Thailand Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

Thailand Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

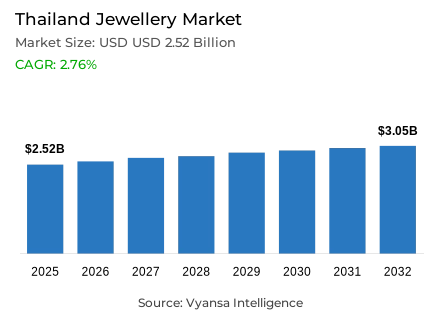

- Jewellery market in Thailand is estimated at USD 2.52 billion in 2025.

- The market size is expected to grow to USD 3.05 billion by 2032.

- Market to register a cagr of around 2.76% during 2026-32.

- Category Shares

- Fine jewellery grabbed market share of 85%.

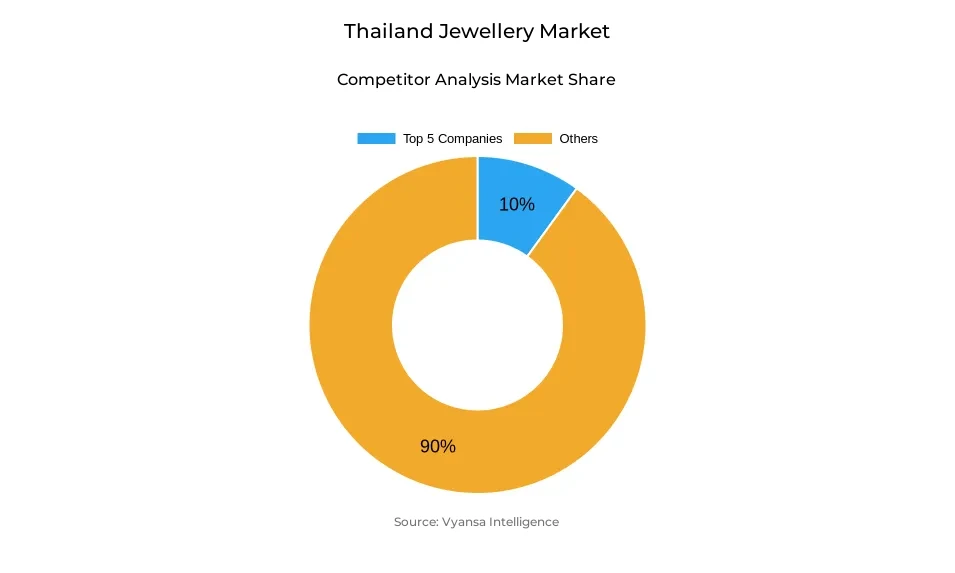

- Competition

- More than 15 companies are actively engaged in producing jewellery market in Thailand.

- Top 5 companies acquired around 10% of the market share.

- Chanel (Thailand) Ltd; LVMH Moët Hennessy Louis Vuitton SA; Hthai (Thailand) Co Ltd; Richemont Luxury (Thailand) Ltd; Jubilee Enterprise Plc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Thailand Jewellery Market Outlook

Thailand jewellery market is expected to grow consistently over the forcast period, which is supported by the economic recovery of the country, the revival of the demand of gold and the aggressive branding. The market is estimated at USD 2.52 billion in 2025 and projected to grow to USD 3.05 billion in 2032, which is a compound annual growth rate of about 2.76%. With the moderation of inflation and the increase in end user confidence, the demand of both fine and costume jewellery is expected to recover, where gold remains the key driver of value addition.

The market is dominated by fine jewellery, which controls about 85% of the market, as Thailand has a strong cultural attachment to gold and natural diamonds. With the stabilisation of economic conditions, middle- and high-income end users will probably start buying again what they had delayed during the high-gold price periods. Market momentum is being supported by leading brands like Jubilee, Pandora and Ravipa with new collections, increased retail networks and improved engagement strategies. Even though lab-grown diamonds are still a niche market, they are slowly finding their way into the hearts of younger, eco-conscious end users.

The growth is also enhanced by the rising investment by both local and international brands. Premium brands are centralizing their offerings with certified and high-quality items, and new labels are appealing to younger shoppers with unique designs, partnerships, and branding stories. With the increase in political stability and domestic spending, both high-end and low-end jewellery will be in demand.

The retail offline, which represents about 95% of sales, will continue to be the leading distribution channel due to the high preference of end users to in-store assessment and personalised service, especially in high-value jewellery. At the same time, the concept of omnichannel is growing with brands incorporating e-commerce, social media, and live selling. Online technologies like AI-based personalisation and influencer-led campaigns are becoming more influential in determining buying behaviour and improving the customer experience, which will facilitate long-term growth by 2032.

Thailand Jewellery Market Growth Driver

Gold Jewellery Demand Strengthened as Inflation Eases and Tourism Rebounds

The macroeconomic conditions in Thailand are improving and this has led to category recovery due to gold jewellery. The Bank of Thailand reported that headline inflation fell to about 0.8% in 2024, compared to 2.5% in 2023, which relieved household budgets and allowed end users, particularly those in higher-income groups, to restart buying gold. Simultaneously, the National Economic and Social Development Council states that Thailand experienced an increase in GDP by approximately 2.5% in the second quarter of 2024, which was backed by increased domestic confidence and improved spending conditions. These gains have assisted the recovery of the demand of fine jewellery following its decline in 2023.

Recovery in tourism has also been critical. According to the UNWTO, Thailand received about 28 000 000 foreigners in 2024, which is an increase of 24.5 000 000 in 2023. This has enhanced the number of people visiting fine jewellery retailers especially in the major tourist destinations. Combined, the reduction of inflation and the rebound in tourism have strengthened the position of gold as a luxury good and a traditional store of value, which has helped the market to grow overall.

Thailand Jewellery Market Challenge

High Gold Prices and Store Closures Reduce Market Stability

Persistently high gold prices continue to undermine affordability, creating a significant challenge for the jewellery market in Thailand and contributing to the closure of numerous stores. According to the Ministry of Commerce and the Gold Traders Association, domestic gold prices increased by over 15% annually in 2023-2024, with April 2024 recording the highest price. Meanwhile, the Bank of Thailand reports that household debt was still high, at approximately 90.9% of GDP in 2024, one of the highest in ASEAN. These pressures have decreased discretionary expenditure on jewellery especially among middle-income end users.

This has seen a number of small gold shops face liquidity issues and the bigger chains slow down growth. The younger generations also tend to be less willing to carry on with low-margin family jewellery business, which is hastening the process of market consolidation. Despite the market stabilising in 2024, structural issues associated with high gold prices still hold back long-term domestic demand, particularly in non-affluent groups.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Thailand Jewellery Market Trend

Rising Brand Engagement Through Events, Ambassadors and Retail Innovation

Brand-led engagement and experiential marketing have gained more significance. According to the Ministry of Commerce of Thailand, retail trade sales in luxury and specialty goods increased by approximately 6.2% in 2024, which was backed by increased expenditure by urban end users. Thematically-based collections, celebrity ambassadors, and immersive retail formats have been the response of jewellery brands. Also, the UNWTO reports that tourist expenditure in Thai retail has returned to approximately 84% of the pre-pandemic rates, which reinforces the prospects of brands to connect with visitors by holding in-store events.

Top brands like Jubilee and Pandora are using styling sessions, limited editions and culturally themed collections like zodiac designs to expand the reach. These are the strategies that make branded jewellery a statement of lifestyle and identity and not just an investment and thus appeal to a broader age and income bracket.

Thailand Jewellery Market Opportunity

Expanding Omnichannel & Digital Personalisation for Jewellery Retailers

There is a good opportunity in the expansion of the omnichannel and digital personalisation. According to the Electronic Transactions Development Agency, retail online expenditure in Thailand increased by approximately 8% in 2024, to approximately THB 900 billion, with fashion and accessories being some of the most popular online products. Simultaneously, the National Broadcasting and Telecommunications Commission reports that approximately 97% of Thai internet users are social media users, which is why digital platforms are at the centre of jewellery discovery and marketing.

These circumstances favour greater online store, social commerce and live selling integration of both fine and costume jewellery. With end users becoming more demanding of convenience and personalised experiences, AI-based recommendations, virtual try-ons, and behavioural profiling can be used by brands to gain trust. There is a high potential of hybrid retail models that combine digital interaction with physical experience in the long run.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Thailand Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery is the largest segment under category, accounting for about 85% of the Thailand jewellery market. This dominance is driven mainly by gold jewellery, which remains preferred for both cultural and investment reasons. As inflation eases and economic conditions improve, demand for gold-based fine jewellery has strengthened again after the weak performance of 2023.

High-income end users are returning to premium purchases, while major players such as Jubilee and NGG support demand through frequent launches, limited editions, and collaborations. Over 2026–2032, fine jewellery is expected to retain leadership as end user confidence improves. Although lab-grown diamonds will grow gradually, natural diamonds and gold will remain the main value drivers.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline dominates sales channel with about 95% share. Jewellery purchasing in Thailand is strongly tied to physical retail, especially for gold and fine jewellery, where end users value certification, trust, and direct evaluation. Gold specialist shops, kiosks, and premium boutiques attract most buyers through personalised service and in-person guidance.

Over 2026–2032, offline retail will remain the preferred channel despite rising digital engagement. Costume jewellery will increasingly move online, but fine jewellery will stay anchored in physical stores due to high transaction values and cultural emphasis on authenticity. Brands will strengthen omnichannel strategies, but in-store retail will remain the core of Thailand’s jewellery market.

List of Companies Covered in Thailand Jewellery Market

The companies listed below are highly influential in the Thailand jewellery market , with a significant market share and a strong impact on industry developments.

- Chanel (Thailand) Ltd

- LVMH Moët Hennessy Louis Vuitton SA

- Hthai (Thailand) Co Ltd

- Richemont Luxury (Thailand) Ltd

- Jubilee Enterprise Plc

- Beauty Gems Group

- Pandora (Thailand) Co Ltd

- Swarovski Thailand Co Ltd

- Kering SA

- Hermès International SCA

Competitive Landscape

Thailand jewellery market remained highly competitive, driven by a mix of strong international brands and rapidly expanding local players. Jubilee continued to stand out through frequent new collection launches, including high-end limited editions and youth-focused designs, supported by celebrity partnerships such as its appointment of Aff Taksaorn as brand ambassador. Pandora further strengthened its position through immersive retail concepts, exclusive styling events, and consistent social-media engagement, earning industry recognition for brand performance. Meanwhile, local brands such as Ravipa accelerated their growth through store expansion and high-profile collaborations with partners like BMW, Sheraton, and The St. Regis, helping broaden their domestic and global presence. Although lab-grown diamond sellers such as Pera Gems & Jewelry, Baan Jewellery, and CVD Jewellery began gaining traction, they continued to serve a niche segment, with natural diamonds retaining stronger cultural value among Thailand end user.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Jewellery Market Policies, Regulations, and Standards

4. Thailand Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Thailand Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Thailand Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Richemont Luxury (Thailand) Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Jubilee Enterprise Plc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Beauty Gems Group

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Pandora (Thailand) Co Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Swarovski Thailand Co Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Chanel (Thailand) Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.LVMH Moët Hennessy Louis Vuitton SA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Hthai (Thailand) Co Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Kering SA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Hermès International SCA

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.