Spain Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0660

- 120

-

Spain Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

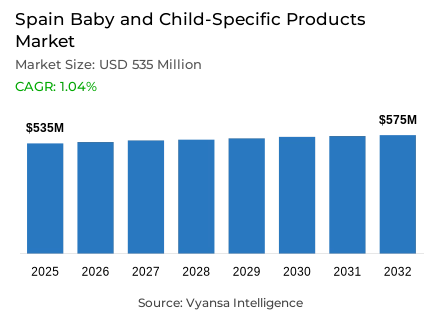

- Baby and child-specific products in Spain is estimated at USD 535 million.

- The market size is expected to grow to USD 575 million by 2032.

- Market to register a cagr of around 1.04% during 2026-32.

- Product Shares

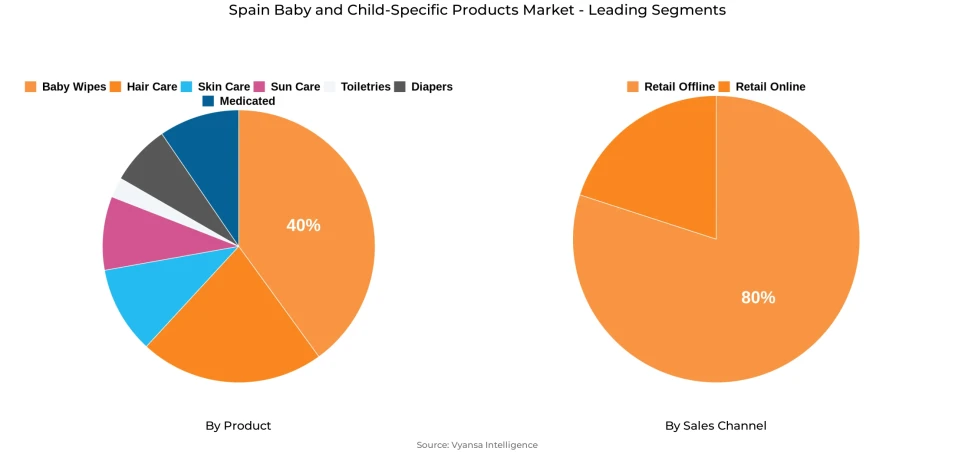

- Baby wipes grabbed market share of 40%.

- Competition

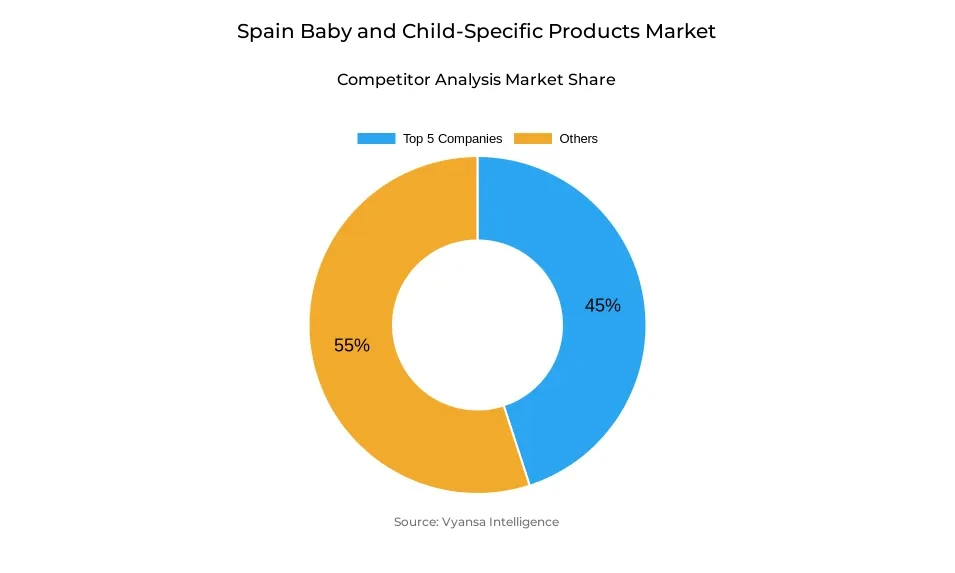

- More than 20 companies are actively engaged in producing baby and child-specific products in Spain.

- Top 5 companies acquired around 45% of the market share.

- Expanscience SA, Laboratoires; Reckitt Benckiser España SL; Eroski, Grupo; Mercadona SA; Centros Comerciales Carrefour SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Spain Baby and Child-Specific Products Market Outlook

The market for products intended for babies and children in Spain is projected to be valued at $535 million in 2025 and increase to a value of $575 million by 2032, resulting in a CAGR of around 1.04% for the period 2026–32. The market is anticipated to remain relatively stagnant, fundamentally due to the low birth rate in Spain, combined with economic factors, which place constraints on parental spending behavior. Baby wipes account for 40% of the market, making them the largest category of products, owing to their essential nature and everyday use. However, demand for the other categories, and particularly baby and child-specific sun care, is expected to increase steadily as parents prioritize protecting their children skin.

Retail offline channels continue to dominate the market and account for 80% of sales, with supermarkets remaining the most common channel for baby wipes and essentials, and pharmacies playing an important role in distributing sun care and skin care products. Warehouse clubs and discounters are continuing to grow from very low bases, with attractive pricing for budget-conscious end users, and baby fairs continue to present opportunities for brands to engage with parents in a direct manner.

Mercadona is likely to retain its leadership position in the market, relying on its strong private label, Deliplus, combined with aggressive pricing and end users confidence. Other companies, like Carrefour and Cantabria, will continue to build market share, through successful promotions, differentiated products, and sun protection offerings. Premium products, like La Roche- Posay and ISDIN, are likely to be favoured by parents willing to more likely purchase these products believing they are safer or more effective for children with sensitive skin.

Opportunities exist to develop products that target older children and teenagers who are becoming increasingly influential in choosing personal category products. Also, the increased focus on the natural, organic, or vegan basis particularly with millennial parents should spur new and innovative product developments. With overall awareness of sun protection and skin health continuing to rise and support steady category growth.

Spain Baby and Child-Specific Products Market Growth DriverIncreased Awareness Towards Sun Protection

The market is being driven by increasing numbers of Spanish parents who understand the importance of skin protection in babies and children. The longer periods of heat as a result of climate change have resulted in families understanding the risks of the sun and increase their sun care product use throughout the year. This means that families are using sunlight products outside of the traditional Summer, in association with spring and autumn holidays where the family is more likely to participate in outdoor activities together.

Changes in end users behaviour have further supported steady growth in baby and child-specific sun care products. Parents are increasingly focused on products that offer further peace of mind and tend to preference long-lasting and water-resistant products that are easier to apply to toddlers and children who have increasingly become more active. There is also a growing perception and understanding of sun care as a health and important measure and not simply an easy seasonal purchase purchase, further driving product demand and innovation in the market.

Spain Baby and Child-Specific Products Market ChallengeFalling Birth Rates and Economic Pressures

The market has ongoing issues from persistently low birth rates in Spain, which limits the demand overall for baby and child-specific products. Many women in Spain are postponing parenthood and opting for fewer children, leading to a decline in births each year. These demographic factors restrain consumption levels overall in the category and slow value growth.

Inflation and high interest rates create continued economic pressure on households, and this strain is particularly acute for households with several children. Parents are more careful in spending and are gravitating towards affordability, including private label or generic options. These factors lead to limited end users purchasing power and result in a difficult environment for premium and branded players to maintain sales performance in a price-sensitive environment.

Spain Baby and Child-Specific Products Market TrendShift Toward Natural and Clean-Label Products

The growing desire for natural, organic, and vegan baby care products is a key trend influencing the market. Today parents, especially millennials, prefer products made with natural ingredients and not science-based materials. Parents’ interest is driven by a greater awareness of the potential health risks presented by synthetic ingredients, coupled with the impact on the environment.

Local brands are responding to the demand for natural products with the introduction of a new line that fits into a natural category, like Keko New Baby by Briseis, addressing gentle or eco-friendly formulations. In addition, the concept of transparency and sustainability continues to gain popularity in the case of baby care products as a parent consideration. Parents who believe they are using a natural product think of it in terms of safety and quality, and that is driving many companies to reformulate their existing product lines to have cleaner, more benign, or more ethical methods of production, or simply a believe that these practices can help them in a crowded baby care product activity.

Spain Baby and Child-Specific Products Market OpportunityExpanding Focus Toward Older Children

An emerging opportunity for brands is expanding their product offerings to an older child and teen demographic. Teens increasingly have money to spend, as well as being more directly involved in family purchasing decisions that go beyond just food items, such as personal hygiene. Parents often even want kids or teens to make their own choices in the category for personal care products expanding brands abilities to develop products recommended for healthy personal care for older kids and teens.

Children ages 11-15 are now more influential in end users trends through social media to be involved in posting and promoting beauty and personal care categories. Expanding that product category to this market is a unique opportunity in an underdeveloped space and can help offset a declining birth rate. Companies can create new revenue generators while being relevant to an ever-changing family unit.

Spain Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with highest market share under Product Type is Baby Wipes, which accounts for roughly 40% of the market. Baby wipes remain the largest segment because of their repetitive usage in daily hygiene routines. Parents seek convenience, a low price point, and mild formulations for their children, all of which support repeat purchases.

On the other hand, baby and child-specific sun care is expected to grow the fastest during the forecast periods. Increased awareness of children being protected from sun exposure coupled with longer periods of hot sunny weather are driving growth here. There is also a growing demand for water-resistant, long lasting, and dermatologically tested baby and child sun care products. Parents are willing to pay for higher end brands and boutique brands that assure everything from quality to safety for their children skin.

By Sales Channel

- Retail Online

- Retail Offline

The segment with highest market share under Sales Channel is Retail Offline, accounting for nearly 80% of the market. Supermarkets represent the predominant channel for this category due to their wide selection of baby wipes, competitive pricing, and private label options. Pharmacies are an important channel for sun care and skin care products due to the trust that parents have in these medically endorsed formulations.

Emerging channels such as warehouse clubs and discounters are showing growth from a low base to provide a low-cost option to price-conscious end users. Offline retail continues to benefit from in-store promotions, product awareness, and because parents prefer to purchase baby products as gifts. This ensures continued demand, in spite of low penetration of e-commerce.

List of Companies Covered in Spain Baby and Child-Specific Products Market

The companies listed below are highly influential in the Spain baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- Expanscience SA, Laboratoires

- Reckitt Benckiser España SL

- Eroski, Grupo

- Mercadona SA

- Centros Comerciales Carrefour SA

- Procter & Gamble España SA

- Johnson & Johnson SA

- ISDIN SA

- Pierre Fabre Ibérica SA

- Beiersdorf SA Spain

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Spain Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Spain Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Spain Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Spain Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Spain Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Spain Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Spain Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Spain Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Mercadona SA

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Centros Comerciales Carrefour SA

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Procter & Gamble España SA

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Johnson & Johnson SA

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. ISDIN SA

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Expanscience SA, Laboratoires

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Reckitt Benckiser España SL

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Eroski, Grupo

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Pierre Fabre Ibérica SA

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Beiersdorf SA Spain

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.