Thailand Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0672

- 115

-

Thailand Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

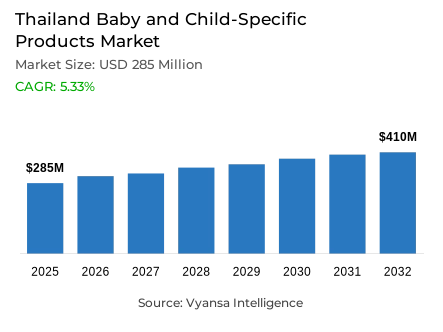

- Baby and child-specific products in Thailand is estimated at USD 285 million.

- The market size is expected to grow to USD 410 million by 2032.

- Market to register a cagr of around 5.33% during 2026-32.

- Product Shares

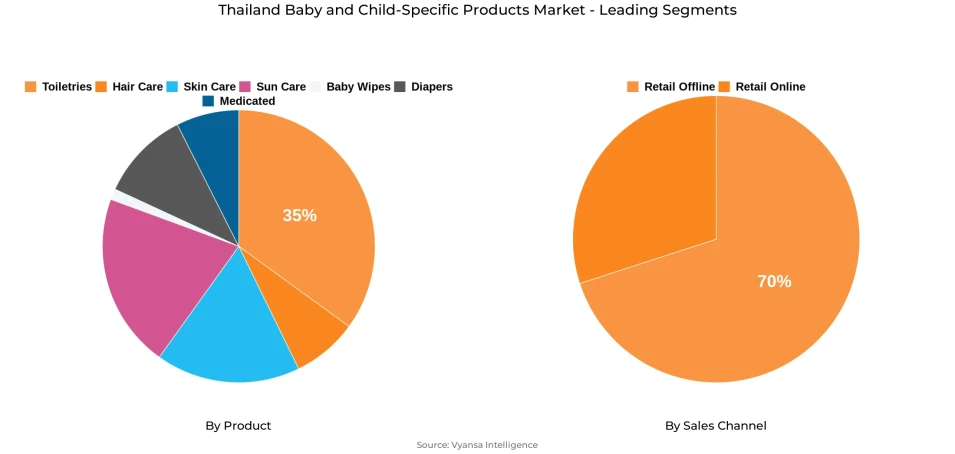

- Toiletries grabbed market share of 35%.

- Competition

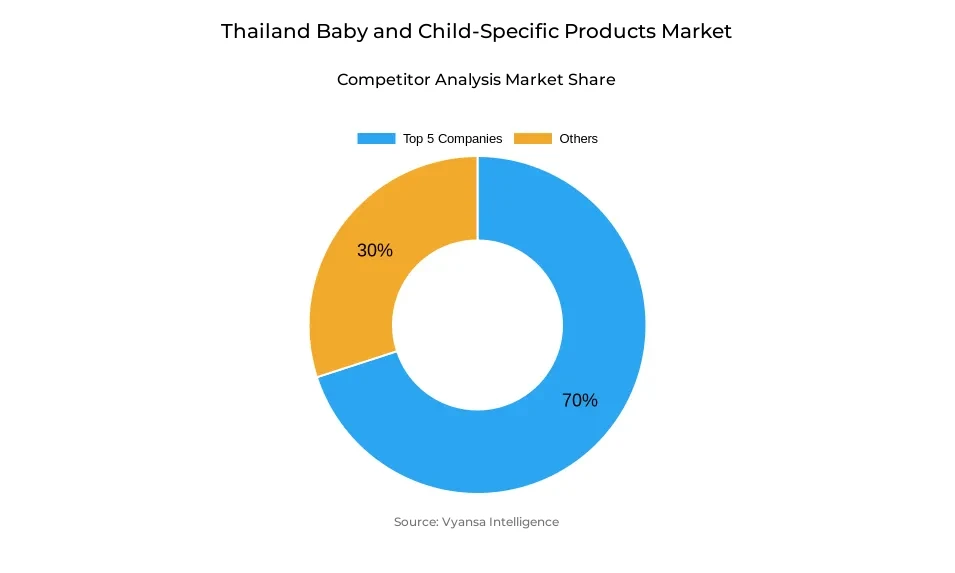

- More than 20 companies are actively engaged in producing baby and child-specific products in Thailand.

- Top 5 companies acquired around 70% of the market share.

- Lison Vision Co Ltd; Moong Pattana International Plc; Berli Jucker PCL; Johnson & Johnson (Thailand) Ltd; Neo Corporate Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Thailand Baby and Child-Specific Products Market Outlook

The Thailand baby and child-specific products market is estimated to reach $285 million in 2025, and is projected to grow to about $410 million by 2032, for a CAGR of approximately 5.33% from 2026-32. The market is expected to become increasingly robust over the forecast period, as parents, especially millennials and Gen Z, will continue to prioritise products that are premium, safe, and organic. Baby and child-specific toiletries, which account for 35% of the market, remain the largest category due to their regular form of use and the strong desire for functional and dermatologically approved products. Baby and child-specific skin care will become the most dynamic category as new products are being launched for relaxation, moisturisation, and general wellness.

Retail offline remain the dominant channel, holding 70% of sales, with supermarkets, and health and personal care stores being the major retail channels for parents. Supermarkets and mass retailers, who have location and range advantages, remain steep in the market however parents are increasingly attracted to specialist stores and health retailers who offer premium products and knowledgeable advice. Retail e-commerce is also set to gain momentum, although from the smaller base, with strong uptake driven by increased digital literacy, social commerce, influencer marketing, and the increasing availability of faster delivery services.

Johnson & Johnson will continue to lead in Thailand, powered by its Johnson’s Baby and Aveeno Baby brands, based on gentle and chemical-free formulation positions. Babi Mild and other energetic local players are likely to further expand on the basis of product innovation, organic product offerings, and strategic partnerships, strengthening brand loyalty. Such innovations as sleep-promoting, hydration, and wellbeing products have a good chance of drawing the health-conscious parent audience and providing differentiation in the marketplace.

Premiumisation and sustainability trends continue to reinforce the market outlook. There is an ever-increasing willingness by parents to pay for organic, friendly to the environment, and safe products. Biodegradable wipes, refillable packs, and eco-conscious packaging will likely resonate with end users. Social media and digital platforms will remain important throughout the forecast period in terms of engaging with parents, driving awareness, and supporting sales growth.

Thailand Baby and Child-Specific Products Market Growth DriverIncreasing demand for premium and safe baby products

Thailand parents are more concerned with the quality and safety of baby and child-specific products. There is a growing tendency among them to pay more for organic and high-quality solutions that guarantee better care and protection. This encourages brands to enlarge offerings in the premium mass segment and makes their specialized products available for a wider circle of discerning parents.

Online access to information makes it easier for parents to learn about and compare products with a view to selecting safer, more reliable products. In return, brands are rewarded for transparency, ingredient safety, and trust with deeper levels of engagement and loyalty. Products such as Johnson's Baby Oil Cotton Touch and the organic product line by Babi Mild emphasize the rising interest in premium positioning: parents are in a search for solutions that will meet high standards of safety and efficacy.

Thailand Baby and Child-Specific Products Market TrendPremiumisation and Organic Positioning

Thailand is experiencing a slow downtrend in the number of newborns which leads to a shrinking market for baby and child specific products. Subsequently, this effects slow down the growth rate as the number of new end users diminishes.

At the same time competition amongst players is expanding. Brands try to set themselves apart through unique product features, packaging, and merchandising collaborations. To address this issue, brand engagement becomes even more important to retain current end users and attract new parents. Campaigns such as Care Bears and Butterbear are examples to differentiate marketing strategies for growth because of the increasing competition. Continuous innovation, quality, and meaningful engagement on the part of brands are required to remain relevant and grow, especially in such challenging demographic trends.

Thailand Baby and Child-Specific Products Market OpportunityRetail Online and Social Commerce for Growth

Retail Online and social commerce will become significant growth opportunities for the Thailand's baby and child-specific products market. Online shopping exudes convenience, speed, and an expanded selection that lures digitally engaged parents.

Influencer-driven social media campaigns, live-stream promotions, and rapid delivery systems are some of the ways in which brands could reach more end users. The digital setting allows them to create trust and foster end users engagement more effectively compared to traditional channels alone. Scaling faster, increasing visibility, and improving end users interaction could be done by solidifying a brand's online presence and integrating social commerce strategies. This digital transformation is bound to emerge as one of the main drivers for increasing market reach and strengthening brand loyalty among Thailand parents.

Thailand Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with highest market share under Product is Toiletries with share of about 35%. It occupies a top-position due in large part to everyday hygiene products, such as washes, lotions, powders, and oils. Notably, millennials and Generation Z parents are increasingly in search of organic, safe, and mild formulations when it comes to products for their children, contributing to a regularly scheduled replacement and repurchasing market.

Innovation in this category is contributing to growth, especially as end users are putting feelings and functional benefits on their issues lists. They are increasingly selecting both functional and beneficial products, for example moisturizing oils, calming lotions, and organic formulas. Brands that are positioned on product safety and dermatological testing may gain a competitive advantage through the differentiation of products, while leveraging trust and loyalty, despite a continually evolving product marketplace. With the continued importance, Baby and Child-Specific Toiletries has an opportunity to remain the largest product segment in the Thailand Baby and Child-Specific Products Market.

By Sales Channel

- Retail Online

- Retail Offline

The segment with highest market share under Sales Channel is Retail Offline, holding a share of approximately 70%. The predominance of supermarkets is due to ease of access, the vast variety of products available, and a trusted reputation amongst parents. For end users, instore purchases allow for a comparison of products while evaluating packaging, and immediate access to products for use.

Retail Offline stores were often health and personal care stores due to demand for premium and organic products. Parents seek advice from infant experts, and confirmation of safety around purchases. Retailing is like offline is still prevalent due to end-users confidence, ease of access, and a large amount of baby and child-specific products available.

List of Companies Covered in Thailand Baby and Child-Specific Products Market

The companies listed below are highly influential in the Thailand baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- Lison Vision Co Ltd

- Moong Pattana International Plc

- Berli Jucker PCL

- Johnson & Johnson (Thailand) Ltd

- Neo Corporate Co Ltd

- Osotspa Co Ltd

- Unicharm Thailand Co Ltd

- Colgate-Palmolive Thailand Ltd

- Beiersdorf Thailand Co Ltd

- Lion Corp (Thailand) Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Thailand Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Thailand Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Thailand Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Thailand Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Thailand Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Thailand Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Thailand Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Thailand Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Johnson & Johnson (Thailand) Ltd

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Neo Corporate Co Ltd

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Osotspa Co Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Unicharm Thailand Co Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Colgate-Palmolive Thailand Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Lison Vision Co Ltd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Moong Pattana International Plc

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Berli Jucker PCL

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Beiersdorf Thailand Co Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Lion Corp (Thailand) Ltd

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.