Belgium Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0522

- 130

-

Belgium Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

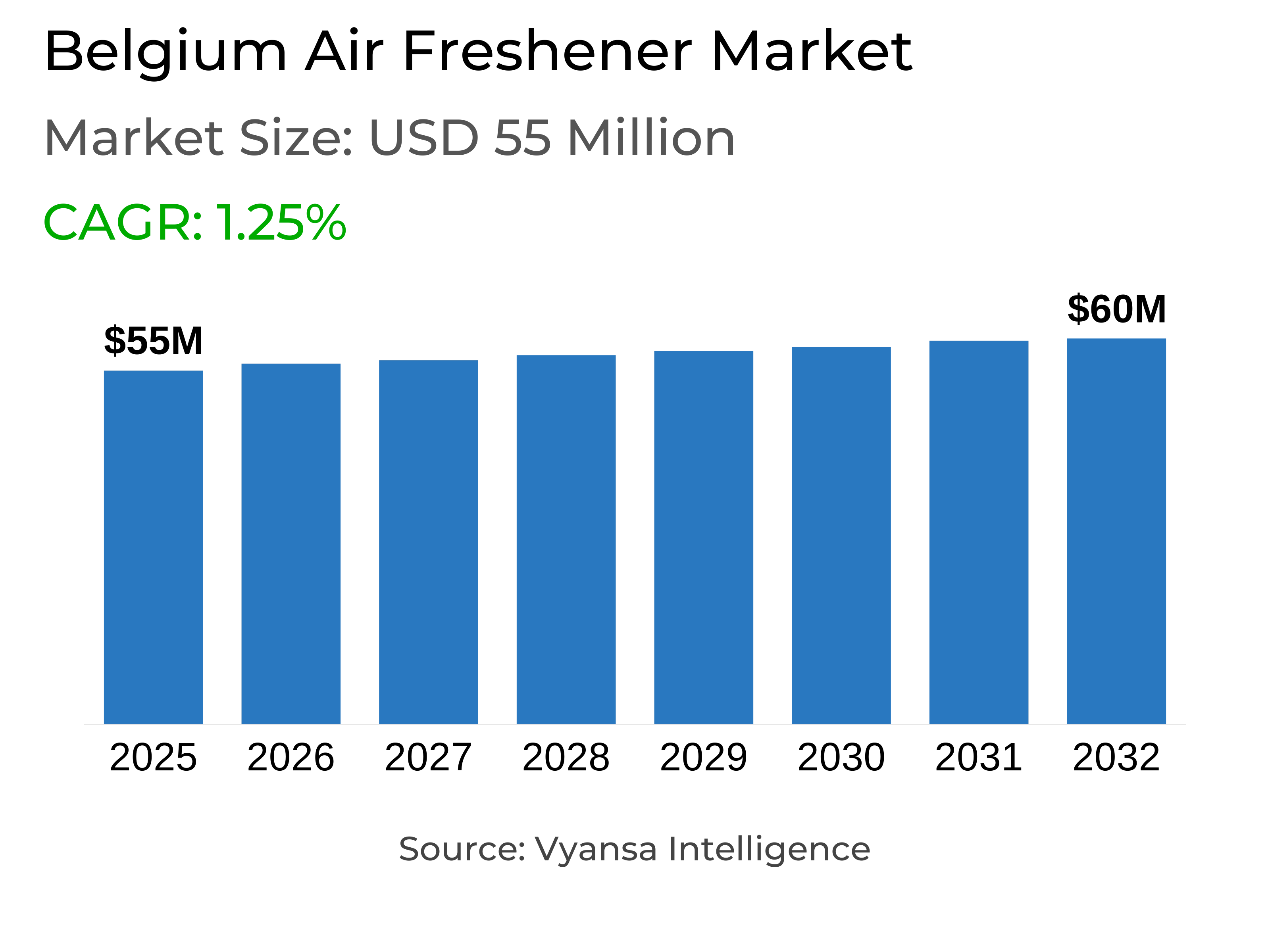

- Air Freshener in Belgium is estimated at $ 55 Million.

- The market size is expected to grow to $ 60 Million by 2032.

- Market to register a CAGR of around 1.25% during 2026-32.

- Product Type Shares

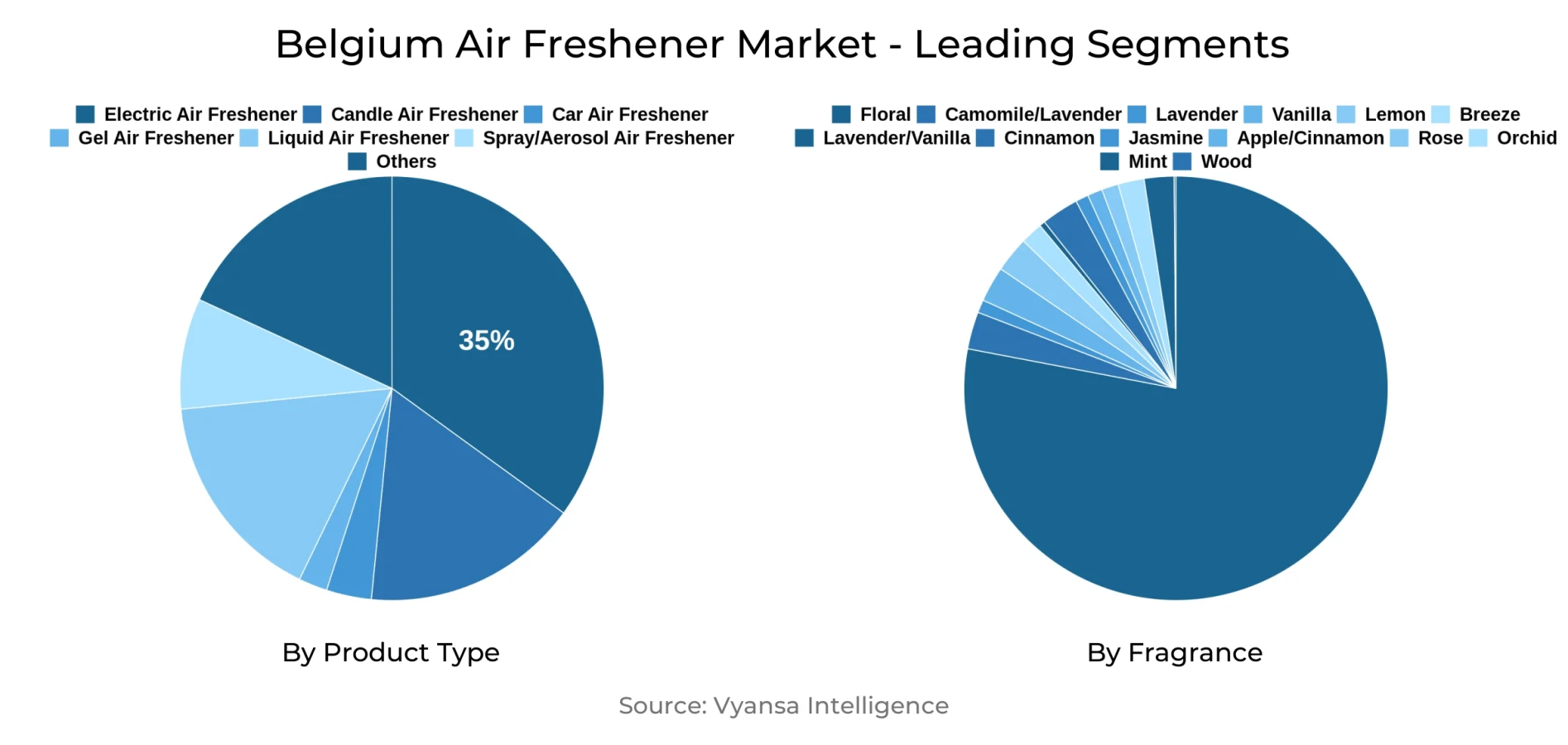

- Electric Air Freshener grabbed market share of 35%.

- Competition

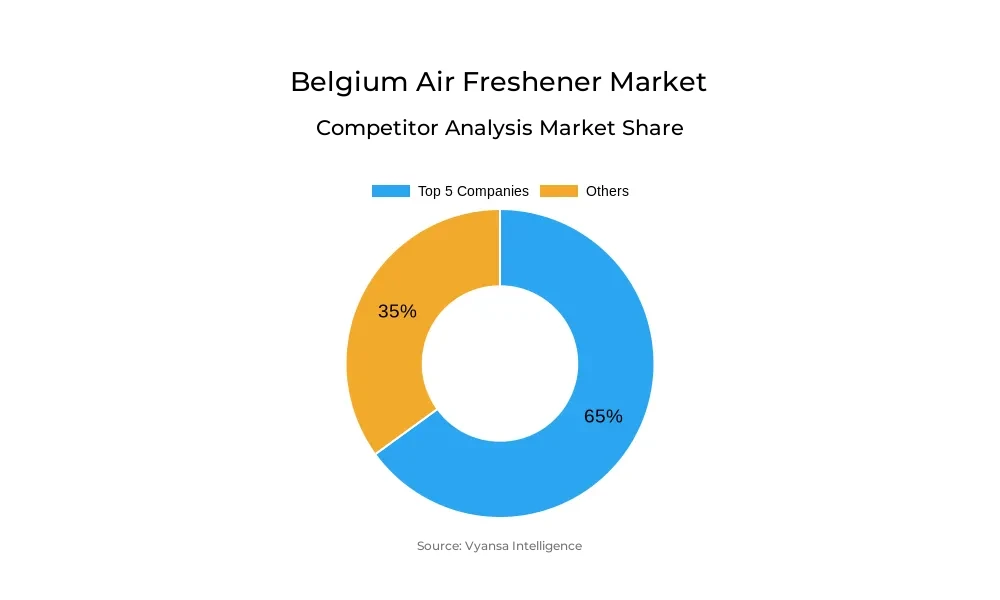

- More than 20 companies are actively engaged in producing Air Freshener in Belgium.

- Top 5 companies acquired around 65% of the market share.

- Bolsius International BV, Etn Franz Colruyt NV, Carrefour Belgium SA/NV, Reckitt Benckiser SA NV, Procter & Gamble Benelux SA NV etc., are few of the top companies.

- Fragrance

- Floral continues to dominate the market.

Belgium Air Freshener Market Outlook

The Belgium Air Freshener Market, worth USD 55 million in the year 2025, is expected to be worth USD 60 million by the year 2032 and demonstrate steady but slow growth. End users are increasingly considering air freshener as a means to personalize their domestic spaces, utilizing fragrance not simply to eliminate odors but to generate atmosphere. Floral fragrance continues to dominate, while demand for upscale formats like candles, reed diffusers, and fragrance lamps has increased. These items add both atmosphere and decoration, and they mirror the increasing part played by scents in contemporary domestic lifestyles.

Notwithstanding this change, economic pressures still constrain overall market performance. In 2024, retail value growth was held back to 1%, and there was a 1% fall in volume, as most households viewed air fresheners as non-essential items. Aerosols and traditional sprays lost traction, while natural and essential oil-based formats became more interesting but were niche products because of tight disposable incomes. Health and naturality concerns also depressed demand for traditional products.

Upscale air fresheners, on the other hand, are experiencing steady growth, particularly among higher-income end users with an interest in wellness and atmosphere. Work from home has driven demand for reed diffusers, candles, and oil-based forms, which manufacturers like Maison Berger and Galeo have met with environmentally friendly, premium offerings. Natural ingredients, sustainability, and craftsmanship of delivery systems support the popularity of this segment, although it is still niche relative to mass-market players.

With respect to product form, electric air fresheners take the lead with 35% market share, providing convenience, newness, and ongoing fragrance release. Offline channels are still dominant with extensive availability, in-store fragrance trials, and excellent brand visibility from companies like Air Wick and Febreze. Although online sales increase for specialty products, offline points continue to provide the base for distribution, maintaining availability in both mass and premium categories.

Belgium Air Freshener Market Growth Driver

Rising Preference for Ambience-Creating Products

Belgium end users increasingly view air freshener products as means of generating ambiance in their homes, and not merely removing objectionable odors. This shift drives demand for more complex and multisensory products that touch the mood and atmosphere of various spaces. End users emphasize personalizing their living spaces with scent, employing it to elicit comfort, relaxation, or energy based on the time of day or room.

Air freshener companies address this growing trend by launching scented candles, reed diffusers, and fragrance lamps. These items not only offer a constant and gentle fragrance but also bring an aesthetic value that creates room appeal. By allowing end users to build custom settings, these formats complement both relaxing escapes and stimulating spaces, underpinning their position within contemporary home life.

Belgium Air Freshener Market Challenge

Perceptions of Air Fresheners as Non-Essential Products

Air freshener items in Belgium still struggle with shifting consumer attitudes and trends. Retail value development in 2024 was capped at 1%, with a 1% drop in volume, translating the perception that these products are discretionary when the economy is uncertain. End users in many cases chose to scale back on discretionary expenditure, downgrading air fresheners in favor of essential items. Traditional aerosol, spray, and electric air fresheners saw diminished sales directly because of this change, suggesting that economic factors are still a major obstacle to market growth.

Coupled with this challenge is increasing acceptance that traditional air fresheners are unhealthy or unnatural. end users are more and more looking to perceived safer alternatives like reeds, diffusers, and essential oil-based formats, and some avoid air fresheners altogether. This changing attitude is likely to remain imposing a constraint on overall retail volume growth as many families embrace a more frugal approach to expenditure on non-essential fragrance products.

Belgium Air Freshener Market Trend

Premiumisation and Sustainability Driving Niche Growth

The premium air freshener market has been growing moderately as a result of end-users seeking to create personalized and homely atmospheres. Remote working lifestyles and health-consciousness have driven demand for advanced alternatives like candles, reed diffusers, and essential oil-containing products. Affluent households are willing to pay more for products that add value to home ambiance as well as individual wellness, again boosting the popularity of premium air fresheners. This segment keeps evolving with sophisticated fragrance combinations and boutique delivery systems to upgrade the home experience.

Sustainability is a continuing driving force behind the premium market. End users are looking for products containing natural ingredients, sustainable packaging, and longer-lasting benefits. Brands like Maison Berger and Galeo have leveraged this trend by presenting high-end, eco-friendly solutions that resonate with these values. Although the premium sector is niche, luxury and sustainability combination is appealing to affluent households willing to spend money on products that not only please the eye but also adhere to ethical considerations.

Belgium Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

In the market, electric air fresheners are the market leaders, commanding a 35% market share, beating other product types. This dominance owes much to convenience, ease of operation, and uninterrupted fragrance emission, which is attractive to end users who value effectiveness and low-maintenance operation. Electric versions also rank as more advanced than conventional sprays, providing an updated solution for home ambiance improvement while blending well into living spaces. Their steady fragrance emission renders them especially desirable for prolonged scent experiences.

The other formats of air fresheners, such as sprays, aerosols, reeds, and candles, cater to niche tastes but suffer from limitations on convenience and durability versus electric products. Though oil diffusers and fragrance lamps find appeal among environmentally-aware and high-end families, they hold a smaller share of the total market. Electric air fresheners find a middle ground between convenience, affordability, and sleek design, which makes them the first choice of a large percentage of end users looking for efficient, continuous fragrance provision.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

Offline retail channels capture the biggest market share because they are widely distributed and accessible to end users. Grocery stores, drugstores, and home improvement stores offer end users easy access to an assortment of air freshener products, both basic and premium. Physical retail also enables end users to smell fragrances before purchasing, a critical factor for products that are meant to create a better home ambiance. The presence of established brands like Air Wick and Febreze in stores further reinforces offline consumer confidence.

Though online shopping is increasing, especially for niche and artisanal items, offline still has a large lead from being easy, having a wide product line, and having pre-existing customer trust. Specialty stores and pharmacies, especially, effectively provide premium and green variants along with core air freshener segments, keeping themselves relevant across market sections. This robust physical presence keeps end users efficiently able to access both necessary and lifestyle-driven offerings, enabling retail offline distribution to continue its dominance.

Top Companies in Belgium Air Freshener Market

The top companies operating in the market include Bolsius International BV, Etn Franz Colruyt NV, Carrefour Belgium SA/NV, Reckitt Benckiser SA NV, Procter & Gamble Benelux SA NV, SC Johnson Benelux Sprl, Spaas NV SA, Delhaize 'Le Lion' SA, Action Belgium BVBA, Auto Sport Diffusion SA, etc., are the top players operating in the Belgium Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Belgium Air Freshener Market Policies, Regulations, and Standards

4. Belgium Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Belgium Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Belgium Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Belgium Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Belgium Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Belgium Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Belgium Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Belgium Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Reckitt Benckiser SA NV

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Procter & Gamble Benelux SA NV

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. SC Johnson Benelux Sprl

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Spaas NV SA

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Delhaize 'Le Lion' SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Bolsius International BV

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Etn Franz Colruyt NV

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Carrefour Belgium SA/NV

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Action Belgium BVBA

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Auto Sport Diffusion SA

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.