Austria Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0521

- 125

-

Austria Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

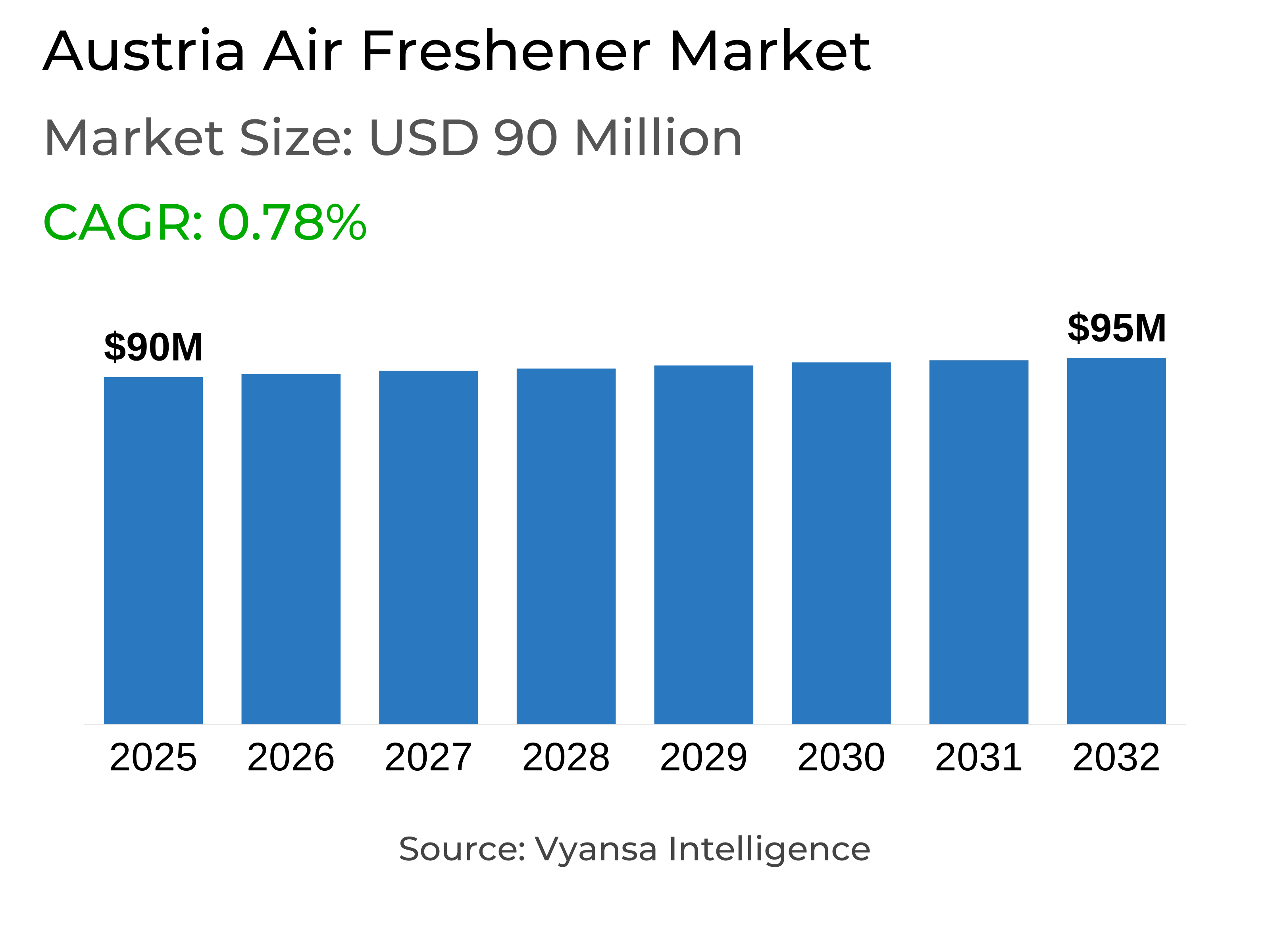

- Air Freshener in Austria is estimated at $ 90 Million.

- The market size is expected to grow to $ 95 Million by 2032.

- Market to register a CAGR of around 0.78% during 2026-32.

- Product Type Shares

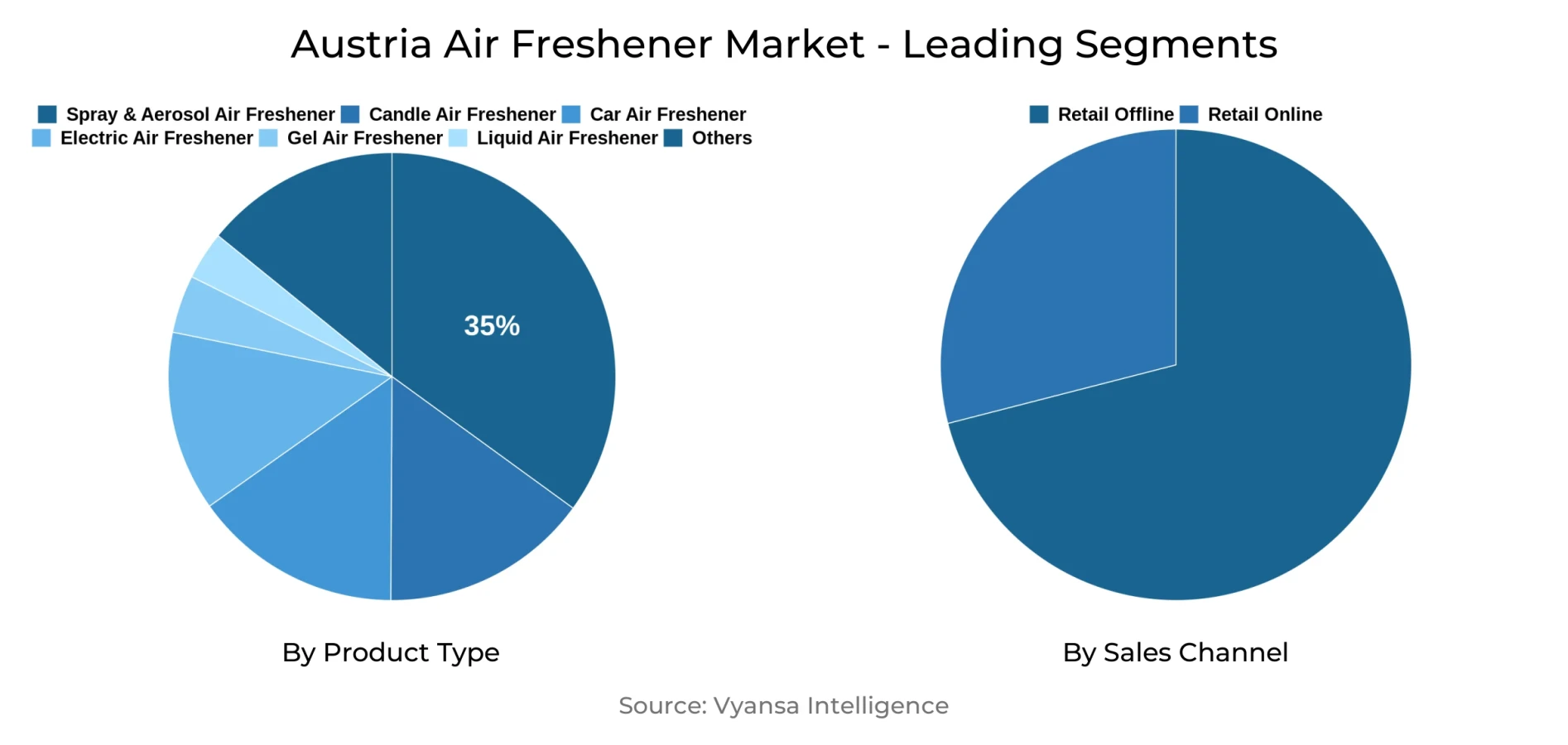

- Spray/Aerosol Air Freshener grabbed market share of 35%.

- Competition

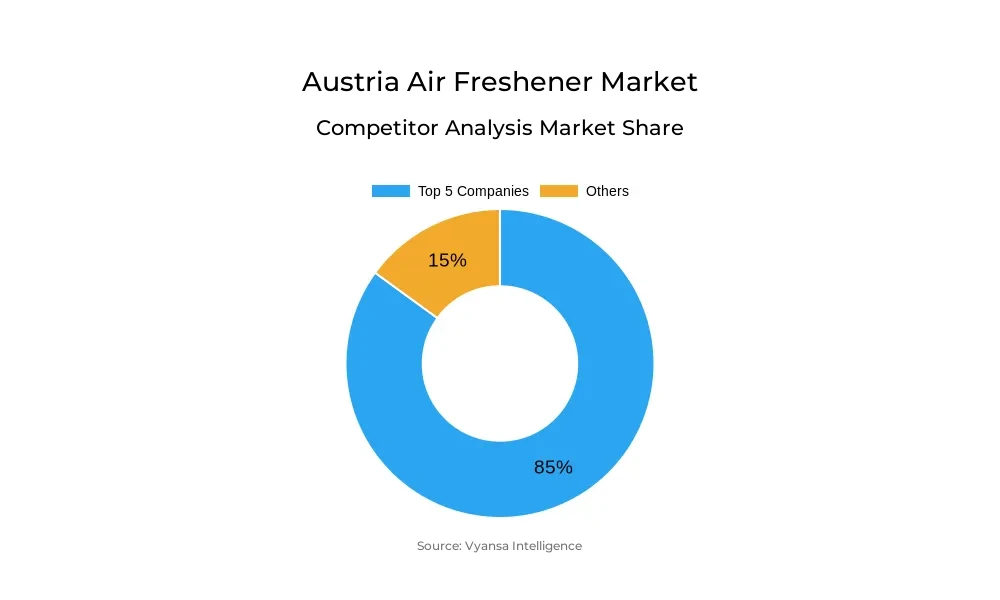

- More than 10 companies are actively engaged in producing Air Freshener in Austria.

- Top 5 companies acquired around 85% of the market share.

- Delta Pronatura Handels GmbH, Henkel Central & Eastern Europe GmbH, Wunder-Baum Vertrieb Österreich ACAR-Karios GmbH, SC Johnson GmbH, Reckitt Benckiser Austria GmbH etc., are few of the top companies.

- Sales Channel

- Retail Offline continues to dominate the market.

Austria Air Freshener Market Outlook

The Austria Air Freshener market is gradually transforming as end users increasingly focus on a refreshing and welcoming home atmosphere. Liquid air fresheners in decorative packaging or diffusers are becoming leading performers as products based on natural ingredients and eco-friendly solutions gain popularity. New and seasonal fragrance releases, including floral, fruit, warm spice, and woody fragrances, are additional drivers of growth by appealing to end users' need for new sensorial experiences and domestic atmosphere correction. International premium brands like SC Johnson (Glade), Reckitt Benckiser (Air Wick), and Procter & Gamble (Febreze) continue to exert market power with varied product ranges, seasonal variants, and eco-friendly packaging appealing to green end users.

2024 economic pressures drove price-conscious end users to cut back on discretionary items, such as air fresheners, and so marginal value increases and falling volumes recorded for spray, electric, candle, and gel forms. Home-made products or reused household product variants temporarily found favour, especially at lower- and middle-end consumer levels. Regardless of this, the image of premium brands as good quality and green continues to hold their attraction, encouraging firms to concentrate on strategic pricing, promotions, and innovation to maintain adoption in a risk-averse environment.

In the future, the market is projected to expand from a targeted $90 million in 2025 to $95 million in 2032. Liquid air fresheners will presumably keep performing well because of their aesthetic value and capability to improve home ambience, while gel formats are bound to decline in demand. Spray/Aerosol Air Fresheners with the largest market share of 35% continue to be in favor due to their convenience, instant fragrance effect, and flexibility to suit seasonal scent shifts, upholding consistent consumption among Austrian homes.

Retail offline channels, especially health and beauty experts, remain the leaders in the market, providing end users with the experience and test opportunities for products prior to acquisition. This hands-on in-store experience combined with handpicked offerings and expert salespeople boosts consumer confidence and influences repeated purchases. Though retail online channels are slowly gaining, offline channels are still the desired method for purchases of premium and festive air fresheners in Austria.

Austria Air Freshener Market Growth Driver

Growing Preference for Fresh and Ambient Home Environments

End users remain keen to keep their homes smelling fresh and inviting, spurring demand for air fresheners that add ambiance, especially those that include natural ingredients and environmentally friendly solutions. Liquid air fresheners, marketed in decorative packaging or diffusers, have been the top-performing subcategory as they are seen to provide a warm and cozy ambiance. Seasonal and new fragrance introductions, such as new floral, fruit, warm spice, and woody fragrances, also drive interest in air fresheners, offering incremental growth opportunities throughout the market.

Premium global brands with large product portfolios like SC Johnson (Glade), Reckitt Benckiser (Air Wick), and Procter & Gamble (Febreze) remain key drivers of market expansion. Strong media support, large offering of formats and fragrances, and seasonal packaging keep brands top of mind and drive repeat purchasing. Seasonal specials and eco-friendly packaging, as in the case of Reckitt Benckiser's Botanica, resonate with end users who are environmentally aware, creating loyalty for premium products.

Austria Air Freshener Market Challenge

Financial Constraints Limiting Air Freshener Adoption

Austria end users, sensitive to prices, in 2024 cut back on discretionary items like air fresheners, leading to modest value development and falling volume sales across spray, electric, candle, and gel forms. Hiked up living expenses and overall economic stress compelled many families to turn towards substitutes like homemade or reused household products like incense, fabric fresheners, and dryer sheets. This conservative buying attitude held back persistent consumption in all air freshener categories, especially at lower- and middle-income end users.

The general feeling of exorbitant expense relative to premium or foreign-made products further limited purchase. Although foreign labels continued to maintain presence and to provide competitive models, certain end users preferred lower-priced indigenous substitutes. This context presents challenges to market actors in reconciling affordability with innovation so as to prompt continuing use while ensuring the attractiveness of high-quality and eco-friendly air fresheners

Austria Air Freshener Market Trend

Preference for Natural Scents and Home Wellness Solutions

Austria end users increasingly look for air fresheners that promote wellness and home convenience. Seasonal scent shifts, such as fresh florals and fruit scents in spring and summer and warm spicy or woody scents in autumn and winter, have become popular. Such flavor trends promote innovation in new launches, allowing end users to experience new sensory impressions and ways to revitalize home spaces. Liquid air fresheners specifically remain to gain advantage from these trends because of their perceived impact on decor and ambience, bolstering consistent demand expansion.

In addition, international brands' focus on natural and sustainable products, like candles and liquid air fresheners with recyclable packaging or natural wax, mirrors wellness-oriented end-user priorities. Product launches positioned as drawing inspiration from nature and made with exotic botanicals like Tunisian rosemary, Moroccan mint, or Himalayan magnolia further supports the trend for holistic home care. The trend bolsters commitment to brands that balance aesthetic desirability with sustainability and health-oriented decisions.

Austria Air Freshener Market Opportunity

Expansion Potential Through New Product Launches and Economic Recovery

The better economic conditions in Austria will support air freshener performance as the end users increasingly move away from essential-only purchase. New product offerings and seasonal fragrances, along with convenience-driven solutions, like decorative diffusers and eco-friendly spray products, will drive growth, as these attract time-pressure households looking for easy-to-use, good-looking air fresheners.

Liquid air fresheners are expected to show consistent performance based on their capacity to boost house ambience and provide aesthetic designs. On the other hand, gel air fresheners are expected to experience weakening demand due to restricted supply and perceived high levels of chemicals. The forecast horizon offers brands the potential to differentiate based on innovation, eco-friendly materials, and augmented sensory stimulation, driving volume growth and supporting price resilience in the market.

Austria Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Spray/Aerosol Air Fresheners enjoy a 35% market lead position that indicates their extensive usage and popularity among end users. Their convenience, ease of use, and capacity to provide instant fragrance coverage suit them to the wide range of home environments, including high-traffic areas and multi-person living spaces.

The versatility of the format also enables regular scent switching, consistent with seasonal trends and end-user experimentation. Small and transportable formats further maximize convenience, rendering Spray/Aerosol Air Fresheners a top choice for instant and efficient home refreshing. Widely available in a variety of retail formats, maintaining the segment's leadership and appeal among Austrian homes.

By Sales Channel

- Retail Online

- Retail Offline

In 2025, retail offline channels, especially health and beauty experts, dominated the market share of air fresheners. End users prefer such stores for in-store testing, comparison, and discovery of new launches or seasonal offerings. The opportunity to smell and experience products prior to purchase enhances confidence, particularly in case of premium or first-time buying, driving repeated sales.

Grocery stores provide convenience and price competitiveness, while health and beauty professionals lead based on edited assortments, trained professionals, and focus on sensory. Retail online expands from a small base, offering convenience and a wide product choice, but the in-store sensory experience remains the main driver of end users' preference for offline channels of retailing.

Top Companies in Austria Air Freshener Market

The top companies operating in the market include Delta Pronatura Handels GmbH, Henkel Central & Eastern Europe GmbH, Wunder-Baum Vertrieb Österreich ACAR-Karios GmbH, SC Johnson GmbH, Reckitt Benckiser Austria GmbH, Procter & Gamble Austria GmbH, Erdal GmbH, dm-Drogerie Markt GmbH & Co KG, Rewe International AG, Lidl Österreich GmbH, etc., are the top players operating in the Austria Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Austria Air Freshener Market Policies, Regulations, and Standards

4. Austria Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Austria Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Austria Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Austria Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Austria Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Austria Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Austria Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Austria Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. SC Johnson GmbH

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Reckitt Benckiser Austria GmbH

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble Austria GmbH

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Erdal GmbH

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. dm-Drogerie Markt GmbH & Co KG

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Delta Pronatura Handels GmbH

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Henkel Central & Eastern Europe GmbH

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Wunder-Baum Vertrieb Österreich ACAR-Karios GmbH

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Rewe International AG

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Lidl Österreich GmbH

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.