Spain Cards and Payments Market Report: Trends, Growth and Forecast (2026-2032)

By Instrument Type (Cards (Debit Card, Charge Card, ATM Card, Pre-Paid Card, Credit Card, Store Card), Mobile Wallets, Cheques, Others), By Card Type (Contact Smart Card, Contactless Smart Card, Non-Smart Card), By Type of Payments (B2B, B2C, C2C, C2B (E-commerce Shopping, Payment at POS Terminals)), By Transaction Type (Domestic, Foreign), By Application (Food & Groceries, Health & Pharmacies, Travel & Tourism, Hospitality, Others (Media & Entertainment))

|

Major Players

|

Spain Cards and Payments Market Statistics and Insights, 2026

- Market Size Statistics

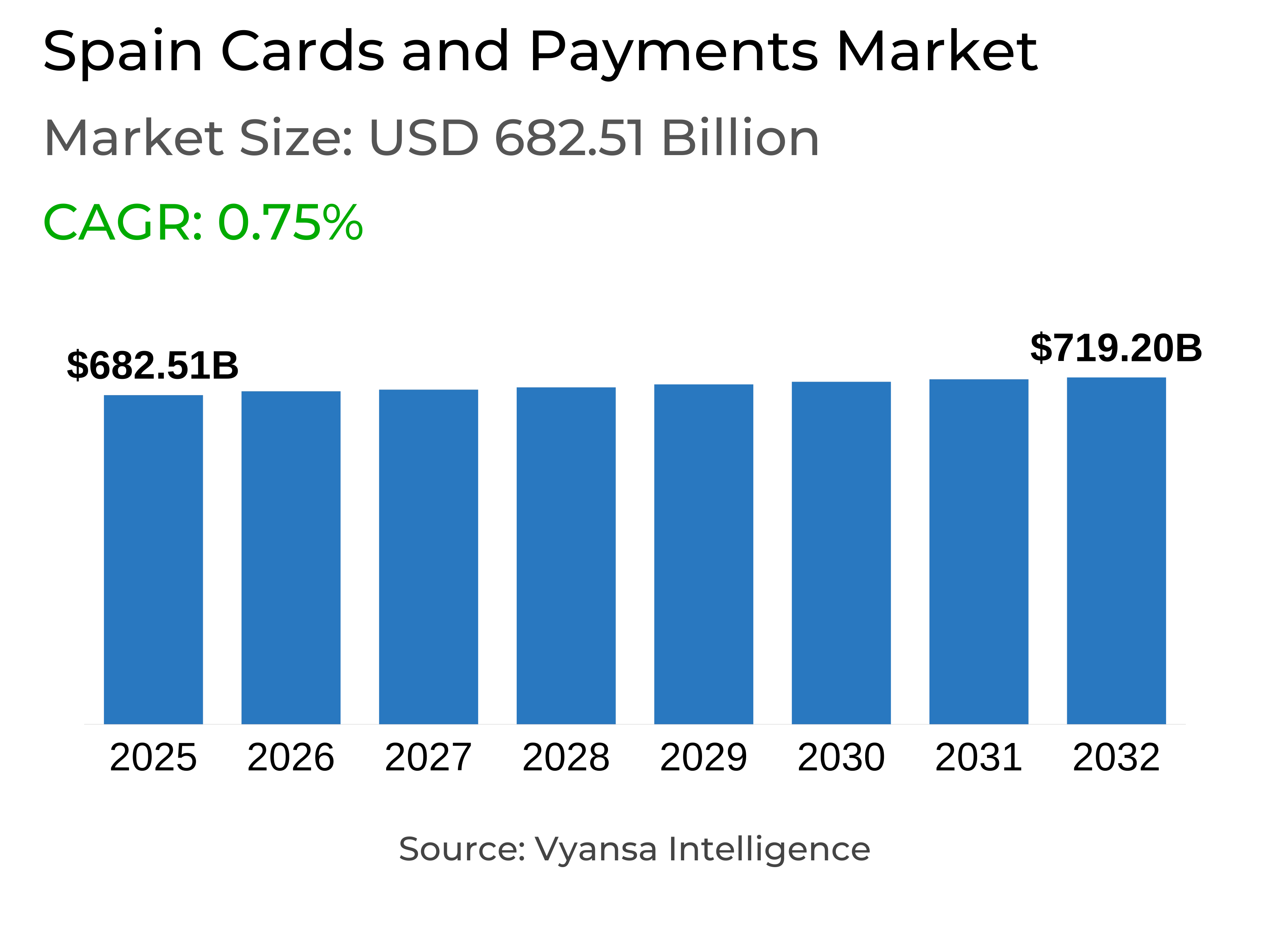

- Cards and Payments in Spain is estimated at $ 682.51 Billion.

- The market size is expected to grow to $ 719.2 Billion by 2032.

- Market to register a CAGR of around 0.75% during 2026-32.

- Instrument Type Shares

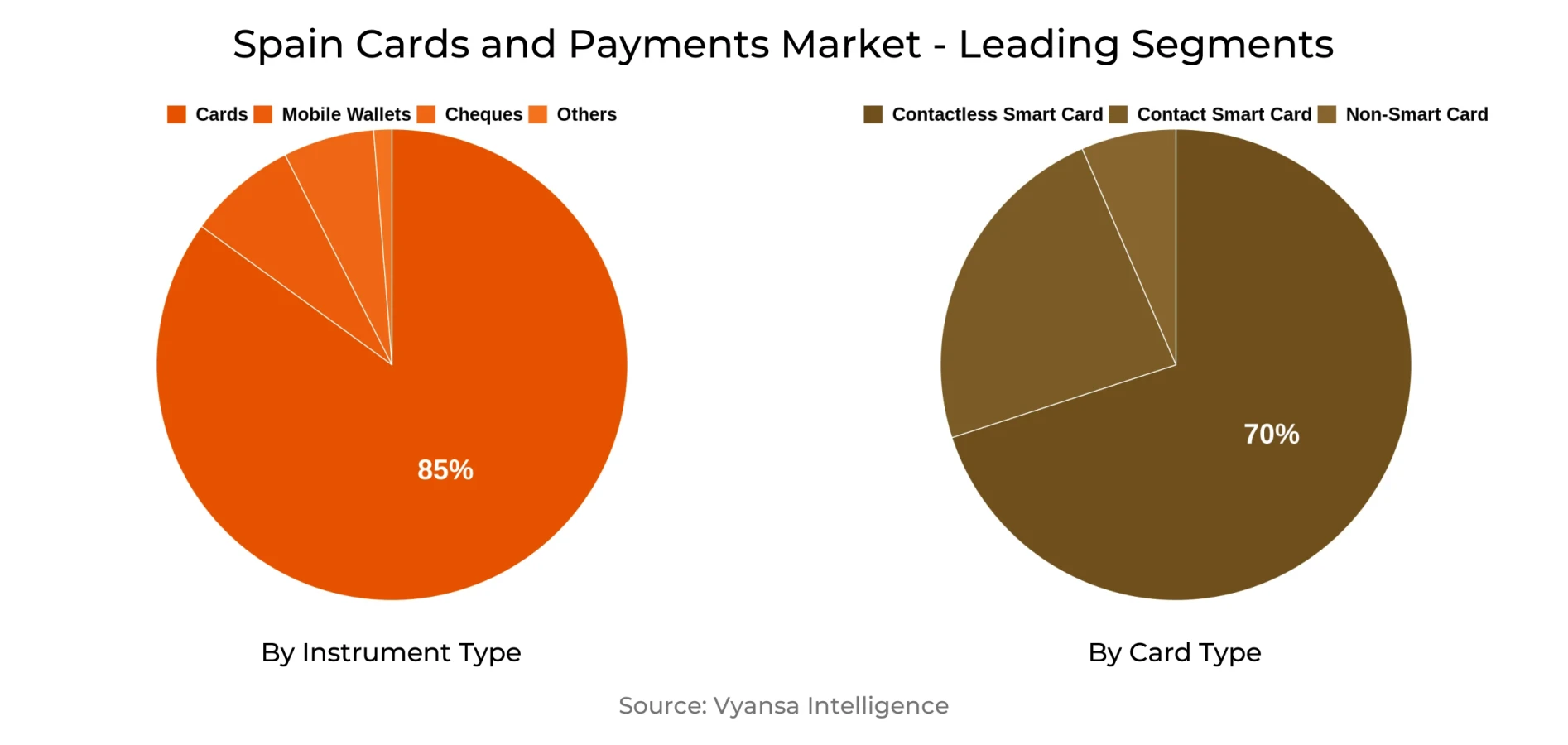

- Cards grabbed market share of 85%.

- Competition

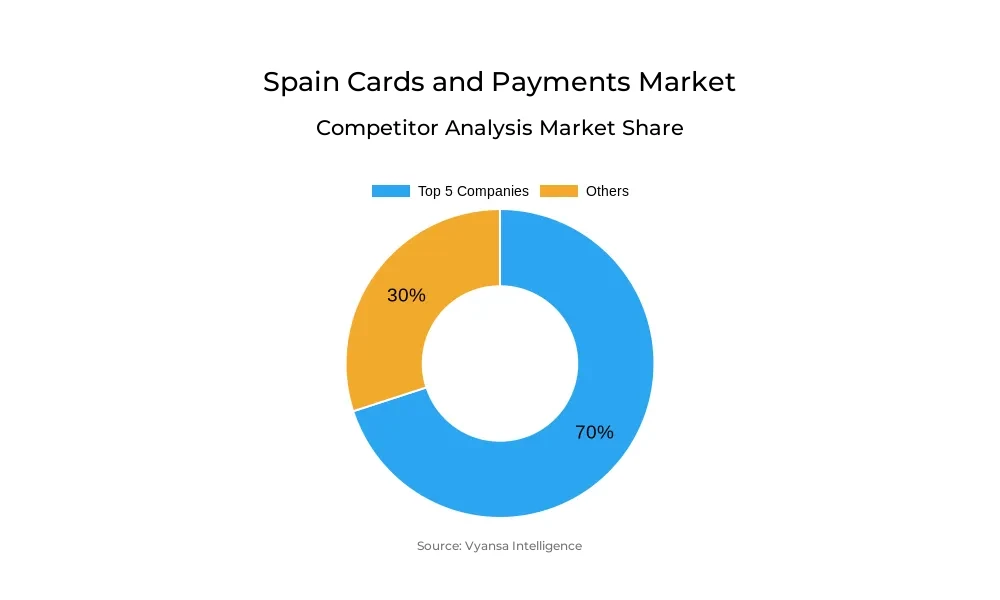

- More than 15 companies are actively engaged in producing Cards and Payments in Spain.

- Top 5 companies acquired 70% of the market share.

- WiZink Bank SAU, Banco Cetelem, Santander Consumer Finance SA, Caixabank SA, Banco Bilbao Vizcaya Argentaria SA etc., are few of the top companies.

- Card Type

- Contactless Smart Card grabbed 70% of the market.

Spain Cards and Payments Market Outlook

The Spain cards and payments market has been valued at USD 682.51 billion and is expected to grow to USD 719.2 billion in 2032, reflecting steady growth driven by economic recovery, tourism, and increased end user confidence. Spain was traditionally a cash-based society, but government policy and an increasingly digitally aware population have pushed the trend toward electronic and card-based payments. Contactless smart cards already dominate 70% of the market, exemplifying how tap-to-pay has become the new standard for daily expenditure.

Credit and debit cards still reign supreme over everyday purchases, but electronic transfers and digital wallets like Apple Pay, Google Pay, PayPal, and Bizum are making great inroads. Bizum, for instance, has gained widespread acceptance as a leading mobile payment platform, with backing from Spanish banks and adoption by Amazon Spain. Prepaid and virtual cards, meanwhile, are gaining traction in social security payments, transport, and online shopping.

Increased usage of cards in digital channels has raised fraud threats, particularly in card-not-present transactions. To counter this, Spanish regulators and banks are making significant investments in AI, biometrics, and tokenisation, in addition to fresh EU regulations like PSD3 and the Digital Commerce Act, to enhance security and end user protection. These measures will prove instrumental in establishing confidence as transactions increasingly go digital.

In the future, Spain payment landscape will continue to be competitive. Debit and credit cards will remain universally accepted, but mobile wallets, m-commerce, and Buy Now, Pay Later (BNPL) services will increasingly eat into their share. BNPL has gained rapid traction in verticals such as clothing and electronics, with players like Klarna and Plazos X at the forefront. The future CCD2 rules in 2026 will impose tighter regulations on BNPL, yet there is expected to be continued demand, which will keep payments competitive and dynamic.

Spain Cards and Payments Market Growth Driver

Digital Adoption Driving Cashless Payments

Strong smartphone penetration and extensive digital acceptance are propelling cash-to-electronic payments in Spain. end users more and more rely on mobile wallets, contactless cards using NFC, and real-time payment systems such as Apple Pay, Google Pay, and Bizum to make quick and convenient day-to-day payments. This digital preparedness fosters the utilization of debit, credit, and charge cards as well as fuels the rise of alternative payments, further strengthening the shift towards a cashless economy.

Prepaid cards remain a significant player in transport, gift, and social welfare payments, with users connecting them to digital wallets for greater convenience. The coupling of cards with mobile payment systems provides fresh potential for frictionless transactions, enabling financial institutions and fintechs to extend their networks and reach end users through innovative digital platforms. This mass digital take-up is a major driver redefining Spain payments future.

Spain Cards and Payments Market Trend

Increasing Emphasis on Cybersecurity

As card usage expands in digital channels, Spain experiences more fraudulent activity, particularly in non-present card transactions. This has resulted in high emphasis on strengthening cybersecurity throughout the payments landscape. Banks and payment issuers are increasingly embracing newer technologies to safeguard end users' data and preserve confidence in digital transactions.

Legislative movements, like the Digital Commerce Act and the PSD3 Directive, enhance this development by encouraging the adoption of biometric verification, Artificial Intelligence (AI), and tokenisation in keeping out fraud and protecting sensitive data. Spanish banks are also making investment in AI to identify suspicious patterns and act to counter impending threats swiftly. These steps not only enhance security but also render management of resources in data protection more effective, identifying cybersecurity as a core trend within Spain cards and payments space.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Spain Cards and Payments Market Opportunity

Increase in Flexible Credit Options

Buy Now, Pay Later (BNPL) services are still growing robustly in Spain, reporting strong popularity among end users for buying clothing, electronics, and domestic appliances. As more end users want flexible payments, BNPL is an easy and convenient method to control spending without facing traditional credit limitations. The increasing application of BNPL in daily transactions points to opportunities for providers to capture new customer bases and enhance interaction with existing users.

The economy is enjoying sustained digital uptake, with instant payment platforms, card-linked buy now pay later (BNPL) products, and mobile wallets facilitating easy transaction. Even with impending legislation under the end user Credit Directive 2 (CCD2), BNPL continues to represent a strong growth opportunity, allowing Spanish banks and fintechs to innovate and expand their services. This makes BNPL a top growth opportunity for the changing cards and payments world.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Spain Cards and Payments Market Segmentation Analysis

By Card Type

- Contact Smart Card

- Contactless Smart Card

- Non-Smart Card

The segmentation with highest market-share under Card Type is Contactless Smart Cards, which captured 70% of the market in Spain. Such cards are extensively applied in debit, credit, and charge payments, a testament to the increasing demand for quick, secure, and easy payments. The expansion of contactless card usage is facilitated by Sistema de Tarjetas y Medios de Pago SA, which oversees the Spanish card payment system, achieves regulation compliance, tracks fraud, and enables interbank and payment network interoperability.

This division is strengthened by close cooperation with Bank of Spain and inputs into the evolving Single European Euro Payments Area (SEPA) to increase its scope and solidity. Contactless Smart Cards remain dominant in the market as end users become increasingly looking for faster and more convenient transactions in everyday life, making them the leading card type in Spain payment market.

Top Companies in Spain Cards and Payments Market

The top companies operating in the market include WiZink Bank SAU, Banco Cetelem, Santander Consumer Finance SA, Caixabank SA, Banco Bilbao Vizcaya Argentaria SA, Banco Santander SA, Banco de Sabadell SA, ING Direct NV, American Express Co, El Corte Inglés SA, etc., are the top players operating in the Spain Cards and Payments Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Cards and Payments Market Policies, Regulations, and Standards

4. Spain Cards and Payments Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Cards and Payments Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Instrument Type

5.2.1.1. Cards- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Charge Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. ATM Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Pre-Paid Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Store Card- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Mobile Wallets- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cheques- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Card Type

5.2.2.1. Contact Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Contactless Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Non-Smart Card- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Type of Payments

5.2.3.1. B2B- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. B2C- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. C2C- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. C2B- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4.1. E-commerce Shopping- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4.2. Payment at POS Terminals- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Transaction Type

5.2.4.1. Domestic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Foreign- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Application

5.2.5.1. Food & Groceries- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Health & Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Travel & Tourism- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Hospitality- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others (Media & Entertainment)- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Spain Cards Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Card Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Spain Mobile Wallets Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Spain Cheques Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Type of Payments- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Transaction Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1. Caixabank SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2. Banco Bilbao Vizcaya Argentaria SA

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3. Banco Santander SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4. Banco de Sabadell SA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5. ING Direct NV

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6. WiZink Bank SAU

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7. Banco Cetelem

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8. Santander Consumer Finance SA

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9. American Express Co

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. El Corte Inglés SA

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Instrument Type |

|

| By Card Type |

|

| By Type of Payments |

|

| By Transaction Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.