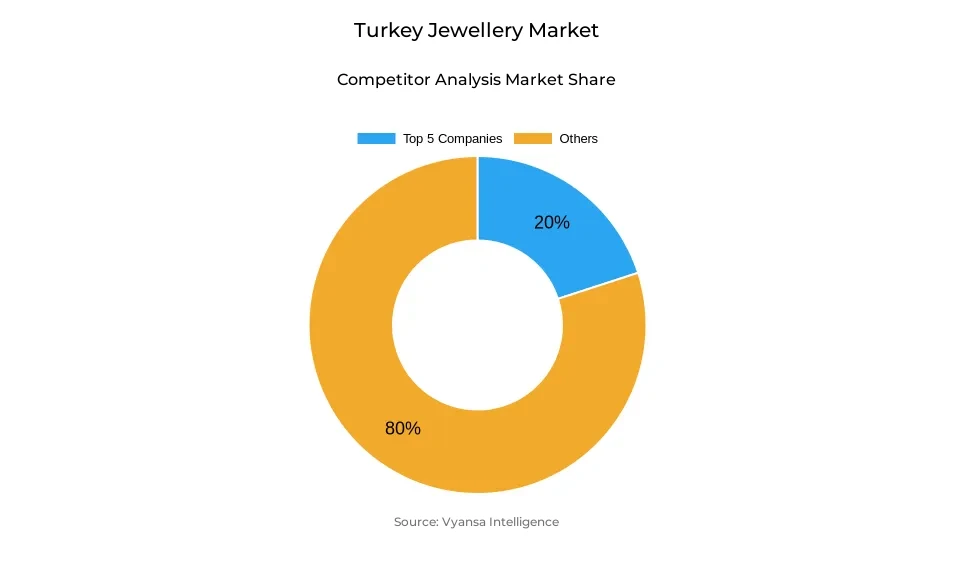

- More than 20 companies are actively engaged in producing jewellery in Turkey.

- Top 5 companies acquired around 20% of the market share.

- Arpas Ihracat Ithalat Ve Pazarlama AS; Sümer Kuyumculuk San ve Tic AS; Zen Turizm Hediyelik Esya San Ve Tic Ltd Sti; Atasay Kuyumculuk San ve Tic AS; Altinbas Kuyumculuk Ith Ihr San Tic AS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Turkey Jewellery Market Outlook

Turkey jewellery market will grow at a slow pace between 2026 and 2032, supported by stabilising macro-economic factors and a continuing cultural attachment to gold and fine jewellery. The market is projected to grow to USD 77.51 billion in 2025 and USD 83.2 billion in 2032, which is a compound annual growth rate of about 1.02%. The dominant segment will remain fine jewellery, which constitutes about 80% of the total market value. However, the growth will be more through the increased demand of lighter and cheaper designs because the long-term inflation has made value-based and lower-carat products more appealing.

Capsule and limited-edition collections are expected to be more significant in creating engagement. The effectiveness of limited launches in driving demand and brand awareness has been proven by the success of Turkey with its Monaco Chain and celebrity-based collections. The same tactics will probably spread throughout the market, providing strong branding opportunities and good margins and attracting younger, fashion-conscious end users.

Development of the market will also be affected by lab-grown diamonds. Their affordability, sustainability factor, and the quality that is improving make them applicable to value-conscious Turkish end users who want to find alternatives to natural diamonds. Global and domestic brands are likely to expand lab-grown collections to diversify portfolios and appeal to modern end users.

Physical store retail, which constitutes about 65% of the sales, will be a necessity, since high-value jewellery requires trust, experience, and tactile assessment. At the same time, the growing use of retail online and brand-based digital investment will boost omnichannel shopping. The increasing popularity of designer-led brands, including Bee Goddess and Kismet by Milka in Turkey, indicate that labels that integrate craftsmanship, narrative, and aspirational identity can become more successful by 2032.

Turkey Jewellery Market Growth DriverHigh inflation and constrained household finances reshape jewellery demand

Household purchasing power remains under pressure due to persistently high inflation, which continues to restrict discretionary spending on non-essential items such as jewellery. The Turkish Statistical Institute (TurkStat) reported that the end user Price Index increased 44.38% year-on-year in December 2024, indicating intense cost-of-living stress.

Demand is also affected by labour-market conditions. According to TurkStat data, the unemployment rate is 8.5% in December 2024, which shows that income stability is not evenly distributed among the population groups. All these reasons justify the move to cheaper jewellery collections and less carat or lighter weight gold items. Value-based collections have thus been a priority of domestic producers and retailers to safeguard volume amidst margin pressure in an inflationary environment.

Turkey Jewellery Market ChallengeChannel change and digital acceleration compress margins and complicate distribution

The rapid growth of retail online has increased price competition and changed the jewellery discovery behaviour. According to government trade statistics, retail online contributed about 6.5% of the Turkish GDP in 2024, which indicates a strong digital growth.

At the same time, TurkStat records internet penetration of over 88-92% among demographic groups, which allows a large number of people to compare and shop online. This digital access and faster retail online development adds the competition of cheaper online players and the risk of commoditisation of the mid-market jewellers. Physical retailers are thus forced to use service quality, trust and experiential differentiation to justify high prices and protect market share.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Turkey Jewellery Market TrendAffordable assortments and lab-grown interest reshape product mixes and sourcing

Affordability is increasingly shaping product strategy across the jewellery market, supported by Turkey’s strong integration into global trade, with imports reaching about USD 344.01 billion in 2024, enabling access to a wide range of jewellery inputs and substitutes.

IMF forecasts show that end user prices can still increase by approximately 34.9% in 2025, further straining household budgets. Consequently, brands are growing reduced-gold lines and are considering lab-grown diamonds as cheaper alternatives. These alternatives meet the affordability and sustainability requirements, and slowly transform sourcing strategies and product mixes.

Turkey Jewellery Market OpportunityCapsule collections, experience and digital reach can broaden market penetration

The high level of digital access provides a good chance of targeted marketing. In 2024, TurkStat indicates that internet use is approximately 92.2% among men and 85.4% among women, which allows conducting digital and social campaigns on a large scale. According to government commerce statistics, online marketplaces constitute a significant portion of retail online transactions, and women comprise about 58% of marketplace purchases. Capsule collections, celebrity partnerships, and marketplace launches can thus grow quickly.

By integrating capsule strategies with an elevated in-store experience and powerful social-first campaigns, brands can appeal to both price-sensitive and aspiration-led end users, expanding market penetration despite macro-economic limitations.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Turkey Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery is the leading category, holding about 80% of the Turkey jewellery market. This dominance reflects the country’s strong cultural attachment to gold as a store of value, particularly during inflation and currency volatility. According to Central Bank of the Republic of Türkiye, inflation averaged above 60% in 2023–24, reinforcing gold’s safe-haven role.

From 2026–2032, fine jewellery will retain leadership, supported by traditions of gifting gold at weddings and family ceremonies. World Gold Council consistently ranks Turkey among the world’s largest gold-consuming countries due to cultural affinity. Gradual economic stabilisation, rising lab-grown diamond visibility, and growth of local designer brands will continue to support fine jewellery value.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline holds about 65% of Turkey’s jewellery market. end users rely on in-person verification, expert advice, and physical inspection, particularly for gold purity. TurkStat notes that over 72% of personal goods retail transactions still occur in-store, reflecting strong offline dependence. Neighbourhood jewellers maintain long-standing trust-based relationships with customers.

over the forcast period, retail offline will remain dominant for high-value jewellery. However, online growth will accelerate as TurkStat reports double-digit annual growth in retail online penetration. Even with rising retail online, physical stores will continue to anchor fine jewellery purchases, ensuring Retail Offline remains the leading channel throughout the forecast period.

List of Companies Covered in Turkey Jewellery Market

The companies listed below are highly influential in the Turkey jewellery market, with a significant market share and a strong impact on industry developments.

- Arpas Ihracat Ithalat Ve Pazarlama AS

- Sümer Kuyumculuk San ve Tic AS

- Zen Turizm Hediyelik Esya San Ve Tic Ltd Sti

- Atasay Kuyumculuk San ve Tic AS

- Altinbas Kuyumculuk Ith Ihr San Tic AS

- Richemont Istanbul Luks Esya Dagitim AS

- Aris Pirlanta

- Pandora Jewelery Mücevherat AS

- Favori Kuyumculuk San ve Tic AS

- Swarovski Kristal Tic Ltd Sti

Competitive Landscape

Turkey’s jewellery market is strongly dominated by domestic players, supported by deep understanding of local tastes and wide retail networks. Atasay Kuyumculuk San ve Tic AS leads the market with around 10% retail value share in 2024, driven by broad geographic coverage, competitive pricing, and a wide product portfolio. Other major local players such as Zen and Aris also hold strong positions, increasingly focusing on lighter and more affordable gold collections in response to rising global gold prices. While store-based jewellery specialists remain central to competition due to the importance of personal advice and trust, e-commerce is becoming a key battleground as brands invest in digital platforms. At the premium end, designer brands like Bee Goddess and Kismet by Milka are raising international visibility, intensifying competition in fine and luxury jewellery.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Trukey Jewellery Market Policies, Regulations, and Standards

4. Trukey Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Trukey Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Trukey Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Trukey Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Atasay Kuyumculuk San ve Tic AS

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Altınbaş Kuyumculuk İth Ihr San Tic AS

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Richemont Istanbul Lüks Eşya Dağıtım AS

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Aris Pırlanta

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Pandora Mücevherat AS

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Arpas İhracat İthalat ve Pazarlama AS

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Sümer Kuyumculuk San ve Tic AS

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Zen Turizm Hediyelik Eşya San ve Tic Ltd Şti

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Favori Kuyumculuk San ve Tic AS

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Swarovski Kristal Tic Ltd Şti

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.