Argentina Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0519

- 115

-

Argentina Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

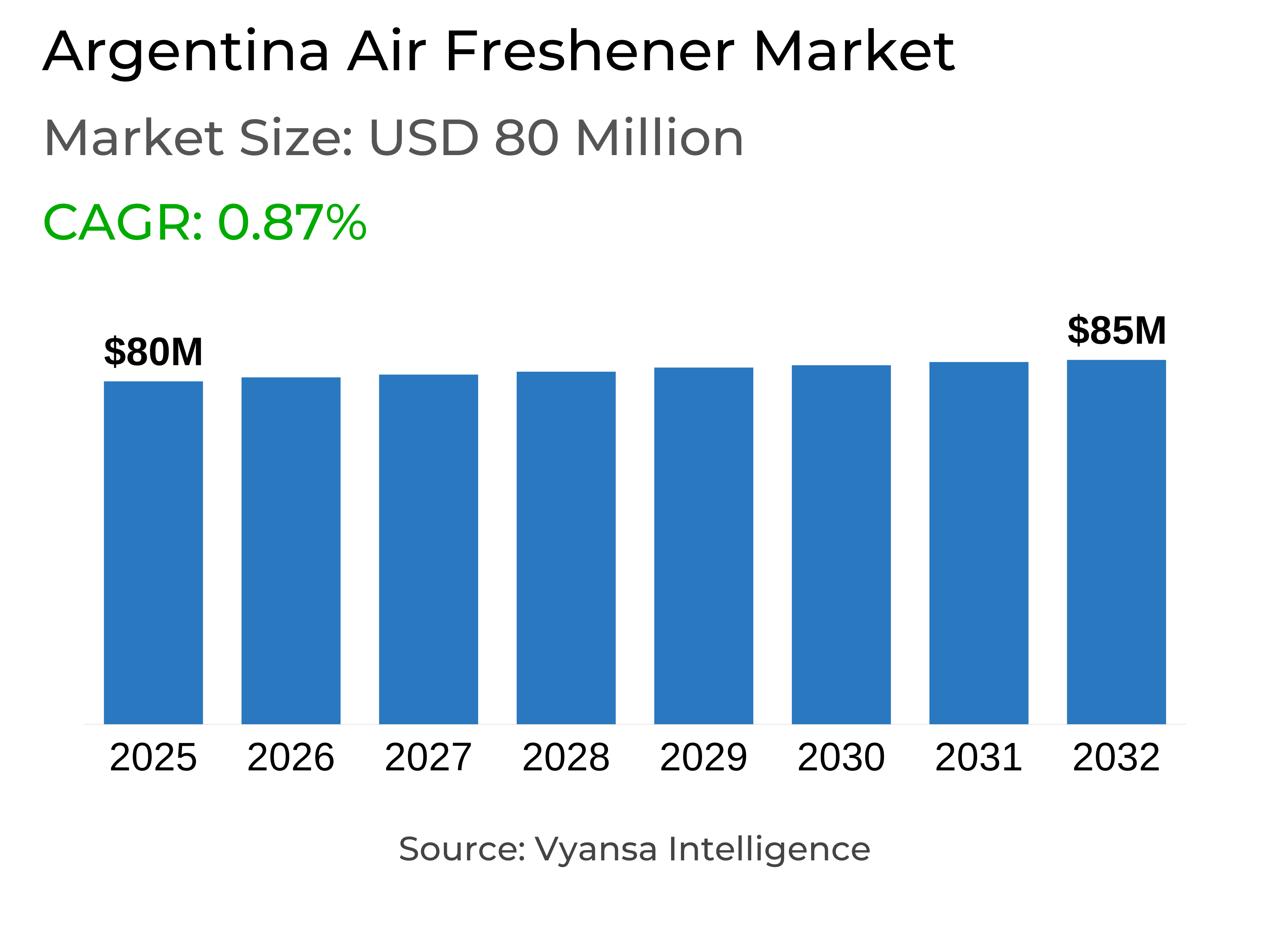

- Air Freshener in Argentina is estimated at $ 80 Million.

- The market size is expected to grow to $ 85 Million by 2032.

- Market to register a CAGR of around 0.87% during 2026-32.

- Product Type Shares

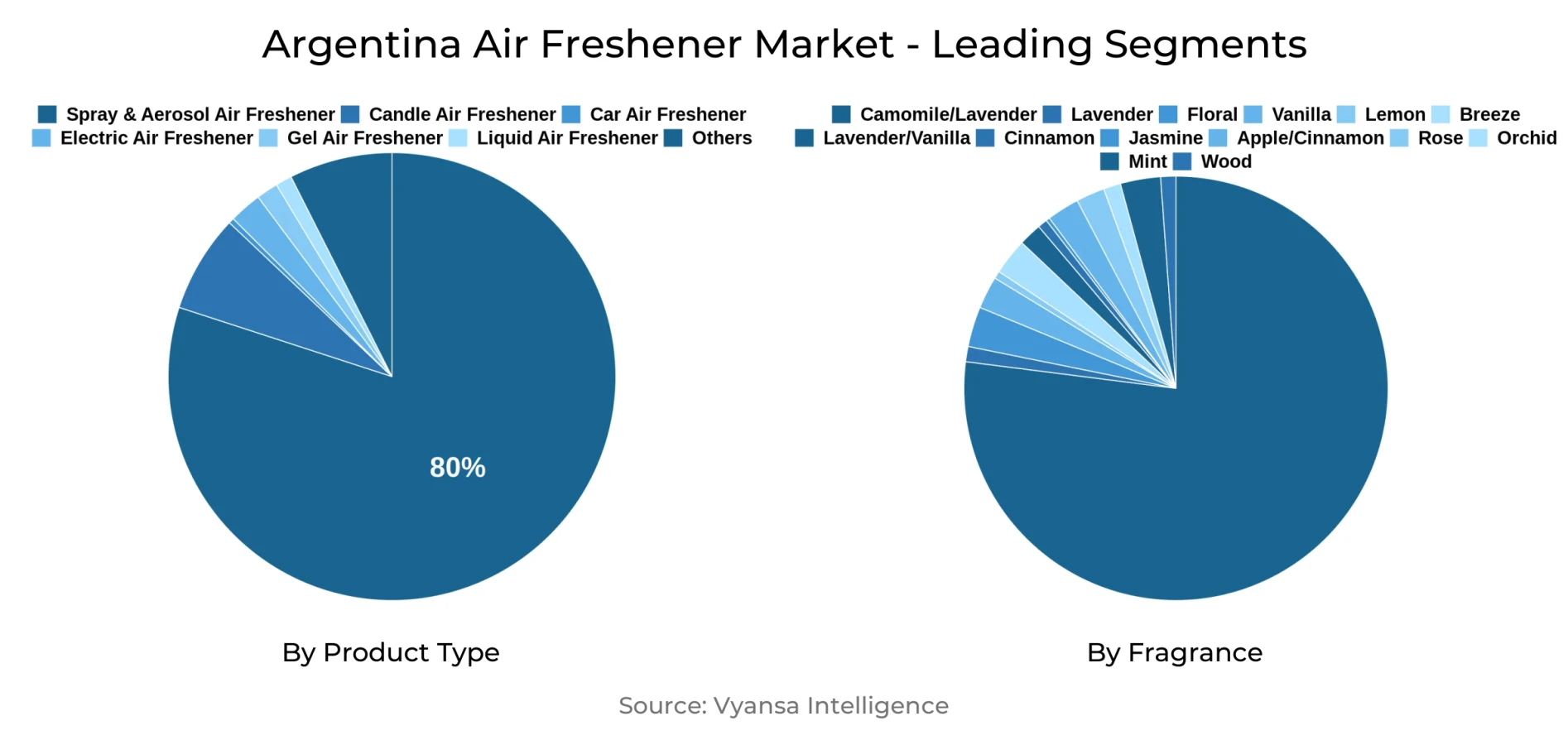

- Spray/Aerosol Air Freshener grabbed market share of 80%.

- Competition

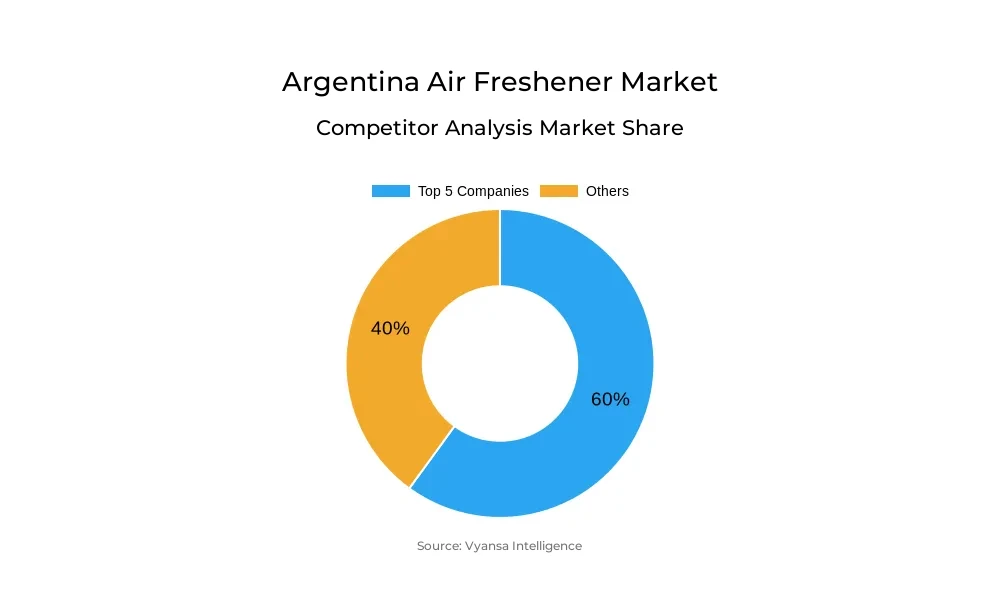

- More than 10 companies are actively engaged in producing Air Freshener in Argentina.

- Top 5 companies acquired around 60% of the market share.

- Godrej Consumer Products Argentina, Beiersdorf Argentina, José Guma S.A., SC Johnson & Son de Argentina SAIC, Clorox Argentina SA etc., are few of the top companies.

- Fragrance

- Camomile/Lavender continues to dominate the market.

Argentina Air Freshener Market Outlook

Argentina Air Freshener Market worth around $80 million in 2025 is estimated to reach $85 million in 2032. The growth in the market indicates sustained demand for household air fresheners, even though economic austerity affects end users' discretionary purchases. Household budgets continue to concentrate on necessities, restricting the aggregate quantity of air freshener usage. Price inflation has moderated this fall to some extent, enabling retail value to rise even while end users are scrupulously prioritizing expenditure on ancillary products.

Shifts in lifestyle habits, such as hybrid work patterns, are influencing the direction of usage in the market. Greater daytime attendance at home has given a boost to demand for spray/aerosol air fresheners, which lead the market with an 80% value share in 2025. They are favored due to their convenience, instant fragrance effect, and versatility across various zones in the home. There is also a discernible move from disinfectant-oriented sprays towards fragrance-based products, as Camomile and Lavender fragrances remain at the forefront of consumer demand, signifying the changing sensory directions in the market.

The electric air freshener category is drawing interest because of its fashionable design and functional interest, resonating with households looking for both design and steady fragrance dispensation. Even though more expensive, the category appeals to design-oriented end consumers, creating opportunities for differentiation in the market. In contrast, car air fresheners are subject to limitations based on decreasing commuting and urban mobility shifts that limit segment growth versus household-oriented formats.

Retail Offline channels continue to be the main channel under the sales channel for end users, providing direct access to products and the ability to try fragrances before buying. Supermarkets, hypermarkets, and convenience stores are the biggest drivers, which is an indication of end users' affinity for physical experiences and familiar retail spaces. On the whole, the Argentina Air Freshener Market will experience steady value growth until 2032, led by spray/aerosol dominance, fragrance-led usage, and incremental growth in stylish electric devices.

Argentina Air Freshener Market Growth Driver

Household Spending Priorities Affect Air Freshener Usage

In 2024, the Argentina Air Freshener Market saw a retail value growth of 233%, with retail volume falling by 9%, reflecting end users’ prioritisation of essential household items amid economic constraints. The category of air fresheners, which includes car, gel, electric, and aerosol air fresheners, faced less consumption due to the decrease in discretionary spending. Consumers prioritised needs at the household level, downgrading additional products like air fresheners and causing a significant dip in total volume.

Retail volume decline was consistent across all categories, with aerosol, electric, gel, and car air fresheners observing lower usage. End consumers controlled their expenditure to essential household needs, impacting market dynamics and putting pressure on brands to continue volume sales. Albeit retail value increase, the volume decline shows that price inflation helped offset reduced consumption partly, capturing the stronger economic pressures affecting demand.

Argentina Air Freshener Market Challenge

Reduced Car Usage and Policy Restrictions Limit Market Expansion

The car air fresheners market is constrained by reducing car usage in urban environments. Measures like higher road tolls, in addition to an increasing trend towards walking, cycling, and working remotely, decrease regular car commuting, thus capping the demand for car air fresheners. Behavioural changes among end users are likely to continue to constrain segment growth, as much as the overall retail value of the market is on the rise.

The decline in in-car product usage affects not only volume but also product innovation and availability. Brands may need to explore alternative formats or multi-use solutions to offset reduced car reliance. Continuous monitoring of transportation trends and urban policies is essential for mitigating these constraints and maintaining relevance in the market.

Argentina Air Freshener Market Trend

Hybrid Working Practices and Fragrance-Oriented Preferences Shape Usage Patterns

Hybrid working patterns are shaping the use of spray/aerosol air fresheners by end users, with heightened daytime domestic occupancy resulting in greater use in bathrooms and public areas. Concurrently, there is a definite decline away from disinfectant aerosols towards fragrance-centric products, underpinning changing home fragrance trends and sensory needs.

These new trends suggest that end users are increasingly incorporating air fresheners into household routines to improve home atmosphere. The overlap of hybrid work styles with a desire for scented surroundings emphasizes a persistent behavioural trend in the market, driving choice of products and category influences without invoking projected expansion.

Argentina Air Freshener Market Opportunity

Stylish Electric Air Fresheners Encourage Market Adoption

Electric air fresheners are attracting attention for their style and design appeal despite higher costs and relatively lower end-user awareness. Consumers are increasingly choosing contemporary, fashionable devices that ensure consistent fragrance release while matching home decor, setting the segment up for increased uptake.

Appeal in the segment comes from merging functionality with visual design, satisfying end users' need for personalised and beautiful home spaces. As the awareness level increases, the electric air freshener category will appeal to design-savvy households, offering the scope for differentiation and greater participation in the overall market.

Argentina Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Spray/Aerosol Air Fresheners capture the Argentina Air Freshener Market with a commanding 80% market share in 2025, as end users value the immediate scent effect, convenience, and versatility for use in multiple home areas. The convenience and familiarity of the segment render it the first recourse for everyday air freshening, solidifying its top-market status.

Other product forms, such as gel, electric, and vehicle air fresheners, together make up the remaining 20% of the market. Electric products are winning popularity for form and function, and gels for long-action fragrance, but none can match the versatility and ubiquity of spray/aerosol products for maintaining the segment's stronghold.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

Retail Offline channel dominate the market in the Argentina Air Freshener Market because of the ease of accessing products and allowing end consumers to smell fragrances prior to purchase. Hypermarkets, supermarkets, and convenience stores are the major points of sale, providing exposure and ready access to a wide variety of air fresheners.

The sensory and touch experience, coupled with proven trust within physical retail spaces, makes Retail Offline channels preeminent. Though retail online is slowly increasing, ingrained purchase behavior and the need to try smells before buying continue to make offline channels the primary channel for end users in Argentina.

Top Companies in Argentina Air Freshener Market

The top companies operating in the market include Godrej Consumer Products Argentina, Beiersdorf Argentina, José Guma S.A., SC Johnson & Son de Argentina SAIC, Clorox Argentina SA, Queruclor SRL, Reckitt Benckiser Argentina SA, Henkel Argentina S.A., Coala, Centro de Distribución Sur, etc., are the top players operating in the Argentina Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Argentina Air Freshener Market Policies, Regulations, and Standards

4. Argentina Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Argentina Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Argentina Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Argentina Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Argentina Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Argentina Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Argentina Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. SC Johnson & Son de Argentina SAIC

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Clorox Argentina SA

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Queruclor SRL

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Reckitt Benckiser Argentina SA

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Henkel Argentina S.A.

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Godrej Consumer Products Argentina

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Beiersdorf Argentina

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. José Guma S.A.

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Coala

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Centro de Distribución Sur

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.