Spain Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0678

- 120

-

Spain Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

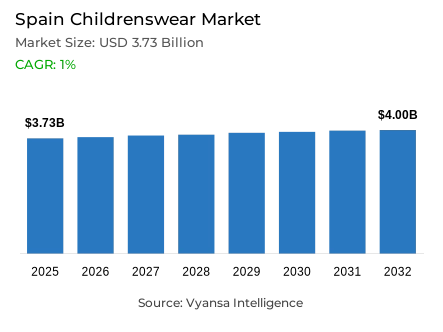

- Childrenswear in Spain is estimated at USD 3.73 billion.

- The market size is expected to grow to USD 4 billion by 2032.

- Market to register a cagr of around 1% during 2026-32.

- Product Type Shares

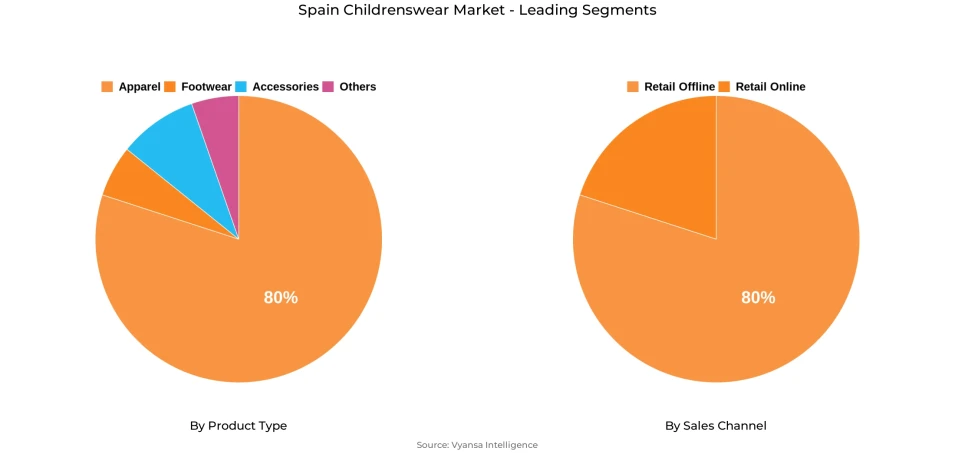

- Apparel grabbed market share of 80%.

- Competition

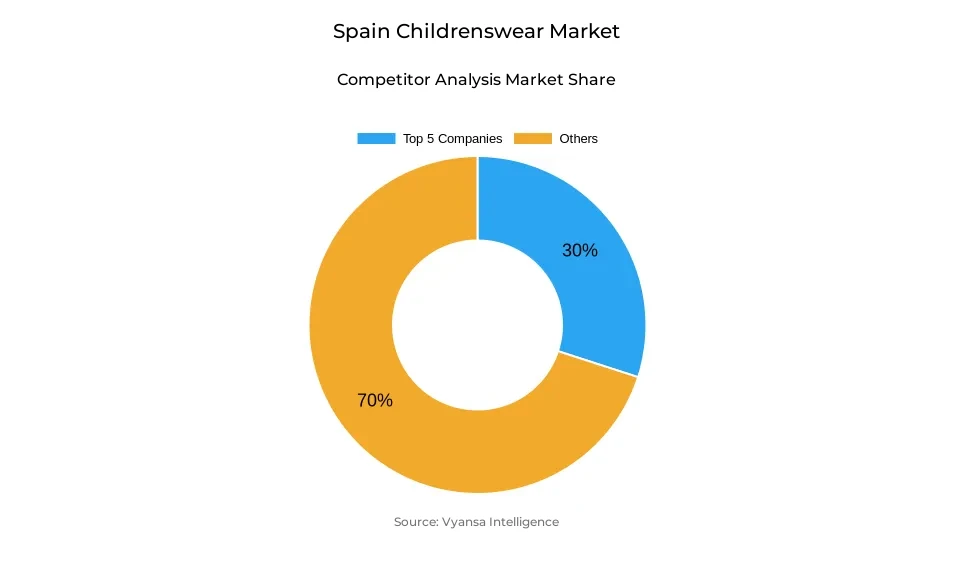

- More than 20 companies are actively engaged in producing childrenswear in Spain.

- Top 5 companies acquired around 30% of the market share.

- Primark Tiendas SLU; Decathlon España SA; Hennes & Mauritz SL; Zara España SA; Centros Comerciales Carrefour SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Spain Childrenswear Market Outlook

The Spain childrenswear market was valued at USD 3.73 billion in 2025 and will reach USD 4 billion by 2032, growing at a CAGR of around 1% during 2026-2032. The market remains under pressure from the high cost of living and low birth rates, limiting overall volume growth. Parents increasingly look out for affordability when buying clothes for their children. This has increased demand for mass-market and private-label apparel, while value retailers such as Primark and Shein continued to perform well. However, retail offline remains the dominant sales channel, accounting for about 80% of overall sales, supported by strong performances from apparel and footwear specialists and outdoor markets such as El Rastro in Madrid.

Apparel continues to be the largest category with around 80% of the total share. Within this category, the role of YouTube and TikTok remains very relevant in influencing the fashion choices of tweens and teens. Mango Teen, Bershka, and Stradivarius are some brands that have been expanding their offering for older children, given the shift in value from babywear to pre-teen and teen apparel. Social media marketing has been crucial for fast-fashion players seeking to connect better with younger audiences through influencer content and pop-up stores.

Demographic challenges, such as one of the lowest fertility rates in Europe, will continue to restrain market growth. Spanish families are having fewer children and often postponed parenthood due to unstable employment and a high cost of living. Second-hand platforms like Vinted and Wallapop will continue to grow, supported by increased awareness of sustainability issues and price sensitivity. This will dampen demand for new childrenswear but encourage retailers to add resale sections in physical stores as a way of maintaining footfall.

Going forward, both domestic and international players would focus on improving in-store experiences to engage both parents and children. In fact, brands like Mango Kids have already initiated re-designing outlets with an interactive layout complete with a play area in an effort to increase engagement. Meanwhile, grandparents, especially those who actively take part in childcare with financial support, are emerging as the significant target segment. Put together with immigration-driven birth rates on a rise and increasing interest in fashion by older children, these factors would continue the modest yet stable market growth in the forecast period.

Spain Childrenswear Market Growth DriverPrice-Conscious Parents and Affordable Retailers Sustain Demand

The Spain childrenswear market continues to be resilient as parents increasingly look for more affordable options due to the continued economic squeeze. As many households struggle with financial difficulties, cost-efficient retailers and value-oriented brands have gained greater acceptance as they offer a fashionable but very affordable product. According to estimates by the Bank of Spain, household disposable income was down 3.4% in real terms in 2023, and Eurostat estimated average inflation of 3.6% in 2024. This has made the price the most influential factor in determining the choice of an item of clothing, with families looking for more affordable alternatives in both physical and online stores.

The rise of low-cost fashion brands and online platforms reflects this broader end users shift towards accessibility and practicality. Parents increasingly started adopting more rational spending patterns, basically focusing on essential and multipurpose apparel to balance function with affordability. Such a pragmatic mindset keeps the base demand stable, even in a market hit by declining birth rates and income growth at a moderate pace.

Spain Childrenswear Market ChallengeLow Birth Rate and Weak Economy Restrict Market Growth

Against this background, Spain's persistently low fertility rate remains a structural obstacle to further expanding the country's childrenswear market. With only 1.16 births per woman in 2024, according to Eurostat, the shrinking customer base for children's clothing continues to hit the country. Economic headwinds exacerbate the problem, with the IMF projecting GDP growth to slow to 1.7% in 2025, while unemployment remains elevated at around 11.5%, constraining household spending capacity and dampening long-term demand for apparel.

Increased housing costs and job insecurity are promoting delays in family formation, causing many adults to postpone or forgo having children. Parents continue to spend on their children, but their purchases are more selective and necessity-driven. These demographic and economic pressures suggest volume growth in Spain's childrenswear market will remain subdued, even as brands leverage digital innovation and low-cost strategies to retain market stability.

Spain Childrenswear Market TrendSocial Media Drives Fashion Awareness Among Children

Social media is increasingly a defining influence in the childrenswear market in Spain, particularly among 8- to 13-year-olds, with both young boys and girls emulating peers and influencers through YouTube, TikTok, and Instagram. Such digital exposure encourages stronger fashion consciousness among children and extends to changes in the dynamics of family purchases. According to INE Spain, 88% of those aged 16-24 use social networks, while 94% of households have internet access, thus underlining the depth of digital involvement that feeds this trend.

In response, brands introduce collections inspired by digital culture, such as Mango Teen and Bershka Kids, which emulate adult fashion aesthetics. The influence of online media extends beyond styles of dress, fostering brand loyalty and impulse purchases through influencer-led campaigns. As children gain greater say in apparel choices, social media continues to reshape buying behavior, making digital influence a key driver in the adoption of fashion among younger end users.

Spain Childrenswear Market OpportunityGrowth Potential in Second-Hand and Sustainable Fashion Channels

The expansion of second-hand and eco-friendly fashion channels is presenting new avenues for growth in Spain's childrenswear market, driven by the trends of sustainability and affordability. In light of the rising awareness related to environmental responsibility and the circular economy, parents are turning to resale platforms like Vinted and Wallapop for quality, budget-conscious apparel. According to INE Spain, 46% of Spaniards purchased second-hand items in 2023, while the European Environment Agency (EEA) highlighted that Spain is among the top 10 adopters of the circular economy within the EU.

This trend is encouraging mindful consumption and less textile waste. Brands are responding through the use of sustainable materials, buy-back programs, and partnerships with resale platforms. Second-hand and eco-friendly channels will have key roles as circular fashion goes mainstream, driving Spain's childrenswear market toward economic and environmental sustainability in the coming years.

Spain Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under Product Type is Apparel represents around 80% of the Spain childrenswear market under the segment of Product Type. Apparel continues to be in the lead, considering children's clothes are highly replaceable, and youngsters are increasingly fashion-conscious. Social networking sites like YouTube and TikTok have deeply influenced Spanish tweens and teenagers and kept the demand for value-for-money, fashionable apparel high from fast-fashion retailers like Shein and Inditex's Zara Kids.

Parents still prioritize stylish and comfortable wear for their children, especially on certain occasions like a baptism or communion, despite the economic squeeze. The shift in focus from babywear to older children's fashion has further strengthened the apparel segment. For instance, Mango Teen and Brownie continue to expand their collections for 10-13-year-olds to capture this highly style-sensitive group. Due to all these reasons, namely, the availability of more affordable mass-market lines, increasing social media influence, and changing fashion preferences, apparel remains the leading product category within Spain's childrenswear

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is Retail offline, that captured the major share, with about 80% of the Spain childrenswear market. Physical stores will still be of vital importance because parents like to assess the quality, fit, and material of clothing before purchasing. Apparel and footwear specialists will continue to dominate offline sales, sustained by the presence of key players such as Inditex and Mango, which offer wide assortments and an engaging in-store experience.

Retail outlets in urban areas and shopping centers remain popular family destinations, therefore contributing highly to sales. However, the offline segment is evolving to adapt to changing shopping behaviour. Retailers are redesigning stores to attract traffic-for example, Mango Kids redesigned its flagship in Barcelona, adding features like play zones and modern layouts to increase engagement. Though online channels are growing, especially through resale platforms like Vinted and Wallapop, retail offline is still the leading sales channel in Spain's childrenswear market because of its trust, tangibility, and experiential appeal

List of Companies Covered in Spain Childrenswear Market

The companies listed below are highly influential in the Spain childrenswear market, with a significant market share and a strong impact on industry developments.

- Primark Tiendas SLU

- Decathlon España SA

- Hennes & Mauritz SL

- Zara España SA

- Centros Comerciales Carrefour SA

- Alcampo SA

- Roadget Business Pte Ltd

- Lidl Supermercados SAU

- Confecciones Mayoral SA

- Grupo Eroski Distribución SA

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Childrenswear Market Policies, Regulations, and Standards

4. Spain Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Spain Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Spain Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Spain Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Zara España SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Centros Comerciales Carrefour SA

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Alcampo SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Roadget Business Pte Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Lidl Supermercados SAU

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Primark Tiendas SLU

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Decathlon España SA

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Hennes & Mauritz SL

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Confecciones Mayoral SA

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Grupo Eroski Distribución SA

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.