Thailand Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Oct 2025

- VI0127

- 112

-

Thailand Skin Care Market Statistics, 2025

- Market Size Statistics

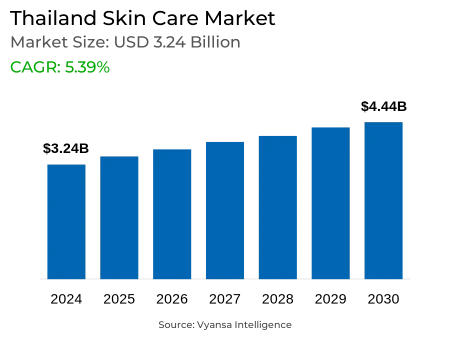

- Skin Care in Thailand is estimated at $ 3.24 Billion.

- The market size is expected to grow to $ 4.44 Billion by 2030.

- Market to register a CAGR of around 5.39% during 2025-30.

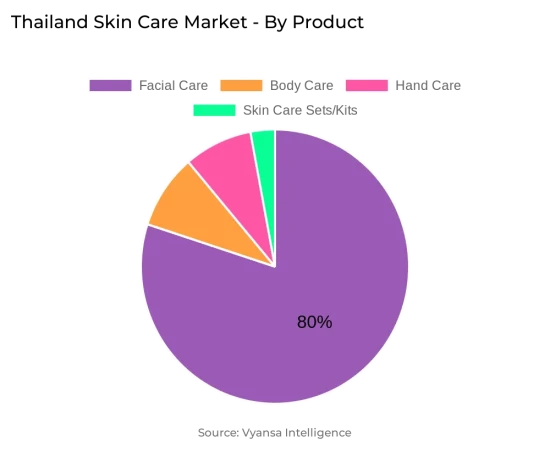

- Product Shares

- Facial Care grabbed market share of 80%.

- Competition

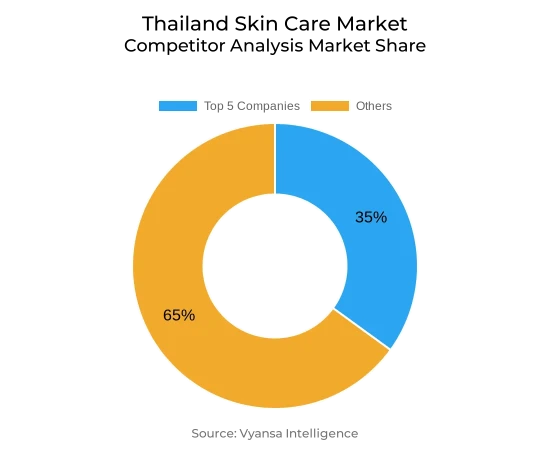

- More than 20 companies are actively engaged in producing Skin Care in Thailand.

- Top 5 companies acquired 35% of the market share.

- Amway (Thailand) Ltd, Shiseido (Thailand) Co Ltd, Rojukiss International PCL, L'Oréal Thailand Co Ltd, Beiersdorf Thailand Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 80% of the market.

Thailand Skin Care Market Outlook

Thailand skin care industry is expected to maintain its steady growth between 2025 and 2030 through expanding health and wellness awareness among consumers. Thai consumers are becoming increasingly aware of skin health and gravitate towards products that are preventative, e.g., moisturisers that build up the skin barrier, sunscreens, and deep cleaners for pollution defense. Ingredients such as niacinamide, ceramides, and retinol are picking up momentum, and demand for anti-ageing and natural options like bakuchiol is increasing as well.

Simple skin care regimens with premium, evidence-based formulations are gaining traction, particularly from urban consumers. Local brands are quickly gaining momentum by providing efficient products with trendy packaging and active ingredients. T-Beauty, which is a combination of K-beauty and J-beauty infused with Thai cultural values, is gaining popularity and may experience global success. The category will undergo innovations in cleansers, face masks, acne treatments, and body care, focusing on hydration, anti-pollution, and sun protection.

Retail e-commerce is the most dynamic sales channel. Customers still trust online platforms such as Shopee, Lazada, TikTok, and LINE for bargains, reviews, and social media-driven promotions. Influencer marketing, live shopping, and short video guides will dominate driving sales, particularly among young consumers. Pharmacies, clinics, and convenience stores such as 7-Eleven will also remain highly relevant due to trust and convenience.

From 2025 to 2030, international and domestic brands will increase their presence in the market. Premiumisation will persist as Gen X and Gen Z demand efficient, safe, science-based solutions. The Thai skin care market awaits innovation and diversification as competition accelerates and digital marketing strategies change.

Thailand Skin Care Market Trend

A digital-first strategy will continue to be a key marketing strategy for Thailand's skin care brands in 2025–30. Social media sites like Facebook, TikTok, Instagram, and LINE Shopping continue to be at the center of driving sales. Brands are increasingly leveraging live shopping events and real-time posting to reach customers and drive instant purchases. Working with micro-influencers also allows brands to reach niche communities and build authenticity and trust.

Local content remains important, with short-form videos, tutorials, and interactive commercials highly engaging with Thai consumers. These formats are conducive to "shoppertainment"—a combination of shopping and entertainment—enabling a more exciting buying process. Video content is especially highly engaging across all platforms since consumers like visual and interactive content. Influencers tend to have higher engagement rates, so they remain a useful vehicle for advertising skin care products to engaged and committed online audiences.

Thailand Skin Care Market Opportunity

Thailand will see a flood of new global skin care brands from 2025 to 2030 due to its high growth prospects. Such brands as Banobagi, Biologique Recherche, Dermafora, Skintific, and The Ordinary will make the inroads. The power of K-beauty continues unabated, with Korean players launching innovative products. J-beauty's minimalism, on the other hand, and emphasis on natural ingredients will also drive new brands to enter. New product forms, like the peptide lip serum from Skintific in a vacuum pump, could also become popular.

Thailand's skin care industry will experience moderate volume and value expansion, supported by increasing domestic demand for skin health, based on a latest study. T-beauty, the fusion of K-beauty, J-beauty, and Thai concepts, is increasingly building pace and can become popular worldwide. Premiumisation will also enable growth, particularly as consumers from Gen X aim for science-supported, high-grade dermo-cosmetic products.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 3.24 Billion |

| USD Value 2030 | $ 4.44 Billion |

| CAGR 2025-2030 | 5.39% |

| Largest Category | Facial Care segment leads with 80% market share |

| Top Trends | Rising Importance of Digital-First Strategies |

| Top Opportunities | Rising Global Interest and Innovation Driving Market Expansion |

| Key Players | Amway (Thailand) Ltd, Shiseido (Thailand) Co Ltd, Rojukiss International PCL, L'Oréal Thailand Co Ltd, Beiersdorf Thailand Co Ltd, Unilever Thai Holdings Ltd, Elca (Thailand) Co Ltd, Procter & Gamble Mfg Thailand Ltd, Amore Pacific (Thailand) Co Ltd, OP Natural Products Co Ltd and Others. |

Thailand Skin Care Market Segmentation Analysis

The most dominant market segment in terms of sales channel is retail offline. In-store shopping is still the preferred choice among Thai consumers for skincare, as they appreciate the specialist advice, genuineness of products, and the opportunity to sample products first before making a purchase. Pharmacies and clinics are reliable sources of dermatologist-recommended items such as La Roche-Posay, Vichy, and CeraVe, with sampling at pop-up kiosks usually available. Luxury brands conduct experiential happenings and shops in shopping malls to connect face-to-face with consumers. Convenience stores like 7-Eleven are favored for sachet packs, value-for-money combos, and loyalty cards, appealing to students, tourists, and impulse buyers.

Additionally, Retail e-commerce is fueled by Thailand's digitally native and price-conscious consumers. E-commerce platforms such as Shopee, Lazada, Watsons, and Central have official brand stores with flash sales, bundles, and cashback. Social commerce sites such as TikTok, Facebook, and LINE are employed for influencer marketing, live shopping, and limited-time offers. Online reviews and social media drive purchase decisions, according to a survey.

Top Companies in Thailand Skin Care Market

The top companies operating in the market include Amway (Thailand) Ltd, Shiseido (Thailand) Co Ltd, Rojukiss International PCL, L'Oréal Thailand Co Ltd, Beiersdorf Thailand Co Ltd, Unilever Thai Holdings Ltd, Elca (Thailand) Co Ltd, Procter & Gamble Mfg Thailand Ltd, Amore Pacific (Thailand) Co Ltd, OP Natural Products Co Ltd, etc., are the top players operating in the Thailand Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Skin Care Market Policies, Regulations, and Standards

4. Thailand Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Thailand Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Thailand Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Thailand Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Thailand Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. L'Oréal Thailand Co Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Beiersdorf Thailand Co Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Unilever Thai Holdings Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Elca (Thailand) Co Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Procter & Gamble Mfg Thailand Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Amway (Thailand) Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Shiseido (Thailand) Co Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Rojukiss International PCL

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Amore Pacific (Thailand) Co Ltd

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. OP Natural Products Co Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.