Poland Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0671

- 120

-

Poland Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

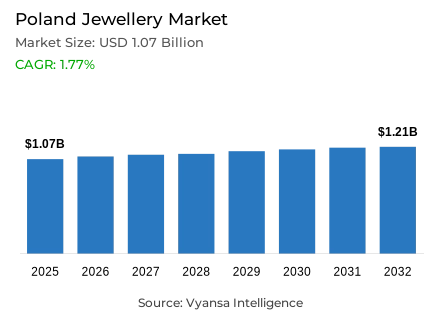

- Jewellery in Poland is estimated at USD 1.07 billion.

- The market size is expected to grow to USD 1.21 billion by 2032.

- Market to register a cagr of around 1.77% during 2026-32.

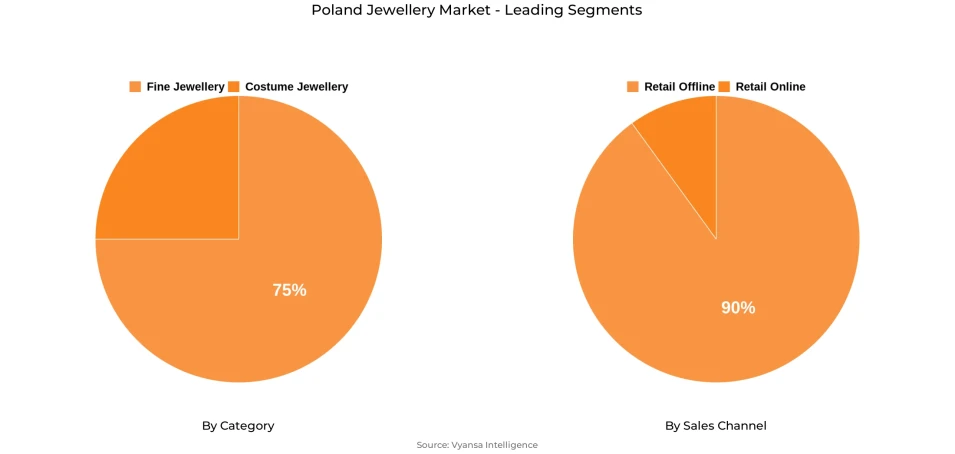

- Category Shares

- Fine jewellery grabbed market share of 75%.

- Competition

- More than 20 companies are actively engaged in producing jewellery in Poland.

- Top 5 companies acquired around 50% of the market share.

- H&M Hennes & Mauritz Sp zoo; Zara Polska Sp zoo; Richemont SA, Cie Financière; Apart Sp zoo; YES Bizuteria SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Poland Jewellery Market Outlook

The Poland jewellery market is worth around USD 1.07 billion in 2025 and is expected to reach around USD 1.21 billion by 2032, with a CAGR of around 1.77% during the forecast period. This growth is supported by the increased demand for vibrant colors and expressive designs along with the persistence of fine jewellery. Most of the end users have shifted from minimalist pieces to more personalized ones that reflect individuality and artistic detail.

At the same time, fine jewellery is still perceived by end users as both a way to make a statement of style and an investment, hence, this segment retains a share of around 75% of the total market. The demand for floral motifs, colorful gemstones, and lab grown diamonds is also growing, most young end users are looking for both elegance and affordability. These evolving tastes continue to make fine jewellery as the largest and most stable category in the market.

Retail offline remains the dominant sale channel, accounting for around 90% of jewellery sales. The end users still prefer retail offline stores because they offer personalized service, the assurance of the product and its quality before making a purchase. Retail online channels are also gaining momentum, however, jewellery purchasing remains a touch-and-feel experience, where end users prefer direct interaction with sellers. Large, established brands with extensive networks of stores have benefited from this preference further strengthening their positions in the market.

The market is moderately consolidated, with more than 20 companies operating actively and the top five players holding around 50% of total market share. Leading brands continue to rely on strong retail networks, brand reputation, and product diversity to sustain their position. Looking ahead, gradual economic recovery and increasing demand for affordable, personalised, and tech-integrated jewellery are expected to drive steady growth through 2032.

Poland Jewellery Market Growth DriverRising Preference for Colourful and Detailed Jewellery Supports Market Expansion

There is strong demand for colourful, bright and detailed jewellery that is encouraging market growth. In fact, many end users are now moving away from minimalist styles, which has drawn a movement toward colourful gemstones, floral motifs and intricate designs in jewellery. As popularity moves toward expressive jewellery, some brands like Apart have introduced a more colourful collection with more floral elements. These bold designs appeal the end user who seeks jewellery that is more personal and expressive, thus contributing to a positive retail value growth rate for fine jewellery.

In addition, the steady rise in household income is strengthening end users purchasing power for premium jewellery. According to Statistics Poland (GUS) and the National Bank of Poland, average disposable income per capita grew from USD 6,780 in 2023 to USD 7,760 in 2024, up 14.1% in real terms. Meanwhile, unemployment decreased to 2.9% in 2024 and continued to sustain confidence in non essential purchases. All these factors when put together create a strong basis for further interest in expressive, yet premium jewellery.

Poland Jewellery Market ChallengeWeak Real Retail Demand Is Reducing Jewellery Purchases

Declining real retail sales and increased household caution are making jewellery sales growth more difficult. Data from Statistics Poland shows that real retail sales, measured at constant prices, fell by 3.0% year on year in September 2024, which indicates some decline in demand from the end user households, reflecting higher utility cost and lower real disposable income. In response to recent economic price shocks, households are now more likely to save or not spend on unnecessary items, which has led to postponed purchases or reduced purchases of jewellery.

Simultaneously, end user confidence has remained weak. According to, the European Commission Poland Consumer Confidence Index declined to -1.00 in September 2025, reflecting continued household caution toward luxury spending. Even with easing inflation, borrowing costs and ongoing fiscal adjustments continue to limit purchasing activity. This cautious spending behavior directly reduces the market's potential to achieve stronger sales growth.

Poland Jewellery Market TrendAffordable Jewellery and Lab-Grown Diamonds Are Shaping Future Demand

Rising interest in personalised and pre owned jewellery is opening new paths for market growth. The end user are becoming increasingly drawn to unique, custom made, pieces that represent individuality or emotional connections, brands continue to integrate technology to support and enhance the experience. For instance photo based search tools online to help co-create personalized design. This shift toward jewellery with greater symbolic and personal value highlights how the category is evolving as a form of self-expression.

According to the World Bank Poland’s unemployment rate is expected to remain steady at 2.8% in both 2025 and 2026, supporting a favorable environment for spending. Simultaneously, the European Commission cited the global smart jewellery market was valued at USD 379.5 million in 2024, with growth projected to reach USD 990.7 million by 2030 at a CAGR of 17.3%. These developments signal strong potential for innovation at the intersection of technology and luxury.

Poland Jewellery Market OpportunityGrowing Demand for Personalised and Smart Jewellery

Rising interest in personalised and pre owned jewellery is opening new paths for market growth. The end user are becoming increasingly drawn to unique, custom made, pieces that represent individuality or emotional connections, brands continue to integrate technology to support and enhance the experience. For instance photo based search tools online to help co-create personalized design. This shift toward jewellery with greater symbolic and personal value highlights how the category is evolving as a form of self-expression.

According to the World Bank Poland’s unemployment rate is expected to remain steady at 2.8% in both 2025 and 2026, supporting a favorable environment for spending. Simultaneously, the European Commission cited the global smart jewellery market was valued at USD 379.5 million in 2024, with growth projected to reach USD 990.7 million by 2030 at a CAGR of 17.3%. These developments signal strong potential for innovation at the intersection of technology and luxury.

Poland Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The segment with the highest share under the category is fine jewellery, which holds around 75% of the total market. The segment continues to strengthen its position in the market, as end users in Poland maintain a strong level of desire for gold and other precious gemstones. Fine jewellery holds to represent strong emotional and investment value and is often purchased as a gift for weddings, anniversaries, and other special occasions. It is regarded as durable and of high quality, which is why it maintains a leading position in overall sales in the market.

Fine jewellery is still expected to lead the segment throughout the years 2026-2032. Coloured gemstones and lab created diamonds appeal the young end users who desire elegance while maintaining lower cost. The fine jewellery segment is likely to build on its strong position during the forecast periods as designs become more contemporary, or modernised, while preserving the aspects of craftsmanship.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is retail offline, which holds around 90% of the total market. In addition, most end users still look at offline stores for buying jewellery due to the personal examination of the product and assistance in stores. Established brands with a wider reach of physical store networks enjoy better visibility and trust among end user for fine and high value jewellery. This hands-on experience remains an important factor in helping the end users feel assured about quality and authenticity before making the purchase.

On the other hand, retail online represents a small portion of sales but is increasing steadily. Most end users browse collections and prices online however, they generally make their purchases through offline channels. In the future, jewellery retail sales is expected to strike a balance between the two, with the retail offline stores maintaining their leading position because of their credibility and face-to-face interaction, while the online version expands in reach through convenience.

List of Companies Covered in Poland Jewellery Market

The companies listed below are highly influential in the Poland jewellery market, with a significant market share and a strong impact on industry developments.

- H&M Hennes & Mauritz Sp zoo

- Zara Polska Sp zoo

- Richemont SA, Cie Financière

- Apart Sp zoo

- YES Bizuteria SA

- W Kruk SA

- Pandora Jewelry CEE Sp zoo

- LPP SA

- Briju 1920 Sp zoo

- Oriens Bijou Sp zoo

Market News & Updates

- Apart Sp zoo, 2025:

Its parent holding Polish Luxury Group sp. z o.o. (owner of Apart) acquired Jubitom sp. z o.o., a jewellery retailer with 30+ stores and an online shop.

- YES Bizuteria SA, 2024:

It launched a new loyalty programme (“YES CLUB”) including a mobile app, to improve engagement with end users.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Jewellery Market Policies, Regulations, and Standards

4. Poland Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Poland Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Poland Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Apart Sp zoo

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.YES Bizuteria SA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.W Kruk SA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Pandora Jewelry CEE Sp zoo

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.LPP SA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.H&M Hennes & Mauritz Sp zoo

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Zara Polska Sp zoo

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Richemont SA, Cie Financière

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Briju 1920 Sp zoo

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Oriens Bijou Sp zoo

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.